Cognac Market Size, Share & Trends Analysis Report By Grade (V.S., V.S.O.P.), By Distribution Channel (On-trade, Off-trade), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-848-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Cognac Market Size & Trends

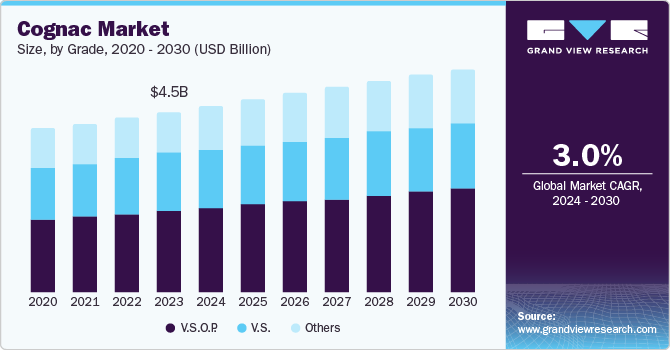

The global cognac market size was valued at USD 4.48 billion in 2023 and is projected to grow at a CAGR of 3.0% from 2024 to 2030. This growth is attributed to increasing disposable incomes in developing economies, enabling consumers to spend more on premium alcoholic beverages. In addition, the rising popularity of craft products among millennials and the trend of "experiential drinking" contribute to this expansion. Furthermore, innovative marketing strategies and product diversification by prominent brands also significantly attract new consumers, fueling market growth.

Cognac is typically applied to a particular brandy produced through double distillation and aging. This brandy was exclusively produced in the region of Cognac in France. White wine creates cognac, which contains a forty-percent alcohol-by-volume ratio. The brandy is refined in copper pot stills twice and aged at least in French oak barrels. The superior quality of cognac will lead to market expansion in the future.

The growing middle class and rising income levels, leading to a higher demand for premium spirits worldwide, drive the increasing market growth. Furthermore, the growing quality, tradition, and skill linked to cognac contribute to its popularity among discerning consumers, driving market expansion. Moreover, the increasing demand for cognac as a sought-after collectible enhances its attractiveness for consumers drawn to uniqueness and scarcity, thus driving market expansion.

Product development is increasingly innovative as producers try new aging methods, blends, and flavors to appeal to a wider range of consumers, driving market growth. Similarly, market growth is driven by introducing very special (VS) or superior old pale (VSOP) cognacs, which are younger and more adaptable for creating cocktails. In addition, the growing presence of exclusive limited-edition launches and partnerships with artists or high-end brands for unique bottle designs contribute to market growth. Moreover, the fast development of high-end packaging that mirrors the brand's quality and legacy is helping drive market expansion.

Grade Insights

V.S.O.P. dominated the market and accounted for the largest revenue share of 43.7% in 2023. Cognacs of the V.S.O.P. (Very Superior Old Pale) grade must be matured for at least four years, resulting in a richer and more intricate taste than the V.S. grade. Furthermore, as consumers become more interested in experiencing various aging techniques and flavor profiles, a growing consumer knowledge and appreciation for cognac drives market expansion

The V.S. (Very Special) segment is expected to register the CAGR of 2.2% during the forecast period attributed to its ease of access and ability to be used in various ways. They have matured for at least two years and attract many customers, from beginners to frequent buyers. In addition, the V.S. grade is gaining wide popularity in cocktail mixology due to its flavor profile being ideal for mixing with other ingredients, thus driving market growth. Furthermore, the increasing popularity of premiumization in the spirits industry, driven by consumers' desire for high-quality products at affordable prices, is boosting market expansion.

Distribution Channel Insights

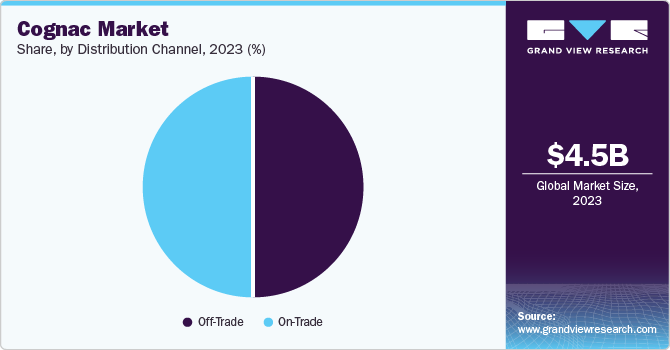

Off-trade led the market and accounted for the largest revenue share of 50.1% in 2023, owing to its widespread coverage and capacity to provide a diverse selection of products. Furthermore, the market is experiencing growth as off-trade is widely popular for its convenience, competitive pricing, and the ability to compare various brands and types of cognac. Furthermore, the ample shelf space and frequent customer visits on off-trade provide an excellent opportunity to introduce new cognac products and brands to a wide range of people.

On-trade is expected to register the fastest CAGR during the forecast period-on-trade targets technology enthusiasts who value the convenience of shopping from their homes. In addition, they provide an extensive variety, which comprises unique and exclusive cognacs that are difficult to find in brick-and-mortar shops. In addition, they act as a crucial direct-to-consumer (DTC) sales outlet for cognac labels, enabling them to interact directly with customers and provide extensive product details, reviews, and virtual tasting opportunities.

Regional Insights

The North America cognac marketdominated the global market and accounted for the largest revenue share of 38.8% in 2023 attributed to robust consumer purchasing ability and a deep-rooted tradition of enjoying top-quality alcoholic beverages. In addition, the market growth is being boosted by consumers' increasing interest in luxury and premium spirits, driven by their popularity in popular culture, particularly music and entertainment. Furthermore, the well-established distribution channels in the region, such as vast networks of supermarkets, liquor stores, and online platforms, contribute to the growth by making Cognac widely available and easily accessible.

U.S. Cognac Market Trends

The cognac market in the U.S.dominated the North American market in 2023 owing to the cultural factors and the economic feelings of customers in those areas. How cognac varieties are enjoyed and consumed is undergoing significant changes. Different types of Cognac are gaining popularity among American consumers, transitioning from being commonly consumed as a digestive or on special occasions. For instance, according to the U.S. Export data from Volza, 256 exporters exported 5.3K shipments of Cognac from the U.S. to 225 buyers.

Asia Pacific Cognac Market Trends

The Asia Pacific cognac market is expected to grow significantly with a CAGR of 3.6% over the forecast period driven by the expanding middle class in the area and the increase in disposable incomes. In addition, the growing favoritism towards higher-tier, renowned cognac categories such as XO (Extra Old) is strengthening the market expansion. Furthermore, the rising popularity of liquor as a representation of prestige, resulting in its intake in professional and social environments, is driving the market expansion.

The cognac market in China is expected to grow rapidly in the coming years. Cognac has become more than just a drink; it now represents an important status symbol. Possessing and giving cognac is generally seen as a symbol of sophistication and success, making it attractive to wealthy individuals seeking to display their social status and appreciation for luxury. Advertising efforts and travel experiences have played a key role in increasing recognition of cognac and its renowned history in the country.

Europe Cognac Market Trends

The Europe cognac market is anticipated to witness significant growth.Having a strong foundation of history and respect for the essence. Increased consumer knowledge of cognac and a growing fondness for traditional, high-quality spirits are fueling market expansion. In addition, the growing recognition of the tradition and skill involved in cognac production in the area is driving the market expansion.

Key Cognac Company Insights

Some key companies in the cognac market include Courvoisier S.A.S., Zino Davidoff, E. Rémy Martin & Co., and others. Companies are concentrating on expanding their customer base to achieve a competitive advantage in the market. Hence, major stakeholders are implementing multiple strategic endeavors.

-

Courvoisier S.A.S is a manufacturer of alcoholic drinks that provides distillation, mixing, and manufacturing services for cognac, wine, and other beverages. Courvoisier serves clients in France.

-

Louis Royer is a manufacturer, provider, and retailer of cognac across France. The company offers a range of alcoholic beverages, such as cognac, brandy, liquor, and vodka, using its conventional techniques to maintain the flavors and scents to produce a unique combination.

Key Cognac Companies:

The following are the leading companies in the cognac market. These companies collectively hold the largest market share and dictate industry trends.

- Courvoisier S.A.S.

- Zino Davidoff

- E. Rémy Martin & Co.

- HENNESSY

- Kelt Cognac

- Louis Royer

- MAISON FERRAND

- Cognac Meukow

- Pernod Ricard

- Thomas HINE & Co.

Recent Developments

-

In July 2024, Pernod Ricard agreed to sell its portfolio of international wine brands to Australian Wine Holdco Limited. This divestment was expected to allow Pernod Ricard to focus on its core spirits business while enabling the wine brands to thrive under new ownership. The transaction reflected Pernod Ricard's strategic shift to adapt to changing market conditions and consumer preferences in the alcoholic beverages sector, with closure expected in the first half of 2025.

-

In April 2024, Rémy Martin, the renowned cognac house, reopened its historic site in the heart of Cognac after a three-year renovation project. This project involved collaborating with local artisans and acclaimed artists, and it aimed to safeguard the house's heritage while embracing its modernity and innovative spirit. The site features various spaces and offers visitors an immersive experience of the brand's rich history and future.

Cognac Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.63 billion |

|

Revenue forecast in 2030 |

USD 5.55 billion |

|

Growth Rate |

CAGR of 3.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in million bottles, Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Grade, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Lettonia, Netherlands, China, Japan, Hong Kong, South Korea, Singapore, Brazil, South Africa |

|

Key companies profiled |

Courvoisier S.A.S.; Zino Davidoff; E. Rémy Martin & Co.; HENNESSY; Kelt Cognac; Louis Royer; MAISON FERRAND; Cognac Meukow; Pernod Ricard; Thomas HINE & Co. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cognac Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. Grand View Research has segmented the global cognac market report based on grade, distribution channel, and region:

-

Grade Outlook (Volume, Million Bottles; Revenue, USD Million, 2018 - 2030)

-

V.S.

-

V.S.O.P.

-

Others

-

-

Distribution Channel Outlook (Volume, Million Bottles; Revenue, USD Million, 2018 - 2030)

-

On-Trade

-

Off-Trade

-

-

Regional Outlook (Volume, Million Bottles; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Latvia

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

Hong Kong

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."