- Home

- »

- Consumer F&B

- »

-

Coffee Concentrates Market Size, Industry Report, 2030GVR Report cover

![Coffee Concentrates Market Size, Share & Trends Report]()

Coffee Concentrates Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Caffeinated, Decaffeinated), By Packaging (Bottles, Cans), By Distribution Channel (B2B, B2C), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-472-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Coffee Concentrates Market Summary

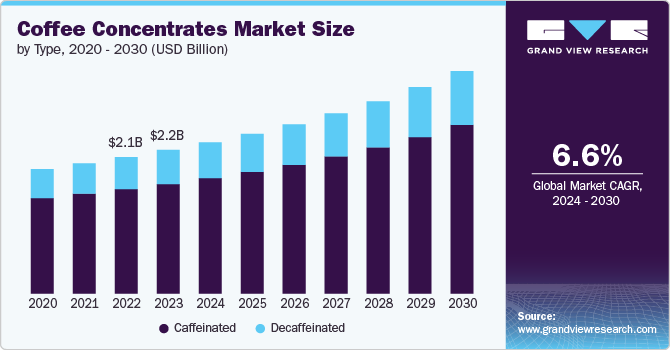

The global coffee concentrates market size was estimated at USD 2.36 billion in 2024 and is projected to reach USD 3.47 billion by 2030, growing at a CAGR of 6.8% from 2025 to 2030. One major factor driving this growth is the increasing popularity of ready-to-drink coffee products.

Key Market Trends & Insights

- Asia Pacific coffee concentrates market dominated the global market and accounted for the highest revenue share of 40.5% in 2024.

- Europe's coffee concentrates market is expected to grow at a CAGR of 7.7% over the forecast period.

- Based on type, the caffeinated segment dominated the global coffee concentrates industry and accounted for the largest revenue share of 77.4% in 2024.

- Based on packaging, the bottle packaging segment led the market and held the largest revenue share of 43.3% in 2024.

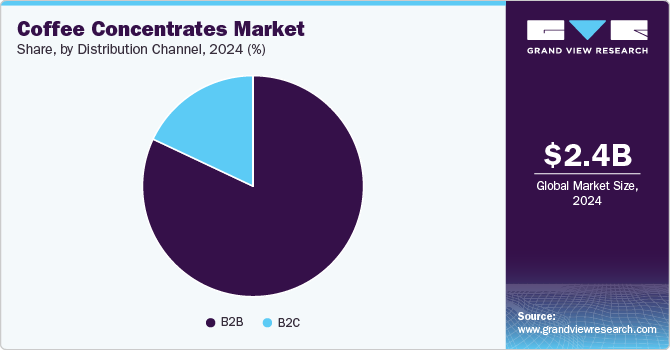

- Based on distribution channel, the B2B distribution channels segment held the dominant position in the market and accounted for the largest share of 83.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.36 Billion

- 2030 Projected Market Size: USD 3.47 Billion

- CAGR (2025-2030): 6.8%

- Asia Pacific: Largest market in 2024

Busy professionals and consumers are seeking convenient and time-saving caffeine options that fit into their fast-paced lifestyles. Coffee concentrates offer a quick solution, allowing users to easily mix concentrated coffee with water or milk to enjoy a flavorful beverage without the need for extensive preparation. This convenience aligns well with the on-the-go lifestyle of many consumers, making coffee concentrates an attractive choice.

Coffee concentrates are highly concentrated forms of coffee, often used to make a variety of coffee drinks. They are typically made by brewing coffee in a way that extracts a strong, rich flavor from the beans. This concentrated coffee can be used to make espresso-style drinks, lattes, or cold brews by diluting it with water or milk. Coffee concentrates offer convenience and flexibility, allowing users to easily adjust the strength of their coffee to their liking. They are popular for both home use and in cafes.

The growing awareness of health benefits associated with coffee consumption is contributing to the rise in demand for coffee concentrates. Many consumers perceive organic and concentrated coffee products as healthier alternatives due to their reduced chemical residues from synthetic pesticides and fertilizers. In addition, this perception is further supported by research indicating that coffee consumption may lower the risk of certain health issues, such as type 2 diabetes and depression, thus appealing to health-conscious consumers. Urbanization also plays a significant role in the increasing consumption of coffee concentrates. As cities expand and lifestyles become busier, there is a greater demand for convenient food and beverage options. The expansion of multinational retail brands offering diverse coffee concentrate products has made these beverages more accessible to consumers, further driving market growth.

Furthermore, technological advancements in brewing and processing methods have also enhanced the appeal of coffee concentrates. Improved extraction techniques and preservation processes ensure that these products maintain their quality and freshness, making them more desirable to consumers. The versatility of coffee concentrates allows for customization in caffeine intake, catering to varying preferences and consumption habits. Moreover, the rise of e-commerce has facilitated easier access to a wide range of coffee concentrate products. Online shopping provides consumers with the opportunity to explore different brands and flavors without geographical limitations, contributing to increased market penetration.

Type Insights

The caffeinated segment dominated the global coffee concentrates industry and accounted for the largest revenue share of 77.4% in 2024. Caffeinated coffee concentrates offer a quick and efficient way to enjoy coffee. They eliminate the need for brewing, allowing consumers to easily mix their preferred strength and flavor, making them ideal for busy lifestyles. These concentrates provide a strong caffeine punch in a small volume, appealing to consumers seeking an immediate energy boost without the bulk of traditional coffee. This is particularly attractive to students and professionals who need a quick pick-me-up.

Decaffeinated coffee concentrates are expected to grow at a CAGR of 7.3% over the forecast period. As more consumers become aware of their caffeine intake, decaffeinated coffee concentrates offer a way to enjoy coffee without the jitters or potential negative effects of caffeine. This appeals to health-conscious individuals looking for a flavorful coffee experience without the stimulating effects. Decaffeinated coffee concentrates often come in a variety of unique flavors and blends, attracting consumers who enjoy experimenting with different taste profiles. This versatility allows for creative uses in beverages and culinary applications.

Packaging Insights

The bottle packaging segment led the market and held the largest revenue share of 43.3% in 2024. Bottled coffee concentrates offer a ready-to-drink option that fits seamlessly into busy lifestyles. Consumers appreciate the convenience of grabbing a bottle for a quick caffeine fix without the need for preparation or brewing. These products are easy to transport, making them ideal for people who are traveling, commuting, or engaging in outdoor activities. The compact packaging allows for easy storage in bags or vehicles, appealing to those seeking coffee solutions while on the move.

Cans are expected to grow at the fastest CAGR of 7.3% over the forecast period. Canned coffee concentrates offer a convenient, ready-to-drink option that fits easily into busy lifestyles. Their compact size makes them easy to carry, allowing consumers to enjoy coffee on the go without the need for preparation. Canned products typically have a longer shelf life compared to bottled options, appealing to consumers who appreciate the ability to stock up and store them for extended periods. This durability makes canned coffee concentrates a practical choice for many households.

Distribution Channel Insights

B2B distribution channels held the dominant position in the market and accounted for the largest share of 83.0% in 2024. Offline stores allow customers to engage with coffee concentrate products firsthand, offering opportunities for tasting and sampling. This sensory experience helps consumers make informed decisions about packaging, quality, and brand, encouraging immediate purchases. As the popularity of coffee concentrates rises, more specialty coffee shops and cafes are offering organic options. These establishments often emphasize quality and sustainability, driving consumers who value these aspects to purchase coffee concentrates directly from brick-and-mortar locations.

B2C channels are expected to grow at a lucrative CAGR of 7.3% from 2025 to 2030. B2C channels often offer a wide range of brands, flavors, and formulations of coffee concentrates, allowing consumers to explore different options and find products that suit their tastes. This variety helps cater to diverse preferences and encourages experimentation. B2C channels, including online retailers and grocery stores, provide easy access to coffee concentrates, allowing consumers to purchase products quickly without the need for wholesale or bulk orders. This convenience appeals to busy individuals looking for quick coffee solutions.

Regional Insights

Asia Pacific coffee concentrates market dominated the global market and accounted for the highest revenue share of 40.5% in 2024. There is a burgeoning interest in coffee, especially among younger consumers, who are embracing café culture and seeking convenient ways to enjoy high-quality coffee at home or on the go. As urban populations grow, busy lifestyles lead to a demand for quick and efficient solutions. Coffee concentrates fit this need by providing an instant way to prepare coffee without the hassle of brewing.

The coffee concentrates market in China led the Asia Pacific market and held the largest share in 2024, driven by increasing demand for convenient coffee products, especially among younger consumers embracing café culture. In addition, as urban lifestyles become busier, coffee concentrates offer a quick way to enjoy high-quality coffee at home or on the go. Furthermore, the expansion of Western coffee culture and major brands' influence also contribute to this growth. Moreover, online platforms facilitate easy access to these products, further boosting demand.

Europe Coffee Concentrates Market Trends

Europe's coffee concentrates market is expected to grow at a CAGR of 7.7% over the forecast period, owing to the rising popularity of specialty coffee and café-style beverages, which has driven demand for coffee concentrates, which allow consumers to replicate high-quality coffee drinks at home. Coffee concentrates are often used in cold brew coffee, which has gained significant popularity across Europe. Cold brew’s smooth taste and lower acidity appeal to younger consumers and health-conscious individuals.

The coffee concentrates market in Germany is expected to be driven by a strong coffee tradition and a preference for high-quality products. Consumers seeking convenient and customizable coffee options drive demand. In addition, the trend towards sustainability and premiumization encourages innovation in coffee processing, leading to organic and specialty coffee concentrates. This focus on quality and sustainability aligns with consumer values, contributing to market growth. Furthermore, the market benefits from a well-established coffee culture that values premium products.

North America Coffee Concentrates Market Trends

The North American coffee concentrates market is expected to grow significantly from 2025 to 2030. Cold brew coffee has become hugely popular in North America, and coffee concentrates are often used to create cold brew at home or in commercial settings, contributing to their rising demand. Many consumers in North America are increasingly health-conscious, and coffee concentrates are often perceived as a cleaner option with fewer additives compared to pre-bottled coffee drinks, aligning with the trend toward cleaner, simpler ingredients.

The coffee concentrates market in the U.S. led the North American market with the largest revenue share in 2024. The market in the country facing intense competition and innovation. With more people seeking café-quality coffee at home, coffee concentrates provide an easy way to make premium beverages without specialized equipment, appealing to convenience-focused consumers. Cold brew coffee has become hugely popular in the U.S., and coffee concentrates are often used to create cold brew at home or in commercial settings, contributing to their rising demand.

Key Coffee Concentrates Company Insights

Key players in the global coffee concentrates industry include Jim’s Coffee Concentrates, Starbucks Corporation, The J.M. Smucker Company, and others. The market is characterized by dynamic competitive dynamics shaped by a combination of factors, including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products. Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

-

Jim's Coffee Concentrates specializes in manufacturing coffee concentrates, offering a convenient way to enjoy coffee at home. The company operates in the beverage segment, focusing on coffee products that are easy to prepare. Their concentrates cater to consumers seeking a quick and flavorful coffee experience without the need for extensive brewing equipment.

-

Starbucks Corporation is a manufacturer of coffee concentrates, including its popular Cold Brew Multi-Serve Concentrate. The company operates in the specialty coffee segment, offering a range of coffee products, including concentrates, roasted beans, and ready-to-drink beverages. Starbucks' coffee concentrates are designed for easy preparation, allowing consumers to enjoy their signature flavors at home.

Key Coffee Concentrates Companies:

The following are the leading companies in the coffee concentrates market. These companies collectively hold the largest market share and dictate industry trends.

- Allegro Coffee Company

- Jim’s Coffee Concentrates

- Counter Culture Coffee

- Death Wish Coffee Co.

- Starbucks Corporation

- Wandering Bear Coffee

- The J.M. Smucker Company

- Keurig Dr Pepper Inc.

- Nestlé S.A.

- Grady’s Cold Brew

Recent Developments

-

In January 2025, NESCAFÉ launched its first-ever liquid concentrate line, NESCAFÉ Espresso Concentrate, expanding its U.S. coffee portfolio. Addressing the growing demand for convenient at-home coffee solutions, this concentrate easily liquefies in milk or water, allowing consumers to quickly create exceptional café-style, iced espresso beverages. Made with 100% Arabica beans, it comes in Black and Sweet Vanilla flavors. The NESCAFÉ Espresso Concentrate customize their drinks, and enjoy coffee shop-quality beverages without needing expensive equipment.

-

In January 2024, Torr Industries, a commercial cold coffee equipment organization, introduced Hive Cafe. This system caters to individual coffee shops needing fresh daily coffee concentrates. The Hive Cafe allows baristas to brew espresso-like concentrate alongside cold brew, yielding up to 0.6 gallons of concentrate in 15-20 minutes. Torr Industries highlights the ability to experiment with temperatures and isolate different concentrate extracts, creating unique products.

Coffee Concentrates Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.49 billion

Revenue forecast in 2030

USD 3.47 billion

Growth Rate

CAGR of 6.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Allegro Coffee Company; Jim’s Coffee Concentrates; Counter Culture Coffee; Death Wish Coffee Co.; Starbucks Corporation; Wandering Bear Coffee; The J.M. Smucker Company; Keurig Dr Pepper Inc.; Nestlé S.A.; Grady’s Cold Brew

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coffee Concentrates Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global coffee concentrates market report based on type, packaging, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Caffeinated

-

Decaffeinated

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cans

-

Pouches

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.