- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Coating Pretreatment Market Size And Share Report, 2030GVR Report cover

![Coating Pretreatment Market Size, Share & Trends Report]()

Coating Pretreatment Market Size, Share & Trends Analysis Report By Type (Phosphate, Chromate, Blast Clean), By Application (Appliance, Construction), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-370-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Coating Pretreatment Market Size & Trends

“2030 coating pretreatment market value to reach USD 5.98 billion.”

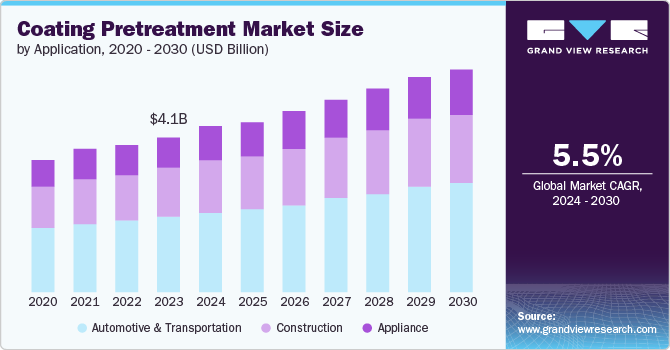

The global coating pretreatment market size was estimated at USD 4.13 billion in 2023 and is estimated to grow at a CAGR of 5.5% from 2024 to 2030.The surge in automobile sales is catalyzing the demand for automotive metal coating pretreatment solutions, aimed at safeguarding against external adversities.

Concurrently, escalating investments in public infrastructure projects are predicted to bolster market growth. Furthermore, the expansion of the middle-class demographic, coupled with robust economic development and increased demand for aircraft, is poised to amplify the utilization of powder-coating pretreatment chemicals for metals within the aerospace and construction industries.

The powder coatings market is experiencing significant growth driven by the increasing adoption of durable, eco-friendly, and cost-effective coatings, advancements in coating technologies, and specialized pretreatment solutions. Recent trends include the integration of nanotechnology to enhance properties, development of functional coatings, use of sustainable formulations, 3D printing integration for customized objects, and increased use in healthcare applications, propelling market growth across automotive, aerospace, construction, and furniture sectors.

Drivers, Opportunities & Restraints

The powder coatings market is experiencing significant growth driven by increasing regulatory pressure for environmentally friendly solutions, particularly in North America and Europe. Stringent regulations aimed at reducing hazardous materials such as chromates are pushing manufacturers towards adopting safer alternatives such as chromate-free pretreatment technologies. This shift meets regulatory compliance and appeals to environmentally conscious consumers and industries.

However, the transition from traditional chromate-based pretreatments to eco-friendly alternatives poses a significant restraint due to the complexity and cost associated with retooling production lines, conducting extensive testing, and ensuring the same level of performance and durability. These factors can slow adoption rates and impact short-term business profitability.

Emerging economies in Asia Pacific and Latin America present a substantial opportunity with rapid urbanization, industrialization, and infrastructure development creating robust demand for coating pre-treatment solutions. Businesses can capitalize on this by investing in localized production, leveraging economies of scale, and establishing strategic partnerships to navigate regulatory landscapes and penetrate new markets effectively. Recent trends also include the integration of nanotechnology to enhance properties, development of functional coatings, and use of sustainable formulations.

Application Insights

“Automotive & Transportation held the largest revenue share of over 48% in 2023.”

The automotive & transportation sector drives the coating pretreatment market with stringent requirements for corrosion protection, paint adhesion, and durability. As the industry shifts towards electric vehicles and lightweight materials, there's a rising demand for advanced pretreatment technologies. This sector spurs innovations in formulations, enhancing efficiency, reducing environmental impact, and meeting global regulations.

This sector also influences technological advancements in pretreatment formulations, pushing for innovations that improve efficiency, reduce environmental impact, and meet regulatory standards globally. Recent trends include the integration of nanotechnology to enhance properties, the development of multi-functional coatings, and the use of renewable and biodegradable raw materials to create more sustainable solutions.

PPG's ENVIROCRON technology, introduced in 2022, is a powder coating system designed for automotive parts that delivers superior edge coverage and corrosion protection. This enables automakers to meet stringent performance standards while reducing environmental impact. These innovative solutions demonstrate the automotive industry's influence in driving the development of advanced, eco-friendly coating pretreatment technologies.

Type Insights

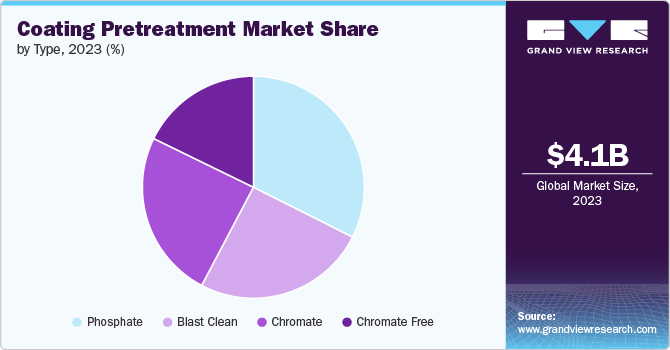

“Phosphate based pretreatment dominated the market with a share of 32.4% in 2023.”

Phosphate-based pretreatment processes have dominated the coating pretreatment market due to their effectiveness in enhancing paint adhesion and corrosion resistance across various industries, acting as a crucial layer between the substrate and the final paint, providing excellent adhesion properties and improving the durability of painted surfaces, despite facing increasing competition from chromate-free alternatives, remaining widely utilized due to their established performance characteristics and relatively lower cost.

The fastest-growing segment is chromate-free pretreatments, driven by stringent environmental regulations and rising awareness of the health hazards associated with hexavalent chromium. Chromate-free pretreatments offer comparable or superior corrosion resistance and paint adhesion properties without the environmental and health risks posed by chromates. Industries such as automotive, aerospace, and construction are increasingly adopting chromate-free alternatives to meet regulatory requirements and consumer demand for sustainable products.

For instance, AD Chemicals presents PreCoat CR Free, a chromium-free coating for aluminum alloy pretreatment, boasting Qualicoat and GSB certification. It delivers exceptional filiform corrosion protection and optimal adhesion with organic coatings.

Regional Insights

“China dominated the revenue share of the Asia Pacific coating pretreatment market.”

Asia Pacific dominates the coating pretreatment market due to rapid industrialization, burgeoning automotive production, and extensive infrastructure development across countries such as China, India, Japan, and South Korea. The region's robust economic growth fuels substantial demand for coating pretreatment solutions in sectors such as automotive, aerospace, construction, and electronics. Factors driving this dominance include increasing urbanization, rising disposable incomes, and stringent regulatory frameworks pushing for sustainable and environmentally friendly pretreatment technologies.

Moreover, Asia Pacific benefits from a strong manufacturing base and ongoing investments in technological advancements, allowing companies in the region to innovate and effectively cater to diverse market demand. For instance, in July 2023, Nippon Paint, a leading Japanese coatings manufacturer, launched a new line of chromate-free pretreatment solutions for the automotive industry, meeting the growing demand for eco-friendly surface preparation technologies.

North America Coating Pretreatment Market Trends

The coating pretreatment sector in North America is poised for a period of vigorous expansion from 2024 through 2030, driven by the region's robust automotive industry presence and a surge in vehicle sales. For instance, Toyota Motor North America (TMNA)'s 2023 U.S. sales announcement reported a year-end figure of 2,248,477 automobiles, marking a 6.6% increase in volume and a 7% rise in daily selling rate (DSR) compared to 2022. Furthermore, burgeoning investment within the semiconductor sector is anticipated to positively impact electronics manufacturers, consequently fostering the integration of coating pretreatment processes for both metal and thermoplastic components in consumer electronics.

U.S. Coating Pretreatment Market Trends

The revival of the automotive & transportation sector in the U.S. is fueling demand for the coating pretreatment market. The rapid urbanization and the increase in infrastructural development projects. For instance, in May 2022, 4,300 infrastructure projects were underway following the signing of the U.S. government’s USD 1 trillion infrastructure package.

In addition, the increasing investments in building renovation projects will increase the demand for metal pretreatment processes in construction applications, spurred by heightened priorities on water conservation and stringent environmental mandates. Consequently, there is a growing requirement for water treatment solutions, significantly driving the coating pretreatment market.

Europe Coating Pretreatment Market Trends

Europe plays a significant role in the coating pretreatment market, driven by strict environmental regulations, advanced manufacturing capabilities, and a focus on sustainable technologies. The region's leadership in automotive, aerospace, and construction industries fuels demand for high-performance pretreatment solutions, including eco-friendly alternatives such as chromate-free formulations. Continuous innovation in pretreatment chemistry and application techniques further supports Europe's position as a key player in the global market.

Key Coating Pretreatment Company Insights

Some of the key players operating in the market include 3M and AkzoNobel N.V.

-

3M is a diversified global company operating in various sectors including healthcare, consumer goods, and industrial markets. In the coating pretreatment market, 3M offers a range of solutions focusing on surface preparation and treatment. Their offerings include abrasives, tapes, adhesives, and specialty chemicals that cater to automotive, aerospace, and general industrial applications. With a commitment to innovation, 3M continues to develop advanced materials and technologies to meet the evolving demand of customers worldwide.

-

AkzoNobel is a leading global paints and coatings company, serving customers across multiple automotive, aerospace, and construction industries. In the coating pretreatment market, AkzoNobel provides a comprehensive portfolio of pretreatment products designed to enhance corrosion resistance and paint adhesion on various substrates. Its solutions include phosphates, chromates, and eco-friendly alternatives, reflecting their commitment to sustainability and regulatory compliance. AkzoNobel leverages its expertise in chemistry and materials science to deliver high-performance coatings that meet customer requirements for durability and environmental responsibility.

Key Coating Pretreatment Companies:

The following are the leading companies in the coating pretreatment market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Nippon Paint Co., Ltd.

- Axalta Coating Systems LLC

- Chemetall GmbH

- PPG Industries

- Henkel AG & Co. KGAA

- Kansai Paint Co. Ltd.

- Nihon Parkerizing Co., Ltd.

- AkzoNobel N.V.

- Nippon Paint Co., Ltd.

- The Sherwin-Williams Company

Recent Developments

-

In June 2024, Henkel, a leading provider of coating pretreatment solutions, has introduced a new cleaner and coater technology, Bonderite M-NT 41044, to enhance efficiency and sustainability in metal pretreatment. This innovation reduces processing steps from ten to four, conserving water and energy while ensuring robust corrosion protection and paint adhesion.

-

In November 2023, Henkel, a surface treatment provider, has expanded its manufacturing capacity in Spain by introducing solvent- and chromium-free metal pretreatment technologies for coating facilities to its European range.

Coating Pretreatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.34 billion

Revenue forecast in 2030

USD 5.98 billion

Growth rate

CAGR of 5.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

3M; AkzoNobel N.V.; Axalta Coating Systems LLC; Chemetall GmbH; Henkel AG & Co. KGAA; Kansai Paint Co. Ltd.; Nihon Parkerizing Co., Ltd.; Nippon Paint Co., Ltd.; PPG Industries; The Sherwin-Williams Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coating Pretreatment Market Report Segmentation

This report forecasts revenue growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global coating pretreatment market report on the basis of type, application, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Phosphate

-

Chromate

-

Chromate Free

-

Blast Clean

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive & Transportation

-

Appliance

-

Construction

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global coating pretreatment market size was estimated at USD 4.13 billion in 2023 and is expected to reach USD 4.34 billion in 2024.

b. The global coating pretreatment market is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030 to reach USD 5.98 billion by 2030.

b. By application, automotive & transportation dominated the market with a revenue share of over 48.0% in 2023.

b. Some of the key vendors of the global coating pretreatment market are 3M, AkzoNobel N.V., Axalta Coating Systems LLC, Chemetall GmbH, Henkel AG & Co. KGAA, Kansai Paint Co. Ltd., Nihon Parkerizing Co., Ltd., Nippon Paint Co., Ltd., PPG Industries, The Sherwin-Williams Company, among others.

b. The key factor driving the growth of the global coating pretreatment market is attributed to the surge in automobile sales, which is catalyzing the demand for automotive metal coating pretreatment solutions aimed at safeguarding against external adversities.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."