Coalescing Agents Market Size, Share & Trends Analysis Report By Product (Hydrophilic Coalescing Agent, Hydrophobic Coalescing Agent), By Application (Paints & Coatings, Adhesive & Sealants), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-380-1

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Coalescing Agents Market Size & Trends

The global coalescing agents market size was valued at USD 1.35 billion in 2023 and is projected to grow at a CAGR of 5.0% from 2024 to 2030 owing to expanding construction and automotive sectors which are further fueling demand for high-performance coatings that enhance durability, appearance, and protection. The market is driven by coalescing agents’ rising application in the formulation of paints and coatings to enhance the formation and performance of the final film. When incorporated into water-based formulations, these agents help lower the minimum film formation temperature, making it easier for the coating to form a cohesive and continuous film upon application.

In the ink industry, the product facilitates the proper dispersion of pigments and dyes in water-based formulations, ensuring smooth application and vibrant color development upon drying. They contribute to ink adhesion, durability, and resistance to smudging or rubbing, crucial qualities for printing applications across various substrates.

In personal care products, the product is often used in formulations such as creams, lotions, and hair care products to improve texture, spreadability, and moisturizing properties. The product helps stabilize emulsions, ensuring that the ingredients blend uniformly and maintain their efficacy over time.

The development and production of advanced coalescing agents, especially those that are low-VOC or high-performance, can involve significant costs. This can make the final products more expensive, potentially limiting their adoption in cost-sensitive markets.

Product Insights

Hydrophilic-based products dominated the market with a revenue share of 58.1% in 2023 owing to their lower volatility compared to hydrophobic coalescing agents, reducing the risk of material loss due to diffusion into the porous substrate. Hydrophilic products are a crucial component in the formulation of water-based paints and coatings.

These agents are designed to enhance the film formation and durability of waterborne coatings by promoting the fusion of individual polymer particles into a cohesive film. For instance, it facilitates the merging of various components, such as pigments, binders, and solvents, into a smooth and continuous coating. Hydrophilic agents generally contribute less to volatile organic compounds (VOCs) compared to hydrophobic coalescing agents, making them a preferred choice for environmentally conscious industries.

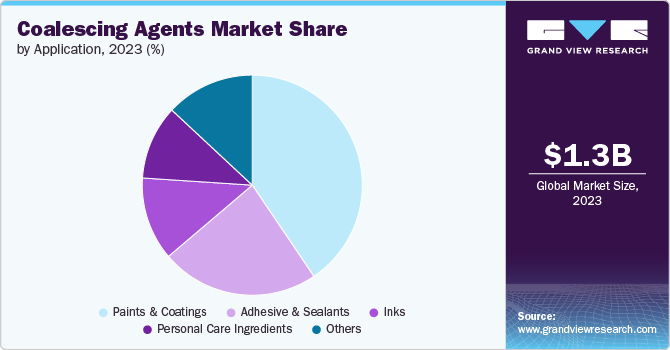

Application Insights

Paints and coatings dominated the market with a revenue share of 40.54% in 2023 owing to the increasing product application in the formulation of water-based paints and coatings. The product is used to enhance film formation, durability, and overall performance of paints & coatings.

In latex paint formulations, the product facilitates the fusion of polymer particles into a continuous and cohesive film during the drying process. They soften the polymer particles and allow them to merge together, resulting in a uniform and smooth paint film. Apart from this the product also finds its wide application in acrylic and vinyl paints.

Regional Insight

North America coalescing agents market is driven by several key factors, including increased environmental regulations and a growing preference for water-based coatings over solvent-based alternatives. Stricter environmental regulations aimed at reducing volatile organic compound (VOC) emissions are compelling manufacturers to adopt coalescing agents that facilitate the production of eco-friendly coatings. Additionally, the booming construction and automotive industries are contributing to the demand for high-performance coatings that provide enhanced durability and aesthetic appeal.

Asia Pacific Coalescing Agents Market Trends

The coalescing agents market in Asia Pacific dominated the global market with a revenue share of 45.7% in 2023 owing to the not increasing demand for industrial and architectural coatings in the region. As per the Coatings World, Asia Pacific paint and coatings market was the largest and fastest growing geographic segment in the world in 2023. In addition, the paints and coatings market in the region is estimated to be 27 billion liters and $88 billion in 2023. The rapidly growing end use industries are further expected to increase the product demand in the region.

China coalescing agents market represents the largest segment of the Asia Pacific coatings market, accounting for 55% of the region’s geographic share, followed by Japan & Korea, with Japan contributing approximately 10% and South Korea contributing 5%, totaling 15% for the sub-region.

Europe Coalescing Agents Market Trends

As per Cosmetic Europa, the region is global flagship market for cosmetics and personal care products Valued at USD 104.58 billion at retail sales price in 2023. It is estimated that the cosmetics and personal care industry brings at least USD 31.59 billion in added value to the European economy annually. Thus, the rapidly growing cosmetic industry in the region is further expected to rocket fuel the consumption of products in the region.

Key Coalescing Agents Company Insights

Some of the key players operating in the market include Stepan Company, Runtai New Material Co., Ltd., ADDAPT Chemicals B.V., Patcham, Chemoxy International, Hallstar, Krishna Antioxidants Pvt. Ltd., Cargill, Incorporated, Dow, Debor and BASF SE.

-

BASF SE, a Germany-based chemicals manufacturing company, holds a significant position globally in the chemicals manufacturing industry. It operates through its 6 business segments namely: Chemicals, Surface Technologies, Materials, Nutrition & care, Industrial Solutions, Agricultural Solutions. BASF offers a comprehensive portfolio of coalescing agents under the Loxanol and Efka brands.

-

ADDAPT Chemicals B.V. is a prominent entity in the global coalescing agents market, recognized for its expertise in providing high-quality chemical additives that enhance the performance of coatings and adhesives.

-

The company excels in developing innovative solutions tailored to meet the evolving demands of various industries, including automotive, construction, and industrial applications. ADDAPT Chemicals B.V. focuses on delivering coalescing agents that optimize film formation and improve the durability and aesthetic properties of water-based coatings while adhering to strict environmental regulations.

Key Coalescing Agents Companies:

The following are the leading companies in the coalescing agents market. These companies collectively hold the largest market share and dictate industry trends.

- Stepan Company

- Runtai New Material Co., Ltd.

- ADDAPT Chemicals B.V.

- Patcham

- Chemoxy International

- Hallstar

- Krishna Antioxidants Pvt. Ltd.

- Cargill, Incorporated

- Dow

- Deborn

- BASF SE

Recent Developments

-

In June 2023, Henkel Adhesive Technologies announced its plans to establish a new adhesive manufacturing plant in the Yantai Chemical Industry Park located in Shandong province, China. This expansion is anticipated to bolster market growth by enhancing production capabilities and meeting increasing demand for adhesive solutions.

-

Companies are increasingly seeking certifications to ensure compliance with environmental standards. An instance is the certification of Dow’s Dowanol coalescing agents under various eco-labels and standards, demonstrating their commitment to producing safer and environmentally friendly chemical solutions.

Coalescing Agents Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.42 billion |

|

Revenue forecast in 2030 |

USD 1.91 billion |

|

Growth rate |

CAGR of 5.0% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; China; India; Japan, South Korea; Brazil; Argentina; South Africa, Saudi Arabia |

|

Key companies profiled |

Stepan Company; Runtai New Material Co., Ltd.; ADDAPT Chemicals B.V.; Patcham; Chemoxy International; Hallstar; Krishna Antioxidants Pvt. Ltd.; Cargill; Incorporated; Dow; Deborn; BASF SE |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Coalescing Agents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global coalescing agents market report based on product, application & region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Hydrophilic Coalescing Agent

-

Hydrophobic Coalescing Agent

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paints & Coatings

-

Adhesive & Sealants

-

Inks

-

Personal Care Ingredients

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global coalescing agents market size was estimated at USD 1.35 billion in 2023 and is expected to reach USD 1.42 billion in 2024.

b. The global coalescing agents market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 1.91 billion by 2030.

b. Some key players operating in the coalescing agents market include Stepan Company, Runtai New Material Co., Ltd., ADDAPT Chemicals B.V., Patcham, Chemoxy International, Hallstar, Krishna Antioxidants Pvt. Ltd., Cargill, Incorporated, Dow, Deborn, BASF SE

b. Key factors that are driving the market growth include owing to expanding construction and automotive sectors which are further fueling demand for high-performance coatings that enhance durability, appearance, and protection.

b. Asia Pacific dominated the market segment with a revenue share of 45.7% in 2023, owing to the increasing demand for industrial and architectural coatings in the region.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."