- Home

- »

- Pharmaceuticals

- »

-

Coagulants Market Size, Share And Growth Report, 2030GVR Report cover

![Coagulants Market Size, Share & Trends Report]()

Coagulants Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Systemic, Topical, Hemostatics), By Application (Surgeries, Trauma, Hemophilia, Bleeding), By Route Of Administration, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-347-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 – 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Coagulants Market Size & Trends

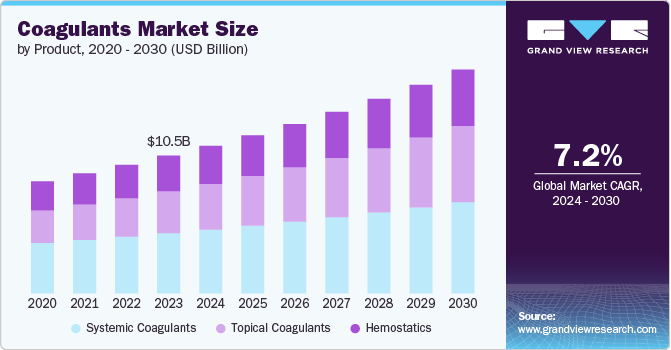

The global coagulants market size was estimated at USD 10.47 billion in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2030. The market in healthcare is primarily driven by the increasing prevalence of bleeding disorders and chronic diseases that require blood clotting factors for treatment. Conditions like hemophilia, von Willebrand disease, and thrombophilia necessitate the use of coagulants to manage and control them effectively. The rising incidence of these disorders globally is propelling the demand for this market.

Moreover, technological advancements and the development of novel coagulation therapies are driving innovation and expanding the sector. Manufacturers are investing in research and development to introduce more efficacious and safer products, including recombinant clotting factors and extended half-life products. These advancements aim to enhance patient outcomes, reduce treatment burden, and improve overall quality of life for individuals with bleeding disorders. According to Centers for Disease Control and Prevention, it's estimated that around 33,000 males in the U.S. are living with hemophilia as of May 2024.

Moreover, advancements in medical technology and research have led to development of novel coagulant products with improved efficacy and safety profiles. Innovations like recombinant clotting factors and extended half-life products offer patients more convenient treatment options and better outcomes. These technological advancements drive growth by expanding the range of available therapies and enhancing patient adherence to treatment regimens. In April 2024, Avenacy launched its FDA-approved Desmopressin Acetate Injection in the U.S., serving as a generic alternative to DDAVP Injection. This medication is aimed at treating central diabetes insipidus, hemophilia A, and Type I von Willebrand's disease.

Furthermore, favorable government initiatives and policies aimed at improving healthcare infrastructure and promoting preventive care are boosting the industry. Governments worldwide are focusing on enhancing access to quality healthcare services, including diagnostic testing facilities for early detection and management of disorders such as clotting factor deficiencies and hypercoagulable states. Incentives for research and development activities focused on hemostasis and thrombosis have also encouraged industry players to invest in developing cutting-edge technologies. For instance, initiatives like the National Hemophilia Program are done in collaboration with Centers for Disease Control and Prevention in the U.S. support research efforts to advance hemostasis-related treatments.

Regulatory requirements play a significant role in driving the healthcare industry. With the increasing emphasis on patient safety and quality care, several regulatory bodies including Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have implemented strict guidelines in healthcare settings. These regulations ensure that the products are safe, effective, and of high quality, thereby driving demand for these products. For instance, the FDA has established the Current Good Manufacturing Practice (CGMP) regulations to ensure that they are product under controlled conditions to maintain their identity, strength, quality, and purity. Compliance with these regulations requires manufacturers to invest in advanced technologies and equipment, which in turn drives the demand.

Product Insights

The systemic coagulants segment dominated the market and accounted for a share of 43.7% in 2023.Systemic coagulant is shaped by factors including the rise in bleeding disorders, surgeries, and trauma incidents. Vitamin K is essential for blood clotting, treating deficiencies, or counteracting anticoagulant overdoses. Protamine reverses heparin effects during surgery, while Desmopressin is used for conditions like von Willebrand disease to boost clot formation. Fibrinogen is crucial for managing conditions or significant loss in surgeries. Tranexamic acid is becoming popular for its effectiveness in bleeding control.A December 2022 National Institute of Health article highlighted that gelatin-based hemostatic agents, popular for their hemostasis ability in medical and dental settings, have unique benefits. Gelatin's safety and availability, alongside its enhanced efficacy when combined with other biopolymers, underscores the importance of developing new or improved versions of these agents.

The hemostatics segment is projected to grow at a significant rate over the forecast period. The hemostatics segment is driven by the increasing number of surgeries worldwide. Surgeries often need hemostatic agents to control bleeding and promote quicker wound healing, boosting the demand for these products. Advancements in surgical techniques and more complex procedures increase the need for innovative hemostatic products. In July 2023, Baxter International Inc. launched PERCLOT, a ready-to-use hemostatic powder for treating minor bleeding in patients with normal coagulants, in the U.S.

Application Insights

The surgeries segment held the largest share of 65.0% in 2023. The segment growth is driven by the global increase in surgical procedures. The growing number of elective and emergency surgeries across specialties like orthopedics, neurology, and general surgery boosts demand. Also, surgical advancements have led to more complex surgeries, requiring effective hemostasis management. According to World Health Organization (WHO) in its Action Framework for Safe and Affordable Surgery in Western Pacific Region (2021–2030) report, an estimated 313 million surgeries are performed annually worldwide. The report highlights a direct link between surgery volumes and the need for coagulants to manage the loss of blood.

Trauma cases segment is anticipated to grow significantly during the forecast period. Trauma cases segment is driven by factors including an increase in road accidents, natural disasters, violence-related injuries, and military conflicts around the world. Trauma cases typically involve significant losing blood that needs quick action to prevent hemorrhagic shock and enhance patient outcomes. Coagulants play a crucial role in managing traumatic losing blood, as they facilitate blood clotting and effectively control hemorrhage. This is pivotal in emergency treatments in which stopping the flow of blood quickly can save lives.As of June 2024, the WHO reports that injuries from accidents and violence result in 4.4 million deaths worldwide annually, making up nearly 8% of all deaths. For those aged 5-29, road accidents, homicide, and suicide are three leading causes of death.

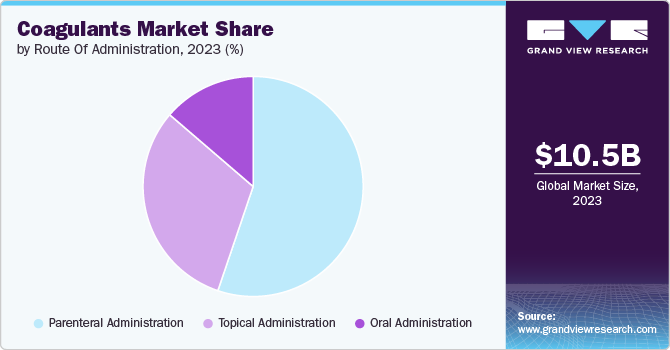

Route Of Administration Insights

The parenteral administration held the largest share of 55.2% in 2023. Parenteral administration, involving injections directly into the body through routes like intravenous, intramuscular, or subcutaneous injections, is crucial. A significant growth driver for parenteral administration is the rising prevalence of coagulants disorders needing immediate and accurate coagulant delivery. This method provides quick action and high bioavailability, important in emergencies for rapid clotting. Advancements in drug delivery technologies have improved the safety and effectiveness of parenteral methods, boosting their use in treatments. The increasing cases of blood loss conditions have heightened their demand. In November 2023, a study in Biomaterials noted that coagulants factor complexes, treatments, and most biologics need injections for delivery, with over 90% of these approved biologics being invasive.

The topical administration is anticipated to witness significant growth over the forecast period. Topical administration, involving the direct application of medications to skin or mucous membranes, is a key area. This method is used primarily for localized treatment of various skin conditions such as wounds, ulcers, and hematomas, utilizing clotting agents to aid healing and limit excessive loss of blood. The growth of topical administration is significantly driven by its convenience and non-invasive nature, making it a preferred option over systemic methods like oral or injectable routes. Patients often choose topical treatments for their simplicity and lower risk of systemic side effects. There's a growing preference for topical hemostatic agents among healthcare professionals for their precise effectiveness without impacts on the whole circulatory system. In May 2022, a National Institute of Health article highlighted that gelatin hemostatic sponges were proven to be safe and effective in managing minor bleed following matrixectomy with segmental phenolization .

Regional Insights

The coagulants market in North America accounted for the largest revenue share of 40.4% share in 2023. In North America, there is an increasing prevalence von Willebrand disease, and other blood loss diseases that require coagulation factors for treatment. The rising aging population in North America contributes to demand due to age-related conditions that affect blood clotting. Additionally, advancements in medical technology and research leading to development of novel coagulation therapies drive growth. For instance, the recombinant factor products like NovoSeven RT for hemophilia patients with blood loss episodes in hemophilia A and B with inhibitors, efficacy was found to be 93% across 227 bleeds, and 90% in 518 severe blood loss episodes involving various sites. Improved healthcare infrastructure, awareness about medical conditions, and favorable government initiatives further propel the expansion in North America.

U.S. Coagulants Market Trends

The U.S. coagulants market held the largest share in North American region in 2023 and the demand is rising for coagulation factor concentrates, which play a crucial role in treating blood disorders like hemophilia, von Willebrand disease, and disseminated intravascular coagulation (DIC). Investments in R&D and initiatives to improve access to therapies are expected to positively impact the industry. In May 2024, Novo Nordisk announced positive results from the Phase IIIa FRONTIER 2 trial for Mim8, a novel treatment for hemophilia A. The study, which involved individuals aged 12 and older, showed that Mim8 administered once weekly or monthly significantly reduced blood loss episodes, successfully meeting its primary goals. Emerging trends include the increasing adoption of pharmacy-based comprehensive coagulation management programs that combine medication delivery, remote monitoring, and telehealth consultations to enhance treatment convenience and personalization for patients with chronic blood loss disorders.

Europe Coagulants Market Trends

The Europe coagulants market was a lucrative region in this industry. There is a notable trend towards the development and adoption of advanced therapies for various disorders. The Haemophilia Society reports that blood loss disorders affect roughly one in every 2,000 people in the UK and are typically inherited. The most prevalent among these is von Willebrand Disorder (VWD), with current diagnoses including 7,071 women and 4,081 men, though many cases likely go undetected. There is a rise in demand for recombinant clotting factors to address hemophilia A and B. Innovations in gene therapy for hemophilia are gaining momentum, with promising clinical trials showing potential for long-term management of this disorder.

On the political front, one notable trend impacting Europe is the regulatory environment surrounding the approval and reimbursement of medical products. The European Medicines Agency (EMA) plays a crucial role in regulating the marketing authorization of pharmaceuticals within the European Union. Changes in regulations, including those related to clinical trial requirements, pricing and reimbursement policies, and post surveillance, can significantly influence industry dynamics and access to innovative therapies. Political decisions regarding healthcare funding, public health priorities, and trade agreements also have a direct impact on the availability and affordability of products in Europe.

Asia Pacific Coagulants Market Trends

Asia Pacific coagulants market is anticipated to witness fastest growth over the forecast period. The Countries like Japan, China, and India are at the forefront due to their large population bases and rising healthcare expenditures. The demand for clotting factors and other coagulation therapies is on the rise as awareness about these disorders increases and access to healthcare improves across the region. For instance, in Japan, where hemophilia A is prevalent, there is an increased adoption of recombinant factor VIII products. In September 2023, Japan approved ALTUVIIIO, a once-weekly treatment for hemophilia A, also approved in Taiwan. This first-in-class therapy significantly reduces bleeding in severe cases by maintaining high factor VIII levels. Additionally, advancements in biotechnology and genetic engineering are leading to development of novel coagulation treatments tailored to specific patient needs.

Key Coagulants Company Insights

Some of the key market players operating in coagulants market include Johnson & Johnson, Baxter International Inc., Pfizer Inc. and Bristol-Myers Squibb Company. These companies are making significant infrastructure investments, which enable them to develop, manufacture, and commercialize worldwide. In addition, to increase their presence globally, companies engage in several strategic partnerships with distributors and other companies.

Key Coagulants Companies:

The following are the leading companies in the coagulants market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson

- Baxter International Inc.

- Pfizer Inc.

- Bristol-Myers Squibb Company

- Sanofi S.A.

- Bayer AG

- Novo Nordisk A/S

- CSL Behring

- Octapharma AG

- Grifols S.A.

- Amgen Inc.

- Takeda Pharmaceutical Company Limited

Recent Developments

-

In November 2023, Ethicon, under Johnson & Johnson MedTech, received approval for ETHIZIA, a hemostat solution clinically shown to manage bleeding effectively where it's hard to control. The first of its kind, the ETHIZIA Hemostatic Sealing Patch uses a unique synthetic polymer technology, making it equally effective on either side.

-

In December 2022, promising findings from the Phase 3 BENEGENE-2 study were announced by Pfizer Inc. This research is examining the potential of fidanacogene elaparvovec as a gene therapy for adult males with moderate to severe hemophilia B. The therapy utilizes a specially engineered adeno-associated virus (AAV) shell and a potent version of the human coagulation FIX gene.

-

In May 2022, Takeda launched Adynovate in India, enhancing haemophilia A management with its innovative, extended half-life recombinant Factor VIII (rFVIII) product. This advancement, leveraging controlled PEGylation technology, broadens Takeda's rare disease treatment offerings.

Coagulants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.21 billion

Revenue forecast in 2030

USD 17.01 billion

Growth rate

CAGR of 7.2% from 2024 to 2030

Actual data

2018 – 2023

Forecast period

2024 – 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, route of administration, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa;Saudi Arabia; UAE; Kuwait

Key companies profiled

Johnson & Johnson; Baxter International Inc.; Pfizer Inc.; Bristol-Myers Squibb Company; Sanofi S.A.; Bayer AG; Novo Nordisk A/S; CSL Behring; Octapharma AG; Grifols S.A.; Amgen Inc.; Takeda Pharmaceutical Company Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coagulants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global coagulants market report based on product, application, route of administration, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical Coagulants

-

Absorbable Gelatin

-

Oxidized Cellulose

-

Microfibrillar Collagen

-

Other topical coagulants

-

Systemic Coagulants

-

Vitamin K

-

Protamine

-

Desmopressin

-

Fibrinogen

-

Other systemic coagulants

-

Hemostatics

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgeries

-

Trauma Cases

-

Hemophilia

-

Bleeding Disorders

-

Other Applications

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical Administration

-

Parenteral Administration

-

Oral Administration

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global coagulants market size was estimated at USD 10.47 billion in 2023 and is expected to reach USD 11.21 billion in 2024.

b. The global coagulants market is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 17.01 billion by 2030.

b. North America dominated the coagulants market with a share of 40.39% in 2023. Factors such as increasing prevalence von Willebrand disease, and other blood loss diseases that require coagulation factors for treatment, and a well-established healthcare infrastructure are responsible for market growth.

b. Some key players operating in the coagulants market include Johnson & Johnson; Baxter International Inc.; Pfizer Inc.; Bristol-Myers Squibb Company; Sanofi S.A.; Bayer AG; Novo Nordisk A/S; CSL Behring; Octapharma AG; Grifols S.A.; Amgen Inc.; Takeda Pharmaceutical Company Limited

b. Key factors that are driving the coagulants market growth include technological advancements in diagnostic tools and treatment options, increasing prevalence of coagulants disorders and chronic diseases, and expanding applications of coagulants testing in various medical fields including hematology, oncology, and critical care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.