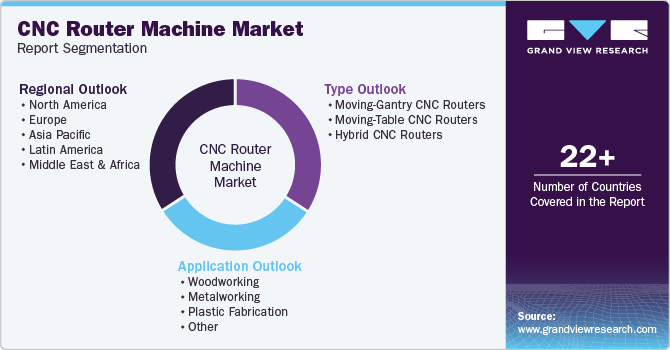

CNC Router Machine Market Size, Share & Trends Analysis Report By Type (Moving-Gantry CNC Routers, Hybrid CNC Routers), By Application (Woodworking, Metalworking, Plastic Fabrication), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-424-5

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

CNC Router Machine Market Size & Trends

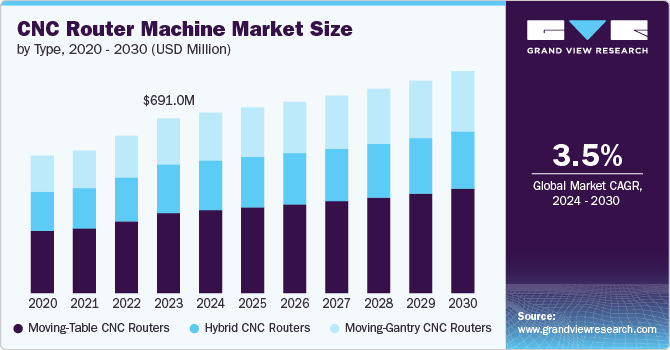

The global CNC router machine market size was estimated at USD 691.0 million in 2023 and is projected to grow at a CAGR of 3.5% from 2024 to 2030. The increasing need for automation and precision in manufacturing processes across various industries primarily drives the rising demand for CNC router machines. CNC routers have become essential tools as companies strive to enhance efficiency, reduce human errors, and maintain consistent product quality. For example, the automotive industry utilizes CNC routers for precise component manufacturing, aligning with the trend toward electric vehicles and advanced manufacturing techniques. The expansion of e-commerce platforms has also fueled demand, as consumers seek personalized furniture options that CNC routers can efficiently produce, further driving market growth.

The demand for CNC router machines is surging across various industries due to the increasing need for automated, precise, and efficient manufacturing processes. In the woodworking application, CNC routers produce intricate designs in furniture, door carvings, and decorative moldings, meeting the growing consumer demand for customized and aesthetically pleasing products. The automotive industry utilizes CNC routers for precise component manufacturing, aligning with the trend toward electric vehicles and advanced manufacturing techniques. The expansion of e-commerce platforms has also fueled demand, as consumers seek personalized furniture options that CNC routers can efficiently produce, further driving market growth. As businesses strive to enhance efficiency, reduce human errors, and maintain consistent product quality, adopting CNC routers has become essential.

Drivers, Opportunities & Restraints

The CNC router machine market is driven by several key factors that enhance its adoption across various industries. One of the primary drivers is the increasing demand for automation and precision in manufacturing processes. As industries seek to improve efficiency and reduce operational costs, CNC routers provide the necessary technology to automate cutting and shaping materials with high accuracy. For instance, in the woodworking sector, CNC routers are used to create intricate designs for furniture and cabinetry, significantly reducing production times compared to manual methods. Additionally, the automotive industry leverages CNC routers for precise component manufacturing, particularly in the production of electric vehicles, which require high-quality parts to meet performance standards.

Opportunities in the market are expanding due to the versatility of these machines and their growing application scope. With advancements in technology, CNC routers can now handle a wider range of materials, including metals, plastics, and composites, making them suitable for various industries beyond woodworking, such as aerospace and construction. The rise of DIY culture and maker communities has also created a demand for smaller, more affordable CNC routers, enabling hobbyists and small businesses to engage in personalized and custom projects. For example, small manufacturers can utilize CNC routers to produce unique home décor items or custom furniture, tapping into niche markets that prioritize personalization.

However, the market faces certain restraints that could hinder its growth. One significant challenge is the high initial investment required for CNC routers, which can be a barrier for small businesses and startups. The costs associated with purchasing the machines, along with necessary software and maintenance, can be substantial. Additionally, there is a need for skilled labor to operate these machines effectively, and the shortage of trained CNC operators can limit market expansion. The complexity of CNC technology also poses challenges, as businesses may struggle with setup, programming, and maintenance without adequate technical expertise. These factors can create hurdles to widespread adoption, particularly in regions with limited access to skilled labor and financial resources.

Type Insights

“The demand for moving table CNC routers type segment is expected to grow at a significant CAGR of 3.9% from 2024 to 2030 in terms of revenue”

The moving-table CNC routers type segment led the market and accounted for 45.8% of the global market revenue share in 2023. The demand for moving-table CNC routers is increasing due to their precision and efficiency in handling smaller workpieces, making them ideal for applications that require detailed cutting and engraving. These machines feature a stationary workpiece while the gantry structure moves, allowing for intricate designs and high-quality finishes, particularly in industries such as woodworking and metal fabrication.

Hybrid CNC routers are also gaining traction in the market, as they combine the capabilities of both moving-gantry and moving-table designs. This versatility allows users to process a wider range of materials and workpiece sizes, making them suitable for various applications, from prototyping to mass production. The integration of additive and subtractive manufacturing technologies in hybrid machines enables manufacturers to produce complex parts in a single setup, streamlining the production process.

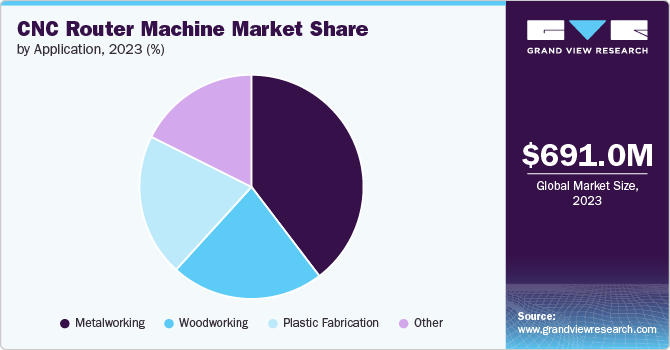

Application Insights

“The demand for plastic fabrication application segment is expected to grow at a significant CAGR of 4.2% from 2024 to 2030 in terms of revenue”

The metalworking application segment accounted for 39.6% of the global market revenue share in 2023. CNC routers play a vital role in metalworking applications, particularly in the processing of non-ferrous metals such as aluminum, brass, and copper. These machines are equipped with specialized tooling, like carbide or diamond-coated bits, which enable precise cutting, shaping, and engraving of metal components. For instance, in the automotive industry, CNC routers are used to manufacture intricate parts and prototypes, ensuring high accuracy and repeatability in production. Additionally, they are employed in creating decorative metal signage and architectural features, where detailed designs are essential. The ability to automate these processes not only enhances productivity but also reduces labor costs and minimizes human error, making CNC routers indispensable in modern metal fabrication shops.

In plastic fabrication, CNC routers are extensively utilized for cutting, milling, and engraving various thermoplastics, including acrylic, PVC, and polycarbonate. These materials are commonly used in signage, displays, and industrial components due to their versatility and durability. For instance, in the signage industry, CNC routers can produce detailed and colorful signs with intricate designs, allowing businesses to create eye-catching displays that attract customers. Furthermore, CNC routers are employed in the production of custom packaging solutions, where precise cuts and shapes are necessary to fit specific products. The growing demand for personalized and unique plastic products, driven by the rise of e-commerce and consumer preferences, is further propelling the adoption of CNC routers in plastic fabrication.

Regional Insights

“India to witness fastest market growth at 5.1% CAGR”

The demand for CNC router machines in the Asia-Pacific region is expected to witness substantial growth from 2024 to 2030, with countries like China and Japan leading the charge. The region's rapid industrialization, coupled with advancements in technology, has created a fertile ground for the adoption of CNC routers across various applications, including woodworking, metalworking, and plastic fabrication. China, in particular, is anticipated to experience the highest compound annual growth rate (CAGR) in the CNC router market, driven by its robust manufacturing base and the increasing demand for high-quality, precise components in sectors such as automotive and aerospace. As businesses in Asia-Pacific continue to embrace automation to improve efficiency and reduce costs, the CNC router market is poised for significant expansion.

India CNC router machine market is growing significantly due to the rapid increase in demand in the country. This is further driven by the country’s expanding manufacturing sector and the growing adoption of automation technologies. As industries such as woodworking, metal fabrication, and plastics seek to enhance productivity and precision, CNC routers have become essential tools. The rise of small and medium-sized enterprises (SMEs) in India, particularly in the furniture and automotive sectors, is further fueling this demand. For instance, Indian manufacturers are increasingly investing in CNC routers to produce customized furniture and automotive components, catering to the evolving consumer preferences for personalized products. With a market size projected to grow significantly over the coming years, India is positioned as a key player in the CNC router market within the Asia-Pacific region.

Europe CNC Router Machine Market Trends

In Europe, the demand for CNC router machines is being propelled by the region's focus on advanced manufacturing technologies and the growing emphasis on sustainability. European manufacturers are increasingly adopting CNC routers to produce complex components with minimal waste, aligning with the industry's shift towards environmentally friendly practices. The woodworking and furniture industries, in particular, are leveraging CNC technology to create intricate designs and customized products that meet consumer demands. Additionally, the rise of Industry 4.0 and smart manufacturing initiatives in Europe is driving the integration of CNC routers with IoT and AI technologies, enhancing their capabilities and further increasing their appeal among manufacturers.

North America CNC Router Machine Market Trends

North America remains a dominant market for CNC router machines, primarily due to the presence of established manufacturing industries and a strong focus on innovation. The automotive and aerospace sectors are significant contributors to the demand for CNC routers, as these industries require high precision and efficiency in component manufacturing. The growing trend of customization in consumer products, including furniture and signage, is also driving the adoption of CNC routers among small and medium-sized enterprises in the region. Furthermore, advancements in CNC technology, such as multi-axis systems and user-friendly software, are making these machines more accessible to a wider range of users, thereby sustaining the demand for CNC routers in North America.

Key CNC Router Machine Company Insights

Some key players operating in the market include Schaeffler, ZF Friedrichshafen, Aisin, BorgWarner, and Valeo, among others.

-

The HOMAG Group is the leading provider of integrated solutions for production in the woodworking industry and woodworking shops. As a global player, the company operates international production plants as well as sales and service companies. With around 7,000 employees, HOMAG has a presence in more than 100 countries and an estimated global market share of over 30%. The HOMAG Group offers its customers solutions for digitized production, based on digital data continuity from point of sale through the entire production process, combined with a comprehensive software suite. Customers use high-tech machines and systems from HOMAG to produce home and office furniture, kitchens, parquet and laminate flooring, windows, doors, staircases, and even complete prefabricated timber-frame buildings. The range of machines and systems available extends from individual machines for trade businesses to complete, networked production lines for highly industrialized, individual furniture production.

-

The Anderson Group is an operationally-oriented private equity firm founded in 1985 and based in St. Petersburg, Florida. With over 30 years of experience, the firm has completed more than 80 investments in a broad range of industries, focusing on the lower end of the middle market. The Anderson Group partners with management teams to effect positive business and operational change, providing capital and operational expertise to generate significant profitability improvement. Free from the pressures of institutional investors, the firm can create flexible ownership structures and long-term partnerships that drive sustainable growth in its portfolio companies.

Exel CNC Ltd. and Solar Industries are some emerging market participants in the market.

-

Exel CNC Ltd is a prominent manufacturer and supplier of CNC routers and related machinery based in the UK, with over 15 years of experience in the industry. The company has established a strong reputation for quality and service, making it one of the largest suppliers of CNC equipment in the region. Exel CNC offers a diverse range of high-quality machines designed for serious industrial production, catering to various sectors including education, aerospace, military, signage, and furniture manufacturing. With hundreds of machines installed globally, Exel CNC is recognized for its commitment to rigorous quality checks and exceptional after-sales service, ensuring customer satisfaction and operational efficiency.

-

Solar Industries is a leading manufacturer and supplier of industrial explosives and detonators, primarily serving the mining, infrastructure, and construction sectors. Founded in 1995 and headquartered in Nagpur, India, the company has expanded its operations to become a key player in the global explosives market. Solar Industries is known for its innovative approach to product development, offering a wide range of explosives and blasting solutions tailored to meet the specific needs of its clients. With a strong focus on safety and environmental sustainability, Solar Industries has established a robust distribution network and has successfully penetrated international markets, contributing to its reputation as a reliable partner in the explosives industry.

Key CNC Router Machine Companies:

The following are the leading companies in the CNC router machine market. These companies collectively hold the largest market share and dictate industry trends.

- Thermwood Corporation

- Anderson Group

- The SHODA Company

- AXYZ Automation Group

- ShopSabre

- Biesse Group

- Carbide 3D LLC

- MultiCam Inc.

- HOMAG Group

- Exel CNC Ltd

- Komo Machine

- Shoda

- Tommotek

- ART

- Solar Industries

Recent Developments

-

In July 2024, SCM introduced the SCM Maker, a new portable CNC router designed for ease of use and flexibility. To celebrate the launch, the company is offering a chance to win a Maker CNC product and is donating USD 100 to the Semper Fi & America's Fund for each entry. The SCM Maker is designed to be lightweight and easily handled, allowing it to be placed directly on the work surface, enabling routing on large surfaces without requiring permanent installation space.

CNC Router Machine Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 713.7 million |

|

Revenue forecast in 2030 |

USD 877.1 million |

|

Growth rate |

CAGR of 3.5% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil;, Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Thermwood Corporation; Anderson Group; The SHODA Company; AXYZ Automation Group; ShopSabre; Biesse Group; Carbide 3D LLC; MultiCam Inc.; HOMAG Group; Exel CNC Ltd; Komo Machine; Shoda; Tommotek, ART; Solar Industries |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global CNC Router Machine Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global CNC router machine market based on the type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Moving-Gantry CNC Routers

-

Moving-Table CNC Routers

-

Hybrid CNC Routers

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Woodworking

-

Metalworking

-

Plastic Fabrication

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global CNC router machine market size was estimated at USD 691.0 million in 2023 and is expected to reach USD 713.7 million in 2024.

b. The CNC router machine market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.5% from 2024 to 2030 to reach USD 877.1 million by 2030.

b. The moving-table CNC routers type segment led the market and accounted for 45.8% of the global market revenue share in 2023. The demand for moving-table CNC routers is increasing due to their precision and efficiency in handling smaller workpieces, making them ideal for applications that require detailed cutting and engraving.

b. Some of the key players operating in the CNC router machine market include Thermwood Corporation, Anderson Group, The SHODA Company, AXYZ Automation Group, ShopSabre, Biesse Group, Carbide 3D LLC, MultiCam Inc., HOMAG Group, Exel CNC Ltd, Komo Machine, Shoda, Tommotek, ART, Solar Industries.

b. The increasing need for automation and precision in manufacturing processes across various industries primarily drives the rising demand for CNC router machines. CNC routers have become essential tools as companies strive to enhance efficiency, reduce human errors, and maintain consistent product quality.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."