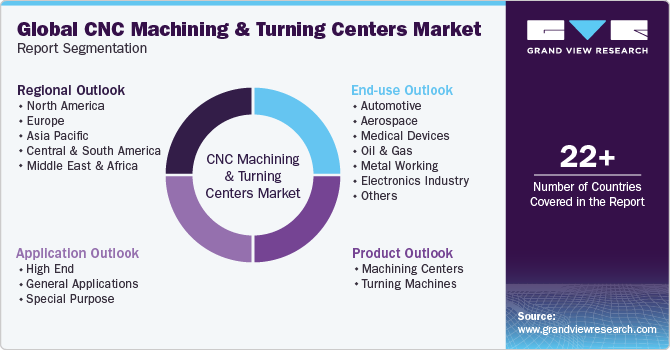

CNC Machining And Turning Centers Market Size, Share & Trends Analysis Report By Product (Machining Centers, Turning Centers), By End-use (Automotive, Aerospace), By Application (High End, General Applications), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-276-1

- Number of Report Pages: 270

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

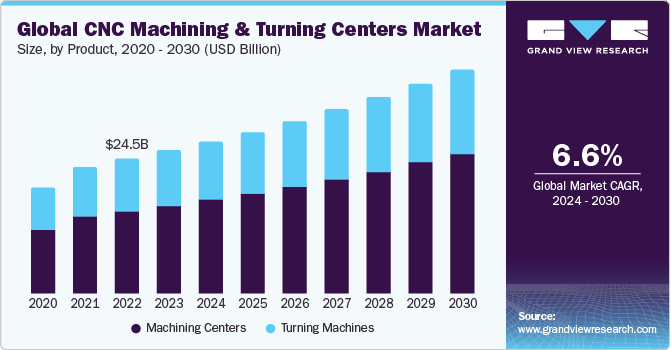

The global CNC machining and turning centers market size was estimated at USD 25.99 billion in 2023 and is projected to grow at a CAGR of 6.6% from 2024 to 2030. These advanced machines offer unparalleled precision, flexibility, and efficiency in producing complex parts, which is essential for meeting the increasingly sophisticated demands of modern industries. Moreover, the surge in demand in various industries such as aerospace, automotive, medical, and defense are further propelling the market expansion. These industries require components with high precision and tight tolerances, which CNC machining and turning centers can reliably provide. The ability to produce complex geometries with ideal surface finishes makes these machines indispensable.

A machining center is essentially any CNC machine equipped with an automatic tool changer and a clamp to secure the workpiece in place. In these centers, the cutting tool moves, but the workpiece remains stationary. The orientation of the spindle primarily distinguishes one CNC machining center from another. Vertical Machining Centers (VMCs) are typically chosen for their precision, whereas Horizontal Machining Centers (HMCs) are preferred for their efficiency in production. These distinctions, however, are not strict rules, and many machining centers do not fit neatly into these categories. Among the various types, 5-axis machining centers stand out for their ability to rotate the tool and the workpiece, allowing for cutting and drilling from multiple angles. Companies such as Okuma offer a wide range of machining centers, including both horizontal and vertical models, as well as 5-axis options in various sizes and configurations to suit diverse manufacturing requirements.

CNC turning centers are state-of-the-art machines that execute precise machining operations by rotating the workpiece. At the same time, various cutting tools are applied to it, shaping the material to the desired dimensions and forms. This process is distinct from CNC milling, in which the tool rotates. Moreover, CNC turning centers are equipped with a computer interface that allows operators to input precise instructions for the machine to execute, allowing the production of complex shapes and designs with high accuracy.

Haas provides a diverse array of turning centers, encompassing toolroom lathes, models with larger bores, configurations with dual spindles, as well, as versions featuring live tooling equipped with C-axis and Y-axis functionalities. In addition, Methods Machine delivers high-efficiency turning centers that accommodate a broad spectrum of turning, multitasking, and auxiliary spindle capabilities to enhance precision in machining tasks. Likewise, Mazak presents CNC turning centers that integrate cutting-edge technology, efficiency, and value. These machines are available in a wide range of specifications, including 2-axis configurations and complex turning centers equipped with a rotary tool spindle, Y-axis, and a secondary spindle, catering to diverse production needs.

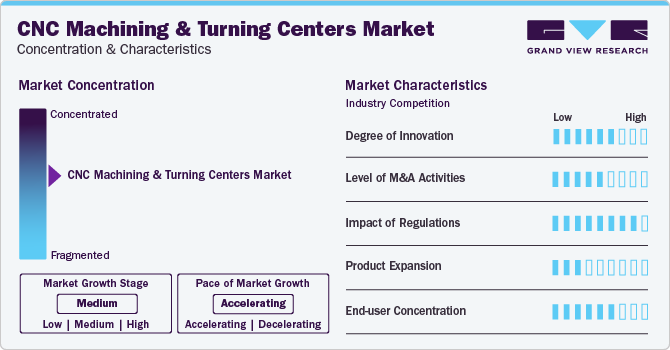

Market Concentration & Characteristics

The market growth stage is medium, with an accelerating pace. The market is characterized by a high degree of innovation owing to rapid technological advancements. Moreover, the companies are further adopting various organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

CNC machining and turning centers each serve distinct segments within the manufacturing industry, characterized by their unique capabilities and applications. CNC machining centers are versatile pieces of equipment capable of performing a variety of cutting tasks, including drilling, milling, and tapping. This flexibility makes them highly sought after in sectors requiring precision and for the production of complex parts, such as aerospace, automotive, and medical devices.

Moreover, the market for CNC machining centers is driven by the demand for efficiency and precision in manufacturing processes. As industries strive for more intricate designs and faster production times, the adoption of advanced machining centers with multi-axis capabilities and high-speed machining technology is on the rise. The integration of automation and smart technologies, such as IoT (Internet of Things) and AI (Artificial Intelligence) for predictive maintenance and optimization, further characterizes this market, highlighting a trend towards more intelligent and efficient manufacturing ecosystems.

Furthermore, CNC Turning Centers are specialized machines designed primarily for shaping metal by rotating the workpiece against a cutting tool. They are predominantly used in the production of cylindrical or round parts, such as rods, shafts, and rings, making them indispensable in industries like oil and gas, construction, and any sector requiring the mass production of turned components. The market for CNC turning centers is characterized by a steady demand for high precision and productivity in turning operations. The evolution of turning centers towards multi-tasking capabilities, where a single machine can perform turning, milling, drilling, and tapping, mirrors the market's direction towards versatility and efficiency.

Manufacturers are continuously innovating to offer machines that reduce cycle times and provide higher accuracy. Advances in control systems and software enhance the user experience and machine performance. The push towards automation and the integration of turning centers into production lines for unmanned operations is a significant trend, reflecting the broader movement towards smart manufacturing and Industry 4.0.

The CNC machine industry is surging with cutting-edge technologies that fuel trends like mass customization, faster deliveries, and error-free production. These advancements demand highly adaptable machines for today's digital landscape. To maximize efficiency, manufacturers must master these new machines, renowned for their affordability, user-friendliness, durability, speed, and superior flexibility.

Regulatory standards play a pivotal role in shaping the CNC machining and turning centers industry, influencing both design and operational practices. These regulations, which often focus on safety, environmental protection, and energy efficiency, compel manufacturers to innovate and adapt their machinery to meet stringent compliance criteria. For instance, energy efficiency standards drive the development of machines that consume less power, promoting cost savings for operators and reducing greenhouse gas emissions. As a result, manufacturers are incentivized to invest in research and development to create machines that not only meet these regulatory requirements but also offer competitive advantages in terms of productivity, safety, and sustainability. This regulatory environment, therefore, not only ensures the safety and efficiency of CNC machining and turning centers but also fosters innovation within the industry, leading to the evolution of more advanced and environmentally friendly machining technologies.

Product Insights

The CNC machining centers segment led the market with a 61.6% share of the global revenue in 2023. CNC machining centers are advanced computer-controlled machines used for producing complex parts with high precision and efficiency. These centers are pivotal in modern manufacturing environments, where they play a crucial role in various industries, including aerospace, automotive, and medical device manufacturing.

Furthermore, CNC machining centers are specialized pieces of equipment that utilize computerized controls to manage the movement and operation of cutting tools. These machines can perform a wide range of manufacturing tasks, such as drilling, milling, turning, and tapping, all within a single setup. This capability not only enhances precision but also significantly reduces production time by minimizing the need for manual tool changes and workpiece repositioning.

The CNC turning centers segment represents cutting-edge machinery designed for exact machining tasks. They function by spinning the workpiece as different cutting tools shape it to the specified dimensions and designs. This method contrasts with CNC milling, where it's the tool that rotates. Furthermore, these turning centers come with a computer interface, enabling operators to program detailed commands for the machine to follow. This capability facilitates the creation of intricate shapes and patterns with great precision.

End-use Insights

The automotive end-use segment led the market in 2023 with the largest revenue share. CNC machining and turning centers have substantially transformed automotive manufacturing by boosting efficiency, accuracy, and production speed. They can execute multiple machining tasks such as milling, drilling, and tapping simultaneously, which markedly cuts down on manufacturing duration and boosts output.For instance, complex engine components such as cylinder heads and engine blocks are manufactured with high precision using CNC machining centers. These centers can maintain tight tolerances, which ensure that each manufactured part meets stringent quality standards that are crucial for the performance and safety of vehicles.

The CNC machining process is crucial for fabricating parts used in assembling and maintaining aircraft and space shuttles. Companies that specialize in aerospace CNC machining rely on various kits, components, and assemblies vital in the aerospace industry. Moreover, the production of aircraft parts, such as bushings, clamps, hinges, or bespoke components, demands the use of high-quality materials to ensure these parts operate safely and effectively. Titanium and Kovar are particularly favored for their reliability. They are commonly used for developing aircraft components, although aluminum, bronze, copper, stainless steel, and certain plastics are also used in the aerospace industry.

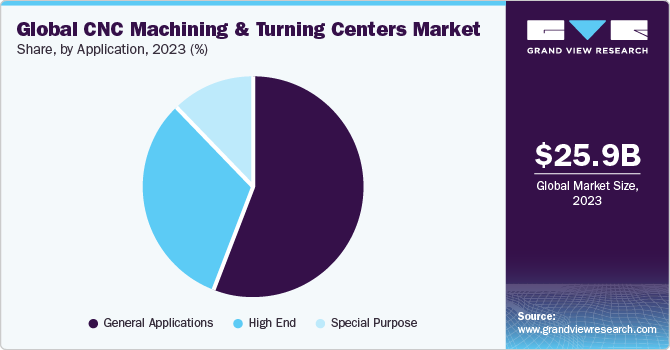

Application Insights

The general application segment dominated the market in 2023 in terms of unit volumes. CNC machining centers and turning centers are advanced and highly versatile pieces of equipment used in metalworking and manufacturing to produce precision parts with minimal manual intervention. These tools have revolutionized the manufacturing industry, allowing for high accuracy, repeatability, and efficiency in producing parts. General applications of CNC machining centers and turning centers include the fabrication of metal parts, woodworking, plastics, and composites machining, among others.

CNC turning centers are used for rotational parts, performing cutting operations while the workpiece is rotating. These centers are invaluable in producing symmetrical parts such as shafts and flanges. For instance, the Okuma LB3000 EX II is a fixed headstock CNC turning center renowned for its precision in manufacturing hydraulic/pneumatic components. Its thermal-friendly design ensures long-term dimensional stability, which is crucial for high-end applications. Moreover, the Star SR-20J II is a Swiss-type CNC turning center widely used in the medical devices industry. Its capability to produce intricate parts with tight tolerances, such as dental implants and surgical tools, is unmatched.

Regional Insights

The CNC machining and turning centers market in North America boasts robust growth, fueled by several key factors such as rising automotive production and increasing budget allocation for defense and commercial aircraft production. Moreover, automotive components require high precision to ensure that they meet all required quality and safety standards.

U.S. CNC Machining And Turning Centers Market Trends

The CNC machining and turning centers market in the U.S. is anticipated to witness a CAGR of 4.9% over the forecast period. The country is witnessing the establishment of various manufacturing facilities that are expected to surge the adoption of CNC machining centers and turning centers in the U.S. during the forecast period. The adoption of these centers enables manufacturers to streamline their production processes, reduce cycle times, minimize waste during the manufacturing process, and optimize resource utilization, such as raw materials being used in the manufacturing sector.

The Canada CNC machining and turning centers market is anticipated to witness a CAGR of 5.3% over the forecast period, owing to the expanding manufacturing facilities. CNC machining centers and turning centers provide precise and consistent machining, resulting in higher-quality components. As manufacturing facilities in Canada aim to meet stringent quality standards, the adoption of advanced machining equipment ensures the production of superior-quality products, enhancing customer satisfaction and market competitiveness.

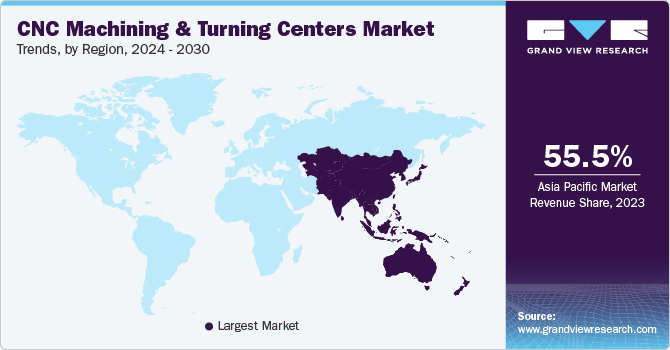

Asia Pacific CNC Machining And Turning Centers Market Trends

The Asia Pacific CNC machining and turning centers market dominated the global market with a revenue share of 55.5% in 2023. The region is experiencing notable growth in industries such as the automotive, defense, and aerospace sectors. According to the International Organization of Motor Vehicle Manufacturers, Asia Pacific is the largest transportation market, with the presence of numerous automobile manufacturers, which ensures a steady growth in automobile production in the region. Moreover, the region witnessed an increase of 10% in vehicle production volume in 2023, as compared to 2022, which is nearly 55.1 million units in 2023. CNC machines are used to manufacture automotive components, such as wheels, helical gears, bevel gears, and other power transmission components.

The CNC machining and turning centers market in China is estimated to grow at a significant CAGR over the forecast period. China's market for CNC machining and turning centers is experiencing robust growth, driven by advancements in manufacturing technology and increasing demand across various industries.According to the China Association of Automobile Manufacturers (CAAM), in 2022, China’s vehicle production increased by 3% compared to 2021. The government, as well as several major automobile companies, are increasingly investing in the country, owing to the growing demand for vehicles. CNC turning centers and machining centers are used to manufacture complex contoured automotive components, such as bevel gears, helical gears, clutch plates, and other power transmission components.

The India CNC machining and turning centers market is anticipated to witness aCAGR of 8.4% over the forecast period. This growth is attributed to the expanding population, growing transportation needs, urbanization, and rising middle-class income, which are driving the demand for automotive vehicles in India.CNC machining centers and turning centers are vital for the production of automotive components, such as engine components, gears, and bearings. Thus, with the growth in automotive production, the demand for CNC turning centers and machining centers is anticipated to grow over the forecast period.

Europe CNC Machining And Turning Centers Market Trends

The CNC machining centers and turning centers market in Europe is witnessing sustained growth in the demand for CNC machining centers and turning centers, owing to the growing automotive and aerospace industries. The rising demand for electric vehicles is driving the adoption of CNC turning centers and machining centers in Europe.In February 2023, the European Parliament gave final approval to ban the new sales of carbon-emitting petrol and diesel cars by 2035 with an aim to phase out conventional fossil fuel-based vehicles. These factors are acting as a big push for the electric vehicle industry. CNC turning centers and machining centers are used to manufacture gearboxes, shafts, power transmission setups, and other components in EVs.

The Germany CNC machining and turning centers market is expected to grow significantly at a CAGR of 6.3% over the forecast period. According to the International Trade Administration, Germany is the third-largest defense and aerospace market in Europe. The country witnessed an export of USD 3.7 billion in 2023. Moreover, the aerospace industry requires high precision and accuracy in the manufacturing process, and CNC machines fulfill these requirements. Thus, with the growing aerospace sector, the demand for CNC machining centers and turning centers is likely to grow over the forecast period.

The CNC machining and turning centers market in Italy held a significant share of 20.5% in the Europe region. CNC machines are used in the production of various surgical instruments, implants, prosthetics, and medical equipment. The country's healthcare industry has a robust local manufacturing sector that produces orthopedics and prosthetics, biomedical instruments, and diagnostic imaging equipment, among others.

Central & South America CNC Machining And Turning Centers Market Trends

The CNC machining centers and turning centers market in Central & South America is estimated to grow rapidly over the coming years. The region has been witnessing an inflow of new automotive companies, particularly from the North American region. Most of the manufacturing and automotive production companies based in North America are strategically orienting their investments in this region, specifically in Costa Rica & Brazil, owing to the presence of exceptional engineering, manufacturing, and servicing facilities in Central & South America.

The Brazil CNC machining and turning centers market is expected to grow significantly at a CAGR of 6.5%, owing to growing investment in the automotive industry. For instance, Toyota announced a new plant in Brazil with an investment of USD 2.2 billion to expand the production capacity of its flex-fuel hybrid vehicles in March 2024. In addition, in March 2024, Chinese EV manufacturer BYD also declared to invest USD 1.1 billion for a production facility of electric vehicles in Brazil. The development of EV manufacturing facilities in Brazil is likely to develop the market for CNC turning centers and machining centers.

Middle East & Africa CNC Machining And Turning Centers Market Trends

The CNC machining centers and turning centers market in the Middle East & Africa is experiencing rapid development as the region is a leading producer and exporter of crude oil & natural gas. With countries in the Middle East ramping up investments to boost oil & gas output, the need for CNC machining centers and turning centers is anticipated to rise during the forecast period. The CNC turning centers and machining centers are used to manufacture a wide range of components such as valve systems, sealing systems, and other complex parts used in oil & gas production equipment. These machines help achieve high accuracy and precision in the oil & gas manufacturing process.

The Saudi Arabia CNC machining and turning centers market is expected to grow significantly at a CAGR of 6.0%. In January 2024, the International Trade Administration reported that Saudi Arabia has approximately 17% of the world’s oil reserves and ranks as one of the largest net exporters of petroleum.In 2022, Saudi Aramco announced a record-breaking revenue of USD 161.1 billion and continued its major expansion drive. The CNC machining centers and turning centers are used to manufacture the components, such as valve systems, used in oil refineries. Thus, the growing oil & gas sector is expected to drive the CNC turning centers and machining centers market in the country.

Key CNC Machining And Turning Centers Company Insights

Some of the key players operating in the market include DMG MORI. CO., LTD., Komatsu Ltd, and DN Solutions.

-

DMG MORI. CO., LTD. products are categorized into four segments, namely machine tools, peripherals, automation systems, and digital solutions. Machine tools products involve 5-axis control machines, multi-axis machines, machining centers, and turning centers. The company has 113 offices in 88 countries, which provide sales, engineering, after-sales service, and education to customers worldwide. DMG MORI has established manufacturing plants in various countries, including Japan, Germany, Poland, Italy, the U.S., and China. This widespread distribution of manufacturing locations enables the optimization of delivery timelines and the reduction of transportation costs.

-

Komatsu Ltd. is engaged in manufacturing mining equipment, construction & demolition, waste recycling, utility equipment, and industrial machinery. As of March 2023, it had a total of 211 consolidated subsidiaries. The company’s three pillars of growth strategy include value creation using innovation, enhancing corporate resilience, and maximizing earnings power. It has a total of 9 locations in Asia Pacific that involve manufacturing operations of industrial machinery and others. Furthermore, it has a total of 60 locations that involve manufacturing operations of construction, mining, and utility equipment.

Okuma Corporation, Hurco Companies, Inc., Haas Automation, Inc., Datron AG., and Amera Seiki are some of the emerging market participants in the market.

-

Okuma Corporation is engaged in the production and distribution of machine tools (including lathes, multitasking machines, machine centers, and grinders), CNC controls, and servo motors. It offers solutions to various end-use industries such as die & mold, automotive, and semiconductor. Its product portfolio includes CNC lathes, grinders, 5-axis machining centers, machining centers, and multitasking machines. It has a total of 3 manufacturing plants in Oguchi, Kani, and Konan in Japan. Its main overseas operations are in Korea, India, Indonesia, the U.S., Australia, China, Germany, Singapore, Taiwan, and Thailand. Okuma's overseas markets are grouped into three major sectors ((ME/Africa/Europe), Asia/Oceania, and the Americas), supported by locally developed frontline solutions. It recorded 57% sales from Japan, followed by 21% from the Americas, 12% from Europe, and 10% from Asia in 2022. The company's worldwide network of offices provides reliable, collaborative after-sales service for highly competitive end users and their global production plans.

-

Hurco Companies, Inc. designs, manufactures, and distributes computerized machines, primarily focusing on vertical machining centers and turning centers. These products are offered to enterprises within the metalworking sector through an extensive network of sales, service, and distribution. The company emphasizes the development of user-friendly computer control systems that are accessible to operators. Its product portfolio comprises 5-axis vertical machining centers, 3-axis vertical machining centers, and turning centers. It serves sectors including aerospace, defense, medical equipment, energy, transportation, and computer equipment. The company operates manufacturing facilities in both Taiwan and China and distributes its products across North America, Europe, and Asia via direct and indirect sales channels. It maintains subsidiaries focused on sales, application engineering support, and services in several countries, including China, Singapore, India, England, Germany, France, Italy, Poland, and the U.S.

Key CNC Machining And Turning Centers Companies:

The following are the leading companies in the cnc machining and turning centers market. These companies collectively hold the largest market share and dictate industry trends.

- HYUNDAI WIA CORP

- Amada Machine Tools Co., Ltd.

- CHIRON Group SE

- DMG MORI. CO., LTD.

- DN Solutions

- Georg Fischer Ltd.

- JTEKT Corporation

- Komatsu Ltd

- Makino

- Okuma Corporation

- Hurco Companies, Inc.

- Dalian Machine Tool Group (DMTG) Corporation

- Amera Seiki

- Haas Automation, Inc

- Datron AG

Recent Developments

-

In April 2024, DMG MORI acquired KURAKI Co., Ltd. to foster expansion. It is intended to rebrand the merged entity as DMG MORI Precision Boring Co., Ltd. KURAKI's portfolio, primarily consisting of CNC horizontal boring and milling machines, is a significant aspect of this acquisition. This move is expected to enable the company to embrace new technologies pioneered by KURAKI, thereby enhancing its offerings in the portfolio of CNC machining centers and turning centers.

-

In January 2024, DN SOLUTIONS formed a strategic alliance with ModuleWorks, a premier software provider for the CAD/CAM sector, marked by equity investment and collaborative business endeavors. This partnership is set to cultivate a synergistic relationship, emphasizing collective efforts for the development of software for machine tools and the establishment of cohesive solutions aimed at propelling the digital evolution of the manufacturing sector. Moreover, this cooperation is expected to enhance the company's lineup in the CNC turning and machining centers domain.

-

In November 2023, DN SOLUTIONS inaugurated its first Technical Center in North Rhine-Westphalia, Germany, covering an area of 1,000 square meters equipped with state-of-the-art amenities. This new facility marks a significant step toward enhancing the company's pre-sales support services in Europe across its product portfolio including the CNC turning centers and machining centers.

CNC Machining And Turning Centers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 27.64 billion |

|

Revenue forecast in 2030 |

USD 40.61 billion |

|

Growth rate |

CAGR of 6.6% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in units, revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Switzerland; China; India; Japan; South Korea; Taiwan; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

HYUNDAI WIA CORP; Amada Machine Tools Co., Ltd.; CHIRON Group SE; DMG MORI. CO., LTD.; DN Solutions; Georg Fischer Ltd.; JTEKT Corporation; Komatsu Ltd; Makino; Okuma Corporation; Hurco Companies, Inc.; Dalian Machine Tool Group (DMTG) Corporation; Amera Seiki; Haas Automation, Inc; Datron AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global CNC Machining And Turning Centers Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the CNC machining and turning centers market report based on product, end-use, application, and region:

-

Product Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

Machining Centers

-

Vertical Machining Centers

-

Horizontal Machining Centers

-

5 Axis

-

-

Turning Machines

-

Vertical Turning Centers

-

Horizontal Turning Centers

-

-

-

End-use Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

By Product

-

Machining Centers

-

Vertical Machining Centers

-

Horizontal Machining Centers

-

5 Axis

-

-

Turning Machines

-

Vertical Turning Centers

-

Horizontal Turning Centers

-

-

-

By Application

-

High End

-

General Applications

-

Special Purpose

-

-

-

Aerospace

-

By Product

-

Machining Centers

-

Vertical Machining Centers

-

Horizontal Machining Centers

-

5 Axis

-

-

Turning Machines

-

Vertical Turning Centers

-

Horizontal Turning Centers

-

-

-

By Application

-

High End

-

General Applications

-

Special Purpose

-

-

-

Medical Devices

-

By Product

-

Machining Centers

-

Vertical Machining Centers

-

Horizontal Machining Centers

-

5 Axis

-

-

Turning Machines

-

Vertical Turning Centers

-

Horizontal Turning Centers

-

-

-

By Application

-

High End

-

General Applications

-

Special Purpose

-

-

-

Oil & Gas

-

By Product

-

Machining Centers

-

Vertical Machining Centers

-

Horizontal Machining Centers

-

5 Axis

-

-

Turning Machines

-

Vertical Turning Centers

-

Horizontal Turning Centers

-

-

-

By Application

-

High End

-

General Applications

-

Special Purpose

-

-

-

Metal Working

-

By Product

-

Machining Centers

-

Vertical Machining Centers

-

Horizontal Machining Centers

-

5 Axis

-

-

Turning Machines

-

Vertical Turning Centers

-

Horizontal Turning Centers

-

-

-

By Application

-

High End

-

General Applications

-

Special Purpose

-

-

-

Electronics Industry

-

By Product

-

Machining Centers

-

Vertical Machining Centers

-

Horizontal Machining Centers

-

5 Axis

-

-

Turning Machines

-

Vertical Turning Centers

-

Horizontal Turning Centers

-

-

-

By Application

-

High End

-

General Applications

-

Special Purpose

-

-

-

Others

-

By Product

-

Machining Centers

-

Vertical Machining Centers

-

Horizontal Machining Centers

-

5 Axis

-

-

Turning Machines

-

Vertical Turning Centers

-

Horizontal Turning Centers

-

-

-

By Application

-

High End

-

General Applications

-

Special Purpose

-

-

-

-

Application Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

High End

-

General Applications

-

Special Purpose

-

-

Regional Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Switzerland

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

- UAE

-

-

Frequently Asked Questions About This Report

b. The CNC machining centers and turning centers market size was estimated at USD 25.99 billion in 2023 and is expected to be USD 27.64 billion in 2024.

b. The CNC machining centers and turning centers market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.6% from 2024 to 2030 to reach USD 40.61 billion by 2030.

b. Asia Pacific region dominated the market and accounted for 55.5% share in 2023 owing to growing automotive production coupled with rising demand from aerospace & defense industries.

b. Some of the key players operating in the CNC machining centers and turning centers market include HYUNDAI WIA CORP, Amada Machine Tools Co., Ltd., CHIRON Group SE, DMG MORI. CO., LTD., DN Solutions, Georg Fischer Ltd., JTEKT Corporation, Komatsu Ltd, Makino, Okuma Corporation, Hurco Companies, Inc., Dalian Machine Tool Group (DMTG) Corporation, Amera Seiki, Haas Automation, Inc, Datron AG, among others.

b. The surge in demand for CNC machining centers and turning centers in various industries such as aerospace, automotive, medical, and defense are further propelling the market expansion. These industries require components with high precision and tight tolerances, which CNC machining and turning centers can reliably provide. The ability to produce complex geometries with ideal surface finishes makes these machines indispensable.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."