CMOS Image Sensor Market Size, Share & Trends Analysis Report By Spectrum (Visible, Non-visible), By Image Processing Technology (2D, 3D), By Resolution, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-103-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

CMOS Image Sensor Market Size & Trends

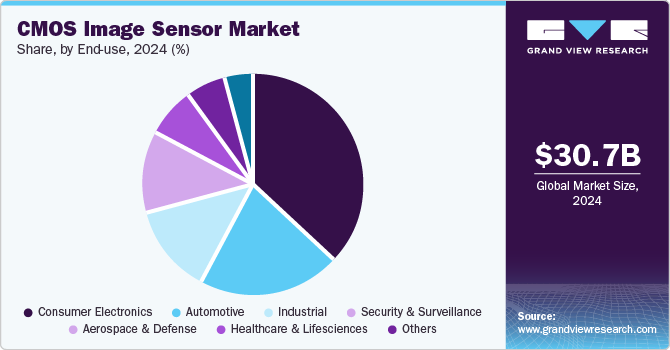

The global CMOS image sensor market size was valued at USD 30.67 billion in 2024 and is projected to grow at a CAGR of 7.7% from 2025 to 2030. The increasing integration of CMOS technology into consumer electronics, particularly smartphones and digital cameras, has been pivotal. These sensors offer advantages such as lower power consumption, higher processing speeds, and cost-effectiveness compared to traditional CCD sensors. In addition, the growing demand for high-resolution imaging capabilities in security applications has further fueled market expansion as businesses and governments invest in advanced surveillance systems to enhance safety measures.

The automotive industry increasingly integrates advanced driver assistance systems (ADAS) that rely on high-performance imaging capabilities for safety and navigation. For instance, the ISX038 represents the first CMOS image sensor designed for automotive cameras to process and output both RAW and YUV images simultaneously. Furthermore, the expansion of smart city initiatives and facial recognition technologies creates additional demand for sophisticated imaging solutions. These developments drive significant growth as industries prioritize enhanced security and efficiency.

Moreover, technological advancements in CMOS image sensors play a pivotal role in market expansion. Innovations such as improved pixel density, back-side illumination technology, and multi-camera systems enhance image quality and versatility across applications. In addition, as production techniques evolve to reduce costs while maintaining performance, the accessibility of these sensors increases in various markets, including healthcare and industrial automation.

Spectrum Insights

The visible segment dominated the market with a share of 69.1% in 2024. The high demand for visible light imaging in smartphones and digital cameras significantly contributes to this dominance. As manufacturers focus on enhancing camera capabilities and features, the preference for visible spectrum sensors remains strong, driving substantial revenue within this segment. In addition, the proliferation of social media platforms that emphasize visual content has spurred consumer interest in high-quality photography.

The non-visible segment is projected to grow at the highest CAGR during the forecast period, driven by advancements in infrared and ultraviolet imaging technologies. These sensors are increasingly utilized in specialized applications such as medical diagnostics, industrial inspections, and security systems. Moreover, infrared sensors are essential for thermal imaging in healthcare settings, enabling early detection of conditions such as fevers or inflammation. The growing emphasis on safety and security across various sectors also boosts demand for non-visible imaging solutions, particularly in surveillance systems that require night vision capabilities.

Image Processing Technology Insights

The 3D segment dominated the market, with the largest revenue share in 2024 due to the applications of augmented reality (AR) and virtual reality (VR) technologies. The growing interest in 3D imaging for gaming, healthcare, and robotics has propelled this segment's growth. 3D sensors are critical in creating immersive gaming experiences and facilitating surgical procedures by providing detailed spatial information. Furthermore, advancements in machine learning and computer vision are enhancing the capabilities of 3D imaging systems, making them more accessible and effective across various applications.

The 2D segment is projected to grow at a significant CAGR during the forecast period, fueled by ongoing advancements in sensor technology that improve image quality and processing speeds. This growth is particularly relevant in consumer electronics and automotive sectors, where high-resolution 2D imaging is essential for various applications such as facial recognition and object detection. Moreover, improvements in sensor miniaturization allow for their integration into smaller devices without compromising performance.

Resolution Insights

The above 16 MP segment dominated the market with the largest revenue share in 2024, driven by consumer demand for high-resolution smartphone cameras and professional photography equipment. The trend towards higher megapixel counts allows for greater detail and improved image quality, making these sensors highly desirable among consumers and professionals. Furthermore, advancements in image processing algorithms enable these high-resolution sensors to perform exceptionally well, even under challenging lighting conditions. This capability appeals to photography enthusiasts and industries such as real estate and e-commerce that rely on high-quality images for marketing purposes.

The 5 MP to 12 MP segment is expected to grow at the highest CAGR over the forecast period as manufacturers focus on providing cost-effective solutions that meet consumer demands for quality without sacrificing affordability. These sensors are found to be extensively used in mid-range smartphones and digital cameras, appealing to a broad audience seeking a balance between performance and price. For instance, the Google Pixel series features a 12.2 MP sensor with a size of 1/2.55 inches and pixel dimensions of 1.4µm. This sensor is paired with a lens equivalent to 27 mm and an aperture of f/1.7, which includes dual-pixel phase detection autofocus and optical image stabilization. In addition, as technology advances and production costs decrease, more manufacturers can offer competitive products within this range.

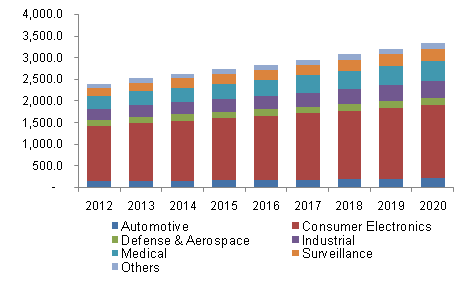

End-use Insights

The consumer electronics segment dominated the market with the largest revenue share in 2024 due to the increasing integration of advanced imaging technologies in smartphones, tablets, and other devices. Manufacturers must continuously innovate as consumers prioritize high-quality imaging capabilities for photography and video recording. For instance, the Galaxy S23 Ultra incorporates a 200MP Adaptive Pixel sensor that utilizes pixel-binning technology to enable simultaneous high-resolution processing at multiple levels, resulting in more vibrant colors. This focus on consumer preferences drives sustained growth within this segment as companies invest heavily in research and development to introduce features such as optical zoom capabilities and enhanced video recording options.

The healthcare & life sciences segment is expected to grow at the fastest CAGR over the forecast period as advancements in medical imaging technologies create new opportunities for CMOS image sensors. Applications such as diagnostic imaging, endoscopy, and telemedicine increasingly rely on high-quality imaging solutions that provide precise visual information for accurate diagnosis and treatment planning. For instance, Teledyne DALSA has developed CMOS-based image sensor technology specifically for dental radiology applications, including panoramic imaging, cone beam computed tomography (CT), and cephalometric imaging. Moreover, as healthcare providers seek to improve patient outcomes through advanced monitoring techniques such as remote patient monitoring, demand for innovative imaging technologies continues to rise. This trend positions healthcare as a critical driver of growth within the CMOS image sensor industry.

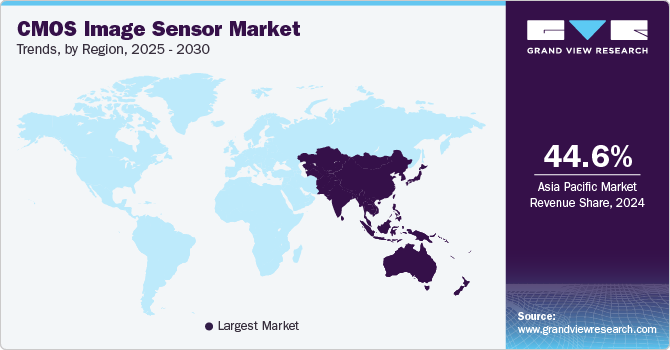

Regional Insights

Asia Pacific CMOS image sensor market dominated the global market with a revenue share of 44.6% in 2024, attributed to rapid technological advancements and increasing production capacities among key manufacturers. Countries such as China and Japan lead this growth trajectory by focusing on innovative applications across various sectors, such as automotive safety systems and industrial automation solutions that require high-quality imaging technology. The region's strategic position enhances its role within the global CMOS image sensor industry as it continues to evolve rapidly, with new entrants bringing fresh ideas into established markets.

China dominated the Asia Pacific region in 2024 due to its extensive manufacturing capabilities and growing domestic demand for advanced imaging technologies. The country's investments in research and development foster an environment conducive to innovation within the CMOS image sensor industry while allowing local companies to compete effectively globally. Furthermore, China's focus on smart city initiatives drives demand for sophisticated surveillance systems equipped with advanced imaging capabilities.

North America CMOS Image Sensor Market Trends

North America CMOS image sensor market is expected to grow at a significant CAGR from 2025 to 2030 due to strong demand from various industries, including automotive, healthcare, and consumer electronics. The region's technological advancements and investment in research and development contribute to its competitive edge in sensor innovation. In addition, North America benefits from a robust ecosystem of leading technology firms that drive continuous improvements in sensor performance through collaboration with academic institutions and research organizations.

U.S. CMOS Image Sensor Market Trends

The U.S. CMOS image sensor market dominated the regional market in 2024 due to its robust consumer electronics sector and significant investments in technology development. Major players based in the U.S., such as leading semiconductor companies, drive innovation through continuous enhancements in sensor performance and capabilities. Furthermore, favorable government policies supporting technological advancement contribute positively to market dynamics.

Middle East and Africa CMOS Image Sensor Market Trends

Middle East and Africa CMOS image sensor market is expected to grow at the highest CAGR from 2025 to 2030. Governments across this region prioritize safety measures through enhanced surveillance capabilities that require high-quality imaging technology tailored for challenging environments. In addition, sectors such as oil & gas are exploring innovative monitoring solutions using advanced imaging technologies for operational efficiency, further expanding opportunities within this market space. This trend indicates a growing recognition of technology's role in addressing regional challenges related to security management while fostering economic development through improved infrastructure investments.

Saudi Arabia dominated the regional market in 2024, reflecting its significant investment in advanced imaging technologies to enhance security and operational efficiency across various sectors. The Saudi government has prioritized sophisticated surveillance systems in urban areas, deploying high-resolution CMOS image sensors to monitor public spaces effectively. In addition, the oil and gas sector is adopting innovative monitoring solutions, with companies such as Saudi Aramco using high-quality CMOS image sensors for pipeline leak detection and operational integrity.

Key CMOS Image Sensor Company Insights

The CMOS image sensor market features several key players that shape its landscape. Panasonic Corporation develops innovative imaging solutions with high-performance sensors for various applications, while Canon Inc. offers a wide range of CMOS image sensors for both consumer and professional markets, focusing on quality and reliability. OmniVision Technologies Inc. specializes in advanced imaging solutions for applications ranging from mobile devices to automotive systems, while Sony Corporation is recognized for its cutting-edge technology and high-quality image sensors used in consumer electronics and professional imaging equipment. These companies play a significant role in shaping the CMOS image sensor industry.

-

Sony Corporation is known for its high-performance sensors, which are utilized in applications such as smartphones, cameras, and automotive systems. The company emphasizes innovation and continuously advances technology to enhance image quality and performance. Sony's commitment to research and development has led to the introduction of advanced products, including sensors for automotive cameras that support multiple image formats.

-

OmniVision Technologies Inc. specializes in developing advanced imaging solutions, particularly CMOS image sensors. The company offers a diverse range of products that cater to various sectors, including consumer electronics, automotive, and medical applications. OmniVision focuses on miniaturization and integration, enabling high-resolution imaging in compact designs. By leveraging innovative technologies, OmniVision addresses the demand for high-quality imaging solutions across multiple industries.

Key CMOS Image Sensor Companies:

The following are the leading companies in the CMOS image sensor market. These companies collectively hold the largest market share and dictate industry trends.

- Panasonic Corporation

- Canon Inc.

- OmniVision Technologies Inc.

- Sony Corporation

- ON Semiconductor Corporation

- ams OSRAM AG

- GalaxyCore Shanghai Limited Corporation

- Hamamatsu Photonics K.K.

- Himax Technologies, Inc.

- PixArt Imaging Inc.

Recent Development

-

In October 2024, Sony Semiconductor Solutions Corporation (SSS) announced the forthcoming launch of the ISX038 CMOS image sensor designed specifically for automotive cameras. This innovative product is recognized as the industry's first to simultaneously process and output both RAW and YUV images. The ISX038 features a proprietary Image Signal Processor (ISP) that enables this dual functionality, making it particularly valuable for advanced driver-assistance systems (ADAS) and autonomous driving applications.

-

In July 2024, onsemi acquired SWIR Vision Systems, a company specializing in colloidal quantum-dot-based (CQD) shortwave infrared technology. With this acquisition, onsemi aims to combine its expertise in silicon-based CMOS sensors with CQD technology to produce highly integrated SWIR sensors that are more compact and cost-effective. This integration is expected to broaden applications across commercial, industrial, and defense sectors, significantly enhancing onsemi's intelligent sensing product portfolio and driving future growth in the CMOS image sensor industry.

CMOS Image Sensor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 33.85 billion |

|

Revenue forecast in 2030 |

USD 49.12 billion |

|

Growth rate |

CAGR of 7.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Spectrum, image processing technology, resolution, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, China, Japan, India, Australia, South Korea, Brazil, Saudi Arabia, South Africa |

|

Key companies profiled |

ams OSRAM AG; Canon Inc.; OmniVision Technologies Inc.; ON Semiconductor Corporation; GalaxyCore Shanghai Limited Corporation; Panasonic Corporation; Hamamatsu Photonics K.K.; Himax Technologies, Inc.; Sony Corporation; PixArt Imaging Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global CMOS Image Sensor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global CMOS image sensor market report based on spectrum, image processing technology, resolution, end-use, and region.

-

Spectrum Outlook (Revenue, USD Million, 2018 - 2030)

-

Visible

-

Non-visible

-

-

Image Processing Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

2D

-

3D

-

-

Resolution Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 5 MP

-

5 MP to 12 MP

-

12 MP to 16 MP

-

Above 16 MP

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Consumer Electronics

-

Healthcare & Lifesciences

-

Industrial

-

Security & Surveillance

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."