Cloud TV Market Size, Share & Trends Analysis Report By Deployment, By Platform (Smart TVs, Mobile Devices, Streaming Devices), By Enterprise Size, By Solution (IaaS, PaaS, SaaS), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-356-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Cloud TV Market Size & Trends

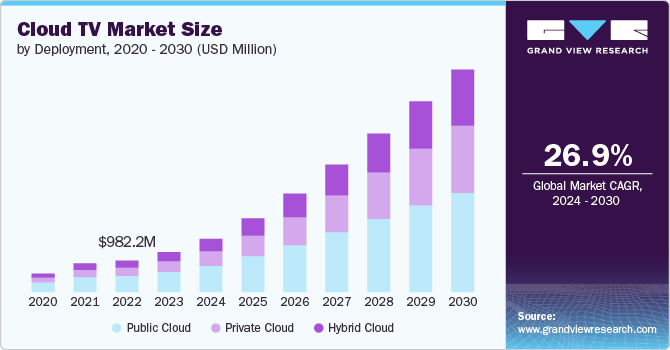

The global cloud TV market size was estimated at USD 1.24 billion in 2023 and is projected to grow at a CAGR of 26.9% from 2024 to 2030. Transformative shifts in media consumption habits, technological advancements, and the evolution of digital content delivery platforms are driving the growth of global cloud TV market. Consumers increasingly prefer on-demand access to a diverse range of content, including movies, television shows, and live events, which are facilitated by cloud TV platforms through scalable and flexible streaming services. The proliferation of smart TVs, smartphones, tablets, and other connected devices has expanded the reach of cloud TV services, allowing users to access content anytime, anywhere.

Cloud-based infrastructure offers broadcasters and content providers scalable solutions that can handle fluctuating demand without upfront investments in physical hardware. This scalability also enables efficient content delivery across global markets. Advancements in streaming technologies, including adaptive bitrate streaming, content delivery networks (CDNs), and cloud-based transcoding, have improved video quality and reduced buffering, enhancing the user experience. The platforms provide robust monetization strategies such as subscription models, advertising insertion, pay-per-view, and content licensing, enabling broadcasters to maximize revenue streams and target specific audience segments effectively. Its services facilitate global expansion for content providers by overcoming geographical barriers and localizing content to cater to diverse cultural preferences and languages.

Strategic partnerships and content acquisitions emerge as essential tactics in this context. By collaborating with a range of content providers, cloud TV platforms can offer a rich tapestry of programming that appeals to various viewer segments. This not only helps widen the user base but also fosters viewer loyalty through personalized viewing experiences. Furthermore, targeting specific demographics with precision while ensuring the availability of a broad spectrum of content can significantly boost viewer engagement.

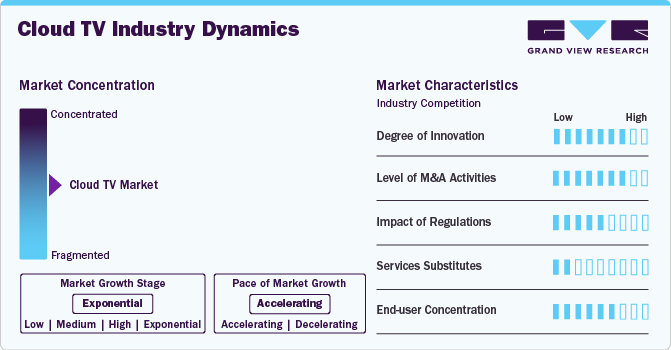

Market Concentration and Characteristics

The market growth stage is exponential, and the pace of the growth is accelerating. This rapid growth is fueled by increasing consumer demand for streaming services, advancements in cloud computing technology, and the expanding availability of high-speed internet. As traditional television consumption declines, cloud TV offers a flexible, scalable, and cost-efficient solution for delivering content.

The cloud TV market is seeing increased number of merger and acquisition (M&A) activities, underscoring its exponential growth stage and ever-expanding potential. This trend is driven by the market's rapid expansion, fueled by growing consumer demand for streaming services, advancements in cloud technology, and wider access to high-speed internet. As stakeholders vie to capitalize on this transformative force in the entertainment and media landscape, the number of M&As is expected to rise, further accelerating innovation and investment in this sector.

The cloud TV market is also subject to moderate regulatory scrutiny and is impacted by its operations and strategic decisions. These decisions are closely monitored and impact the market's growth trajectory. This oversight ensures that as these services expand and evolve amidst increasing consumer demand and technological advancements, they do so within a framework that safeguards consumer interests and promotes healthy market competition.

Cloud TV faces minimal competition from product substitutes in the market. This scenario allows it to refine and expand its services more aggressively without the immediate threat of being overshadowed by alternatives. However, its operations and strategic decisions must continue to be closely monitored. This oversight is essential to ensure that as Cloud TV services expand and evolve amidst increasing consumer demand and technological advancements, they do so within a framework that safeguards consumer interests and promotes healthy market competition.

End-user concentration is a significant factor in the cloud TV market. As Cloud TV's user base grows, understanding and catering to diverse viewer preferences become essential. The broad consumer base demands varied content, necessitating strategic partnerships and content acquisitions. Moreover, targeting specific demographics while ensuring a wide range of content can enhance viewer engagement and loyalty.

Deployment Insights

Public cloud accounted for the largest market revenue share in 2023. The market offers scalable infrastructure and cost-effective solutions for content delivery. Providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform enable broadcasters and streaming services to leverage robust cloud resources for media processing, storage, and distribution. This segment's growth is driven by the flexibility to scale operations based on demand, global reach, enhanced security measures, and advanced analytics capabilities that optimize content delivery and viewer engagement across diverse markets.

Private cloud is expected to register the fastest CAGR from 2024 to 2030. The segment caters to broadcasters and media companies seeking enhanced control and security over their content delivery infrastructure. Companies like IBM Cloud and Oracle Cloud Infrastructure offer tailored private cloud solutions that provide dedicated resources for media processing, storage, and streaming. This segment's growth is fueled by the need for stringent data security, compliance with regulatory requirements, customizable configurations, and high-performance capabilities to deliver seamless and reliable media experiences to global audiences.

Platform Insights

Mobile devices accounted for the largest market revenue share in 2023. The market is driven by the proliferation of smartphones and tablets as primary viewing devices. Platforms like Hulu and Disney+ optimize content delivery for mobile screens, offering seamless streaming experiences via cloud infrastructure. This segment's growth is fueled by increasing mobile internet penetration, consumer preference for on-the-go entertainment, and advancements in mobile technology that support high-quality video streaming, interactive content, and personalized viewing recommendations.

Smart TVs are expected to register the fastest CAGR from 2024 to 2030. The segment was facilitated by integrating internet connectivity and advanced features in modern television sets. Companies like Samsung Smart TV, LG WebOS, and Roku leverage cloud-based technologies to offer immersive viewing experiences with access to streaming services like Netflix and Amazon Prime Video. This segment's growth is fueled by consumer demand for seamless content access on large screens, enhanced user interfaces, and integration with smart home ecosystems, driving innovation and market.

Enterprise Size Insights

Large enterprises accounted for the largest market revenue share in 2023. The market is leveraging scalable cloud infrastructure to deliver comprehensive media solutions. Companies like IBM Cloud Video and Google Cloud Platform cater to large broadcasters and media conglomerates by offering robust streaming capabilities, content management, and analytics tools. This segment's growth is fueled by the need for centralized, secure platforms that support global content distribution, enhanced viewer engagement through personalized experiences, and efficient monetization strategies across diverse markets and audiences.

Small and medium sized enterprise is expected to register the fastest CAGR from 2024 to 2030. The segment is benefiting from scalable and cost-effective cloud-based solutions. Providers like Vimeo OTT and Wistia offer tailored platforms that empower SMEs to launch and manage their streaming services with minimal upfront investment. This segment's growth is propelled by increasing digital content consumption trends among SMEs, facilitated by easy-to-use tools for content creation, distribution, and monetization, thereby enhancing market reach and viewer engagement.

Solution Insights

Infrastructure as a Service (IaaS) accounted for the largest market revenue share in 2023. The on-demand computing resources that support media processing and content delivery. Providers like Amazon Web Services (AWS) and Microsoft Azure enable broadcasters and streaming platforms to deploy and manage virtualized infrastructure efficiently. This segment's growth is fueled by cost efficiencies, flexibility in resource allocation, and the ability to rapidly scale operations to meet fluctuating demand for live streaming, on-demand content, and data analytics in the media industry.

Software as a Service (SaaS) is expected to register the fastest CAGR from 2024 to 2030. This technology offers streamlined applications for content management, distribution, and monetization. Platforms like Brightcove and Kaltura provide comprehensive SaaS solutions that enable broadcasters and content providers to deliver, analyze, and monetize video content efficiently. This segment's growth is driven by the increasing adoption of cloud-based technologies, which offer scalability, cost-effectiveness, and enhanced user experiences through features such as personalized recommendations and targeted advertising.

Application Insights

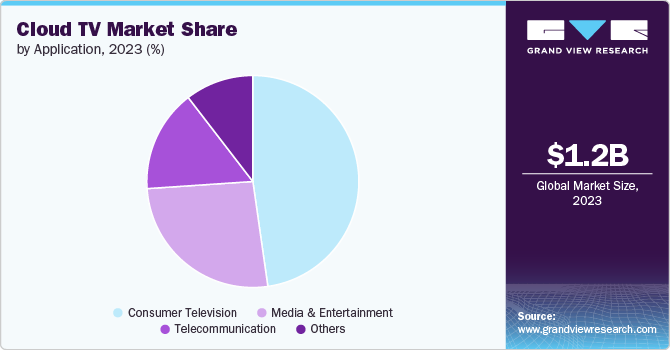

The consumer television segment accounted for the largest market revenue share of 47.7% in 2023. This growth is driven by increasing consumer demand for personalized, on-demand content accessible across devices. Platforms like Netflix and Hulu exemplify this trend, offering extensive libraries of movies, series, and original programming via cloud-based streaming. Advanced features such as AI-driven recommendations and seamless user interfaces enhance viewer engagement. This segment's growth is fueled by technological advancements in content delivery, robust internet infrastructure, and evolving viewer preferences towards flexible, subscription-based entertainment solutions.

The telecommunication segment is expected to grow at a CAGR of 30.2% from 2024 to 2030. This growth is due to leveraging robust infrastructure to deliver integrated TV services over broadband networks. Companies like AT&T TV and Verizon FiOS utilize cloud-based platforms to offer bundled services, including live TV, on-demand content, and DVR functionalities. This segment's growth is propelled by the increasing convergence of telecommunications and media, enabling seamless content delivery across multiple devices. Enhanced customer experiences, network scalability, and competitive pricing strategies are further stimulating market expansion.

Regional Insights

North America accounted for the highest revenue share of 37.5% in the cloud TV market, in 2023, owing to robust demand for scalable, secure, and innovative media delivery solutions. Companies like Brightcove and Akamai Technologies are leading with advanced streaming technologies, enabling broadcasters and content providers to deliver high-quality video content seamlessly across devices while also focusing on personalized viewer experiences and efficient monetization strategies.

U.S. Cloud TV Market Trends

The cloud TV market in the U.S. is expected to have a notable CAGR from 2024 to 2030, propelled by leading companies such as Netflix, Hulu, and Amazon Prime Video, which have pioneered on-demand streaming services. These platforms leverage cloud infrastructure to deliver high-quality video content to a broad audience, emphasizing personalized recommendations, original programming, and seamless user experiences. Advanced analytics and advertising capabilities further drive growth by optimizing content monetization and enhancing viewer engagement.

Asia Pacific Cloud TV Market Trends

The cloud TV market in Asia Pacific accounted for a significant revenue share in 2023 due to rapid digital transformation and increasing internet penetration, which are fueling growth in the market. Companies such as Alibaba Group, Sony, and Zee Entertainment leverage cloud-based platforms to cater to diverse content preferences, enhance user engagement through personalized experiences, and capitalize on growing online video consumption trends.

The Japanese cloud TV market is estimated to grow significantly from 2024 to 2030. Companies like Netflix, Amazon Prime Video, and local providers such as Hulu Japan and dTV drive the market. These platforms leverage cloud technologies to deliver a diverse range of content, including anime, dramas, and international films, with an emphasis on high-quality streaming and user-friendly interfaces. Growth is driven by technological advancements, a strong culture of media consumption, and increasing subscription rates for on-demand and live-streaming services.

The cloud TV market in India is estimated to record a notable CAGR from 2024 to 2030, driven by rapidly expanding with platforms like Hotstar (Disney+ Hotstar), Amazon Prime Video, and SonyLIV leading the charge. These services utilize cloud infrastructure to cater to diverse regional content preferences, offering a mix of Bollywood movies, original series, and live sports events. The market growth is fueled by increasing smartphone penetration, affordable data plans, and a growing preference for on-the-go entertainment, supported by robust content localization and targeted marketing strategies.

The China cloud TV market had the largest revenue share in 2023. The Chinese market is dominated by tech giants like Tencent Video, iQIYI, and Youku (Alibaba Group), which utilize cloud-based platforms to offer extensive content libraries and innovative features such as AI-driven recommendations and interactive viewing experiences. The market growth is fueled by widespread internet adoption, mobile device penetration, and increasing consumer demand for high-definition streaming content, including live sports and local entertainment.

Europe Cloud TV Market Trends

The cloud TV market in Europe is anticipated to grow at a moderate CAGR from 2024 to 2030, driven by technological advancements and shifting consumer preferences towards on-demand and personalized content. Companies like Sky, Canal+, and ProSiebenSat.1 Media is leading with innovative streaming services integrating seamless content delivery, robust security measures, and targeted advertising strategies to optimize viewer engagement and revenue generation.

The France cloud TV market accounted for a significant revenue share in 2023. Cloud-based platforms drive this growth to offer a wide range of content, including news, sports, and entertainment programming. These services prioritize seamless streaming experiences, interactive features, and content personalization to cater to diverse audience preferences. Growth is driven by increasing digital adoption, regulatory support for local content production, and strategic partnerships that expand content offerings and enhance service capabilities.

The cloud TV market in the UK is estimated to grow at the highest CAGR from 2024 to 2030. The market is dominated by platforms such as BBC iPlayer, ITV Hub, and Sky Go, which utilize cloud infrastructure to deliver live TV, catch-up services, and on-demand content. These services focus on providing a seamless viewing experience across multiple devices, supported by advanced streaming technologies and personalized content recommendations. Growth is driven by a strong tradition of media consumption, increasing mobile connectivity, and innovative business models that optimize advertising revenues and subscription monetization.

The Germany cloud TV market is estimated to grow at a moderate CAGR from 2024 to 2030. This growth is driven by companies such as Zattoo, Joyn, and Sky Deutschland, which offer a variety of live TV and on-demand streaming services. These platforms leverage cloud technology to deliver personalized content experiences, including sports events, movies, and original programming. Growth is supported by high internet penetration rates, strong consumer demand for flexible viewing options, and advancements in streaming technology that enhance content delivery efficiency and viewer engagement.

Middle East & Africa (MEA) Cloud TV Market Trends

The cloud TV market in the Middle East and Africa (MEA) region is estimated to grow significantly from 2024 to 2030. This growth is due to rising demand for cloud TV solutions driven by increasing internet connectivity and digital media consumption. Companies like MBC Group and OSN (Orbit Showtime Network) are at the forefront, leveraging cloud-based platforms to deliver a diverse range of content, including live sports and entertainment, while focusing on enhancing the user experience through localized content and efficient content delivery infrastructures.

The cloud TV market in Saudi Arabia accounted for a considerable revenue share in 2023, driven rapidly by companies like Shahid (MBC Group), OSN, and STARZPLAY Arabia. These platforms leverage cloud-based technologies to deliver a wide range of Arabic and international content, including dramas, movies, and live sports events. Growth is driven by high smartphone penetration, increasing digital content consumption, and strategic investments in local content production and distribution infrastructure to meet growing viewer demand for premium entertainment experiences.

Key Cloud TV Company Insights

Some of the key players operating in the market include Brightcove Inc., Fordela Corp, and Amino Technologies PLC.

-

Brightcove Inc. provides scalable and secure cloud solutions, enabling media organizations to deliver high-quality video content across various devices globally. The company's advanced capabilities in live streaming, on-demand video, and monetization strategies have positioned it at the forefront of transforming how content is distributed and consumed online. Brightcove continues to innovate and expand its footprint, driving substantial growth and shaping the future of digital media delivery.

-

Fordela Corp has various solutions that streamline media management and delivery. Specializing in cloud-based video workflows, Fordela empowers content creators and distributors with robust tools for encoding, transcoding, storage, and distribution. Their platform facilitates seamless integration with existing systems, ensuring efficient content delivery across multiple devices globally.

MUVI Television Ltd. and Monetize Media Inc. are some of the emerging market participants in the cloud TV market.

-

MUVI Television Ltd offers a comprehensive platform for broadcasters and content creators to launch and manage their streaming services. Leveraging robust cloud infrastructure, MUVI provides scalable solutions that encompasses live streaming, on-demand content delivery, and monetization tools. Their customizable platform supports seamless integration with various devices, ensuring a superior viewing experience.

-

Monetize Media Inc. innovative monetization solutions tailored for digital media. Specializing in ad insertion, subscription management, and content monetization strategies, Monetize Media enables broadcasters and content owners to maximize revenue streams across various platforms. Their platform offers comprehensive analytics and targeting capabilities, enhancing advertising effectiveness and viewer engagement.

Key Cloud TV Companies:

The following are the leading companies in the cloud tv market. These companies collectively hold the largest market share and dictate industry trends.

- Ooyala Inc.

- Brightcove Inc.

- MediaKind

- Fordela Corp.

- Amino Technologies PLC

- DaCast LLC, Kaltura Inc.

- MatrixStream Technologies Inc.

- MUVI Television Ltd.

- Minoto Video Inc.

- Monetize Media Inc.

Recent Developments

-

In April 2024, Accedo and Brightcove collaborated with Al Sharqiya Group to enhance its 1001 OTT streaming service, introducing Iraq’s pioneering Subscription Video-On-Demand (SVOD) platform and live linear channels. Sharqiya, renowned for its factual and entertainment content across Iraq and the MENA region, achieved a notable milestone with the expansion of its media offerings through the support of 1001. This partnership marked a significant advancement in the region’s media landscape, bolstering Sharqiya's position as a leading provider of media content in the area.

-

In April 2024, MediaKind partnered with Qvest and Qibb to launch Television New Zealand’s (TVNZ) new sports streaming service on their TVNZ+ platform. This cloud-based OTT live-streaming platform was established following TVNZ’s acquisition of major sports rights. Integrating MediaKind’s streaming technology, Qvest’s systems integration expertise, and Qibb’s cloud-native orchestration software, TVNZ+ successfully scaled workflows for multiple sports events concurrently with minimal user intervention. This collaboration exemplified a technology-driven solution that set new benchmarks in the streaming industry, emphasizing seamless integration and operational efficiency.

Cloud TV Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.66 billion |

|

Revenue forecast in 2030 |

USD 6.93 billion |

|

Growth rate |

CAGR of 26.9% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Deployment, platform, enterprise size, solution, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East and Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Ooyala Inc.; Brightcove Inc.; MediaKind; Fordela Corp.; Amino Technologies PLC; DaCast LLC; Kaltura Inc.; MatrixStream Technologies Inc.; MUVI Television Ltd.; Minoto Video Inc.; Monetize Media Inc.; among others |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Cloud TV Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cloud TV market report based on deployment, platform, enterprise size, solution, application, and region.

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart TVs

-

Mobile Devices

-

Streaming Devices

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small and Medium Sized Enterprise

-

Large Enterprise

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Infrastructure as a Service (IaaS)

-

Platform as a Service (PaaS)

-

Software as a Service (SaaS)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Television

-

Media & Entertainment

-

Telecommunication

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud TV market size was estimated at USD 1.24 billion in 2023 and is expected to reach USD 1.66 billion in 2024.

b. The global cloud TV market is expected to grow at a compound annual growth rate of 26.9% from 2024 to 2030 to reach USD 6.93 billion by 2030.

b. North America accounted for the highest market revenue share in 2023, driven by robust demand for scalable, secure, and innovative media delivery solutions. Companies like Brightcove and Akamai Technologies lead with advanced streaming technologies, enabling broadcasters and content providers to deliver high-quality video content seamlessly across devices, while also focusing on personalized viewer experiences and efficient monetization strategies.

b. Some key players operating in the cloud TV market include Brightcove Inc., Fordela Corp, Amino Technologies PLC, MUVI Television Ltd. Monetize Media Inc. and among others

b. Cloud-based infrastructure offers broadcasters and content providers scalable solutions that can handle fluctuating demand without upfront investments in physical hardware. This scalability also enables efficient content delivery across global markets.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."