- Home

- »

- Communications Infrastructure

- »

-

Cloud Services Brokerage Market Size, Industry Report, 2030GVR Report cover

![Cloud Services Brokerage Market Size, Share & Trends Report]()

Cloud Services Brokerage Market (2024 - 2030) Size, Share & Trends Analysis Report By Service (Integration & Support), By Platform (Internal, External), By Deployment (Private, Public), By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-044-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud Services Brokerage Market Trends

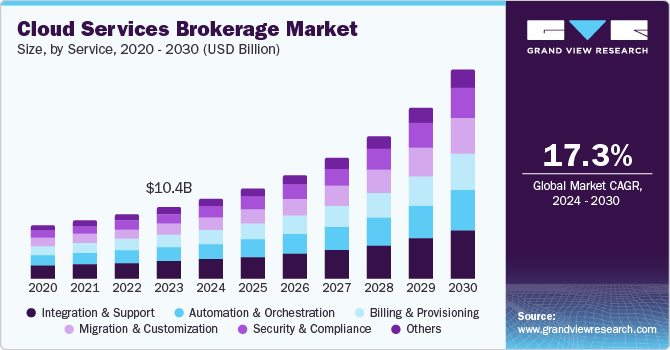

The global cloud services brokerage market size was valued at USD 10.44 billion in 2023 and is projected to grow at a CAGR of 17.3% from 2024 to 2030. The increasing complexity of cloud-based environments, cost optimization efforts by companies, and stringent security and compliance norms have fueled the demand for intermediaries that can facilitate cloud-based services and enhance and customize business information in multi-cloud platforms. By offering orchestration, implementation, and integration support, CSB providers assist organizations in optimizing their use of multiple cloud environments to achieve business objectives. Growing data storage and security demands have compelled various critical industries such as manufacturing, energy, and FMCG to approach CSB providers, which is expected to ensure steady market growth.

Factors such as the proliferation of cloud service providers and the emergence of hybrid and multi-cloud architectures have created complex IT landscapes. For instance, as per a report by AAG IT Services, it was estimated that about 60% of the data of corporate enterprises was stored on cloud platforms in 2022, led by established names such as Amazon Web Services (AWS) and Google Cloud. Cloud service brokerage providers offer valuable expertise navigating these environments, optimizing resource utilization, and ensuring seamless integration. Moreover, organizations increasingly seek to maximize returns on their cloud investments while minimizing expenditures. CSB models provide cost management strategies, rightsizing recommendations, and financial transparency, enabling clients to achieve operational efficiency.

As data breaches and regulatory requirements intensify, organizations prioritize deploying robust security measures. Cloud service brokers offer specialized security services, risk assessments, and compliance frameworks, mitigating security risks and ensuring stringent adherence to industry standards. The increasing availability of cloud-based applications and services across various industries has created new opportunities for cloud service brokers. By offering a curated marketplace of cloud solutions, these providers can address the diverse needs of their clients. Such factors are expected to drive steady demand for CSB over the forecast period.

Service Insights

Integration and support services accounted for the highest revenue share of 24.2% in 2023. The increasing adoption of hybrid and multi-cloud strategies among enterprises globally has resulted in the emergence of complicated IT infrastructures. Cloud service brokers seamlessly integrate different cloud services, applications, and on-premises systems, enhancing operational efficiency and data flow. Moreover, the ever-changing nature of cloud computing requires its constant management and optimization. Cloud service brokers offer performance monitoring, capacity planning, and cost management services to ensure optimal resource utilization and cost efficiency. These factors lead to segment dominance in this market.

Security and compliance services are expected to register the fastest CAGR over the cloud services brokerage market forecast period. The increasing frequency and severity of cyberattacks across several industry verticals have amplified the demand for advanced cybersecurity measures. For instance, as per the IBM X-Force Threat Intelligence Index 2024, it has been estimated that there has been a 71% year-on-year growth in the occurrence of cyberattacks. Cloud service brokers offer specialized expertise in threat detection, prevention, and incident response, providing a critical layer of protection for organizations from data theft. As these attacks become more advanced, the demand for robust cloud security measures is expected to rise proportionately, driving industry expansion.

Platform Insights

Internal brokerage enablement platforms accounted for a larger market share in 2023. These platforms provide a unified framework for organizations to manage their cloud services, enabling streamlined governance and control. By leveraging these platforms, enterprises can effectively negotiate with cloud providers, ensuring optimal pricing and reduced costs. The demand for internal enablement models has been particularly noticed among SMEs looking to bring in CSB. Additionally, internal platforms prioritize security and compliance, ensuring the required adherence to regulatory standards. These factors contribute to the dominance of this segment in the global market.

Meanwhile, the external brokerage enablement platform segment is expected to grow comparatively faster from 2024 to 2030. This sharp rise in demand is poised to be driven by its ability to address the evolving needs of businesses seeking agile, cost-effective, and innovative cloud solutions. As small and medium-sized enterprises increasingly adopt cloud services, external platforms have emerged as an attractive option, offering scalability, flexibility, and convenience of payment options that align with their dynamic requirements. Furthermore, strategic partnerships with cloud providers have enabled these platforms to expand their offerings and reach. These factors have led to the accelerated growth prospects of this segment.

Deployment Insights

The public cloud segment dominated the market with the highest revenue share in 2023. This is due to the affordability and enhanced security features of public cloud platforms. Public cloud platforms offer services at a more affordable rate than private platforms. These platforms are continuously updated to meet timely and enhanced security requirements. Additionally, organizations are not required to be concerned about the huge maintenance costs associated with public platforms. These factors attract a large organizational base to adopt public cloud services for cost-effectively storing non-classified data, leading to segment dominance that is expected to continue in the coming years.

The hybrid cloud segment is anticipated to advance at the fastest CAGR during the forecast period. Organizations worldwide are increasingly adopting hybrid solutions owing to the scalability and flexibility of these platforms' data storage. For instance, they can store sensitive data on their private cloud platforms to maintain confidentiality and enhanced security. Meanwhile, generic and less classified data can be conveniently stored on public cloud platforms, which may not pose any notable security or financial consequences in case of breaches. This flexibility assists organizations in their cost-optimization efforts, leading to the increased adoption of hybrid models.

Enterprise Size Insights

Large enterprises held the highest market share in 2023. This is due to their requirements for dedicated cloud service platforms to manage enormous amounts of data effectively. These requirements are driven by their complex operational needs and substantial IT budgets. With their extensive resources and well-established IT departments, large enterprises have effectively integrated CSB platforms into their existing infrastructure. Moreover, their robust security, compliance, and governance requirements have led to increased demand for advanced cloud brokerage services, further solidifying their dominant position in the market.

On the other hand, small and medium-sized enterprises are expected to adopt CSB services at a faster rate than large enterprises over the forecast period. This is owing to the availability of a limited budget for IT services and inadequate infrastructure for in-house data processing. A report by AAG IT Services, updated in June 2024, showed that small and medium enterprises stored over 57% of their workload and 56% of their data on cloud platforms in 2022. SMEs increasingly leverage CSB platforms to access scalable, flexible, cost-effective cloud services. Furthermore, the availability of tailored solutions for these enterprises has increased their adoption of CSB services, fueling a substantial growth rate.

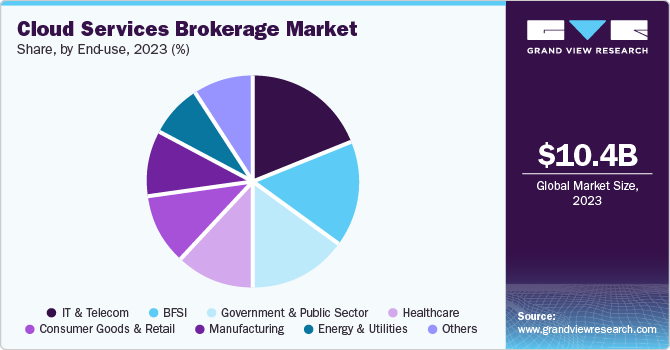

End-use Insights

The IT & telecom sector accounted for the highest market share in 2023. This is owing to the industry’s reliance on high-end technology and infrastructure to drive innovation, efficiency, and customer satisfaction. As pioneers in cloud adoption, these organizations have leveraged CSB platforms to optimize operations, enhance network infrastructure, and deliver cloud-based services to their customers. Moreover, the sector’s substantial investments in cloud infrastructure, applications, and services have increased market share. As demand for business analytics and intelligence, IoT, and unified communication rises, the position of this sector is expected to solidify further.

The energy and utilities sector is anticipated to register the fastest growth rate during the forecast period. The sector has witnessed an accelerated adoption of cloud solutions to address challenges such as improvement in operational efficiencies, grid modernization, and renewable energy integration. As the sector is experiencing rapid transformation, CSB platforms have enabled companies to leverage advanced technologies such as IoT, data analytics, and artificial intelligence. Furthermore, the increasing emphasis on sustainability and decarbonization has led to increased investment in cloud-enabled smart grid solutions, contributing to the sector's high demand for cloud service brokers.

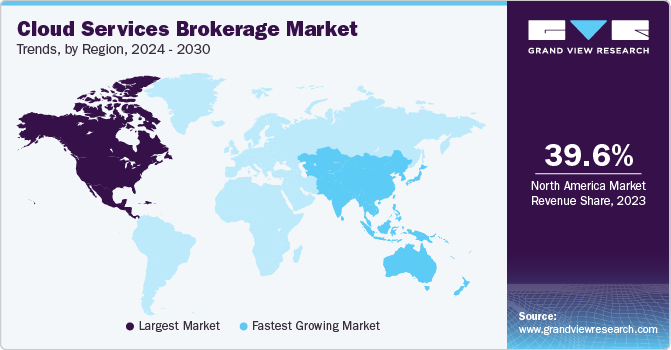

Regional Insights

North America cloud services brokerage market dominated the global market with a revenue share of 39.6% in 2023. This substantial contribution can be attributed to the region's early adoption and widespread acceptance of cloud-based technologies, coupled with a robust ecosystem of cloud service providers and brokerage platforms in countries such as the U.S. and Canada. Additionally, the region's stringent regulatory requirements and complex IT environments have fueled demand for cloud brokerage solutions, enabling organizations to navigate compliance and integration challenges.

U.S. Cloud Services Brokerage Market Trends

The U.S. held the highest share of the regional market in 2023. The country has a robust IT ecosystem in the Silicon Valley region of California. Prominent multinational IT companies and CSB providers such as Cognizant, IBM, and others have headquarters in the country and offer distinct cloud brokerage services to organizations, catering to their diverse operational and organizational requirements. These factors have led to the economy's dominant position in the regional CSB market.

Europe Cloud Services Brokerage Market Trends

Europe accounted for a significant share of the global market in 2023. This is due to the region's strategic emphasis on deploying and adopting cloud-enabled solutions. Moreover, the presence of a well-established and diverse landscape of industries such as finance, healthcare, manufacturing, and energy in Europe has created a vast potential for cloud adoption. The European Union's initiatives to promote a digital single market and the implementation of data protection regulations such as GDPR have further accelerated cloud adoption by companies, driving market expansion.

The UK held a notable share of the European market in 2023. The evolving technological environment, stringent national data protection and privacy mandates, and increasing demand from untapped sectors such as healthcare, manufacturing, and energy & utilities have acted as major growth drivers for this market. Additionally, with the advent of artificial intelligence and machine learning technologies, the cloud landscape is changing rapidly. These factors have led to heightened demand for this market in the country.

Asia Pacific Cloud Services Brokerage Market Trends

Asia Pacific cloud services brokerage market is expected to grow fastest from 2024 to 2030. The region's large and diverse market, comprising countries such as India, China, South Korea, and Japan, has created a significant potential for cloud growth. Additionally, the increasing focus on digitalization, e-governance initiatives, and smart city projects has accelerated cloud adoption. In contrast, a thriving ecosystem of cloud providers and brokerage platforms has further fueled growth.

India has experienced a significant rise in the number of startups and small and medium-sized enterprises in the past few years owing to favorable government policies, substantial funding from venture capitalists, and increased foreign direct investments. For instance, the government's Department for Promotion of Industry and Internal Trade (DPIIT) recognized about 117,254 startups as of December 2023. These enterprises increasingly adopt cloud solutions to drive business growth, leading to a significant demand for cloud service brokers.

Key Cloud Services Brokerage Company Insights

Some key companies involved in the cloud services brokerage market include Wipro, ActivePlatform, and Atos SE, among others.

-

Wipro is an Indian multinational IT services company that offers cybersecurity, artificial intelligence, data analytics, business processes, consulting, and cloud services to over 25 industries worldwide. In the cloud services segment, Wipro offers FullStride Cloud advisory and consulting, which assist businesses in making optimum cloud utilization strategies. In addition, it provides distinct cloud-based services such as migration and modernization, infrastructure, cloud security, cloud studio, industry cloud, digital workplace, and other related services catering to organizational requirements.

-

ActivePlatform is a Belarus-based technology company offering full-service automated cloud brokerage services. The company provides white-labeled cloud solutions of Microsoft and other vendors to organizations in over 50 countries globally. In addition, it assists in automated service provisioning, billing and subscription management, analytics and reporting, and user management. Through its 30 connected cloud services, the company enables the deployment of fast and automated cloud-based solutions for vendors and customers.

Key Cloud Services Brokerage Companies:

The following are the leading companies in the cloud services brokerage market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- ActivePlatform

- Arrow Electronics, Inc.

- Atos SE

- Cognizant

- Fujitsu

- IBM

- NTT DATA Group Corporation

- Tech Mahindra Limited

- Wipro

Recent Developments

-

In July 2024, Wipro announced its contract with MAHLE, a major international automotive supplier. MAHLE has selected Wipro to upgrade its IT infrastructure by deploying a hybrid cloud solution. The development would see Wipro migrating MAHLE’s core data centers into the hybrid solutions of Wipro FullStride Cloud, aiding MAHLE’s IT structure to enable business agility, undergo digitization of their IT ecosystem, and meet regulatory requirements.

-

In April 2024, Cognizant announced its strategic partnership with Google Cloud and Shopify to help global brands and retailers undergo digital transformation. The alliance aims to bring together the expertise of these companies - Shopify’s commerce platform, Cognizant’s client delivery, and Google Cloud’s core cloud infrastructure - to offer customers shopping assistance, customized offers, and real-time recommendations.

-

In January 2024, Accenture announced the acquisition of Navisite, a U.S.-based company that provides managed services and digital transformation solutions. Through this strategic move, Accenture aims to strengthen its managed services capabilities to enable its North American clients to undergo modernization of their IT infrastructure.

Cloud Services Brokerage Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.69 billion

Revenue forecast in 2030

USD 30.49 billion

Growth rate

CAGR of 17.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Service, platform, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; Australia; South Korea; India; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Accenture; ActivePlatform; Arrow Electronics, Inc.; Atos SE; Cognizant; Fujitsu; IBM; NTT DATA Group Corporation; Tech Mahindra Limited; Wipro

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud Services Brokerage Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cloud services brokerage market report based on service, platform, deployment, enterprise size, end-use, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Integration and Support

-

Automation and Orchestration

-

Billing and Provisioning

-

Migration and Customization

-

Security and Compliance

-

Others

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Internal Brokerage Enablement

-

External Brokerage Enablement

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Private

-

Public

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small and Medium-sized Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

IT and Telecom

-

BFSI

-

Government and Public Sector

-

Healthcare

-

Consumer Goods and Retail

-

Manufacturing

-

Energy and Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global Cloud Service Brokerage (CSB) market size was estimated at USD 5,636.4 million in 2020 and is expected to reach USD 6,481.8 million in 2020.

b. The global Cloud Service Brokerage (CSB) market is expected to grow at a compound annual growth rate of 17.3% from 2019 to 2025 to reach USD 17,198.0 million by 2025.

b. Cloud integration, sourcing, and procurement dominated the Cloud Service Brokerage (CSB) market with a share of 40.1% in 2019. This is attributable to rising demand for integration services across large enterprises, which provides ease of accessibility to businesses worldwide.

b. Some key players operating in the Cloud Service Brokerage (CSB) market include Accenture PLC; IBM Corp.; Atos SE; Capgemini SE; Jamcracker, Inc.; Cognizant Technology Solutions Corporation; DXC Technology Company; Infosys Limited; Hewlett Packard Enterprise Development LP; Fujitsu Ltd.; NTT DATA, Inc.; Tech Mahindra Limited; and Wipro Limited.

b. Key factors that are driving the market growth include adoption of multi-cloud platforms by enterprises coupled with increasing investments for the betterment and deployment of advanced telecom network infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.