Cloud Point Of Sale Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Type, By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-350-2

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Cloud Point Of Sale Market Size & Trends

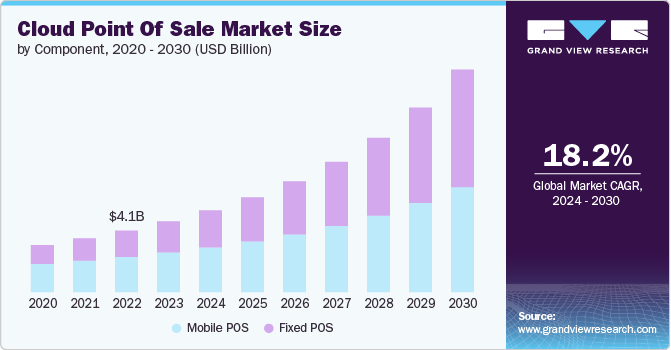

The global cloud point of sale market size was estimated at USD 4.70 billion in 2023 and is expected to grow at a CAGR of 18.2% from 2024 to 2030. The rising adoption of cloud technology across various industries has made businesses more comfortable with transitioning their operations to the cloud. Similarly, the need for enhanced operational efficiency and the ability to provide superior customer experience are encouraging businesses to invest in cloud point of sale (POS) systems. Further, significant regulatory changes and the need for secure, compliant transaction processing are also pushing businesses towards adopting more advanced POS technologies.

The rising integration of advanced technologies including artificial intelligence (AI) and machine learning (ML) into POS systems is gaining traction, enabling businesses to gain deeper insights into customer behavior and improve inventory management. Further, rapidly increasing contactless payment systems, the growing preference for digital wallets, and shift towards omnichannel retailing are the key trends driving the need for POS systems that can seamlessly handle transactions across various sales channels.

Consumers today expect a seamless shopping experience whether they are online, in-store, or using a mobile device. Cloud POS systems facilitate this by integrating various sales channels, enabling businesses to provide a cohesive customer experience. The flexibility and convenience offered by cloud POS systems make them an attractive option for retailers looking to stay competitive in a rapidly evolving market.

With the increasing penetration of smartphones and tablets, mPOS systems are becoming popular among small and medium-sized enterprises (SMEs) and even larger retail chains. These systems allow for transactions to be processed anywhere within the store, enhancing customer service and reducing wait times. Additionally, mPOS solutions are often more cost-effective and easier to implement than traditional POS systems, making them a viable option for businesses of all sizes.

Component Insights

The solution segment accounted for the largest market share of over 67% in 2023. The demand for cloud POS solutions is primarily driven by the need for greater operational efficiency and enhanced customer experiences in the retail and hospitality sectors. Businesses are increasingly recognizing the benefits of cloud-based systems, such as real-time data access, remote management, and scalability. These systems enable seamless integration with other business applications, facilitating comprehensive data analysis and insights into sales trends, inventory management, and customer preferences. This integration is crucial for businesses aiming to maintain a competitive edge, as it allows for quick adaptation to market changes and personalized customer service.

The service segment is expected to grow at a significant rate during the forecast period. The demand for cloud POS services is significantly influenced by the growing complexity of business operations and the need for specialized support and maintenance. As businesses adopt cloud POS solutions, they require continuous assistance to ensure smooth system integration, data migration, and user training. Professional services such as implementation, consulting, and training are critical in helping businesses maximize the benefits of their cloud POS investments. Additionally, managed services, including system monitoring, maintenance, and security management, are essential for ensuring the reliability and security of cloud POS systems.

Type Insights

The fixed POS segment accounted for the largest market share of over 56% in 2023. Fixed POS systems, traditionally located at checkout counters or designated points within a store, have seen increased demand driven by several key factors. One primary driver is the need for enhanced security and reliability. Fixed POS systems often come with robust hardware and software integration, which ensures higher data security and stability compared to mobile counterparts. Retailers and businesses with high transaction volumes prefer these systems due to their durability and ability to handle complex operations such as inventory management, customer relationship management (CRM), and loyalty programs.

The mobile POS segment is expected to grow at a significant rate during the forecast period. Mobile POS (mPOS) systems have experienced a surge in demand primarily due to their flexibility and portability. These systems, which can operate on smartphones, tablets, or dedicated handheld devices, cater to the increasing need for mobility in various business settings. One of the key factors driving this demand is the growing trend of on-the-go services and pop-up stores, which require a POS solution that is not tied to a specific location. The hospitality and food service industries benefit greatly from mPOS systems as they enable staff to take orders and process payments directly at the table, enhancing the customer experience and improving operational efficiency.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share of over 58% in 2023. The flexibility and integration capabilities of cloud POS systems are crucial for large enterprises. Businesses often utilize various other systems such as ERP (Enterprise Resource Planning), CRM, and HR management systems. Cloud POS solutions can seamlessly integrate with these existing systems, creating a cohesive technology ecosystem that enhances operational efficiency and data accuracy. Moreover, the scalability of cloud POS systems allows large enterprises to quickly adapt to market changes, expand to new locations, or launch new sales channels without the need for extensive reconfiguration or additional infrastructure.

The SMEs segment is expected to grow at a significant rate over the forecast period. The demand for cloud-based Point of Sale (POS) systems among SMEs is driven primarily by the need for cost-efficiency and scalability. Traditional POS systems often require substantial upfront investments in hardware and software, which can be prohibitive for smaller businesses. Cloud POS systems, on the other hand, typically operate on a subscription basis, reducing initial costs and allowing businesses to scale their operations as needed without significant additional investment. Furthermore, cloud POS solutions often include integrated features such as inventory management, customer relationship management (CRM), and analytics, providing SMEs with comprehensive tools to streamline their operations and make data-driven decisions.

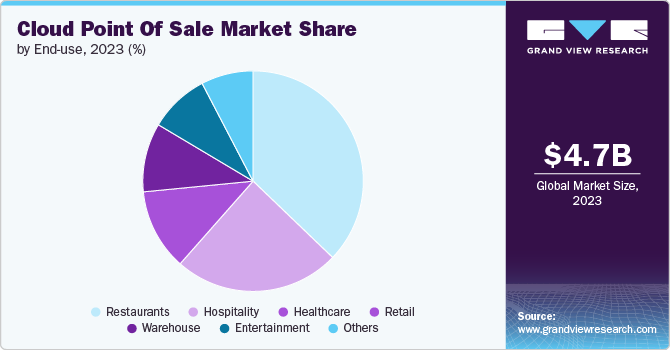

End-use Insights

The retail segment accounted for the largest market share of over 35% in 2023. The retail segment of the market is driven by several key factors that reflect the dynamic needs of modern retail businesses. First, the increasing adoption of e-commerce and omnichannel retailing strategies requires robust, flexible, and scalable POS systems that can seamlessly integrate online and offline sales channels. Cloud POS solutions offer retailers the ability to manage inventory, track sales, and analyze customer data across multiple locations and platforms in real-time, enhancing operational efficiency and customer experience.

The healthcare segment is expected to grow at a significant rate during the forecast period. In the healthcare sector, the demand for cloud POS systems is primarily driven by the need for enhanced operational efficiency and improved patient care. Healthcare providers, including hospitals, clinics, and pharmacies, require POS systems that can seamlessly integrate with existing healthcare management systems, such as electronic health records (EHR) and practice management software. Cloud POS solutions enable healthcare providers to streamline billing processes, manage inventory more effectively, and ensure accurate and timely financial transactions.

Regional Insights

The cloud Point of Sale (POS) market of North America held a market share of over 34% in 2023. The North America market is driven by several such as the highly developed retail sector where businesses are increasingly adopting advanced technology solutions to enhance customer experience and operational efficiency. Cloud POS systems offer scalability and flexibility, which are crucial in a dynamic retail environment. Further, stringent regulatory requirements in North America regarding data security and compliance push businesses towards cloud solutions that offer robust security measures and regulatory compliance features.

U.S. Cloud Point Of Sale Market Trends

The U.S. cloud Point of Sale (POS) marketis growing significantly at a CAGR of 16.9% from 2024 to 2030. In U.S. the shift towards cloud-based solutions in the retail and hospitality sectors is fueled by the need for scalability and flexibility. Cloud POS systems offer businesses the ability to easily scale operations up or down, depending on seasonal demand or business expansion, without the need for significant hardware investments.

Asia Pacific Cloud Point Of Sale Market Trends

The cloud Point of Sale (POS) market of Asia Pacific is growing significantly at a CAGR of 19.6% from 2024 to 2030. The expanding retail sector in countries like China, India, and Southeast Asia is fueling demand for modern POS solutions that can handle large transaction volumes and support diverse payment methods. Cloud POS systems are particularly appealing to small and medium-sized enterprises (SMEs) in these markets due to their affordability, ease of deployment, and low maintenance costs. Further, the increasing penetration of internet and mobile technology in Asia Pacific countries is driving the adoption of cloud-based solutions that enable businesses to operate from anywhere and offer flexible payment options to customers.

Europe Cloud Point Of Sale Market Trends

Europe cloud Point of Sale (POS) market is growing significantly at a CAGR of 17.6% from 2024 to 2030. In Europe, the demand for cloud POS systems is driven by a unique set of factors that reflect the region's diverse retail landscape and regulatory environment. One significant driver is the emphasis on omnichannel retail strategies. European retailers are increasingly adopting cloud POS solutions to integrate online and offline sales channels seamlessly. This integration allows for a unified customer experience across various touchpoints, enhancing customer satisfaction and loyalty.

Key Cloud Point Of Sale Company Insights

Some of the key players operating in the market include Block, Inc.; QuickBooks; Shopify; Lightspeed; Clover Network, LLC; Toshiba Global Commerce Solutions; NEC Corporation; NCR Voyix Corporation; Oracle Corporation; PAX Technology, and SAMSUNG among others. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Cloud Point Of Sale Companies:

The following are the leading companies in the cloud point of sale market. These companies collectively hold the largest market share and dictate industry trends.

- Block, Inc.

- QuickBooks

- Shopify

- Lightspeed

- Clover Network, LLC

- Toshiba Global Commerce Solutions

- NEC Corporation

- NCR Voyix Corporation

- Oracle Corporation

- PAX Technology

- SAMSUNG

Recent Developments

-

In May 2023, PAX Technology introduced technologically advanced Android SmartPOS and Android EPOS products specifically designed to meet the changing requirements of acquiring banks and payment service providers, and merchants.

-

In May 2023, Toast, Inc. collaborated with Deliverect, a company offering solutions that streamline the integration of online orders from food delivery services into restaurant POS systems. This partnership leverages the Toast Partner Ecosystem to empower restaurants to handle online orders efficiently through their Toast POS systems, providing greater flexibility and simplicity.

-

In January 2023, EE a UK-based subscription business group, in collaboration with Aptos, a leader in unified commerce solutions, unveiled a cutting-edge cloud-based POS solution for its retail stores. This innovative technology promises heightened customer engagement capabilities and a streamlined IT infrastructure footprint across all 400+ EE stores in the UK

Cloud Point Of Sale Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.43 billion |

|

Revenue forecast in 2030 |

USD 14.79 billion |

|

Growth rate |

CAGR of 18.2% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, type, enterprise size, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

Block, Inc.; QuickBooks; Shopify; Lightspeed; Clover Network, LLC; Toshiba Global Commerce Solutions; NEC Corporation; NCR Voyix Corporation; Oracle Corporation; PAX Technology; SAMSUNG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cloud Point Of Sale Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global cloud Point of Sale (POS)market report based on component, type, enterprise size, end-use, and region:

-

Component Outlook (Revenue; USD Billion; 2018 - 2030)

-

Solution

-

Services

-

-

Type Outlook (Revenue; USD Billion; 2018 - 2030)

-

Fixed POS

-

Mobile POS

-

-

Enterprise Size Outlook (Revenue; USD Billion; 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

End-use Outlook (Revenue; USD Billion; 2018 - 2030)

-

Restaurants

-

Hospitality

-

Healthcare

-

Retail

-

Warehouse

-

Entertainment

-

Others

-

-

Regional Outlook (Revenue: USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud point of sale market size was estimated at USD 4.70 billion in 2023 and is expected to reach USD 5.43 billion in 2024.

b. The global cloud point of sale market is expected to grow at a compound annual growth rate of 18.2% from 2024 to 2030 to reach USD 14.79 billion by 2030.

b. The solution segment accounted for the largest market share of over 67% in 2023. The demand for cloud POS solutions is primarily driven by the need for greater operational efficiency and enhanced customer experiences in the retail and hospitality sectors.

b. Key players in the cloud POS market include Block, Inc., QuickBooks, Shopify, Lightspeed, Clover Network, LLC, Toshiba Global Commerce Solutions, NEC Corporation, NCR Voyix Corporation, Oracle Corporation, PAX Technology, and SAMSUNG.

b. The rising adoption of cloud technology across various industries has made businesses more comfortable with transitioning their operations to the cloud. Similarly, the need for enhanced operational efficiency and the ability to provide superior customer experience are encouraging businesses to invest in cloud POS systems.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."