- Home

- »

- IT Services & Applications

- »

-

Cloud Native Storage Market Size And Share Report, 2030GVR Report cover

![Cloud Native Storage Market Size, Share & Trends Report]()

Cloud Native Storage Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment (Public Cloud, Private Cloud), By Enterprise Size, By End Use, By Region, and Segment Forecasts

- Report ID: GVR-4-68040-357-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud Native Storage Market Summary

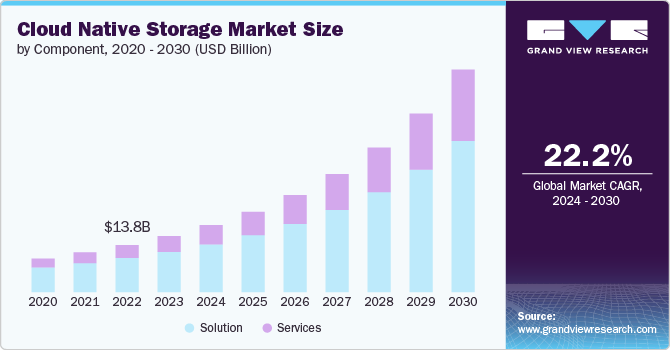

The global cloud native storage market size was estimated at USD 16.37 billion in 2023 and is projected to reach USD 65.04 billion by 2030, growing at a CAGR of 22.2% from 2024 to 2030. The rapid increase in data volume generated by enterprises is a significant growth driver for the global market.

Key Market Trends & Insights

- North America dominated the global market with the largest revenue share of 37.8% in 2023.

- The cloud native storage market in Asia Pacific is expected to grow at the fastest CAGR of 24.8% from 2024 to 2030.

- Based on component, the solution segment led the market with the largest revenue share of 72.08% in 2023.

- Based on deployment, the public cloud segment led the market with the largest revenue share of 71.0% in 2023.

- Based on enterprise size, the large enterprises segment led the market with the largest revenue share of 57.9% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 16.37 Billion

- 2030 Projected Market Size: USD 65.04 Billion

- CAGR (2024-2030): 22.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

As businesses across various sectors generate and process massive amounts of data from IoT devices, social media, transaction records, and other digital activities, the need for scalable, efficient, and cost-effective storage solutions becomes critical. The growing reliance on data-driven decision-making and analytics fuels the demand for advanced cloud-native storage technologies, driving market expansion and innovation.

The rising need for automation in application updates significantly drives the market growth. In today's fast-paced digital landscape, enterprises require continuous integration and continuous deployment (CI/CD) practices to swiftly and efficiently roll out updates and new features. Cloud native storage solutions support these practices by providing automated, scalable, and reliable storage infrastructures that integrate seamlessly with development pipelines. This automation reduces downtime, minimizes human error, and accelerates the update process, allowing businesses to respond quickly to market demands and maintain a competitive edge. Consequently, the demand for cloud native storage solutions that facilitate automated application updates is propelling market growth.

Enterprises demand robust and efficient systems to ensure data is securely backed up and can be quickly restored in case of data loss or system failures. Cloud native storage solutions offer superior backup and recovery speeds, leveraging the scalability and flexibility of cloud infrastructure. This capability minimizes downtime and enhances business continuity, making it an attractive option for businesses aiming to protect their critical data and maintain uninterrupted operations. As the volume and importance of data continue to grow, the need for efficient backup and recovery systems further propels the adoption of cloud native storage solutions.

In May 2022, VMware a U.S.-based cloud computing and virtualization technology company partnered with Wipro, a global information technology, consulting, and business process services company. This collaboration aims to help consumers achieve the desired cloud freedom with the enterprise control they need as they implement their digital strategies. Through this collaboration, the companies will combine the power of VMware Cross-Cloud services with Wipro FullStride Cloud Services to assist global enterprises in speeding up application modernization and reducing the cost, complexity, and risk of transitioning to the cloud.

Component Insights

Based on component, the solution segment led the market with the largest revenue share of 72.08% in 2023, due to the widespread adoption of cloud-native technologies. As organizations continue to migrate their workloads to the cloud, there is an increasing need for storage solutions that are designed specifically for cloud environments. Cloud-native storage solutions offer scalability, flexibility, and efficiency that traditional storage systems cannot match. These solutions are optimized for containerized applications and micro services, enabling businesses to manage and organize their data storage needs seamlessly within a cloud infrastructure. This growing reliance on cloud-native applications accelerates the demand for specialized storage solutions tailored to these environments.

The services segment is projected to witness at a significant CAGR from 2024 to 2030, due to the rising need for robust data management and analytics capabilities. Enterprises are increasingly generating vast amounts of data from various sources, necessitating efficient storage and retrieval systems. Cloud-native storage solutions provide the necessary infrastructure to support real-time data processing, analytics, and insights, enabling businesses to make informed decisions swiftly. For instance, in March 2024, Qumulo, a U.S.-based data storage company, introduced its latest innovation, Azure Native Qumulo Cold, as an offering of cloud-native file storage for vast amounts of cold data. This represents a significant shift toward providing users with an affordable and straightforward approach to managing cold data. ANQ Cold emerges as the first of its kind, a cloud-native, fully managed SaaS solution tailored for the storage and access of cold file data. It maintains parity with ANQ Hot in terms of the breadth of data services and functionalities offered. It encompasses all the advanced features one would anticipate from an on-premises file system, including encrypted snapshots, set data limits, compatibility with SMB/NFS/S3/REST file protocols, integrated security measures, among many other features.

Deployment Insights

Based on deployment, the public cloud segment led the market with the largest revenue share of 71.0% in 2023, owing to the rise in digital transformation initiatives. As businesses undergo digital transformation, there is a growing need to modernize IT infrastructure, which includes adopting cloud-native storage solutions. Public cloud deployment supports the migration of applications to modern, containerized environments, improving performance and reducing the total cost of ownership. In addition, the demand for big data analytics, artificial intelligence (AI), and Internet of Things (IoT) applications is directing organizations towards public cloud environments that can handle vast amounts of data with high performance and reliability. According to the 2024 Wasabi Global Cloud Storage Index by Wasabi Technologies, a U.S.-based cloud storage provider, there is a notable surge in the global adoption and budget allocations for public cloud storage by organizations aiming to boost innovation. A remarkable 93% of these organizations are set to expand their public cloud storage capabilities within the year 2024.

The private cloud segment is projected to witness at a significant CAGR from 2024 to 2030. The rising trend of hybrid cloud strategies is contributing to the expansion of the private cloud deployment segment. Many organizations are adopting hybrid cloud models to leverage the benefits of private clouds. Private clouds provide a secure and controlled environment for sensitive workloads, while public clouds offer scalability and cost-efficiency for less critical applications. The integration of private clouds within a hybrid cloud framework allows businesses to achieve a balanced approach to their IT needs, optimizing resource utilization and enhancing operational agility. This strategic shift towards hybrid cloud architectures is driving the demand for private cloud solutions as part of comprehensive cloud-native storage strategies.

Enterprise Size Insights

Based on enterprise size, the large enterprises segment led the market with the largest revenue share of 57.9% in 2023. The need for enhanced data security and compliance is propelling large enterprises towards cloud-native storage solutions. As regulatory requirements become more stringent and the risk of data breaches increases, businesses are investing in advanced storage technologies that offer robust security features and compliance with international standards. Cloud-native storage providers often include encryption, access controls, and other security measures that ensure data integrity and confidentiality, thus meeting the high-security demands of large enterprises.

The SMEs segment is projected to witness at a significant CAGR from 2024 to 2030, due to the advancement and adoption of DevOps practices among SMEs. Cloud-native storage is inherently designed to support DevOps environments, where continuous integration and continuous deployment (CI/CD) pipelines are essential. By integrating storage solutions that are compatible with DevOps tools and practices, SMEs can streamline their development processes, reduce deployment times, and improve software quality. This alignment with DevOps methodologies enhances the overall productivity and competitiveness of SMEs, making cloud-native storage an attractive option.

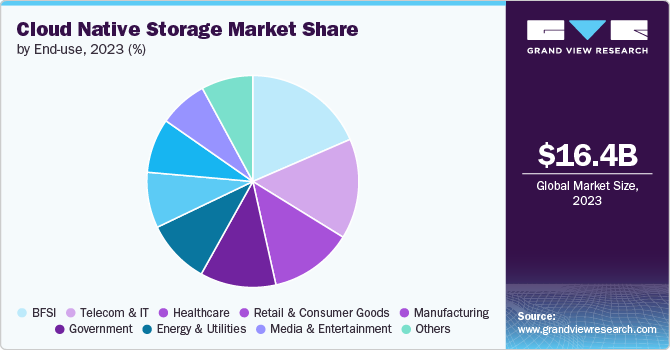

End Use Insights

Based on end use, the BFSI segment led the market with the largest revenue share of 18.5% in 2023, due to need for robust security and compliance features in the sector. Financial institutions are subject to stringent regulatory requirements and must ensure the confidentiality, integrity, and availability of sensitive customer data. Cloud native storage solutions often come with advanced security features, including encryption, access controls, and compliance certifications that meet industry standards. These features help BFSI organizations mitigate risks associated with data breaches and ensure compliance with regulations such as GDPR, HIPAA, and PCI-DSS. By leveraging cloud native storage, financial institutions can enhance their security posture and reduce the burden of compliance management. For instance, in June 2024, Nutanix, a U.S.-based cloud computing company revealed insights from its yearly international Financial Services Enterprise Cloud Index (ECI) study and analysis, estimating the advancement of hybrid cloud integration within the financial services and insurance sectors. The adoption rate of hybrid multicloud setups has stayed steady annually within the financial sector, those surveyed anticipate a tripling in these deployments over the coming three years, placing it as the dominant IT infrastructure model for the industry.

The media & entertainment segment is projected to witness at a significant CAGR from 2024 to 2030. The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) in media workflows is driving the need for cloud storage solutions. Cloud native storage platforms equipped with AI-driven analytics and data management capabilities empower media companies to extract valuable insights from their vast content repositories. These insights can inform content strategy, optimize resource allocation, and enhance audience engagement through personalized content recommendations and targeted advertising.

Regional Insights

North Americadominated the cloud native storage market with the largest revenue share of 37.8% in 2023. The region's robust adoption of cloud computing across various industries, including technology, finance, healthcare, and retail, underscores the demand for scalable and efficient storage solutions. Cloud native storage, with its ability to support modern cloud architectures such as micro services and containerization, aligns with the region's digital transformation initiatives.

U.S. Cloud Native Storage Market Trends

The cloud native storage market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030, due to the expanding use of containers and Kubernetes orchestration platforms in the U.S. market. Cloud native storage solutions are essential in this ecosystem, providing persistent storage capabilities that are crucial for stable applications running on Kubernetes clusters. For instance, in March 2024, Microsoft Azure Container Networking introduced Retina, a new observability platform designed for cloud-native container networking. This innovative platform provides Kubernetes users, including administrators and developers, with tools to visualize, monitor, troubleshoot, and study the traffic of Kubernetes workloads. It operates across different Container Network Interfaces (CNIs), operating systems, and clouds, offering broad compatibility and insight.

Asia Pacific Cloud Native Storage Market Trends

The cloud native storage market in Asia Pacific is expected to grow at the fastest CAGR of 24.8% from 2024 to 2030, driven by several key factors. The proliferation of mobile devices and the increasing internet penetration rates are generating vast amounts of data across Asia Pacific. This data growth is particularly pronounced in sectors such as e-commerce, telecommunications, media, and entertainment, where organizations are grappling with the challenge of storing, managing, and analyzing massive volumes of data efficiently.

Europe Cloud Native Storage Market Trends

The cloud native storage market in Europe is expected to witness at a notable CAGR from 2024 to 2030, due to the regulatory requirements in Europe, such as GDPR (General Data Protection Regulation), compelling organizations to reevaluate their data storage and management strategies. Cloud native storage offers enhanced data protection mechanisms and compliance features that help businesses meet stringent regulatory standards while leveraging the scalability and flexibility of cloud platforms.

Key Cloud Native Storage Company Insight

Key players operating in the global market includeAlibaba Group Holding Limited, Amazon Web Services, Inc., Citrix Systems, Inc., Google LLC, Huawei Technologies Co., Ltd., IBM Corporation, Microsoft Corporation, Rackspace Technology, Inc. and Splunk, Inc.The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Cloud Native Storage Companies:

The following are the leading companies in the cloud native storage market. These companies collectively hold the largest market share and dictate industry trends.

- Alibaba Group Holding Limited

- Amazon Web Services, Inc.

- Broadcom

- Citrix Systems, Inc.

- Google LLC

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Microsoft Corporation

- Rackspace Technology, Inc.

- Splunk, Inc.

Recent Developments

-

In April 2024, NetApp, U.S.-based data Infrastructure Company, expanded its collaboration with Google Cloud to simplify how companies can use their data for generative AI (GenAI) applications and various hybrid cloud tasks. The enhancement includes the introduction of the Flex service tier for Google Cloud NetApp Volumes, accommodating storage volumes of virtually any dimension. Additionally, NetApp is rolling out a beta version of its GenAI toolkit's reference architecture, designed for retrieval-augmented generation (RAG) tasks on Google Cloud's Vertex AI platform

-

In October 2023, IBM unveiled the IBM Storage Scale System 6000, marking the latest advancement within its IBM Storage for Data and AI collection. This data solution is tailored for the landscape of data-heavy and AI-focused tasks. The IBM Storage Scale System 6000 aims to further IBM's leading role by offering an upgraded, high-performance parallel file system tailored for demanding data applications

Cloud Native Storage Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 19.56 billion

Revenue forecast in 2030

USD 65.04 billion

Growth rate

CAGR of 22.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Alibaba Group Holding Limited; Amazon Web Services, Inc.;Broadcom; Citrix Systems, Inc.; Google LLC; Huawei Technologies Co., Ltd.; IBM Corporation; Microsoft Corporation; Rackspace Technology, Inc.; Splunk, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud Native Storage Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cloud native storage market report based on component, deployment, enterprise size, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Object storage

-

Block storage

-

File storage

-

Container storage

-

Others

-

-

Services

-

System Integration & Deployment

-

Training & Consulting

-

Support & Maintenance

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public Cloud

-

Private Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Telecom & IT

-

Healthcare

-

Retail & Consumer Goods

-

Manufacturing

-

Government

-

Energy & Utilities

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud native storage market size was estimated at USD 16.37 billion in 2023 and is expected to reach USD 19.56 billion in 2024.

b. The global cloud native storage market is expected to grow at a compound annual growth rate of 22.2% from 2024 to 2030 to reach USD 65.04 billion by 2030.

b. The solution segment had the largest market share, 72.1%, in 2023. This expansion can be credited to many organizations continuing to migrate their workloads to the cloud; there is an increasing need for storage solutions designed specifically for cloud environments.

b. Some key players operating in the cloud native storage market include Alibaba Group Holding Limited, Amazon Web Services, Inc., Broadcom, Citrix Systems, Inc., Google LLC, Huawei Technologies Co., Ltd., IBM Corporation, Microsoft Corporation, Rackspace Technology, Inc., and Splunk, Inc.

b. The rapid increase in data volume generated by enterprises is a significant growth driver for the cloud-native storage market. As businesses across various sectors generate and process massive amounts of data from IoT devices, social media, transaction records, and other digital activities, the need for scalable, efficient, and cost-effective storage solutions becomes critical.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.