Cloud Native Applications Market Size, Share & Trends Analysis Report By Component (Platforms, Services), By Deployment Type, By Organization Size, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-345-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Cloud Native Applications Market Trends

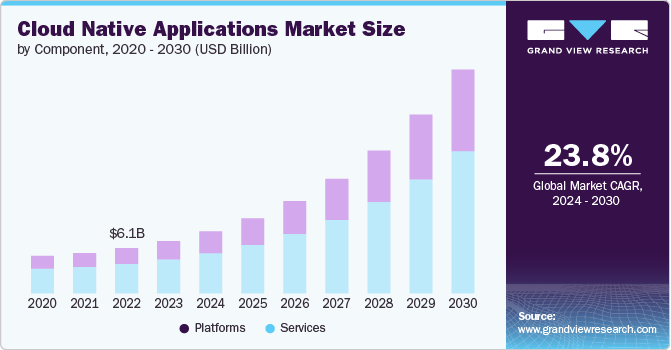

The global cloud native applications market size was estimated at USD 7.06 billion in 2023 and is projected to grow at CAGR of 23.8% from 2024 to 2030. Several key factors are driving the market growth for cloud-native applications. Firstly, the demand for scalable and flexible IT infrastructure has surged as businesses seek to enhance agility and responsiveness in a rapidly evolving digital landscape. This demand is further fueled by the proliferation of micro services architecture, which enables organizations to build and deploy applications more efficiently and with greater resilience. In addition, advancements in containerization technologies, such as Docker and Kubernetes, have significantly streamlined the development and management of cloud-native applications, reducing operational complexities and costs.

The growing adoption of DevOps practices also plays a crucial role, as it facilitates continuous integration and delivery (CI/CD), accelerating time-to-market for new applications and features. RedGate's State of DevOps report, released in 2021, surveyed over 3,200 enterprises. It revealed that approximately three-quarters of organizations had implemented DevOps practices for development in some capacity, a significant increase from 47% five years prior. In addition, the report indicated a notable rise in the use of cross-platform databases. Moreover, the increasing reliance on hybrid and multi-cloud strategies allows businesses to leverage the best capabilities of different cloud providers, ensuring optimal performance and cost-effectiveness. Finally, the ongoing emphasis on digital transformation and the need for businesses to remain competitive in a tech-centric world continue to propel the adoption of cloud-native applications.

The growing adoption of DevOps practices significantly drives the market growth by fostering a culture of continuous integration and delivery (CI/CD). DevOps practices streamline the software development lifecycle, allowing for faster and more reliable deployment of applications. This agility is essential for businesses looking to respond to market changes and customer demands rapidly. By integrating development and operations teams, DevOps enhances collaboration and efficiency, reducing the time required to develop, test, and release new features. Furthermore, DevOps practices are inherently aligned with cloud-native architectures, which leverage micro services and containerization technologies to achieve scalability and flexibility. This synergy between DevOps and cloud-native applications improves operational efficiency, reduces costs, and minimizes downtime, accelerating innovation and competitive advantage for organizations. As a result, adopting DevOps is a crucial enabler for the proliferation and success of cloud-native applications in various industries.

The proliferation of micro services architecture drives the market growth by enabling modularity, scalability, and agility in application development. By breaking down applications into more minor, independent services, micro services allow for efficient updates and scaling, reducing operational complexity. This modularity supports continuous integration and deployment (CI/CD) practices, enhancing development speed and operational efficiency. In addition, micro services facilitate deployment in diverse environments through containerization technologies, further promoting the resilience and scalability of cloud-native applications.

Component Insights

Based on component, the platforms segment led the market with the largest revenue share of 65.27% in 2023. The driving factors for the market growth of cloud-native application platforms include the increasing need for scalable and flexible IT solutions, the widespread adoption of micro services architecture, and advancements in containerization technologies such as Docker and Kubernetes. These platforms enable organizations to develop, deploy, and manage applications more efficiently, promoting agility and reducing time-to-market for new features.

The services segment is expected to register at the fastest CAGR from 2024 to 2030. The need for agility, scalability, and cost efficiency drives the growth of cloud-native application services. These services enable continuous integration and deployment, allowing rapid response to market changes. The scalability and flexibility provided by containerization and micro services architecture support efficient resource management and scaling. In addition, hybrid and multi-cloud strategies enhance performance and redundancy, while digital transformation initiatives push enterprises to modernize legacy systems and adopt cloud-native platforms for competitive advantage.

Deployment Type Insights

Based on deployment, the public cloud segment led the market with the largest revenue share of 56.65% in 2023. Several key factors drive the adoption of cloud-native applications on public cloud platforms. Foremost is the need for scalability and flexibility, allowing organizations to adjust resources to meet varying demands efficiently and dynamically. Through pay-as-you-go models, public clouds' cost-efficiency reduces capital expenditure and optimizes operational costs. In addition, leveraging advanced services and technologies offered by public cloud providers, such as AI, machine learning, and big data analytics, enhances innovation and competitive advantage. Public clouds also support robust security and compliance measures, critical for protecting sensitive data and meeting regulatory requirements. Furthermore, public cloud infrastructure's global reach and redundancy ensure high availability and disaster recovery capabilities, which are crucial for business continuity.

The hybrid cloud segment is expected to register at the fastest CAGR of around 25.39% from 2024 to 2030. Several key factors drive the adoption of cloud-native applications on hybrid cloud environments. Primarily, the need for flexibility and scalability enables organizations to leverage the best of both private and public clouds, optimizing resource allocation and cost efficiency. This hybrid approach supports regulatory and compliance requirements by allowing sensitive data to reside on private clouds while utilizing public clouds for less critical operations. In addition, hybrid cloud solutions enhance disaster recovery and business continuity by providing robust redundancy and failover capabilities. Integrating micro services and containerization technologies further simplifies application deployment and management across diverse environments. Finally, the push for digital transformation compels enterprises to adopt hybrid cloud strategies to modernize their IT infrastructure and remain competitive in an increasingly digital economy.

Organization Size Insights

Based on organization size, the large enterprises segment led the market with the largest revenue share of 59.24% in 2023. The adoption of cloud native applications among large enterprises is driven primarily by the need for scalability, agility, and cost efficiency. Large enterprises benefit from cloud-native architectures due to their ability to scale resources dynamically in response to fluctuating demand, thereby optimizing performance, and reducing operational costs. Furthermore, the micro services architecture inherent in cloud-native applications allows for greater agility, enabling rapid development and deployment cycles, which are crucial for maintaining competitive advantage in fast-paced markets.

The SMEs segment is expected to register at the fastest CAGR from 2024 to 2030. For small and medium-sized enterprises (SMEs), the adoption of cloud-native applications is propelled by the promise of reduced capital expenditure and operational overhead. Cloud-native solutions provide SMEs access to advanced technologies and infrastructure without significant upfront investment in hardware and software. This democratization of technology enables SMEs to compete more effectively with larger organizations. Moreover, the flexibility and ease of integration offered by cloud-native applications allow SMEs to quickly adapt to market changes and customer needs, fostering innovation and growth. The pay-as-you-go model associated with cloud services further ensures that SMEs can manage their budgets more efficiently while scaling their operations as needed.

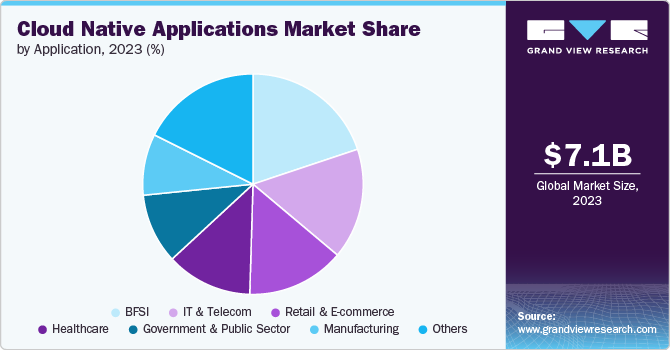

Application Insights

Based on applications, the BFSI segment led the market with the largest revenue share of 19.87% in 2023. Financial institutions leverage cloud native technologies to streamline operations, reduce IT infrastructure costs, and rapidly deploy new services to meet evolving customer demands. The ability to scale resources on demand ensures that banks and financial firms can handle fluctuating workloads, particularly during peak transaction periods. Moreover, cloud service providers' stringent security and compliance measures help BFSI organizations maintain regulatory compliance while protecting sensitive financial data.

The healthcare segment is expected to grow at a significant CAGR over the forecast period. In the healthcare sector, the adoption of cloud-native applications is motivated by the imperative to improve patient care, data interoperability, and operational efficiency. Cloud-native solutions facilitate seamless data sharing across different healthcare systems, enhancing collaboration among healthcare providers and enabling comprehensive patient care. The scalability of cloud-native applications allows healthcare organizations to manage large volumes of data generated by electronic health records (EHRs), medical imaging, and IoT devices. As of 2021, approximately 93.0% of office-based physicians in the U.S. use EHR systems in their practices. In addition, the cloud infrastructure's cost benefits and flexibility support telemedicine and personalized medicine innovation. At the same time, robust security frameworks ensure the protection of patient information in compliance with healthcare regulations.

Regional Insights

North America dominated the cloud native applications market with the revenue share of 40.45% in 2023. The adoption of cloud-native applications is primarily driven by the region's advanced technological infrastructure, robust ecosystem of cloud service providers, and a highly competitive business environment. Organizations seek to enhance agility, scalability, and innovation, leveraging cloud-native technologies to respond swiftly to market demands and technological advancements. In addition, the emphasis on digital transformation across industries, combined with significant investments in cloud technology and talent development, propels the shift towards cloud-native solutions.

U.S. Cloud Native Applications Market Trends

The cloud native applications market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. In the U.S., the adoption of cloud-native applications is fueled by the rapid pace of technological innovation and the need for businesses to maintain a competitive edge in a dynamic market. The focus on improving operational efficiency, reducing costs, and accelerating time-to-market for new products and services drives organizations to embrace cloud-native architectures. Furthermore, the U.S. benefits from a mature cloud ecosystem, with major cloud service providers headquartered domestically, offering cutting-edge solutions and support.

Asia Pacific Cloud Native Applications Market Trends

The cloud native applications market in Asia Pacific is expected to grow at the fastest CAGR of 27.25% from 2024 to 2030. The adoption of cloud-native applications is primarily driven by rapid digital transformation initiatives, increasing demand for scalability and agility, and the burgeoning startup ecosystem. Governments and enterprises heavily invest in cloud technologies to enhance efficiency and innovation. In addition, the region's diverse and expanding customer base necessitates robust and flexible solutions that cloud-native applications provide. The adoption is further fueled by the rise of mobile internet usage and the need for cost-effective infrastructure solutions, enabling organizations to remain competitive in a dynamic market environment.

Europe Cloud Native Applications Market Trends

The cloud native applications market in Europe is expected to grow at a significant CAGR from 2024 to 2030.In Europe, the adoption of cloud-native applications is influenced by stringent regulatory requirements, such as GDPR, which necessitate advanced data management and security capabilities. European businesses prioritize digital innovation to stay ahead in a competitive global market, and cloud-native technologies offer the flexibility and efficiency needed to achieve this. In addition, the push for sustainability and energy efficiency in IT operations encourages the shift to cloud-native solutions, which often have a lower environmental footprint. Collaboration among European nations on digital initiatives and the support for cloud adoption from various government bodies also drive this trend.

Key Cloud Native Applications Company Insights

Key players operating in the market include Alibaba Cloud, Amazon Web Services, Inc., Broadcom, Google, Infosys Limited, International Business Machines Corporation, Microsoft, Oracle, Red Hat, Inc., and SAP SE. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Cloud Native Applications Companies:

The following are the leading companies in the cloud native applications market. These companies collectively hold the largest market share and dictate industry trends.

- Alibaba Cloud

- Amazon Web Services, Inc.

- Broadcom

- Infosys Limited

- International Business Machines Corporation

- Microsoft

- Oracle

- Red Hat, Inc.

- SAP SE

Recent Developments

-

In May 2024, Mavenir announced the signing of a five-year Strategic Collaboration Agreement (SCA) with Amazon Web Services, Inc. (AWS) aimed at enhancing the deployment of telecom workloads on AWS. This collaboration involves jointly architecting Mavenir’s technology to optimize the development, testing, integration, and application of cloud-native solutions. By leveraging the high scalability, availability, and security capabilities of AWS services, this partnership seeks to establish a new telco-grade deployment model. The objective is to revolutionize how operators launch 5G, Radio Access Network (RAN), IP Multimedia Subsystem (IMS), and future network technologies

-

In June 2024, Google Cloud and Oracle announced a partnership to provide customers the option to integrate Oracle Cloud Infrastructure (OCI) with Google Cloud technologies, facilitating the acceleration of application migrations and modernization efforts. The newly introduced multicloud capabilities will offer seamless experience for managing, deploying, and utilizing Oracle Database instances within Google Cloud. Additionally, it will enable the transfer of data and deployment of new cloud-native applications across both cloud platforms. This collaboration allows organizations to achieve significant advancements in the cloud, utilizing their existing expertise to harness the combined strengths of Oracle and Google Cloud capabilities

Cloud Native Applications Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 8.37 billion |

|

Revenue forecast in 2030 |

USD 30.24 billion |

|

Growth rate |

CAGR of 23.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment type, organization size, applications, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Alibaba Cloud; Amazon Web Services, Inc.; Broadcom; Google; Infosys Limited; International Business Machines Corporation; Microsoft; Oracle; Red Hat, Inc.; SAP SE |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cloud Native Applications Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global cloud native applications market report based on component, deployment type, organization size, applications, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Platforms

-

Services

-

-

Deployment Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Applications Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government & Public Sector

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail and E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud native applications market size was estimated at USD 7.06 billion in 2023 and is expected to reach USD 8.37 billion in 2024

b. The global cloud native applications market is expected to grow at a compound annual growth rate of 23.9% from 2024 to 2030 to reach USD 30.24 billion by 2030

b. The global cloud native applications market is expected to grow at a compound annual growth rate of 23.9% from 2024 to 2030 to reach USD 30.24 billion by 2030

b. Some key players operating in the cloud native applications market include Alibaba Cloud, Amazon Web Services, Inc., Broadcom, Google, Infosys Limited, International Business Machines Corporation, Microsoft, Oracle, Red Hat, Inc., and SAP SE.

b. The cloud native applications market is driven by several key factors. Firstly, the demand for scalable and flexible IT infrastructure has surged as businesses seek to enhance agility and responsiveness in a rapidly evolving digital landscape. This demand is further fueled by the proliferation of microservices architecture, which enables organizations to build and deploy applications more efficiently and with greater resilience.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."