Cloud-native Application Protection Platform Market Size, Share, & Trends Analysis Report By Offering (Platform, Services), By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-347-3

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

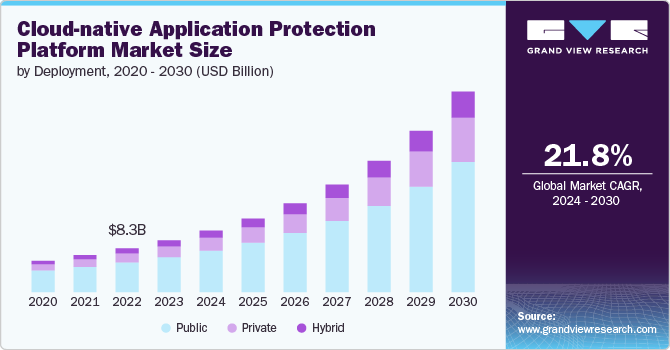

The global cloud-native application protection platform market size was estimated at USD 9.79 billion in 2023 and is expected to grow at a CAGR of 21.8% from 2024 to 2030. The market is witnessing significant growth due to the increasing adoption of cloud-native applications and the rising need for robust security solutions. Cloud-native application protection platforms (CNAPP)s offer comprehensive protection for cloud-native environments, encompassing various security aspects such as workload protection, runtime protection, and compliance management. These platforms are designed to secure applications built using cloud-native technologies, ensuring they remain resilient against a broad range of cyber threats.

Several key factors are driving the demand for CNAPPs including the shift towards microservices and containerization has increased the complexity of securing applications, making traditional security approaches inadequate. CNAPPs address this challenge by providing visibility and control over dynamic, distributed environments. Secondly, the surge in cyberattacks targeting cloud-native applications has heightened awareness of the need for advanced security measures. Organizations are increasingly prioritizing security to protect their sensitive data and maintain customer trust.

The integration of artificial intelligence (AI) and machine learning (ML) capabilities. These technologies help in enhancing threat detection and response capabilities by assessing vast amounts of data and identifying anomalies in real-time. Additionally, the rise of DevSecOps practices, which integrate security into the development and operations processes, is driving the adoption of CNAPPs. This approach ensures that security is a continuous concern throughout the application lifecycle, rather than an afterthought.

Furthermore, there is a growing emphasis on compliance and regulatory requirements. As governments and industry bodies impose stricter regulations on data protection and privacy, organizations are compelled to adopt CNAPPs to ensure compliance. These platforms offer features such as automated compliance checks and reporting, helping organizations avoid hefty fines and reputational damage.

Offering Insights

The platform segment accounted for the largest market share of over 60% in 2023. Cloud-native application protection platforms (CNAPPs) provide a comprehensive security framework designed to safeguard cloud-native environments. These platforms integrate various security tools and practices to ensure robust protection throughout the application lifecycle, from development to deployment and beyond. Key components of CNAPPs include workload protection, vulnerability management, compliance monitoring, and runtime defense. The platform-centric approach emphasizes seamless integration with existing cloud infrastructure, offering unified visibility and control.

The service segment is expected to grow at a significant rate during the forecast period. Cloud-native application protection services complement platforms by offering specialized, on-demand security capabilities tailored to the unique needs of cloud-native environments. These services include managed detection and response (MDR), threat intelligence, incident response, and continuous compliance auditing. The flexibility and scalability of service-based models allow organizations to adapt quickly to evolving threats and compliance requirements.

Deployment Insights

The public cloud segment accounted for the largest market share of over 68% in 2023. Public cloud environments often host critical business applications and sensitive data, making them attractive targets for cyberattacks. Consequently, companies are investing in advanced security tools that offer real-time threat detection, automated response mechanisms, and compliance management. Trends in this space include the integration of artificial intelligence and machine learning to predict and mitigate threats, the rise of zero-trust security models, and the development of cloud-native security platforms that seamlessly integrate with existing cloud infrastructures.

The hybrid cloud segment is expected to grow at a significant rate during the forecast period. The demand for hybrid cloud native application protection platform is driven by the need for consistent security policies across diverse environments, seamless data integration, and flexibility in resource allocation. Key factors influencing this market include the increasing complexity of IT infrastructures, the need for robust data governance, and the desire for cost-effective security solutions.

Enterprise size Insights

The large enterprise segment accounted for the largest market share of over 58% in 2023. Large enterprises exhibit a distinct approach to cloud-native application protection platform, focusing on comprehensive, enterprise-grade security solutions to manage complex infrastructures and diverse application ecosystems. Key factors influencing their choices include scalability across global operations, advanced threat intelligence capabilities, and regulatory compliance requirements. Further, the demand for integrated security platforms that offer centralized visibility and control over cloud environments, supporting hybrid and multi-cloud deployments seamlessly is significantly growth among large business organizations.

The SMEs segment is expected to grow at a significant rate over the forecast period. For small and medium enterprises (SMEs), cloud-native application protection platforms are increasingly critical as they adopt cloud technologies to enhance operational efficiency and scalability. SMEs often face resource constraints compared to larger enterprises, making robust security solutions a challenge. Key factors driving demand include cost-effectiveness, scalability, and ease of deployment. SMEs prioritize solutions that integrate seamlessly with their existing cloud infrastructure and offer comprehensive threat detection and response capabilities without requiring significant in-house expertise.

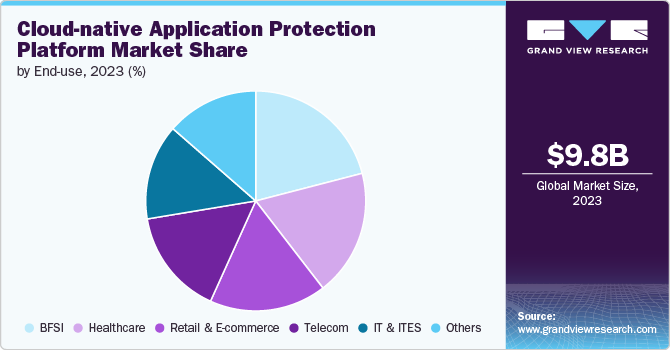

End-use Insights

The BFSI segment accounted for the largest market share of over 21% in 2023. In the BFSI sector, cloud-native application protection platforms have become paramount as institutions increasingly migrate their critical workloads to the cloud to leverage scalability, flexibility, and cost-efficiency. The key factors driving the demand include the need for robust data security measures, compliance with stringent regulatory requirements, and the protection of sensitive financial information from sophisticated cyber threats.Additionally, the surge in digital banking, mobile payments, and fintech innovations has necessitated enhanced security measures to ensure customer trust and safeguard transactional data.

The telecom segment is expected to grow at a significant rate during the forecast period. In the transition to 5G networks, the proliferation of IoT devices, and the expansion of edge computing are significantly driving the demand for cloud-native application protection. Key factors include the need to secure an exponentially growing volume of data and connections, protect against emerging cyber threats targeting network vulnerabilities, and ensure the integrity and availability of services.Similarly, telecom providers are also focusing on enhancing customer data privacy, complying with global regulatory standards, and leveraging cloud-native security tools to ensure scalable and resilient network operations amidst the evolving threat landscape.

Regional Insights

The Cloud-Native Application Protection Platform market of North America held a market share of over 39% in 2023. In North America, the cloud native application protection platform (CNAPP) market is experiencing significant growth due to the increasing adoption of cloud technologies by enterprises across various industries. The region's advanced IT infrastructure, combined with a high rate of digital transformation initiatives, drives the demand for robust cloud security solutions. Key factors influencing the market include stringent regulatory frameworks, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), which mandate stringent data protection measures.

U.S. Cloud-native Application Protection Platform Market Trends

The U.S. Cloud-Native Application Protection Platform market is growing significantly at a CAGR of 20.5% from 2024 to 2030. The country's emphasis on technological innovation and digital transformation across sectors such as finance, healthcare, and retail drive the adoption of cloud services and, consequently, the need for advanced security measures. Further, the key factors driving the market include a well-established technological ecosystem, significant investment in cybersecurity, and a regulatory environment that prioritizes data protection and privacy.

Asia Pacific Cloud-native Application Protection Platform Market Trends

The Cloud-native application protection platform market of Asia Pacific is growing significantly at a CAGR of 24.5% from 2024 to 2030. The Asia Pacific region is witnessing rapid growth in the cloud native application protection platform market, driven by the increasing digitalization and cloud adoption across emerging economies. Countries like China, India, and Japan are at the forefront of this growth, fueled by expanding IT sectors and significant investments in cloud infrastructure. Key factors include a surge in small and medium-sized enterprises (SMEs) adopting cloud services to enhance operational efficiency, coupled with a rising awareness of the importance of cybersecurity.

Europe Cloud-native Application Protection Platform Market Trends

Europe Cloud-native application protection platform market is growing significantly at a CAGR of 21.3% from 2024 to 2030. In Europe, the cloud native application protection platform market is driven by stringent data protection regulations and a strong emphasis on privacy. The implementation of GDPR has been a significant catalyst, compelling organizations to adopt comprehensive security measures for cloud applications. Key factors include a mature cloud adoption landscape, high regulatory compliance standards, and a proactive approach towards cybersecurity. Further, the increasing use of cloud services in critical sectors like banking, healthcare, and government, along with the rise of remote working and digital transformation initiatives, are fueling the demand for CNAPP in the region.

Key Cloud-native Application Protection Platform Company Insights

Some of the key players operating in the market include Palo Alto Networks; Cisco Systems, Inc.; CrowdStrike; Aqua Security Software Ltd.; Check Point Software Technologies Ltd.; Trend Micro Incorporated.; McAfee; Qualys; Snyk Limited; and Lacework among others. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Cloud-native Application Protection Platform Companies:

The following are the leading companies in the cloud-native application protection platform market. These companies collectively hold the largest market share and dictate industry trends.

- Palo Alto Networks

- Cisco Systems, Inc.

- CrowdStrike

- Aqua Security Software Ltd.

- Check Point Software Technologies Ltd.

- Trend Micro Incorporated.

- McAfee

- Qualys

- Snyk Limited

- Lacework

Recent Developments

-

In May 2024, Palo Alto Networks, a global cyber security company announced a strategic partnership with IBM Corporation a provider of hybrid cloud and AI technology. Based on the agreement Palo Alto Networks will acquire IBM Corporation's QRadar SaaS assets, facilitating client migration to its advanced Cortex XSIAM platform. This collaboration underscores the importance of comprehensive security measures in modern enterprises, complementing Palo Alto Networks' Cloud Native Application Protection Platform (CNAPP) to provide robust, AI-driven threat protection, and streamlined security operations to the customers.

-

In June 2023, enhances cloud-native application security by providing comprehensive end-to-end lifecycle protection, from development to production. The new Attack Path Engine and integrated visual dashboard streamline security for APIs, serverless, containerized, and Kubernetes environments, offering advanced capabilities for modern, hybrid cloud applications. This innovation marks a significant advancement in Cisco’s end-to-end Security strategy, ensuring robust, scalable protection for critical business applications.

-

In January 2023, Check Point Software Technologies Ltd. introduced its new risk management engine alongside enhanced capabilities for its Check Point CloudGuard Cloud Native Application Protection Platform. This update introduces entitlement management, intelligent risk prioritization, agentless scanning, and pipeline security, significantly simplifying cloud security operations. The new features focus on context, speed, and automation, enabling security teams to efficiently address comprehensive threats from code-to-cloud throughout the application lifecycle.

Cloud-native Application Protection Platform Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 11.66 billion |

|

Revenue forecast in 2030 |

USD 38.01 billion |

|

Growth rate |

CAGR of 21.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, deployment, enterprise size, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

Palo Alto Networks; Cisco Systems, Inc.; CrowdStrike; Aqua Security Software Ltd.; Check Point Software Technologies Ltd.; Trend Micro Incorporated.; McAfee; Qualys; Snyk Limited; Lacework |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cloud-native Application Protection Platform Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global Cloud-Native Application Protection Platform (CNAPP) market report based on offering, deployment, enterprise size, end-use, and region:

-

Offering Outlook (Revenue; USD Billion; 2018 - 2030)

-

Platform

-

Services

-

-

Deployment Outlook (Revenue; USD Billion; 2018 - 2030)

-

Private

-

Public

-

Hybrid

-

-

Enterprise Size Outlook (Revenue; USD Billion; 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

End-use Outlook (Revenue; USD Billion; 2018 - 2030)

-

BFSI

-

Healthcare

-

Retail & E-commerce

-

Telecom

-

IT & ITES

-

Others

-

-

Regional Outlook (Revenue: USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud-native application protection platform market size was estimated at USD 9.79 billion in 2023 and is expected to reach USD 11.66 billion in 2024.

b. The global cloud-native application protection platform market is expected to grow at a compound annual rate of 21.8% from 2024 to 2030, reaching USD 38.01 billion by 2030.

b. The public cloud segment had the largest market share, over 68%, in 2023. Public cloud environments often host critical business applications and sensitive data, making them attractive targets for cyberattacks. Consequently, companies are investing in advanced security tools that offer real-time threat detection, automated response mechanisms, and compliance management.

b. Palo Alto Networks, Cisco Systems, Inc., CrowdStrike, Aqua Security Software Ltd., Check Point Software Technologies Ltd., Trend Micro Incorporated, McAfee, Qualys, Snyk Limited, and Lacework are some of the players driving the growth of the cloud-native application protection platforms market.

b. The cloud-native application protection platform market is witnessing significant growth due to the increasing adoption of cloud-native applications and the rising need for robust security solutions. CNAPPs offer comprehensive protection for cloud-native environments, encompassing various security aspects such as workload protection, runtime protection, and compliance management.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."