Cloud Integration Software Market Size, Share & Trends Analysis Report By Type, By Enterprise Size (Large Size Enterprises, Small & Medium Sized Enterprises (SMEs)), By End Use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-164-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

The global cloud integration software market size was valued at USD 3.23 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.7% from 2023 to 2030, owing to the increasing adoption of cloud computing across various industries, driving the growth of the market. As businesses transition to the cloud, they often encounter a complex landscape of disparate applications, databases, and systems that need to share data. Cloud integration software enables seamless data transfer and helps businesses integrate on-premises and cloud-based applications, fostering a cohesive IT environment.

The COVID-19 pandemic had a positive impact on the market. The demand for cloud-based solutions surged as businesses rapidly adapted to remote work models and aimed for greater operational efficiency. Cloud integration software emerged as a keystone in this transformation, facilitating the seamless connection of distributed teams, applications, and data sources. The imperative to enable remote collaboration and ensure business continuity prompted organizations to invest in cloud technologies, driving the adoption of cloud integration solutions.

Moreover, the increasing demand for scalable storage solutions significantly affects the market growth of cloud integration software. As businesses need extensive data, flexible and expandable storage capabilities become essential. The scalability offered by cloud integration allows organizations to efficiently manage and integrate large volumes of data, adapting to fluctuating storage requirements without the need for extensive on-premises infrastructure.

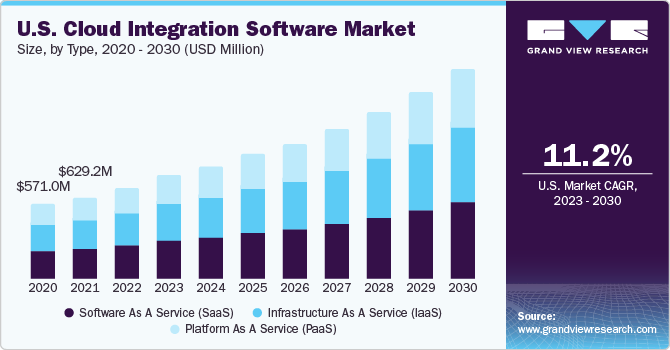

Type Insights

In terms of type, the market is further segmented into infrastructure as a service (IaaS), software as a service (SaaS), and platform as a service (PaaS). The infrastructure as a service (IaaS) segment accounted for the largest revenue share of 41.3% in 2022. Infrastructure as a Service (IaaS) in cloud integration software refers to the foundational cloud computing service that provides virtualized computing resources, such as storage, servers, and networking, to support the deployment of integration solutions. When integrating various applications and systems in the cloud, IaaS plays a critical role by offering the necessary infrastructure components.

The platform as a service segment is anticipated to grow at the fastest CAGR of 17.2% during the forecast period. Platform as a Service (PaaS) in cloud integration software refers to a cloud-based platform that provides a comprehensive environment for developing, deploying, and managing integration solutions. PaaS offerings are designed to simplify the process of building, customizing, and running integration applications.

Enterprise Size Insights

Based on enterprise size, the global market is sub-segmented into large size enterprises and small and medium-sized enterprises (SMEs). The large size enterprise segment held the largest revenue share of 59.9% in 2022. Cloud integration software is crucial in large enterprises by facilitating the seamless connection of various applications and data. Moreover, it enables organizations to efficiently manage the data between hybrid environments, where some applications and data are on-premises and others are in the cloud. It ensures smooth interaction between on-premises applications and cloud-based resources, enhancing operational efficiency and data accessibility.

The small and medium-sized enterprises segment is anticipated to grow at the fastest CAGR of 16.3% during the forecast period. Many small and medium-sized companies are adopting cloud solutions as it help them save costs and enable scalability, thus driving market growth. SMEs can use cloud integration software to scale their operations as they grow without significant upfront infrastructure costs.

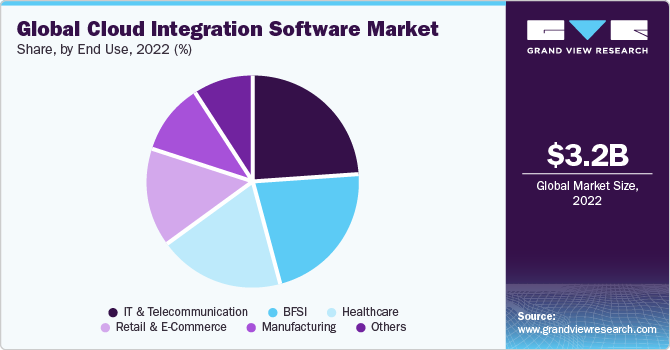

End Use Insights

Based on the end use, the global market is segmented into IT & telecommunication, BFSI, healthcare, retail and e-commerce, manufacturing, and others. The IT & telecommunication segment held the largest revenue share of 23.5% in 2022. IT & telecommunication organizations often use many applications, databases, and platforms. Cloud integration software enables these companies to connect and synchronize their infrastructure, ensuring smooth data flow and interoperability.

On the other hand, the manufacturing segment is anticipated to grow at the fastest CAGR rate of 18.8% during the forecast period. In manufacturing, various systems such as enterprise resource planning (ERP), customer relationship management (CRM), and supply chain management (SCM) often need to share data. Cloud integration software enables these companies to share data, thus enhancing operational efficiency seamlessly.

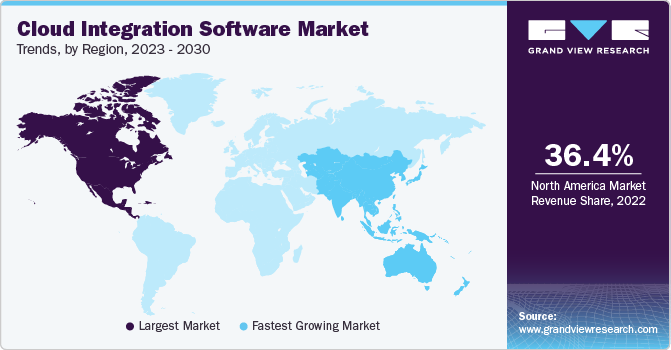

Regional Insights

North America dominated the market with a share of 36.4% in 2022 and is anticipated to dominate the market over the forecast period. The presence of developed cloud infrastructure in the region creates opportunities for the seamless deployment and operation of cloud integration solutions. Many companies are launching solutions to cater to the increasing demand for cloud-integrated solutions. For instance, in October 2023, Boomi, an automation and intelligent connectivity company, introduced the Silicon Valley Boomi Partner Summit, a new program for software providers. The program is equipped with pre-configured integration packages for quick time to value and easy entry to market for its partners.

Asia Pacific is anticipated to grow at the highest CAGR of 19.5% during the forecast period. The increasing digital transformation and adoption of cloud computing by regional companies are driving the growth of the market. Moreover, many companies in the region are adopting software as a service model to scale up their business, thus creating opportunities for the cloud integration software market.

Key Companies & Market Share Insights

The market has a consolidated competitive landscape with numerous regional and global players. Industry players are undertaking strategies such as new developments related to digital billboards, partnerships, mergers & acquisitions, and collaborations to survive the highly competitive environment and expand their business footprints. For instance, in March 2022, Sprout Social, Inc. partnered with the Salesforce service cloud to provide brands with a 360-degree view of customer interactions. Integrating Service Cloud ensures that Salesforce customers can handle all social customer care requests directly within Service Cloud. This integration enhances customer CRM profiles by incorporating social data, offering a comprehensive perspective on customer interactions.

Key Cloud Integration Software Companies:

- Boomi, LP

- Zapier Inc.

- Salesforce, Inc.

- International Business Machines corp.

- Microsoft

- WORKATO

- Oracle Corporation

- Informatica

- Amazon Web Services, Inc.

- Cloud Software Group, Inc.

- Tencent Cloud Cinécraft Productions, Inc.

- Alibaba Cloud

- Verizon

- VMware, Inc.

- Red Hat, Inc

Cloud Integration Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 3.66 billion |

|

Revenue forecast in 2030 |

USD 9.54 billion |

|

Growth Rate |

CAGR of 14.7% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, And Trends |

|

Segments covered |

Type, enterprise size, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Netherlands; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Boomi, LP; Zapier Inc.; Salesforce, Inc.; International Business Machines corp.; Microsoft; WORKATO; Oracle Corporation; Informatica; Amazon Web Services, Inc.; Cloud Software Group, Inc.; Tencent Cloud Cinécraft Productions, Inc.; Alibaba Cloud; Verizon; VMware, Inc.; Red Hat, Inc |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cloud Integration Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cloud integration software market report based on type, enterprise size, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Infrastructure as a Service (IaaS)

-

Software as a Service (SaaS)

-

Platform as a Service (PaaS)

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Size Enterprises

-

Small and Medium Sized Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

IT & Telecommunication

-

BFSI

-

Healthcare

-

Retail and E-Commerce

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud integration software market size was estimated at USD 3.23 billion in 2022 and is expected to reach USD 3.66 billion in 2023

b. The global cloud integration software market is expected to grow at a compound annual growth rate of 14.7% from 2022 to 2030 to reach USD 9.54 billion by 2030

b. North America dominated the cloud integration software market with a market share of 36.4% in 2022. This can be attributed to the high adoption of cloud computing and the need for businesses to connect and integrate various cloud-based applications and services.

b. Some key players operating in the cloud integration software market include Boomi, LP, Zapier Inc., Salesforce, Inc., International Business Machines corp., Microsoft, WORKATO, Oracle Corporation, Informatica, Amazon Web Services, Inc., Cloud Software Group, Inc., Tencent Cloud Cinécraft Productions, Inc., Alibaba Cloud, Verizon, VMware, Inc. Red Hat, Inc.

b. Factors such as the increasing support of government for the adoption of cloud technologies to enhance efficiency, reduce costs, and foster innovation are driving market growth of the cloud integration software market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."