Cloud ERP Market Size, Share & Trends Analysis Report By Deployment (Public Cloud, Private Cloud, Hybrid Cloud), By Enterprise Size, By Function, By End Use, By Region And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-114-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Cloud ERP Market Size

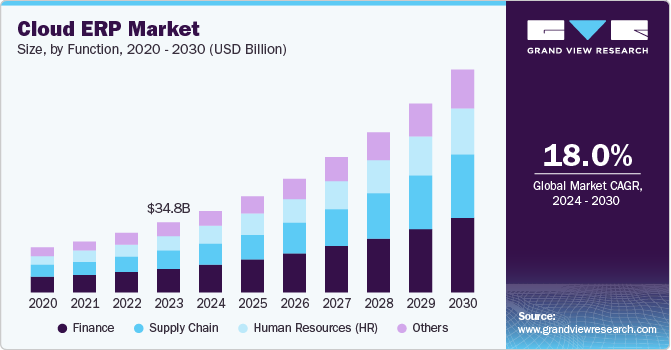

The global cloud ERP market size was valued at USD 34.83 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 18.0% from 2024 to 2030. The global market growth attributed to factors such as the rising adoption of SaaS solutions owing to the functional ability of cloud computing to improve the business performance of enterprises and the increasing migration of enterprises to the cloud ecosystem for reducing operational costs and improving security. Additionally, a growing need to deploy advanced ERP solutions that contain advanced analytics features and identify probable issues such as delays and disruptions, and rapid inclusion of artificial intelligence (AI) & machine learning (ML) technologies in the development of cloud enterprise resource planning (ERP) solutions are observed as key trends contributing to the market growth.

Moreover, cloud ERP providers prioritize data security, often implementing stringent measures such as encryption, multi-factor authentication, and frequent security assessments. This robust safety structure offers companies additional protection that may be complicated to provide internally, reducing risks related to data breaches and cyber threats. This factor is expected to drive the market growth over the forecast period, thereby providing numerous growth opportunities for the stakeholders.

Cloud ERP has emerged as a transformative solution for several end-use industries, such as construction, addressing various complexities inherent in project-based environments. Construction companies may effectively control project costs with the help of cloud ERP applications as they link financial data with project operations. With the help of this integration, it is possible to keep a tab on how resources are being used, budget allocations, and expenses in real-time, which is another factor that is positively impacting the market growth. For instance, in May 2023, IFS, a cloud software company, announced a partnership with NCC, a construction company, to increase productivity and efficiency across all its businesses in the four Nordic countries. IFS Cloud will replace the current Infor Lawson ERP and IBM Maximo EAM solution at NCC. The technology will give NCC's business visibility, boost operational effectiveness, and simplify accounting procedures. Through the partnership, NCC Company will use IFS Cloud Enterprise Asset Management (EAM), and IFS Cloud ERP will support 7,000 users across NCC.

Cloud ERP has emerged as a prime focus for government organizations and large-scale enterprises. These organizations gain access to several opportunities as they make strategic investments, including rapid innovation and increased operational effectiveness to improve data governance and compliance. For instance, in February 2023, Oracle announced an investment of USD 1.5 billion to meet cloud computing requirements in Saudi Arabia. Oracle announced plans to create a third public cloud region in Saudi Arabia to address the rapidly expanding demand for cloud services. The new cloud region is expected to support the local businesses with reduced latency issues and increased scalability options that will in turn drive the adoption rate of cloud ERP solutions in the country. Consequently, the number of enterprises migrating from their conventional hosting platforms to cloud platforms will increase, thereby creating pavement of opportunities for cloud migration services associated with ERP software.

Cloud ERP eliminates the need for small businesses to invest in costly hardware and IT infrastructure. This means that small businesses can save money on hardware and maintenance costs, which is expected to drive the market growth. Moreover, it provides a robust platform for SMEs to digitally transform their business operations, modernize their procedures, and remain competitive in a rapidly evolving business environment. Cloud ERP systems offer real-time visibility into the utilization of resources, helping SMEs allocate assets effectively and reduce costs. For instance, in March 2023, SAP SE, a software company, launched an innovative offering termed GROW with SAP for midsize companies to take advantage of the proven features of cloud ERP. GROW with SAP, which is explicitly developed to assist midsize businesses in maximizing the benefits of cloud ERP, assures that customers will stay up to date with the current technological advancements to help them develop efficiently. A global community of specialists and free instructional resources are also available to midsize companies who use GROW with SAP, ensuring they achieve real business results.

The increasing threats of cyberattacks are pushing cloud ERP providers to enhance their security measures. Advanced cybersecurity frameworks are necessary for ensuring data safety, compliance, and resilience when businesses entrust sensitive information to the cloud. However, several cloud ERP providers frequently perform security audits and penetration tests to identify vulnerabilities in the system. These timely approaches can assist in identifying and addressing various issues before intruders can take advantage of them. Moreover, robust encryption techniques need to be adopted by cloud ERP providers to protect data security throughout server storage and transfer between users and the cloud.

Deployment Insights

The public cloud segment dominated the market, accounting for a market revenue share of 57.1% in 2023. The segment growth is attributed to the growing flexibility in cost models, the increasing need to avoid vendor lock-in situations, and the rising adoption of containerization architecture to enhance scalability. Subscription-based deployments of public cloud ERP are becoming more prevalent, aligning costs with actual usage. As a result, resource allocation is made more flexible, modular, and effective, maximizing IT spending while retaining performance. Besides this, containerization architecture is driving agility in cloud ERP deployments. The increasing adoption of container management in enterprises demonstrates the appeal of multi-cloud architectures.

Furthermore, public cloud platforms allow end users to manage multiple heterogeneous cloud platforms to achieve maximum independence. Hence, public cloud eliminates vendor lock-in and facilitates seamless migration between vendors. All these factors are expected to drive the segment's market growth.

The private cloud segment is expected to grow significantly over the forecast period. Security is essential for many organizations, especially those operating in highly regulated finance, healthcare, and government industries. Private cloud deployment provides enhanced security features, as the infrastructure is dedicated to a single organization. It allows for greater control over security protocols, data access, and compliance with industry regulations. With a private cloud, organizations implement security measures, including customized encryption, advanced firewalls, and secure access controls, ensuring that sensitive data is protected from external threats and unauthorized access.

Enterprise Size Insights

The large enterprises segment accounted for the largest market revenue share in 2023. The market growth in large enterprises is driven by the necessity of scalability, automation for efficiency, monitoring processes, and unified data administration. Large enterprises manage huge amounts of data from various sources. With cloud ERP, organizations can centralize customer data, increase data accuracy, and deliver insightful data, which is expected to drive segment growth in the market.

The small and medium-sized Enterprises (SMEs) segment is expected to witness the fastest CAGR over the forecast period. SMEs leverage Cloud ERP to optimize resource allocation, minimize cost, and enhance operational efficiency. Cloud ERP systems provide real-time visibility into resource utilization, helping SMEs allocate assets effectively and reduce costs. Cloud ERP systems include extensive analytics and reporting features that enable SMEs to extract useful information from their data and make decisions that promote innovation in the cloud ERP market growth.

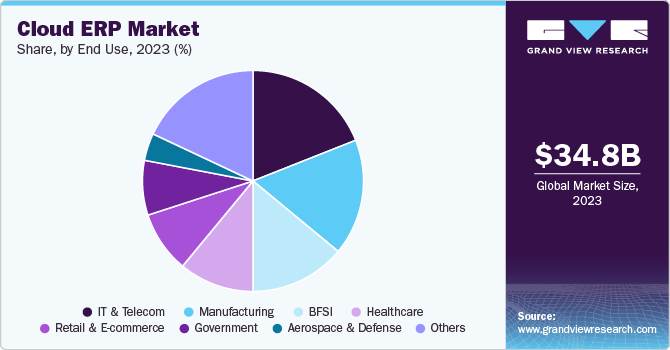

End Use Insights

The IT & Telecom sector accounted for the largest market revenue share in 2023. The emergence of 5G technology created new opportunities for the IT and Telecom sector. Cloud ERP providers started focusing on integrating capabilities to manage and optimize 5G network resources, ensuring efficient service delivery and customer experience, which is expected to drive market growth. For instance, in September 2022, Mavenir, a network software provider, announced the integration of Google Cloud's public cloud architecture with cloud-native 5G solutions. Through their partnership, Mavenir and Google Cloud will enable Communications Service Providers (CSPs) to use Google Cloud's scalable infrastructure, big data analytics services, container deployment, management tools, and 5G applications and products. Without affecting network management, performance, or insights, Mavenir's solution lowers complexity and costs for CSPs by shifting portions of the regular telecom application business to cloud operations.

The aerospace & defense segment is anticipated to register the fastest CAGR over the forecast period. The aerospace & defense industry operates extensive supply chains involving numerous suppliers, subcontractors, and partners across the globe. Managing this complexity requires robust tools to ensure coordination, real-time visibility, and effective inventory management. Cloud ERP systems provide A&D companies with an integrated platform that offers end-to-end supply chain visibility, enabling better demand forecasting, inventory optimization, and supplier collaboration. The real-time data access facilitated by Cloud ERP allows companies to respond to changes in demand, production schedules, and supply disruptions, which is essential in an industry where delays have significant financial and operational impacts.

Function Insights

The finance segment accounted for the largest market revenue share in 2023. Financial organizations seek to modernize their operations, improve data-driven decision-making, and adhere to regulatory regulations, cloud ERP adoption is gaining traction in the finance sector. Financial forecasting has evolved due to the emergence of Artificial Intelligence (AI) and machine learning. Cloud ERP systems use AI algorithms to analyze historical data, market patterns, and outside influences, providing more precise and useful financial projections, thereby boosting finance segment growth in the cloud ERP industry.

Supply chain segment is anticipated to register the fastest CAGR over the forecast period. The segment growth attributed to the increasing integration of digital twin technology. To enable real-time monitoring and predictive analytics for optimized operations, digital twins make virtual replicas of physical assets. Furthermore, cloud ERP systems are incorporating RPA to streamline manual processes, reduce errors, and enhance efficiency in supply chain and operations, which is further expected to drive the segment growth in the market.

Regional Insights & Trends

North America cloud ERP market accounted for the largest revenue share of 40.5% in 2023. In North America, the market growth can be attributed to factors such as the growing adoption of hybrid cloud strategies that combine on-premises and cloud infrastructures by North American companies. With the ability to easily interface with hybrid configurations, cloud ERP solutions enable organizations to combine the management of on-premises systems with the scalability of the cloud. By combining cloud ERP with advanced analytics, businesses can extract valuable insights from their data, which helps them make assertive, well-informed decisions, that is further expected to drive the market growth.

U.S. Cloud ERP Market Trends

The U.S. dominated the regional cloud ERP industry in 2023. Cloud ERP systems are essential for enabling remote work by providing employees access to critical business applications and data from any location with an internet connection. This capability supports the ongoing trend of hybrid work models, where employees split their time between the office and remote locations. The flexibility offered by Cloud ERP systems ensures business continuity and productivity, driving its development as companies adapt to new ways of working.

Asia Pacific Cloud ERP Market Trends

Asia Pacific is expected to witness the fastest CAGR over the forecast period. Asia-Pacific has been a rapidly growing region in terms of digital adoption and e-commerce, with countries such as China, India, South Korea, and Japan witnessing significant advancements in cloud ERP adoption. For instance, in April 2023, Huawei, a manufacturing company, announced that its MetaERP system had substituted the old ERP system that the company fully controls. 80% of Huawei's business volume and all business scenarios are handled using MetaERP. Additionally, Huawei has collaborated with partners to integrate advanced technologies into the MetaERP system, substantially improving service effectiveness and operational quality. These technologies include cloud-native architecture, metadata-driven multi-tenant architecture, and real-time intelligence. Such developments are expected to flourish the market growth in the region.

The China cloud ERP market is expected to witness significant growth over the forecast period. Businesses in China are looking to modernize their operations and compete globally, often turning to Cloud ERP solutions as a cost-effective and scalable way to achieve this. Additionally, as companies expand, they require ERP systems that manage complex operations across multiple regions and comply with diverse regulatory requirements. The expansion of businesses into emerging markets within the country increases the adoption of Cloud ERP solutions.

Europe Cloud ERP Market Trends

Europe cloud ERP market is expected to witness significant growth over the forecast period. Small and medium-sized enterprises (SMEs) are essential to the European economy, and many are shifting to Cloud ERP systems to improve their operational efficiency and competitiveness. Cloud ERP offers a more accessible solution for SMEs. The subscription-based pricing model, ease of deployment, and scalability of Cloud ERP systems make them particularly efficient for European SMEs with limited IT resources requiring powerful ERP capabilities. This shift of SMEs drives its demand in the market.

The UK cloud ERP market is expected to witness significant growth over the forecast period. Cloud ERP systems contribute to this by providing a suitable view of customer interactions, streamlining order processing, and improving the efficiency of customer service operations. By integrating CRM (Customer Relationship Management) with other business processes, Cloud ERP systems enable businesses to deliver more personalized and responsive services. This focus on enhancing customer experience is suitable for retail, hospitality, and service industries, where customer satisfaction is linked to business success. The ability to deliver superior customer experiences through Cloud ERP systems is driving for adoption in the UK.

Key Company & Market Share

Key players in cloud ERP market include Acumatica, Inc., Deltek, Inc., SAP SE, Epicor Software Corporation., Microsoft and others.

-

Acumatica is a cloud-based ERP (Enterprise Resource Planning) software provider. The company specializes in delivering integrated business management applications developed for small and mid-sized enterprises across various industries, including manufacturing, distribution, retail, and services.

-

SAP SE is a leading company in enterprise application software. The company specializes in developing software solutions that aid businesses manage their operations and customer relationships more effectively. The company offers SAP S/4HANA, an enterprise resource planning software developed by SAP SE for large enterprises.

Key Cloud ERP Companies:

The following are the leading companies in the cloud ERP market. These companies collectively hold the largest market share and dictate industry trends.

- Acumatica, Inc.

- Deltek, Inc.

- Epicor Software Corporation

- Infor

- Microsoft

- Oracle

- Ramco Systems.

- Sage Group plc

- SAP SE

- Syspro

- Unit4

- Workday, Inc.

Recent Developments

-

In April 2024, Truckin Digital launched its 2024 Trucking Software ERP (Enterprise Resource Planning) suite. This comprehensive software is developed to enhance trucking operational capabilities and streamline trucking operations through advanced technology. It offers features covering every part of trucking operations, from planning and dispatching to accounting.

-

In July 2024, SAP and Indigi Consulting and Solutions Private Limited collaborated to launch Grow with SAP, a cloud enterprise resource planning (ERP) offering. This ERP solution is specifically designed for small and mid-sized organizations in India, particularly in the West Bengal region. It aims to fuel the growth ambitions of these enterprises by providing them with a strong and scalable IT landscape powered by cutting-edge innovation.

Cloud ERP Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 40.79 billion |

|

Revenue forecast in 2030 |

USD 110.26 billion |

|

Growth Rate |

CAGR of 18.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Deployment, Enterprise Size, Function, End Use, and Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Japan China, India, Australia, South Korea, Thailand, Indonesia, Brazil, South Africa, South Arabia, and UAE |

|

Key companies profiled |

Acumatica, Inc., Deltek, Inc., Epicor Software Corporation., Infor, Microsoft, Oracle, Ramco Systems, Sage Group plc, SAP SE, Syspro, Unit4, Workday, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cloud ERP Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cloud ERP market report based on deployment, enterprise size, function, end use, and region.

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Private Cloud

-

Public Cloud

-

Hybrid Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small and Medium-sized Enterprises (SMEs)

-

Large Enterprises

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Finance

-

Supply Chain

-

Human Resources (HR)

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

BFSI

-

Healthcare

-

Retail & E-commerce

-

Government

-

Aerospace & Defense

-

IT & Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

South Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."