Cloud Database And DBaaS Market Size, Share & Trends Analysis Report By Component (Solution, Service), By Database Type, By Deployment (Public, Private), By Enterprise Size, By End-use (BFSI, Healthcare), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-063-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Cloud Database And DBaaS Market Trends

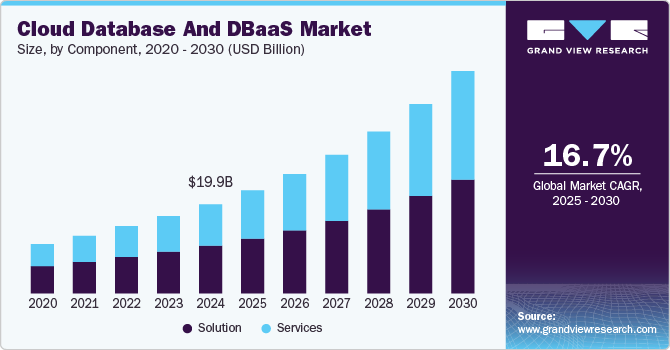

The global cloud database and DBaaS market size was estimated at USD 19.95 billion in 2024 and is anticipated to grow a CAGR of 16.7% from 2025 to 2030. The growth can be attributed to the growing adoption of cloud computing technology. Cloud computing technology offers businesses a cost-effective and flexible alternative to traditional on-premises data management solutions. It enables businesses to access their data and applications from anywhere in the world, using any device with an internet connection. It is particularly beneficial for businesses with remote or distributed workforces, as it allows employees to collaborate and share data in real time regardless of location. As data volumes and complexity grow, businesses can add more resources to their cloud database or DBaaS to handle the increased workload. It ensures businesses have the necessary resources to handle their data management needs without investing in costly hardware or software.

Businesses globally are rapidly digitizing their operations, leading to growth in structured and unstructured data. The growing need for cost-effective and scalable solutions has pushed businesses to opt for cloud databases, eliminating the constraints on premises systems. Moreover, DBaaS offers a pay-as-you-go model, minimizing upfront costs and operational complexity while ensuring access to high-performance database services. The cost-effective model enables MSMEs to access advanced capabilities without any high investments. In addition, automation and AI-driven database management minimize administrative overhead, further improving operational efficiency.

Gaining popularity of serverless databases as they eliminate the need for manual infrastructure management is driving the growth of cloud database and DBaaS industry. Platforms like Google Cloud Firestore and Amazon Aurora Serverless provide autoscaling capabilities, reducing operational complexities and improving efficiency. The rise in data generated from various sources, including social media, IoT devices, and enterprise applications, has created a demand for efficient data management solutions. Cloud databases enable businesses to store, process, and analyze large datasets in real time, facilitating faster decision-making and improved customer insights are increasing the adoption of cloud database and DBaaS.

In response to growing cyber-attacks, cloud database providers have integrated advanced security measures, including identity access management, encryption, and multi-factor authentication. Compliance with regulatory frameworks such as CCPA, GDPR, and HIPAA has become critical factors in cloud database adoption, ensuring data protection and governance.

Component Insights

In terms of component, the cloud database and DBaaS market is segmented into solutions and services. The solution segment is further bifurcated into database management and storage. The solution segment dominated the market in 2024 and accounted for the revenue share of over 53.0%. The solution segment refers to the range of offerings cloud databases and DBaaS providers provide their customers to meet their specific database needs. The solution segment includes many services, such as data migration, backup and recovery, performance tuning, security, and scalability. These services help businesses optimize their database infrastructure, reduce costs, and improve their efficiency. Cloud database and DBaaS providers offer a variety of solutions to their customers, ranging from primary database hosting to advanced analytics and data management services.

The service segment is expected to witness the fastest CAGR during the forecast period. The service segment is bifurcated into professional services and managed services. The services in the cloud database and DBaaS industry refer to vendors' offerings to help organizations implement, manage, and optimize their cloud databases. These services further encompass consultation, support, training, migration, and ongoing maintenance and monitoring. Consultation services can help organizations determine which type of cloud database or DBaaS solution is best suited for their needs and provide guidance on implementing and integrating it with their existing systems. Support services are essential for ensuring that any issues or problems with the database are addressed quickly and effectively. Training services can help organizations get up to speed on using and optimizing their cloud database, while migration services can help them move their existing data to the cloud.

Database Type Insights

Based on database type, the global cloud database and DBaaS industry is segmented into NoSQL and relational databases. The relational database segment held the largest revenue share of over 58.0% in 2024. Relational databases have been a driving factor for the development of cloud databases due to their popularity in modern applications. As businesses and organizations have become more data-driven, the demand for efficient and scalable data storage solutions has significantly grown in recent years. Cloud databases provide an ideal solution for this need, as they offer flexible storage options and the ability to scale up or down as data needs quick changes.

The NoSQL segment is expected to witness the fastest CAGR of 17.7% during the forecast period. The emergence of NoSQL databases can be considered as one of the driving factors behind the rise of cloud databases. NoSQL databases have been developed to address the limitations of traditional relational databases, which are designed to handle structured data in a highly consistent manner. However, with the advent of big data, social media, and the internet of things (IoT), there is a need for databases that could handle large amounts of unstructured data in a flexible and scalable way. Hence, such factors are driving the demand for NoSQL database.

Deployment Insights

Based on deployment, the global industry for cloud database and DBaaS is divided into public, private, and hybrid. The hybrid segment dominated the market in 2024 and accounted for a revenue share of over 47.0%. The adoption of hybrid cloud databases has become increasingly popular as it provides businesses with the flexibility to use both on-premises and cloud-based databases. The hybrid approach allows companies to leverage the benefits of cloud-based databases, such as scalability and cost savings, while still maintaining control over their sensitive data and complying with data sovereignty regulations. Additionally, hybrid cloud databases offer a flexible and cost-effective solution for businesses that want to maintain control over their sensitive data while also leveraging the benefits of cloud-based databases. With the increasing adoption of hybrid cloud databases, it is anticipated to drive the market growth.

On the other hand, the private cloud segment is expected to witness the fastest CAGR during the forecast period. Private cloud infrastructure provides a dedicated and isolated environment for storing, processing, and managing data. Private cloud databases can be customized and optimized to meet the specific needs and requirements of the organization, such as performance, scalability, availability, and disaster recovery. Hence, such factors are expected to drive the market growth of this segment during the forecast period.

Enterprise Size Insights

The large size enterprise segment dominated the market and accounted for a revenue share of over 52.0% in 2024. Large enterprises are gaining a significant competitive edge by migrating to cloud database solutions due to rapid digital acceleration. Large-size organizations often have complex and diverse data requirements, which can be challenging to manage with traditional on-premises databases. Cloud databases offer virtually limitless scalability, allowing organizations to quickly and easily add more storage capacity or processing power quickly and efficiently as their data needs increase over time. This means they can avoid the costs and complexities of maintaining on-premises infrastructure. In December 2022, Cockroach Labs, a cloud-native distributed SQL database company, partnered with Computacenter plc, independent technology and services provider to enhance and boost the widespread utilization of cloud-native technology. This collaboration enables large enterprises to streamline migrations, automate manual tasks, and boost effectiveness and efficiency.

On the other hand, the small and medium-sized enterprises segment is anticipated to witness the fastest CAGR from 2025 to 2030. Small and medium-sized organizations are increasingly adopting cloud database and Database-as-a-Service (DBaaS) solutions. Cloud databases and DBaaS solutions can offer SMEs a cost-effective, scalable, and reliable way to manage their data without needing expensive on-premises infrastructure. One of the key benefits of cloud databases and DBaaS for SMEs is that it can provide a more cost-effective way to manage their data.

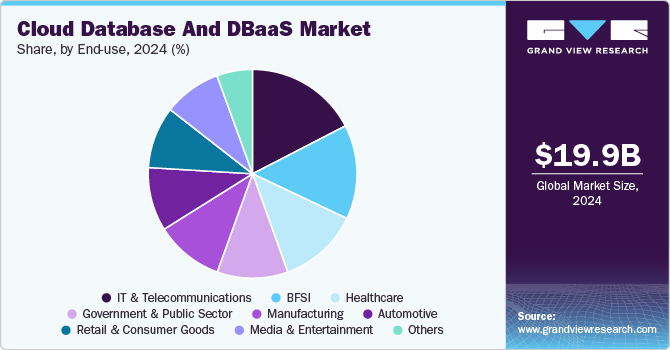

End-use Insights

The IT & telecommunications segment held the largest revenue share of over 17.0% in 2024 and is expected to maintain its dominance over the forecast period. Cloud database technologies and DBaaS offerings allow IT & Telecommunication companies to quickly provision and scale their database infrastructure without needing physical hardware. This can significantly reduce the time and resources required to manage and maintain databases while providing greater agility and scalability to support changing business needs. In addition to database provisioning and management, DBaaS providers offer a range of features and services to help IT & Telecommunication companies optimize their database infrastructure. These include backup and recovery services, automatic scaling, load balancing, and security features such as encryption and access control. The segment expected to grow in the coming years as more companies move their database infrastructure to the cloud.

The automotive segment is anticipated to witness the fastest CAGR of 19.0% during the forecast period. The automotive industry increasingly adopts cloud databases and Database-as-a-Service (DBaaS) solutions to manage their data, optimize their operations, and deliver better customer experiences. With cloud databases, automotive companies can store, and process vast amounts of data generated by their vehicles, customers, and operations. Cloud databases and DBaaS solutions can store and process data from various sources, including sensors, IoT devices, and customer interactions which can help the industry in making better decisions based on the collected data.

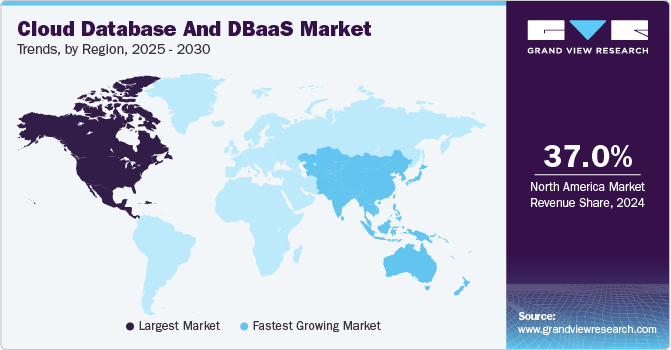

Regional Insights

North America cloud database and DBaaS market dominated and accounted for a revenue share of over 37.0% in 2024. There has been a significant increase in the demand for cloud databases in North America in recent years. This growth is driven by several factors, including the increased adoption of cloud-based technologies across various industries and the rise of big data and analytics. Also, the expansion of cloud computing is one of the main factors driving the growth of cloud databases in the region. As more businesses move to the cloud, the demand for cloud-based data storage solutions is rising. Organizations in the region are launching the latest updates to their cloud database solutions to gain a competitive edge over its competitors.

U.S. Cloud Database And DBaaS Market Trends

The cloud database and DBaaS market in the U.S. is expected to grow significantly from 2025 to 2030, owing to high cloud-adoption rate, growing investments in AI and machine learning, and strong presence of market vendors. Market players like Google LLC, Microsoft Corporation, and AWS offer comprehensive cloud database solutions. The growing demand for data security, AI-driven analytics, and hybrid cloud environments continues to shape the industry landscape.

Europe Cloud Database And DBaaS Market Trends

Europe cloud database and DBaaS market is expected to register a CAGR of 15.2% from 2025 to 2030. The market in the region is influenced by stringent data privacy regulations such as GDPR, encouraging enterprises to adopt secure and compliant cloud solutions. Countries in the region are witnessing substantial investments in cloud infrastructure further anticipated to drive the demand for cloud database and DBaaS over the forecast period.

The U.K. cloud database and DBaaS market is expected to grow rapidly in the coming years. This growth can be attributed to the rapid adoption of digital banking, enterprise cloud migration strategies, and fintech growth. Furthermore, the rise of multi-cloud adoption is another trend shaping the market in the U.K.

Asia Pacific Cloud Database And DBaaS Market Trends

The cloud database and DBaaS industry in the Asia Pacific is growing significantly at a CAGR of over 19.0% from 2025 to 2030. The market for cloud database and DBaaS in this region is driven by the rise in investments by cloud computing companies. For instance, in September 2022, Alibaba Cloud, the cloud computing subsidiary of Alibaba.com, announced its plans to invest USD 1 billion to help customers adopt cloud computing solutions, reignite growth, and bolster the company's market position. The investment is specifically focused on offering cloud computing services, including data storage, artificial intelligence, and analytics capabilities, to customers across various industries. The move comes amid fierce competition in the cloud computing market in China and globally, with tech giants like Tencent, Huawei Technologies Co., Ltd., and Amazon Web Services, Inc. competing over gaining market share.

The cloud database and DBaaS market in China held a substantial market share in 2024, owing to strong government support for cloud computing and digital infrastructure development. Additionally, companies like Tencent Cloud, Alibaba, and Huawei are investing heavily in DBaaS solutions is further driving the market growth in China. The push for AI-driven database management and the expansion of cloud-based fintech applications are anticipated to drive the market growth in China.

Key Cloud Database And DBaaS Company Insights

The key market players in the global cloud database and DBaaS market include Oracle, IBM Corporation, SAP SE, Google LLC, Microsoft Corporation, and Alibaba Cloud. The market has a fragmented competitive landscape as it features various global and regional market players. Leading industry players are undertaking strategies such as product launches, collaborations, and partnerships to survive the highly competitive environment and expand their business footprints.

-

In September 2024, Oracle Corporation launched a database named Oracle Database@AWS in a strategic partnership with Amazon Web Services, Inc. (AWS). The database allows the customers to access Oracle Exadata Database Service and Oracle Autonomous Database within AWS.

-

In January 2024, Silk, a cloud data platform provider launched Cloud Database as a Service (DBaaS) platform. Through the platform the company offers cloud database services such as updates, monitoring, tuning, and patching to their users.

-

In January 2023, DataStax, a real-time Artificial Intelligence (AI) company, acquired Kaskada Inc., a machine learning (ML) company. With this acquisition, DataStax intends to initially open source the basic Kaskada Inc., technology, with plans to launch a new machine learning cloud component in the same year.

Key Cloud Database And DBaaS Companies:

The following are the leading companies in the cloud database and DBaaS market. These companies collectively hold the largest market share and dictate industry trends.

- Google LLC

- Nutanix

- Oracle

- IBM Corporation

- SAP SE

- Amazon Web Services, Inc.

- Alibaba Cloud

- MongoDB, Inc.

- Microsoft

- Teradata

- Ninox

- DataStax

Cloud Database And DBaaS Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 23.05 billion |

|

Revenue forecast in 2030 |

USD 49.78 billion |

|

Growth rate |

CAGR of 16.7% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, database type, deployment, enterprise size, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Sweden; Finland; Netherlands; China; India; Japan; Australia; Singapore; Brazil; Chile; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Google LLC; Nutanix; Oracle; IBM Corporation; SAP SE; Amazon Web Services, Inc.; Alibaba Cloud; MongoDB, Inc.; Microsoft; Teradata; Ninox; DataStax |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cloud Database And DBaaS Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cloud database and DBaaS market report based on component, database type, deployment, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Database Management

-

Storage

-

-

Service

-

Professional Services

-

Managed Services

-

-

-

Database Type Outlook (Revenue, USD Million, 2018 - 2030)

-

NoSQL

-

Relational Database

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Public

-

Private

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Size Enterprises

-

Small and Medium Sized Enterprises (SMEs)

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

IT & Telecommunications

-

BFSI

-

Healthcare

-

Government & Public Sector

-

Manufacturing

-

Automotive

-

Retail & Consumer Goods

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Sweden

-

Finland

-

Netherlands

-

Finland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud database and DBaaS market size was estimated at USD 19.95 billion in 2024 and is expected to reach USD 23.05 billion in 2025

b. The global cloud database and DBaaS market is expected to grow at a compound annual growth rate of 16.7% from 2025 to 2030 to reach USD 49.78 billion by 2030

b. North America dominated the market in 2024 and accounted for a revenue share of over 37.0% in 2024. There has been a significant increase in the demand for cloud databases in North America in recent years. This growth is driven by several factors, including the increased adoption of cloud-based technologies across various industries and the rise of big data and analytics.

b. Some key players operating in the cloud database and DBaaS market include Google LLC, Nutanix, Oracle, IBM Corporation, SAP SE, Amazon Web Services, Inc., Alibaba Cloud, MongoDB, Inc., Microsoft, Teradata, Ninox, DataStax

b. Key factors driving the market growth include growing adoption of cloud computing and increased demand for NoSQL database

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."