- Home

- »

- Next Generation Technologies

- »

-

Cloud Computing Market Size, Share, Industry Report, 2030GVR Report cover

![Cloud Computing Market Size, Share & Trends Report]()

Cloud Computing Market (2026 - 2033) Size, Share & Trends Analysis By Service (IaaS, PaaS, SaaS), By Deployment (Public, Private, Hybrid), By Workload (Application Development & Testing, Data Storage & Backup), By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-210-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud Computing Market Summary

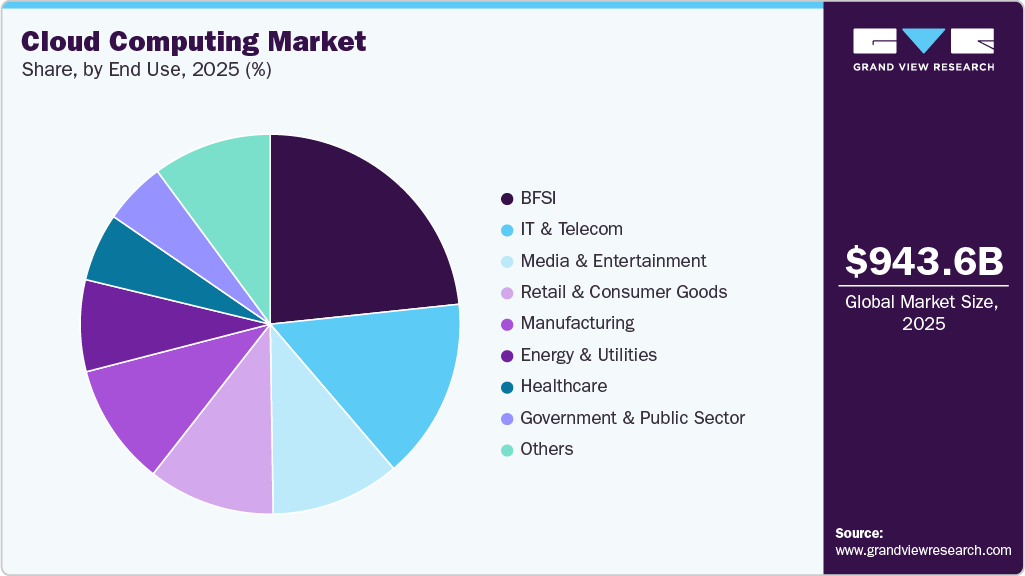

The global cloud computing market size was estimated at USD 943.65 billion in 2025 and is projected to reach USD 3,349.61 billion by 2033, growing at a CAGR of 16.0% from 2026 to 2033 due to the ongoing shift from legacy on-premises infrastructure to more scalable, flexible, and cost-efficient cloud environments. Enterprises across industries are modernizing applications, consolidating data platforms, and adopting consumption-based pricing models that reduce capital expenditure and accelerate deployment cycles.

Key Market Trends & Insights

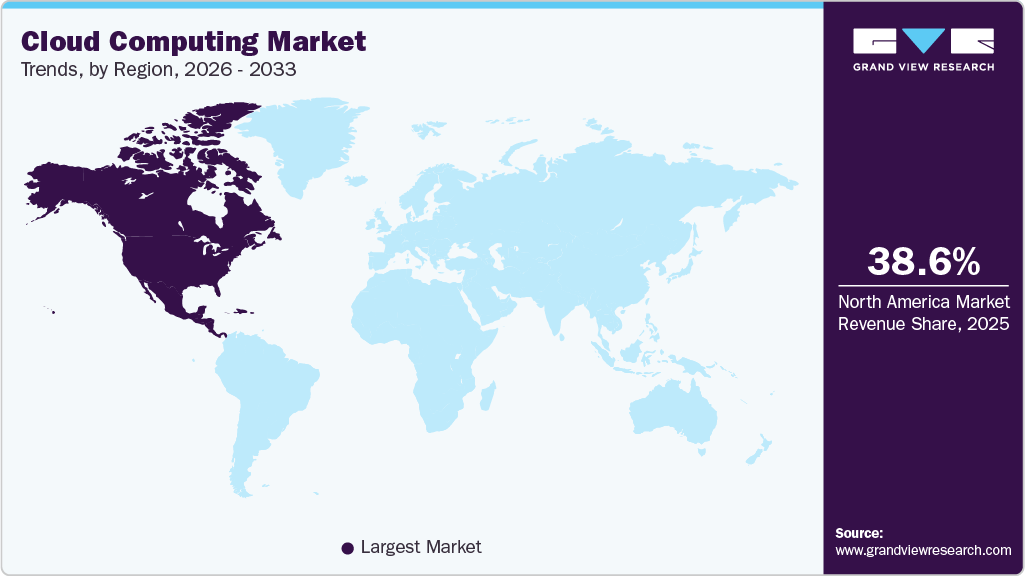

- North America cloud computing dominated the global market with the largest revenue share of 38.6% in 2025.

- The cloud computing industry in U.S. is expected to grow significantly over the forecast period.

- By service, Software as a Service (SaaS) led the market and held the largest revenue share of 53.6% in 2025.

- By deployment, the private segment held the dominant position in the market and accounted for the largest revenue share in 2025.

- By end use, the BFSI segment is expected to grow at the fastest CAGR from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 943.65 Billion

- 2033 Projected Market Size: USD 3,349.61 Billion

- CAGR (2026-2033): 16.0%

- North America: Largest market in 2025

The surge in AI, machine learning, and advanced analytics adoption contributes to market growth. Training and running modern AI models requires massive compute, high-performance GPUs, and elastic infrastructure, capabilities that cloud platforms are uniquely positioned to deliver at scale. As organizations build AI-enabled products, automate operations, and implement predictive analytics, their reliance on cloud services continues to rise sharply.

The rise of hybrid and multicloud strategies is also driving the market. Companies increasingly prefer diversified architectures to avoid vendor lock-in, improve resiliency, and optimize performance. Modern cloud-management platforms, container orchestration, and cross-cloud networking make it easier to run applications seamlessly across providers, encouraging broader adoption. According to Flexera’s annual State of the Cloud, nearly one-third of enterprises now allocate over USD 12 million each year solely to public-cloud services as AI-related investments accelerate, according to new industry indicators. With cloud costs running about 17% higher than planned, companies are stepping up efforts to rein in spending 60% are increasing reliance on managed service providers, while 59% are strengthening their FinOps teams to improve cost governance and optimize resource use.

Growth in edge computing and IoT ecosystems adds another layer of momentum. Connected manufacturing, smart cities, autonomous systems, and distributed retail environments require low-latency processing and localized compute. This fuels demand for edge-cloud architectures, where centralized cloud resources work in tandem with regional or on-device processing.

Security and compliance advancements are further accelerating cloud migration. Providers now offer robust cloud-native security suites, zero-trust models, automated threat detection, and regulatory compliance frameworks. As data-sovereignty policies tighten globally, cloud hyperscalers’ expansion into new regions also boosts adoption by enabling local processing and storage within required jurisdictions.

Service Insights

The software as a service (SaaS) segment dominated the market and accounted for the revenue share of 53.6% in 2025. A significant driver of SaaS growth is the global preference for subscription pricing and operational-expense models over traditional license-based software. SaaS eliminates upfront capital investments, reduces upgrade/maintenance burdens, and provides predictable, recurring costs, appealing to both SMBs and large enterprises. As organizations tighten budgets, the flexibility to scale up or down based on usage further amplifies SaaS adoption across departments such as HR, CRM, finance, and collaboration.

The infrastructure as a service (IaaS) segment is anticipated to grow at the highest CAGR during the forecast period. Enterprises are accelerating their migration away from legacy on-premise data centers toward cloud-based infrastructure to improve agility, reduce maintenance overhead, and modernize their technology stack. IaaS offers instant provisioning of virtualized compute, storage, and network resources, enabling organizations to deploy applications faster, scale infrastructure globally, and experiment with new digital services without committing to heavy capital expenditures. As businesses adopt cloud-native architectures, containerization, and microservices, demand for scalable IaaS environments continues to rise.

Workload Insights

The resource management segment dominated the market and accounted for the largest revenue share in 2025. Enterprises are increasingly operating across multiple cloud platforms and combining public, private, and on-premise infrastructures. This complexity makes manual oversight impractical. Resource management tools, covering compute, storage, and network orchestration, are essential for providing unified visibility, automated provisioning, and consistent governance across fragmented environments. As hybrid and multi-cloud become the default architecture, demand for intelligent resource orchestration solutions continues to surge.

The application development & testing segment is anticipated to grow at the highest CAGR during the forecast period. DevOps has become a mainstream operational model, and cloud platforms are now the backbone for CI/CD pipelines, automated testing, and infrastructure-as-code. Cloud providers offer integrated repositories, build pipelines, automated test suites, and deployment orchestration. These capabilities reduce manual effort, minimize human error, and enable continuous delivery at scale. As organizations adopt DevOps culture more deeply, reliance on cloud-based development and testing accelerates.

Deployment Insights

The private segment dominated the market and accounted for the largest revenue share in 2025, driven by the rising emphasis on secure, controlled environments-especially in highly regulated sectors like BFSI, healthcare, government, and telecom. Private deployments allow organizations to maintain dedicated infrastructure with strict access controls, data-sovereignty compliance, and customized security policies that are harder to achieve in public cloud settings. As global regulations around data protection, residency, and industry-specific certifications tighten, enterprises are leaning more toward private clouds to mitigate compliance risks.

The hybrid segment is expected to grow at a significant CAGR during the forecast period. Enterprises increasingly use multiple cloud providers for redundancy, performance optimization, and vendor diversification. Hybrid models create a unified operational framework that links private cloud or on-premise infrastructure with multiple public clouds. This interoperability helps enterprises avoid lock-in, optimize costs, and select best-in-class services, driving rapid investment in hybrid platforms, orchestration tools, and cloud networking.

Enterprise Size Insights

The large enterprise segment dominated the market and accounted for the largest revenue share in 2025. Large enterprises are undertaking multi-year digital transformation programs that require modern, scalable, and globally distributed infrastructure. Cloud computing enables them to modernize legacy applications, shift to microservices, and adopt cloud-native architectures at scale. The need to support new business models, digital customer experiences, and enterprise-wide automation is pushing large organizations to migrate core workloads to the cloud, driving strong demand within this segment.

The small & medium enterprises segment is expected to grow at a significant CAGR during the forecast period. SMEs increasingly adopt cloud computing because it eliminates the need for heavy upfront investments in servers, hardware, and IT maintenance. Cloud services offer pay-as-you-go pricing, allowing smaller businesses to align technology spending with revenue cycles. This cost flexibility is especially important for SMEs operating with limited capital or fluctuating demand, making cloud adoption a financially strategic choice.

End Use Insights

The BFSI segment dominated the market and accounted for the largest revenue share in 2025. Many BFSI organizations adopt hybrid cloud models to balance regulatory requirements, performance, and business continuity. Sensitive customer data may reside in private clouds or on-premise systems, while analytics, customer engagement, or innovation platforms leverage public cloud scalability. This hybrid approach ensures security without sacrificing flexibility, further driving cloud investments in BFSI.

The manufacturing segment is expected to grow at a significant CAGR over the forecast period. Manufacturers are increasingly adopting cloud computing to enable Industry 4.0 initiatives such as smart factories, predictive maintenance, and digital twins. Cloud platforms provide the infrastructure and analytics capabilities required to integrate IoT sensors, real-time monitoring, and automation across production lines. By leveraging cloud-based solutions, manufacturers can optimize operations, reduce downtime, and enhance productivity, driving strong adoption in this sector.

Regional Insights

North America dominated the global market with the largest revenue share of 38.6% in 2025, driven by high adoption of AI and machine learning workloads among enterprises, supported by large-scale hyperscaler investments in advanced data centers. Organizations in the region are rapidly integrating AI-driven analytics, DevOps, and automation into core operations, which fuels demand for scalable IaaS and PaaS platforms.

U.S. Cloud Computing Market Trends

The cloud computing market in the U.S. is expected to grow significantly at a CAGR of 16.8% from 2026 to 2033, due to government digitalization and public-sector cloud initiatives. Agencies and defense organizations are modernizing legacy IT systems and migrating critical workloads to secure cloud environments, boosting demand for hybrid, private, and compliant cloud solutions.

Europe Cloud Computing Market Trends

The cloud computing market in Europe is anticipated to register considerable growth from 2026 to 2033 due to stringent data protection and privacy regulations (GDPR) that require localized, secure cloud solutions. Enterprises are increasingly adopting private and hybrid clouds to ensure compliance while benefiting from cloud scalability and advanced analytics capabilities.

The UK cloud computing market is expected to grow rapidly in the coming years, owing to the financial services sector, where banks and insurance firms are modernizing their IT infrastructure to enhance customer experience, implement real-time analytics, and strengthen cybersecurity frameworks in highly regulated environments.

The cloud computing market in Germany held a substantial market share in 2025 due to the manufacturing and automotive sectors' adoption of cloud computing, leveraging Industry 4.0 initiatives, digital twins, and IoT-driven smart factories. Cloud computing enables real-time operational insights, predictive maintenance, and supply chain optimization.

Asia Pacific Cloud Computing Market Trends

The cloud computing market in the Asia Pacific region held a significant share in the global market in 2025, due to Rapid digitalization among SMEs, e-commerce growth, and government smart-city projects. Cloud platforms provide cost-effective, scalable IT infrastructure for startups and mid-sized businesses while supporting regional innovation initiatives.

Japan cloud computing market is expected to grow rapidly in the coming years, driven by AI and robotics integration in manufacturing, healthcare, and logistics sectors. Cloud computing enables high-performance computing, edge deployments, and automation solutions, supporting precision manufacturing and advanced robotics initiatives.

The cloud computing market in China held a substantial market share in 2025, due to the large-scale adoption of 5G networks and IoT ecosystems. Cloud computing provides the infrastructure needed to support smart cities, autonomous vehicles, digital payments, and massive real-time data processing for both enterprise and government applications.

Key Cloud Computing Company Insights

Key players operating in the cloud computing industry are Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), Oracle Cloud, Salesforce, Inc., and Alibaba Cloud. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2025, Salesforce announced Agentforce 3, an upgrade to its AI‑powered digital labor platform, introducing a new Command Center that gives enterprises complete observability into their AI‑agent activity. The update lets companies monitor, measure, and optimize how their AI agents work, track performance and health, and scale deployments with governance and control, addressing the biggest barrier to large‑scale AI‑agent adoption.

-

In May 2025, Alibaba Cloud announced strategic partnerships with UAE-based financial services leader LuLu Financial Holdings (LuluFin) and Ant Digital Technologies. The collaborations aim to accelerate digital transformation in the region by providing businesses with advanced infrastructure and AI-enabled tools, reinforcing Alibaba Cloud’s commitment to supporting the growth of AI-powered solutions across the Middle East.

-

In September 2024, IBM Corporation and Microsoft announced the launch of three new IBM-Microsoft Experience Zones within IBM’s Client Innovation Centers. These zones are intended to help global clients across sectors, including financial services, healthcare, industrial, government, manufacturing, and consumer packaged goods, explore and unlock value from hybrid cloud, generative AI, and other Microsoft technologies.

Key Cloud Computing Companies:

The following are the leading companies in the cloud computing market. These companies collectively hold the largest market share and dictate industry trends.

- Alibaba Cloud

- Amazon Web Services, Inc.

- CloudHesive

- Coastal Cloud

- DigitalOcean

- GroundCloud

- IBM

- Microsoft Azure

- Oracle Cloud

- Rackspace Technology, Inc.

- Salesforce, Inc.

- Tencent

- The Descartes Systems Group Inc.

- VMware LLC

Cloud Computing Report Scope

Report Attribute

Details

Market size in 2026

USD 1,188.10 billion

Revenue forecast in 2033

USD 3,349.61 billion

Growth rate

CAGR of 16.0% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service, workload, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Alibaba Cloud; Amazon Web Services, Inc.; CloudHesive; Coastal Cloud; DigitalOcean; Google; GroundCloud; IBM; Microsoft Azure; Oracle Cloud; Rackspace Technology, Inc.; Salesforce, Inc.; Tencent; The Descartes Systems Group Inc.; VMware LLC

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud Computing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cloud computing market report based on service, workload, deployment, enterprise size, end use, and region:

-

Service Outlook (Revenue, USD Billion, 2021 - 2033)

-

Infrastructure as a Service (IaaS)

-

Platform as a Service (PaaS)

-

Software as a Service (SaaS)

-

-

Workload Outlook (Revenue, USD Billion, 2021 - 2033)

-

Application Development & Testing

-

Data Storage & Backup

-

Resource Management

-

Orchestration Services

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Public

-

Private

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Small & Medium Enterprises

-

Large Enterprise

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

IT & Telecom

-

Retail & Consumer Goods

-

Manufacturing

-

Energy & Utilities

-

Healthcare

-

Media & Entertainment

-

Government & Public Sector

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud computing market size was estimated at USD 943.65 billion in 2025 and is expected to reach USD 1,188.10 billion in 2026.

b. The global cloud computing market is expected to witness a compound annual growth rate of 16.0% from 2025 to 2033 to reach USD 3,349.61 billion by 2033.

b. North America dominated the global market with the largest revenue share of 38.6% in 2025, driven by high adoption of AI and machine learning workloads among enterprises, supported by large-scale hyperscaler investments in advanced data centers.

b. Alibaba Cloud, Amazon Web Services, Inc., CloudHesive, Coastal Cloud, DigitalOcean, Google, GroundCloud, IBM, Microsoft Azure, Oracle Cloud, Rackspace Technology, Inc., Salesforce, Inc., Tencent, The Descartes Systems Group Inc., VMware LLC, are some of the prominent players present in the cloud computing market.

b. The global cloud computing market report scope covers segmentation by service, workload, deployment, enterprise size, end use, and region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.