Cloud-based Data Management Services Market Size, Share & Trends Analysis Report By Function (Data Analytics, Database Management), By Deployment (Public, Private), By Enterprise Size, By End-use (IT & Telecom), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-530-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

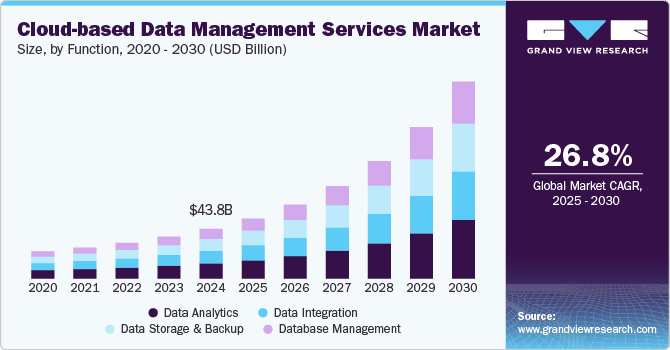

The global cloud-based data management services market size was estimated at USD 43.83 billion in 2024 and is anticipated to grow at a CAGR of 26.8% from 2025 to 2030. The growth of the market is driven by the increasing volume of data generated across industries, promoting businesses to adopt scalable and efficient data storage, processing, and security function. As organizations shift from traditional on-premises infrastructure to cloud environments, the demand for data management services that ensure seamless data integration, governance, and analytics continues to rise. Companies are leveraging cloud function to enhance operational efficiency, reduce IT costs, and support data-driven decision-making, further fueling market expansion.

The increasing adoption of cloud computing services across industries is a major factor driving the expansion of the cloud-based data management services industry. Organizations are rapidly shifting from traditional on-premises infrastructure to cloud-based function to improve scalability, flexibility, and cost efficiency. Cloud platforms enable businesses to store, manage, and process vast amounts of structured and unstructured data without requiring extensive in-house IT infrastructure. As enterprises undergo digital transformation, cloud adoption has become a strategic priority, accelerating the demand for data management services that facilitate seamless data integration, security, and real-time access.

One of the primary reasons behind this shift is the cost-effectiveness and operational efficiency offered by cloud services. Companies can significantly reduce capital expenditure (CapEx) by eliminating the need for physical servers and hardware while benefiting from a pay-as-you-go pricing model. Cloud-based data management function also enable businesses to scale storage and computing resources based on demand, allowing for more agile data operations. This cost optimization has encouraged enterprises of all sizes, including startups and SMEs, to transition to cloud-based data ecosystems, further fueling market growth.

In addition, the growing reliance on cloud-native applications, artificial intelligence (AI), and big data analytics has further augmented the demand for cloud-based data management services. As businesses generate vast volumes of data, they require cloud-driven function to efficiently process and analyze real-time information for better decision-making. According to Broadcom's The State of Cloud Native Application Platforms 2024 report, most organizations utilize more than one cloud-native application platform. Nearly 72% manage multiple platforms to accommodate different application types and deployment approaches, while around 46% operate three or more such platforms.

Function Insights

The data analytics segment dominated the market and accounted for the revenue share of over 30.0% in 2024 due to the increasing reliance on data-driven decision-making across industries. Organizations are leveraging cloud-based analytics function to extract valuable insights from vast amounts of structured and unstructured data, enabling them to improve operational efficiency, enhance customer experiences, and drive business growth. As competition intensifies, enterprises are prioritizing real-time data analytics to gain a competitive edge, fueling demand for cloud-based data analytics tools and platforms.

The database management segment is expected to grow at a significant CAGR of 28.0% over the forecast period due to the increasing need for scalable, secure, and efficient data storage and retrieval function. As organizations generate and process vast amounts of structured and unstructured data, they are shifting towards cloud-based database management systems (DBMS) that offer high availability, automation, and real-time access to data. This shift is driven by the need to manage complex data ecosystems while reducing operational costs and IT infrastructure burdens.

Deployment Insights

The public segment accounted for the largest revenue share of nearly 52.0% in 2024. The data-as-a-service (DaaS) model is gaining traction, as businesses seek flexible, on-demand access to data management capabilities without maintaining complex infrastructure. Public cloud environments offer the ideal platform for DaaS, enabling companies to store, process, and analyze data efficiently while benefiting from pay-as-you-go pricing models. As organizations increasingly rely on real-time data analytics, cloud providers offering public deployment options are seeing increased demand from enterprises looking to optimize data accessibility and insights.

The private segment is expected to grow at a significant CAGR over the forecast period. The rise of edge computing and IoT-driven data processing is accelerating the demand for private cloud deployment. Industries such as manufacturing, automotive, and telecommunications are increasingly relying on private cloud-based edge infrastructure to process data closer to the source, reducing latency and improving real-time analytics. By integrating private cloud with edge computing, organizations can store, analyze, and secure vast amounts of IoT-generated data while maintaining low-latency connections and ensuring high data privacy.

Enterprise Size Insights

The large enterprises segment accounted for a largest revenue share of over 67.0% in 2024 due to the exponential growth of data volumes generated by large organizations across industries such as banking, healthcare, retail, manufacturing, and telecommunications. As enterprises continue to expand their digital operations, they require scalable, high-performance cloud-based data management function to handle structured and unstructured data efficiently. Cloud-based data management enables them to store, process, and analyze massive datasets without the limitations of on-premise infrastructure, ensuring agility and seamless operations.

The SMEs segment is expected to grow at a significant CAGR over the forecast period. Multi-cloud and hybrid cloud adoption is becoming increasingly popular among SMEs seeking to balance cost, security, and flexibility. Many small and mid-sized businesses prefer private cloud function for sensitive data and public cloud services for scalability, creating a hybrid environment that supports their evolving business needs. Cloud-based data management platforms facilitate seamless integration across multiple cloud environments, allowing SMEs to maximize operational efficiency while maintaining data security and compliance.

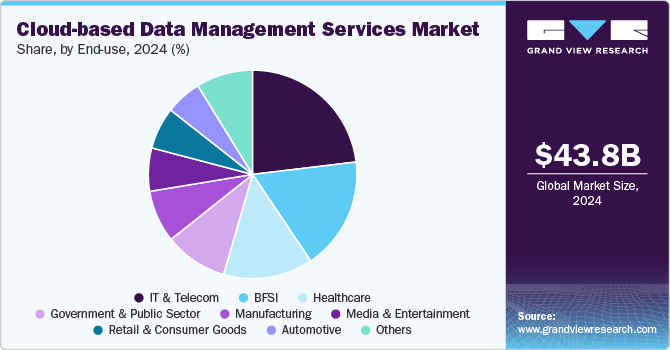

End-use Insights

The IT & telecom segment accounted for a largest revenue share of over 23.0% in 2024. With the expansion of 5G networks, IoT devices, and cloud-native applications, telecom providers and IT companies require high-speed, low-latency, and scalable storage function to handle the growing data volume. Cloud-based platforms allow them to dynamically scale storage capacity based on demand, ensuring efficient resource utilization and cost optimization.

The healthcare segment is expected to grow at a significant CAGR over the forecast period due to the widespread implementation of electronic health records (EHRs). Healthcare providers need centralized, real-time access to patient data to ensure seamless collaboration among doctors, specialists, and healthcare institutions. Cloud-based EHR function offer scalability, interoperability, and enhanced accessibility, enabling healthcare professionals to retrieve and update patient information securely from any location. The rise of telemedicine and digital health platforms has further increased the need for cloud-based data management, allowing remote patient monitoring and virtual consultations to be conducted efficiently.

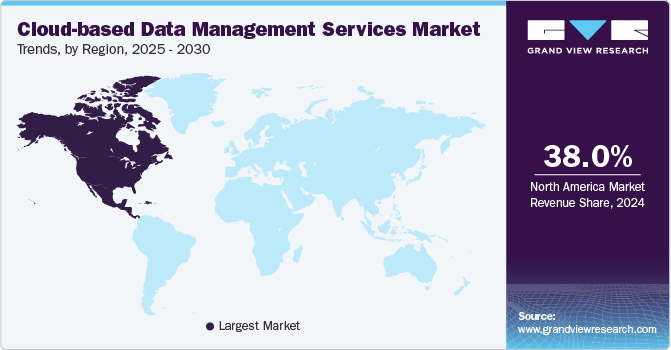

Regional Insights

The cloud-based data management services market in North America held the largest share of nearly 38.0% in 2024. With the increasing risk of cyberattacks, ransomware threats, and natural disasters, businesses are investing in cloud-based disaster recovery and backup function. Cloud platforms offer automated backup systems, geo-redundant storage, and AI-driven anomaly detection, ensuring business continuity and minimal downtime in case of disruptions. Many enterprises are shifting away from traditional on-premises disaster recovery function in favor of cost-effective, cloud-native alternatives.

U.S. Cloud-based Data Management Services Market Trends

The cloud-based data management services market in the U.S. is expected to grow significantly at a CAGR of 24.2% from 2025 to 2030 owing to the regulatory compliance and data security requirements. The U.S. has some of the strictest data protection regulations, including the California Consumer Privacy Act (CCPA), the Health Insurance Portability and Accountability Act (HIPAA), and the Sarbanes-Oxley Act (SOX). These regulations require businesses to enforce robust data governance, encryption, and real-time monitoring to prevent breaches and unauthorized access. Cloud providers are addressing these needs by offering zero-trust security models, AI-driven compliance tools, and blockchain-based data integrity function to help enterprises meet regulatory requirements while ensuring data protection.

Europe Cloud-based Data Management Services Market Trends

The cloud-based data management services industry in Europe is anticipated to register a considerable growth from 2025 to 2030. The healthcare and BFSI sectors are among the most prominent adopters of cloud-based data management function in Europe. Healthcare providers are utilizing cloud platforms for Electronic Health Records (EHRs), AI-driven diagnostics, and telemedicine function, ensuring secure patient data management while complying with GDPR and HIPAA-like regulations. In June 2023, Oracle launched its EU Sovereign Cloud, enabling organizations to meet EU data privacy and regulatory requirements while accessing full Oracle Cloud Infrastructure (OCI) services. Operated entirely within the EU by EU-based personnel and legal entities, it offers the same pricing, support, and SLAs as OCI’s public cloud. Part of OCI’s distributed cloud strategy, it provides a secure, compliant solution for data sovereignty needs.

The UK cloud-based data management services market is expected to grow rapidly in the coming years. Investment in cloud-based data lakes and warehousing functions is rising in the UK Businesses are deploying platforms like Snowflake, Google BigQuery, and Microsoft Azure Synapse Analytics to store and analyze large-scale datasets efficiently. These functions are helping companies improve data-driven decision-making, business intelligence, and AI-powered automation.

The Germany cloud-based data management services market held a substantial market share in 2024. Germany’s focus on smart manufacturing, Industry 4.0, and IoT-enabled infrastructure is driving demand for edge computing and cloud-based data management. With the expansion of 5G networks and IoT adoption, businesses are integrating cloud and edge computing to process data closer to the source, reducing latency and enhancing real-time decision-making. This is particularly crucial in industries such as automotive, logistics, and energy, where real-time analytics can significantly improve efficiency and performance.

Asia Pacific Cloud-based Data Management Services Industry Trends

Asia Pacific is growing significantly at a CAGR of 29.9% from 2025 to 2030. The Asia Pacific (APAC) cloud-based data management services market is witnessing rapid growth, fueled by digital transformation, increasing cloud adoption, regulatory shifts, and advancements in AI-driven data analytics. The region’s diverse economies, including China, India, Japan, South Korea, Australia, and Southeast Asian nations, are experiencing a surge in cloud investments across industries such as BFSI, healthcare, IT & telecom, manufacturing, and retail. As enterprises accelerate their cloud migration strategies, the demand for scalable, secure, and AI-powered data management functions are increasing significantly.

The Japan cloud-based data management services market is expected to grow rapidly in the coming years. Japan’s leadership in smart cities, 5G, and IoT is fueling demand for cloud-based data management integrated with edge computing. Enterprises in automotive, telecom, and logistics are leveraging real-time cloud analytics and IoT-generated data to optimize fleet management, predictive maintenance, and connected infrastructure.

The China cloud-based data management services market held a substantial market share in 2024. China’s digital economy is evolving at a fast pace, with enterprises, government agencies, and SMEs embracing cloud technologies to improve efficiency and scalability. The push for "New Infrastructure" development, which includes 5G, AI, data centers, and industrial IoT (IIoT), is accelerating cloud adoption across industries.

Key Cloud-based Data Management Services Company Insights

Key players operating in the cloud-based data management services industry are IBM Corporation, Oracle, Snowflake, Informatica, and Alibaba Cloud. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In September 2024, Oracle announced the introduction of Intelligent Data Lake and generative AI-powered analytics for its Data Intelligence Platform, enhancing how organizations integrate and analyze data from multiple sources. Built on Oracle Cloud Infrastructure (OCI), the platform unifies data orchestration, warehousing, analytics, and AI to streamline data management. The upcoming Intelligent Data Lake will further strengthen Oracle’s Data Intelligence capabilities by integrating with Oracle Autonomous Data Warehouse, Oracle Analytics Cloud, HeatWave, AI services, and third-party function. Designed to meet diverse data needs, Intelligent Data Lake is set to become available in a limited release in 2025.

-

In May 2024, Informatica introduced new innovations aimed at expanding the use of generative AI (GenAI) across businesses while ensuring secure, real-time data access. The enhancements include CLAIRE GPT, designed to embed GenAI into all aspects of data management, and tools that enable users to build and deploy GenAI applications on a trusted data foundation. Recognizing that the success of GenAI depends on effective data management, Informatica’s integrated function focus on delivering high-quality, ready-to-use data to enhance automation, personalization, and decision-making.

-

In February 2024, Veeam launched Veeam Data Cloud, a comprehensive solution for cloud backup, storage, and ransomware recovery designed to enhance data resilience for Microsoft Azure and Microsoft 365 users. Built on Azure, this managed Data Cloud service integrates advanced data protection and security technology within a streamlined user experience. The offering leverages Cirrus Backup-as-a-Service (BaaS) software, acquired by Veeam, to provide comprehensive protection for Microsoft services, reinforcing its commitment to secure and efficient cloud-based data management.

Key Cloud-based Data Management Services Companies:

The following are the leading companies in the cloud-based data management services market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Alibaba Cloud

- Cisco Systems Inc

- Dell Technologises

- Experian

- Fujitsu

- Hewlett Packard Enterprise Development LP

- IBM

- Informatica

- Oracle Corporation

- SAP SE

- Snowflake

- Teradata

- TIBCO Software

Cloud-based Data Management Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 52.99 billion |

|

Revenue forecast in 2030 |

USD 173.63 billion |

|

Growth rate |

CAGR of 26.8% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Base year for estimation |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report services |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Function, Deployment, Enterprise Size, End-use, Region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

Accenture; Alibaba Cloud; Cisco Systems Inc; Dell Technologies; Experian; Fujitsu; Hewlett Packard Enterprise Development LP; IBM Corporation; Informatica; Oracle; SAP SE; Snowflake; Teradata; TIBCO Software |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cloud-based Data Management Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cloud-based data management services market report based on function, deployment, enterprise size, end-use, and region:

-

Function Outlook (Revenue, USD Billion; 2018 - 2030)

-

Data Analytics

-

Data Storage & Backup

-

Database Management

-

Data Integration

-

-

Deployment Outlook (Revenue, USD Billion; 2018 - 2030)

-

Public

-

Private

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Billion; 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

End-use Outlook (Revenue, USD Billion; 2018 - 2030)

-

IT & Telecom

-

BFSI

-

Healthcare

-

Government & Public Sector

-

Manufacturing

-

Automotive

-

Retail & Consumer Goods

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud-based data management services market size was estimated at USD 43.83 billion in 2024 and is expected to reach USD 52.99 billion by 2025.

b. The global cloud-based data management services market is expected to grow at a compound annual growth rate of 26.8% from 2025 to 2030 to reach USD 173.63 billion by 2030.

b. The data analytics segment dominated the market and accounted for the revenue share of over 35.0% in 2024 due to the increasing reliance on data-driven decision-making across industries. Organizations are leveraging cloud-based analytics function to extract valuable insights from vast amounts of structured and unstructured data, enabling them to improve operational efficiency, enhance customer experiences, and drive business growth.

b. Some key players operating in the cloud-based data management services market include Accenture, Alibaba Cloud, Cisco Systems Inc, Dell Technologies, Experian, Fujitsu, Hewlett Packard Enterprise Development LP, IBM Corporation, Informatica, Oracle, SAP SE, Snowflake, Teradata, and TIBCO Software

b. The growth of the market is driven by the increasing volume of data generated across industries, promoting businesses to adopt scalable and efficient data storage, processing, and security function.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."