Cloud Backup Market Size, Share, & Trends Analysis Report By Component (Solutions, Services), By Solution, By Deployment, By Enterprise Size, By Service Providers, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-389-8

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Cloud Backup Market Size & Trends

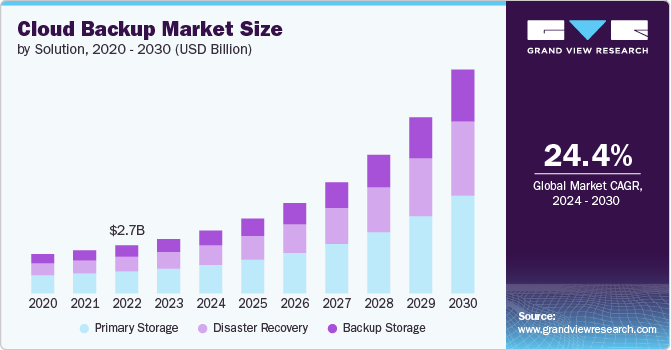

The global cloud backup market size was estimated at USD 4.69 billion in 2023 and is expected to grow at a CAGR of 24.4% from 2024 to 2030. The increasing volume of data generated by businesses across various sectors is among the key factors driving the demand for cloud backup. As organizations accumulate larger datasets, the need for reliable and scalable backup solutions has become critical to ensure data protection and continuity in operations. Cloud backup offers advantages such as flexibility, scalability, and cost-effectiveness compared to traditional on-premises backup solutions, further fueling its adoption.

Rising awareness among enterprises about the importance of disaster recovery and business continuity planning is also accelerating the demand for cloud backup solutions and services. With businesses becoming more reliant on digital data and applications, the ability to recover quickly from disruptions or data loss events is paramount. Cloud backup solutions provide automated backup processes, data redundancy across multiple servers, and rapid recovery options, thereby enhancing resilience and minimizing downtime.

The increasing adoption of hybrid cloud strategies among enterprises is creating a favorable environment for the growth of cloud backup market. Hybrid cloud backup solutions combine the advantages of both public and private clouds, offering greater flexibility in data storage and management while ensuring compliance with regulatory requirements. This hybrid approach allows organizations to optimize costs and performance based on their specific needs and data sensitivity levels.

Further, the proliferation of Internet of Things (IoT) devices and edge computing technologies has opened new avenues for cloud backup providers. These technologies generate vast amounts of data at the edge of networks, necessitating efficient and secure backup solutions. Cloud-based backup services can seamlessly integrate with IoT platforms, enabling real-time data replication and backup from distributed devices to centralized cloud repositories.

Component Insights

The solution segment accounted for the largest market share of over 64% in 2023. The demand for cloud backup solutions is rising due to the digital transformation initiatives undertaken by businesses with the aim to enhance operational efficiency and reduce costs. Companies are increasingly moving their data to the cloud, seeking robust, scalable, and secure backup solutions to protect against data loss and cyber threats. The flexibility and accessibility offered by cloud backup solutions, coupled with advanced features such as automation, encryption, and easy data recovery, are compelling businesses to invest in these technologies. Additionally, the growing volume of data generated by enterprises and the need for real-time data availability further fuel the demand for comprehensive cloud backup solutions.

The service segment is expected to grow at a significant rate during the forecast period. Key drivers for this demand include the increasing complexity of IT environments, the rising need for consulting support, and the growing requirements for training and development within organizations to manage their cloud environments. These factors are boosting the demand for cloud backup services, encompassing both managed services and professional support. Businesses are turning to service providers to handle their backup needs, ensuring data integrity, availability, and security without burdening their internal IT teams. These services include regular monitoring, updates, and maintenance, which are crucial for optimal performance and compliance with industry standards.

Solution Insights

The primary storage segment accounted for the largest market share of over 45% in 2023. With the exponential rise in data from various sources such as IoT devices, social media, and enterprise applications, businesses are seeking solutions that ensure scalability and efficiency for data storage. Cloud-based primary storage offers the flexibility to handle large datasets, providing seamless access and robust security measures. Additionally, the integration of advanced technologies such as AI and machine learning into cloud storage platforms enhances data management capabilities, enabling businesses to leverage their data for insights and decision-making.

The disaster recovery segment is expected to grow at a significant rate during the forecast period. The disaster recovery segment is witnessing robust growth due to the increasing awareness of the potential financial and reputational damage caused by data loss and downtime. Businesses are increasingly prioritizing disaster recovery solutions to ensure business continuity in the event of cyber-attacks, natural disasters, or system failures. Further, the rise in cyber threats, particularly ransomware attacks, has underscored the importance of having a reliable disaster recovery plan, driving more organizations to adopt cloud disaster recovery solutions that offer automated failover and rapid data restoration capabilities.

Deployment Insights

The public cloud segment accounted for the largest market share of over 55% in 2023. The growth of the public cloud segment in the market is driven by the increasing adoption of cost-effective and scalable storage solutions. Businesses including small and medium organizations are leveraging public cloud services to minimize upfront capital expenditure on IT infrastructure. This segment benefits from economies of scale offered by major cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform, which enable them to offer competitive pricing. Additionally, the growing trend of digital transformation across industries is compelling organizations to migrate their data to the public cloud to enhance agility and accessibility.

The hybrid cloud segment is expected to grow at a significant rate during the forecast period. The hybrid cloud deployment is gaining traction as businesses seek to optimize their IT strategies by combining the best features of both public and private clouds. This approach allows organizations to maintain control over critical data and applications on private clouds while leveraging the scalability and cost benefits of public clouds for less sensitive operations. The hybrid cloud model offers flexibility, enabling businesses to dynamically allocate resources based on current needs and workloads.The hybrid cloud deployments are suitable for industries with fluctuating demand patterns, such as retail and manufacturing. Thus, these are the key factors driving the growth of the segment.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share of over 70% in 2023. The growing complexity and large volume of data generated from various sources, including IoT devices, social media, and enterprise applications, elevates the demand for efficient backup solutions among large enterprises that can handle massive data volumes. Further, the need for compliance with stringent data protection regulations among large IT, BFSI, and healthcare enterprises is another critical factor driving the demand for cloud backup solutions among these businesses.

The SMEs segment is expected to grow at a significant rate over the forecast period. The rising awareness among small and medium-sized enterprises about the catastrophic impact of data loss, causing operational downtime and financial penalties, prompting a surge in the demand for reliable cloud backup solutions. The affordability and scalability of cloud-based services are particularly attractive to SMEs, which often operate on tight budgets and require flexible solutions that can grow with their business needs.

Service Provider Insights

The cloud service provider segment accounted for the largest market share of over 40% in 2023. The cloud service provider segment growth is driven by the increasing adoption of multi-cloud strategies among enterprises. Organizations are seeking to leverage the best features of multiple CSPs to optimize performance, reduce costs, and enhance security.

The managed service provider segment is expected to grow at a significant rate over the forecast period. The managed service provider is gaining traction due to the increasing complexity of IT environments and the shortage of skilled IT professionals. Businesses are turning to the managed service provider to manage their cloud backup solutions to reduce the burden on internal IT teams and ensure reliable data protection and recovery processes.

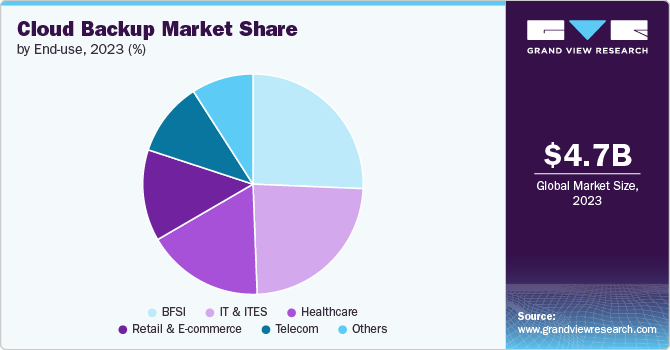

End-use Insights

The BFSI segment accounted for the largest market share of over 25% in 2023. The demand for cloud backup in the BFSI sector is driven by the sector's need for robust data security and compliance. Financial institutions are mandated to adhere to stringent regulatory requirements, necessitating secure and reliable data storage solutions. Cloud backup services offer advanced encryption, multi-factor authentication, and seamless integration with existing compliance frameworks, making them an attractive choice for BFSI companies.

The IT & ITES segment is expected to grow at a significant rate during the forecast period. Companies in the IT & ITES sector are increasingly dealing with large volumes of data generated from various sources, including software development, customer interactions, and business operations. Cloud backup solutions offer the scalability and flexibility required to manage this data efficiently, allowing these companies to store, access, and analyze data in real-time. This capability is crucial for businesses looking to maintain a competitive edge through data-driven decision-making and innovation.

Regional Insights

The cloud backup market in North America held a market share of over 36% in 2023. In North America, the market is witnessing robust growth due to the region's strong technological infrastructure and high adoption rates of cloud solutions among enterprises and individual consumers. Further, the proliferation of data-intensive industries, such as finance, healthcare, and technology, drives demand for secure and scalable backup solutions in the region.

U.S. Cloud Backup Market Trends

The U.S. cloud backup market is growing significantly at a CAGR of 20.7% from 2024 to 2030. The U.S. remains a dominant player in the cloud backup market, largely due to its technological leadership and the presence of major cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. The surge in remote work and digital collaboration has heightened the need for robust cloud backup solutions to ensure data continuity and security.

Asia Pacific Cloud Backup Market Trends

The cloud backup market in Asia Pacific is growing significantly at a CAGR of 27.7% from 2024 to 2030. The Asia Pacific region is experiencing rapid growth in the cloud backup market, driven by the accelerated digitalization of emerging economies and the expansion of cloud infrastructure. The region's vast and diverse market presents opportunities for cloud backup providers to cater to various industry needs, from small and medium-sized enterprises (SMEs) to large corporations.

Europe Cloud Backup Market Trends

Europe cloud backup market is growing significantly at a CAGR of 24.0% from 2024 to 2030. In Europe, the market is propelled by stringent data protection regulations such as the General Data Protection Regulation (GDPR), which mandate rigorous data management and security practices. Further, the increasing adoption of digital transformation strategies among European enterprises is also driving the market growth, as organizations seek to modernize their IT infrastructure and enhance data security.

Key Cloud Backup Company Insights

Some of the key players operating in the market include Acronis International GmbH.; Amazon Web Services Inc.; Asigra Inc.; Backblaze; Datto Inc.; Dropbox Inc.; IDrive Inc.; IBM Corporation; Microsoft Corporation; Open Text Corporation among others. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2024, OpenText Cybersecurity has announced the launch of its new Carbonite Cloud-to-Cloud Backup service in India, aimed at helping organizations safeguard their business-critical data stored on third-party SaaS applications. This service supports a wide range of platforms including Microsoft 365, Salesforce, Google Workspace, Dropbox, and Box.

-

In June 2024, Backblaze partnered with Coalition to offer enhanced cyber risk management through the Coalition Control platform. This collaboration provides businesses with direct access to Backblaze’s enterprise-grade, unlimited, automatic cloud backup solution, addressing critical gaps in cybersecurity and supporting cyber insurance eligibility amid rising ransomware threats.

-

In June 2023, Impossible Cloud launched its Partner Program, enabling seamless integration of its decentralized cloud platform with innovative backup solutions from Comet Backup and Acronis. This program supports VARs, SIs, MSPs, and ISVs in offering innovative, secure, and cost-effective cloud backup services. Leveraging web3 benefits, the program ensures business continuity with scalable, consumption-based storage infrastructure, enhancing efficiency and security over traditional cloud providers.

Key Cloud Backup Companies:

The following are the leading companies in the cloud backup market. These companies collectively hold the largest market share and dictate industry trends.

- Acronis International GmbH.

- Amazon Web Services Inc.

- Asigra Inc.

- Backblaze

- Datto Inc.

- Dropbox Inc.

- IDrive Inc.

- IBM Corporation

- Microsoft Corporation

- Open Text Corporation

Cloud Backup Market Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.49 billion |

|

Revenue forecast in 2030 |

USD 20.34 billion |

|

Growth rate |

CAGR of 24.4% from 2024 to 2030 |

|

Base year |

2023 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, solutions, deployment, enterprise size, service providers, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa. |

|

Key companies profiled |

Acronis International GmbH.; Amazon Web Services Inc.; Asigra Inc.; Backblaze; Datto Inc.; Dropbox Inc.; IDrive Inc.; IBM Corporation; Microsoft Corporation; Open Text Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cloud Backup Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global cloud backup market report based on component, solutions, deployment, enterprise size, service providers, end use, and region:

-

Component Outlook (Revenue; USD Billion; 2018 - 2030)

-

Solutions

-

Services

-

-

Solution Outlook (Revenue; USD Billion; 2018 - 2030)

-

Primary Storage

-

Disaster Recovery

-

Backup Storage

-

-

Deployment Outlook (Revenue; USD Billion; 2018 - 2030)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Enterprise Size Outlook (Revenue; USD Billion; 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Service Providers Outlook (Revenue; USD Billion; 2018 - 2030)

-

Cloud Service Provider

-

Telecom and Communication Service Provider

-

Managed Service Provider

-

Others

-

-

End-use Outlook (Revenue; USD Billion; 2018 - 2030)

-

BFSI

-

Healthcare

-

Retail & E-commerce

-

Telecom

-

IT & ITES

-

Others

-

-

Regional Outlook (Revenue: USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud backup market size was estimated at USD 4.69 billion in 2023 and is expected to reach USD 5.49 billion in 2024.

b. The global cloud backup market is expected to grow at a compound annual growth rate of 24.4% from 2024 to 2030 to reach USD 20.34 billion by 2030.

b. The solution segment accounted for the largest market share of over 64% in 2023. The demand for cloud backup solutions is rising due to the digital transformation initiatives undertaken by businesses with the aim to enhance operational efficiency and reduce costs.

b. Some key players operating in the cloud backup market include Acronis International GmbH.; Amazon Web Services Inc.; Asigra Inc.; Backblaze; Datto Inc.; Dropbox Inc.; IDrive Inc.; IBM Corporation; Microsoft Corporation; Open Text Corporation among others.

b. The increasing volume of data generated by businesses across various sectors is among the key factors driving the demand for cloud backup. As organizations accumulate larger datasets, the need for reliable and scalable backup solutions has become critical to ensure data protection and continuity in operations.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."