Cloud Analytics Market Size, Share & Trends Analysis Report By Component (Solutions, Service), By Deployment, By Organization Size, By Application, By Industry Vertical (BFSI, IT & Telecommunication), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-980-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Cloud Analytics Market Size & Trends

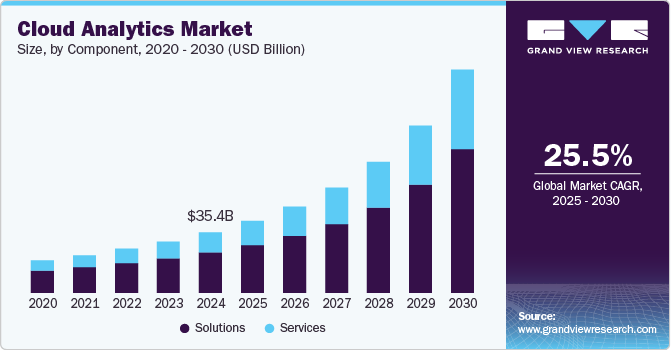

The global cloud analytics market size was estimated at USD 35.39 billion in 2024 and is projected to grow at a CAGR of 25.5% from 2025 to 2030. The cloud analytics industry is witnessing rapid growth due to the increasing complexity and volume of data, rising adoption of digital platforms, and demand for real-time data connectivity. Key trends include the proliferation of IoT devices, advancements in AI and cloud technologies, and the growing need for data visualization tools. Organizations are increasingly adopting cloud analytics to process data in real-time, reduce upfront investments in hardware and software, and analyze customer behavior to enhance products and services.

The growing adoption of cloud analytics for applications like personalized treatment plans, remote patient monitoring, clinical trial optimization, fraud detection, risk assessment, customer segmentation, and supply chain optimization drives market growth. Trends also include its increasing use in predictive maintenance, real-time network monitoring, and network optimization across industries.

The rising demand for self-service analytics is a significant trend in the cloud analytics industry. These tools, such as Tableau Online and Power BI, empower non-technical users like marketers, sales professionals, and business managers to access and analyze data independently, reducing reliance on IT departments. This shift eliminates bottlenecks, accelerates decision-making, and ensures immediate access to up-to-date data. Users can create and customize dashboards to monitor key metrics like sales performance, financial data, and customer insights, enhancing operational efficiency. Growing adoption of self-service analytics drives the demand for cloud analytics, fueling market growth.

Furthermore, the growing demand for data visualization is a major trend driving the cloud analytics industry. Tools like Tableau, Power BI, and Looker enable users to interact with data, uncover deeper insights, and collaborate through shared dashboards for collective decision-making. Pay-as-you-go models make these tools accessible to businesses of all sizes, allowing scalable adoption without hefty upfront investments, further boosting market growth.

The rising adoption of hybrid and multi-cloud architectures is a key trend driving the cloud analytics industry. These environments allow organizations to store and process data across private clouds, public clouds, and on-premise systems, offering flexibility and scalability. Multi-cloud setups enable secure local storage for sensitive data while utilizing public clouds for large-scale analytics. Businesses increasingly choose specialized tools like Google Cloud BigQuery, AWS Redshift, and Azure Synapse Analytics to meet diverse needs. The growing preference for hybrid and multi-cloud solutions, coupled with their expanding product portfolios and benefits, accelerates the adoption of cloud analytics solutions and services, fueling market growth.

Cloud analytics is revolutionizing industries by delivering advanced data insights, improving efficiency, and enabling real-time decision-making. It analyzes electronic health records (EHR) to enhance care delivery and predict outcomes. Retailers use it to track consumer behavior and personalize marketing across touchpoints, while banks and insurers leverage it to understand customer preferences and tailor services. This growing demand for industry-specific cloud analytics applications drives their adoption and market significance.

Component Insights

The solutions segment accounted for the largest market share in 2024, primarily due to the rising demand for cloud analytics solutions, increasing focus on technological advancements for cloud analytics solutions, and growing demand for business intelligence (BI) tools, enterprise information management solutions, governance, risk and compliance solutions, enterprise performance management solutions, and a variety of analytics tools. Furthermore, there is an increasing requirement for enterprise performance management solutions that enable organizations to gain insights, enhance agility, and plan effectively across HR, finance, sales, and supply chain functions. These solutions also streamline financial techniques, resulting in better outcomes and improved decision-making. Moreover, simplified administration across various domains and enhanced user experience are expected to increase the adoption of enterprise performance management solutions.

Services is expected to witness the fastest CAGR from 2025 to 2030, driven by the growing need to analyze customer behavior, preferences, and sentiment to improve customer experience and loyalty, growing need to improve operational efficiency, reduce costs, and enhance supply chain management, and increasing need to monitor financial performance, identify fraud, and optimize risk management. The companies involved in providing cloud analytics services offer professional and managed services. The service providers offer services to analyze, manage, and organize data that provide insights to help clients make business decisions. The increasing preference from SMEs and large organizations to manage data and quality insights is expected to fuel market growth in the coming years.

Deployment Insights

The public cloud segment dominated the market in 2024, owing to the growing demand for cloud computing solutions to analyze data and provide business intelligence (BI) insights and the growing need for cloud solutions by multiple organizations to use the same resources and services, such as virtual machines, data storage, and data processing, without sharing data. Furthermore, the growing need for public cloud solutions by organizations to avoid large upfront investments in hardware and software is also supporting the growth of this segment.

The hybrid cloud segment is expected to witness the fastest CAGR from 2025 to 2030, driven by the growing need to reduce costs by optimizing spending and avoiding the need to purchase all data center equipment, increasing adoption of hybrid cloud analytics solutions to enhance data security through encryption, multi-factor authentication, and continuous monitoring, and increasing need to use both on-premises and cloud resources. The hybrid cloud provides services by combining private and public cloud deployment. Enterprises are adopting hybrid cloud infrastructure to meet short-term demand without investing in cloud infrastructure. The benefits, such as cost-efficiency, low-risk exposure, and scalability offered by the hybrid cloud, are expected to boost the demand for hybrid cloud platforms in the forecast period.

Application Insights

The sales and marketing segment dominated the market in 2024, owing to the growing adoption of cloud analytics solutions by businesses to analyze data, identify patterns, and make predictions, increasing popularity for CRM platforms that include powerful analytics tools to track sales pipelines, forecast revenue, analyze sales performance, and identify opportunities for improvement, rising need to provide AI-powered insights to optimize sales processes, predict deal outcomes, and improve sales productivity. The growth is also attributed to emerging trends such as text analytics, social analytics, and increased demand to gain insights into better business planning. There is also increasing demand for advanced analytics capabilities to track customer journeys, analyze website traffic, measure campaign effectiveness, and personalized marketing experiences.

Customer service is expected to witness notable growth from 2025 to 2030. This growth is driven by several factors, including a growing need for customer journey analytics solutions that specialize in product analytics, user engagement, and feedback collection, an increasing need to gauge customer satisfaction levels and identify recurring themes to inform service improvements, and an increasing adoption of cloud analytics solutions to gain real-time insights into customer sentiment, wait times, and agent performance to make immediate adjustments.

Industry Vertical Insights

BFSI dominated the market in 2024, owing to the growing demand for cloud analytics solutions by banks to analyze customer data to offer tailored financial products and services, such as personalized investment portfolios or customized loan offerings, increasing the need to gain real-time insights into customer behavior, preferences, and needs, and increasing need to predict potential failures and schedule maintenance proactively, minimizing downtime and reducing operational costs. Further, it helps banks comply with stringent regulations by automating compliance checks, generating reports, and analyzing data to identify potential compliance breaches.

The healthcare & life sciences segment is expected to witness notable growth from 2025 to 2030. This growth is driven by the growing adoption of cloud analytics solutions for tracking and analyzing patient outcomes to optimize treatment plans, the rising need to provide clinicians with immediate access to patient data, lab results, and clinical guidelines, and the rising demand for personalized medicine. Cloud analytics solutions help healthcare and life sciences to make essential decisions from collected healthcare data. It enables healthcare teams and management to instantly assess workforce, financial, and operational performance in any solution of a healthcare organization, including variances, trends, and future implications.

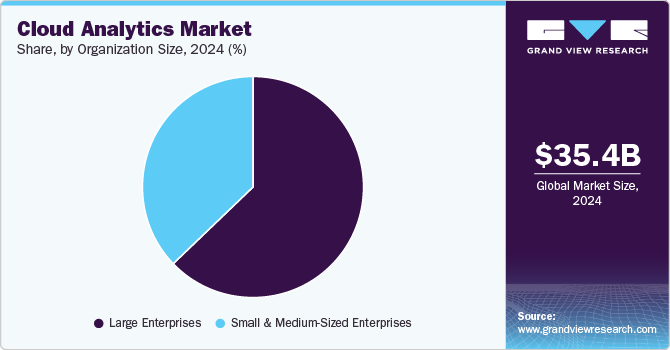

Organization Size Insights

The large enterprises segment accounted for the largest market share of over 63% in 2024, driven by the increasing adoption of cloud analytics solutions by large enterprises to collect, integrate, and analyze vast data, the growing need for highly customized cloud infrastructure for advanced data analytics and complex simulations, growing need for global collaborations, and rising demand for high levels of customization, security, and scalability.

SMEs is expected to witness the fastest CAGR of over 27% from 2025 to 2030, driven by the increasing adoption of cloud-analytics solutions by SMEs owing to the growing need to provide enhanced security and privacy, availability of a pay-as-you-go model instead of making a large upfront investment in infrastructure, an increasing need to provide scalable infrastructure for SMEs, and a rising need to automate processes, personalize customer experiences, and make better decisions. Moreover, cloud analytics solutions are reliable and increase teams' productivity by allowing them to access it anywhere. The minimized operational costs and increased workforce productivity due to cloud analytics solutions are expected to increase the demand for cloud analytics solutions in SMEs in the coming years.

Regional Insights

North America cloud analytics market dominated the market with a revenue share of over 38% in 2024, driven by strong investment in cloud computing infrastructure and a favorable regulatory environment, presence of well-established players, and rapidly growing end users for cloud analytics solutions & services. Prominent players in the region are increasingly adopting cloud-based analytics solutions to meet the demand for improved data quality, enhanced integration, and effective data visualization. In addition, the growing investments in cloud services by major players and the endorsement of Cross-Border Privacy Rules (CBPR) by the U.S. is anticipated to create significant growth opportunities for the market in the region. Furthermore, the shift towards subscription-based services, the rising use of smartphones, and technological advancements have contributed to the market's expansion.

U.S. Cloud Analytics Market Trends

The cloud analytics market in the U.S. held a dominant position in 2024. The growing culture of technological advancement fuels the market growth, as do the presence of well-established companies offering cloud analytics solutions, a skilled workforce with expertise in data science, analytics, and cloud technologies, the growing need for improved customer experiences and loyalty, and a growing shift toward subscription-based services.

Europe Cloud Analytics Market Trends

The cloud analytics market in Europe is expected to grow at a considerable CAGR of 25% from 2025 to 2030, driven by the rising need for data-driven decision-making in businesses, growing focus to adopt cloud-based analytics solutions to eliminate the need for significant upfront investments in hardware and software, availability of flexible pricing models, rising adoption of cloud analytics solutions by banks to improve risk management, fraud detection, customer segmentation, and personalized financial services. In Europe, manufacturing companies utilize cloud analytics to optimize production processes, reduce costs, and improve product quality. Further, different healthcare providers are leveraging cloud analytics to analyze patient data, optimize clinical workflows, and improve patient outcomes.

The UK cloud analytics market is expected to grow rapidly in the coming years. In the UK, cloud analytics demand is rising due to the increasing adoption of cloud analytics solutions by the BFSI sector for risk management, fraud detection, and customer segmentation, increasing need for cloud analytics to analyze patient data, optimize clinical workflows, and improve patient outcomes, retailers focus on cloud analytics to gain insights into customer behavior, optimize inventory management, and personalize marketing campaigns.

The cloud analytics market in Germany held a substantial market share in 2024, driven by growing demand for cloud analytics solutions owing to the growing need for cloud analytics solutions to optimize processes, reduce costs, and improve productivity, rising adoption of advanced analytics tools and technologies, and the increasing presence of cloud analytics industry across the country, growing adoption of cloud analytics solutions to optimize processes, reduce costs, and improve productivity. Manufacturing companies use cloud analytics to optimize supply chain management, predictive maintenance, and quality control. Furthermore, German automotive manufacturers leverage cloud analytics to optimize production processes, improve vehicle performance, and enhance customer experiences. Several healthcare providers are utilizing cloud analytics to analyze patient data, optimize clinical workflows, and improve patient outcomes.

Asia Pacific Cloud Analytics Market Trends

The cloud analytics market in Asia Pacific is expected to experience a CAGR of 27% in the coming years. Some significant factors, including a favorable regulatory landscape and a strong emphasis on digital transformation, drive this growth. The emergence of e-commerce giants and online marketplaces has heightened the demand for cloud analytics solutions to obtain data-driven insights. Furthermore, the increasing use of smartphones and mobile devices, a rising need for advanced analytics tools to derive valuable insights, and growing investments in cloud technologies are also contributing to this expansion.

Japan cloud analytics market is expected to grow rapidly in the coming years due to the increasing adoption of cloud analytics solutions to optimize operations, reduce costs, and improve productivity, growing need to ensure product quality and consistency through data-driven insights, favorable government initiatives to promote digitalization, and the adoption of cloud technologies; and increasing adoption of cloud analytics solutions by automotive manufacturers to optimize production processes, improve vehicle performance, and enhance customer experiences.

The cloud analytics market in China held a substantial market share in 2024. The growth is attributed to the government policies to encourage the adoption of cloud technologies, the emergence of new industries across the country, the thriving e-commerce industry, and the availability of a range of cloud analytics services tailored to the specific needs of Chinese businesses.

Key Cloud Analytics Company Insights

Some of the key players operating in the market include Microsoft Corporation and Amazon Web Services, Inc.

-

Microsoft Corporation is a provider of cloud analytics solutions and services. The company operates through three segments: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. Cloud analytics solutions & services are offered through the Intelligent Cloud segment. Intelligent Cloud segment includes private, public, and hybrid server products and cloud services. Server products and cloud services include Azure and other cloud services such as Windows Server, SQL Server, System Center, Visual Studio, and related Client Access Licenses, Nuance, and GitHub. The company provides a comprehensive suite of analytics tools, including Power BI, Azure Synapse Analytics, and Azure Data Lake Analytics. Microsoft's cloud analytics solutions integrate seamlessly with other Microsoft products and services, such as Microsoft 365, Dynamics 365, and Azure. This makes it easier for organizations to leverage their existing technology stack and data sources.

-

Amazon Web Services, Inc. is a provider of cloud analytics solutions and services. The company operates through three segments, such as North America, International, and Amazon Web Services (“AWS”). Cloud analytics solutions & services are offered through the Amazon Web Services segment. The company provides a range of cloud-based products and services, including analytics, storage, computing, and more. Its product portfolio includes Amazon Redshift, Amazon EMR, Amazon Athena, Amazon QuickSight, and Amazon SageMaker. The company offers flexible pricing options, including pay-as-you-go and reserved instances, allowing businesses to optimize their costs based on their specific needs.

GoodData Corporation, and Databricks, Inc. are some of the emerging market participants.

-

GoodData Corporation is a provider of cloud-based analytics solutions, empowering organizations to unlock the value of their data and drive data-driven decision-making. The company provides GoodData Platform, a foundational platform that provides tools and infrastructure for building and scaling custom data products. It includes features such as data integration, modeling, AI-assisted insights, and a powerful analytics engine. The company caters to a wide range of industries, including technology, financial services, healthcare, retail, and manufacturing. Further, it offers GoodData Cloud, a robust cloud-based analytics solution offering a range of data analysis, visualization, and reporting features.

-

Databricks Inc. is a provider of cloud analytics solutions & services. The company provides a cloud-based platform that enables enterprises to develop, scale, and manage data and AI. Its product portfolio includes Databricks Data Intelligence Platform, and AI/BI Dashboards. The company primarily operates on a subscription-based model, charging customers based on usage and features. The company provides a unified cloud-based platform for data engineering, data science, and machine learning.

Key Cloud Analytics Companies:

The following are the leading companies in the cloud analytics market. These companies collectively hold the largest market share and dictate industry trends.

- IBM Corporation

- Microsoft Corporation

- Amazon Web Services, Inc.

- Sisense Ltd.

- GoodData Corporation

- Tableau Software LLC (Salesforce, Inc.)

- Databricks, Inc.

- SAS Institute Inc.

- Oracle Corportion

- Google LLC

Recent Developments

-

In October 2024, Oracle Corporation launched Oracle Analytics Intelligence for Life Sciences, an AI-driven, cloud-based data and analytics platform designed to facilitate and speed up the process of generating insights. By consolidating various data sets into a cohesive, intelligent workspace, this solution enables users to tackle multidisciplinary research inquiries, derive insights, and include that information in their current Oracle Health and Life Sciences applications.

-

In June 2023, CloudZero Inc. announced the release of Analytics,a powerful business intelligence capability that automates the delivery of cloud cost intelligence.

Cloud Analytics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 42.00 billion |

|

Revenue forecast in 2030 |

USD 130.63 billion |

|

Growth rate |

CAGR of 25.5% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, organization size, deployment, application, industry vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

IBM Corporation; Microsoft Corporation; Amazon Web Services, Inc.; Sisense Ltd.; GoodData Corporation; Tableau Software, LLC (Salesforce, Inc.); Databricks, Inc.; SAS Institute Inc.; Oracle Corporation; Google LLC |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cloud Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cloud analytics market report based on component, organization size, deployment, application, industry vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solutions

-

Services

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium-Sized Enterprises

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sales and Marketing

-

Research & Development

-

Customer Service

-

Accounting & Finance

-

Human Resource

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT & Telecommunication

-

Manufacturing

-

Healthcare & life sciences

-

Government

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

UAE

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud analytics market size was estimated at USD 35.39 billion in 2024 and is expected to reach USD 42.00 billion in 2025.

b. The global cloud analytics market is expected to grow at a compound annual growth rate of 25.5% from 2025 to 2030 to reach USD 130.63 billion by 2030.

b. North America dominated the cloud analytics market with a share of over 38% in 2024. The shift of businesses towards digital platforms and the increasing demand for data connectivity through cloud environments are expected to fuel market growth over the forecast period.

b. Some key players operating in the cloud analytics market include International Business Machines Corporation; Microsoft; Amazon Web Services; Inc.; QlikTech International AB; Sisense Inc.; GoodData Corporation; Tableau Software, LLC; Databricks; SAS Institute Inc.; Oracle; Google LLC

b. Key factors that are driving the market growth include increasing data connectivity via the use of hybrid and multi-cloud environments, cost-effective solutions in cloud analytics, and rapid digitalization across the globe.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."