Clinical Trials Support Services Market Size, Share & Trends Analysis Report By Phases (Phase I, Phase II, Phase III, Phase IV), By Service, By Sponsor, By Region (North America, Europe, APAC), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-475-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

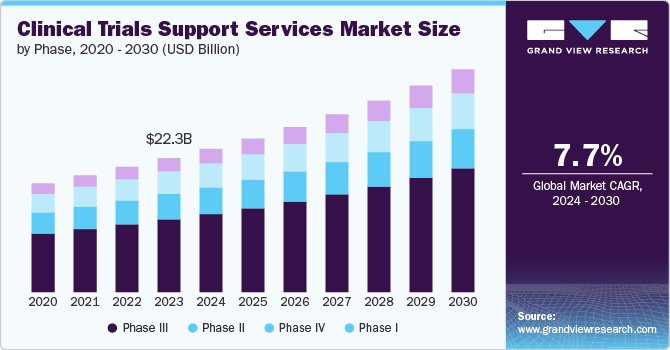

The global clinical trials support services market size was valued at USD 23.88 billion in 2024 and is projected to grow at a CAGR of 7.72% from 2025 to 2030. The global market is projected to expand rapidly due to the rising demand for trials in emerging economies, rising R&D investment, and an increasing number of contract research organizations (CROs). The pharmaceutical firms’ (R&D) venture has been steadily increasing every year, largely due to patent expirations. An ordinary patent terminates after 20 years; in the pharmaceutical area, there is an arrangement that provides for the entry of a generic version of the medication into the market following a time of 10 years. Thus, firms are boosting their R&D interests to speed the advancement of drugs, subsequently extending the whole market.

Clinical trials support services are quite useful in the event of a drug such as assay design, and clinical testing. It also covers tasks such as strengthening clinical test locations, securing and storing research medicines, drug dosage calculation, and kit handling. Preclinical groundwork and research are provided by clinical test support services, which include clinical test site assistance, obtaining & storing study drugs, blinding of drugs for studies, patient recruiting, coordination, and reconciliation of returned medications.

In addition, growing adoption of new technologies has fueled market growth. Many software tools for data management are referred to as “Clinical Data Management” (CDM) systems. Multicentric trials require CDM systems to handle massive volumes of data. The majority of CDM systems utilized by pharmaceutical companies are commercial, but there are a few free-source tools accessible as well. Oracle Clinical, Clintrial, Oracle Clinical, Macro, RAVE, and eClinical Suite are common CDM tools. Maintaining an audit record of data management actions is important in regulatory submission. These CDM tools help ensure the audit trail and manage discrepancies. The CDM activities include data collection, CRF annotation, CRF tracking, database design, data entry, medical coding, data validation, discrepancy management, and database lock.

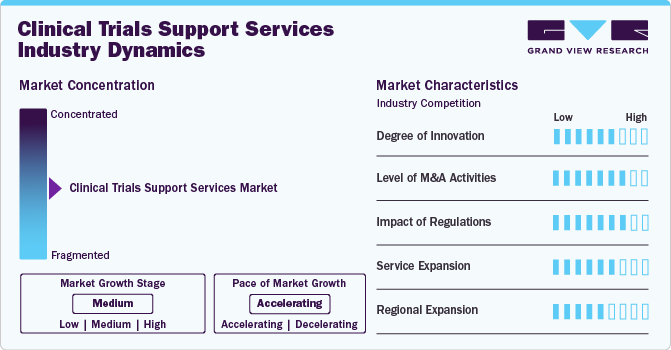

Market Characteristics

The clinical trials support services market growth stage is medium, and growth is accelerating. The market is characterized by the level of M&A activities, degree of innovation, regulatory impact, product expansions, and regional expansions.

Clinical trial support services have observed rising demand due to growing patient requirements and technological advancements in clinical trial security that have improved efficiency and accuracy in clinical trials.

Regulations are expected to be an advantage for clinical trial services that provide services of global standards. Regulatory bodies and other authorities ensure compliance with quality standards, which can positively influence the clinical trials support services market.

Increasing R&D activities regarding the safety and quality of pharmaceutical products and the rising number of drug launches can positively influence market dynamics.

Changing clinical trials dynamics across the globe, emerging markets, and shifts in research priorities have increased market demand. Rising expansions and product adoption can positively influence market dynamics.

The increase in R&D expenditure, the existence of technologically advanced service providers, and the rising requirement for new pollutants testing fuel the market growth.

Phases Insights

On the basis of phases segment, the market includes phase I, phase II, phase III & phase IV.In 2024, the phase III segment dominated the market, accounting for a revenue share of 54.43%. This growth can be attributed to the fact that phase III clinical trials are the most expensive ones and involve a significant number of subjects. The failure rate in this phase is the highest due to the sample size, and the study design requires complex dosing at an optimum level. The loss associated with failure is both human & financial, and the majority of the failures occur due to noncompliance with safety & efficacy standards.

The phase I segment is anticipated to register the fastest CAGR of 9.16% during the forecast period. Clinical trial support services for phase I include sample collection management, early phase patient screening, data management, and assay redesign & others. The U.S., Europe, and China, followed by Canada & Australia, are thus recognized as crucial centers for registering and conducting substantial phase-I clinical trials. As a result, there is a significant market for clinical trial management services in these countries.

Service Insights

On the basis of the service segment, the market is segmented to clinical trial site management, patient recruitment management, data management, administrative staff, IRB, and others. Patient recruitment management is further segmented into patient retention, patient recruitment & registry services, and others. Clinical trial site management accounted for the largest market share of 45.73% in 2024. The rising number of clinical trials, high prevalence of chronic diseases, and the increase in the number of CROs offering services are key factors anticipated to drive the market in the coming years.

Proper site management by the sponsor and/or CRO is crucial for trial execution and trial success. A sufficient degree of site administration and monitoring enables facilities to efficiently recruit, treat, and retain subjects while maintaining regulatory compliance, protocol adherence, subject rights protection, subject safety, and overall management of screened and recruited subjects.

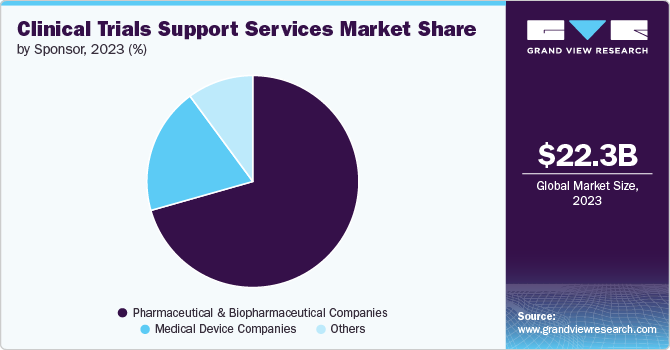

Sponsor Insights

On the basis of the sponsor segment, the market is segmented into pharmaceutical & biopharmaceutical companies, medical device companies, and others. The pharmaceutical & biopharmaceutical companies' segment dominated the market with the largest revenue share of 70.80% in 2024. This can largely be attributed to the increasing R&D investments and introduction of new drugs, which have increased in the past two decades.

The medical device companies’ segment is anticipated to show lucrative growth CAGR 7.02% during the forecast period. In the clinical research industry, medical device manufacturers are minor customers, and clinical research sites generally focus on the more profitable sectors of biotechnology, pharmaceuticals, and fundamental research. However, as the FDA places an increasing focus on excellent clinical procedures, device makers will interact with this complicated business on a far more regular basis.

Regional Insights

North America dominated the global market in 2024 with the largest share of 48.80%, as most pharmaceutical businesses in the U.S. perform most of their business in this region. This market is likely to grow due to the area's high number of clinical trials. Significant R&D investments and government support for clinical trials further promote market growth. The presence of key CROs offering clinical trial support services and multinational pharmaceutical & biopharmaceutical companies making significant investments in clinical research has contributed to market growth in North America.

U.S. Clinical Trials Support Services Market Trends

The U.S. accounts for the highest share of the North America clinical trials support services market owing to the presence of established market players, increasing demand for faster and more cost-effective research sites, and increasing capacity and performance of clinical trials. The U.S. has a significant number of market players offering clinical trial support services, as 80% of all clinical trials fail to meet patient enrollment targets, which increases the need for support services.

Canada Clinical Trials Support Services Market Trends

The clinical trials support services market in Canada is driven by an increase in the adoption of support services with patient-centric, clinical research coordination services & support toward the advancement of clinical studies, improving the clinical trials across a diverse range of therapeutic areas. For instance, in January 2023, the Canadian Institutes of Health Research Clinical Trials Fund announced funding from the Minister of the Federal Economic Development Agency for Southern Ontario. The USD 31 million investment will support training programs, new clinical trial projects, and the new Accelerating Clinical Trials (ACT) Consortium, Canada's first national clinical trials consortium. Such initiatives are expected to drive market growth over the estimated period.

Europe Clinical Trials Support Services Market Trends

Europe clinical trials support services market is driven by increased favorite sites for clinical trials, a growing pharmaceutical industry, rising demand for outsourcing services, and emerging research and development activities are expected to stimulate market growth. In addition, the increasing number of drug candidates in the pipeline is expected to fuel the European market.

Germany accounts for the highest share of the European clinical trial support Services market owing to the growing number of clinical trials in the country, rising R&D investment, and growing continuous demand for pharmaceutical products, contributing to innovations in clinical trial support services. Besides increasing research activities, the cost-efficiency offered by companies is contributing to its prominence in this field, which fuels market growth.

The clinical trials support services market in the UK is driven by cost-effective research services, technological advancements, and growing requirements for support services to monitor clinical research studies that are anticipated to fuel the market. Such factors are expected to drive market growth. For instance, in June 2023, the NIHR announced the research support services from October 2023. The NIHR research support services will provide researchers free access to support, advice & expertise. It will help to develop and deliver clinical and applied health and care research.

Asia Pacific Clinical Trials Support Services Market Trends

Asia Pacific is expected to grow at a CAGR of 8.75% during the forecast period. The growing burden of oncology, infectious diseases, developing healthcare infrastructure, and the increasing number of clinical trials has the demand for drugs, and the evolving clinical trials scenario for the emerging economies in the region drives the clinical trials support services market in Asia Pacific. Moreover, a significant increase in clinical studies and growing pharmaceutical & medical sectors are a few factors supporting the growth of the clinical trials support services market. Furthermore, increasing emphasis on the quality of clinical trials in the region contributes to the region's market growth.

Japan Clinical Trials Support Services Market Trends

The clinical trials support services market in Japan is driven by various cost-saving clinical trial support services, technological advancements, and growing expertise across disease studies. Such factors are anticipated to drive the Japanese market.

The clinical trials support services market in China is driven by the vast patient pool, increase in clinical trials, low cost of trials, developed clinical research infrastructure, growing approval of new drugs, technological advancement, a strong hospital network, and the availability of medical practitioners are further boosting the growth of the Asia Pacific market. Also, R&D expenditures made by market players for the creation of new treatments have led to a rise in clinical trial numbers, further fueling the market growth. These clinical trials support services in the country and contribute to advancing clinical research.

India's Clinical Trials Support Services market is driven by the presence of key players offering comprehensive support services; the presence of multinational pharmaceutical & biopharmaceutical companies has led to the rise in the requirement for various clinical trial support services. Moreover, the growing medical research and developing pharmaceuticals are further expected to drive market growth in India. For instance, in October 2023, Roche Pharma launched a clinical trial excellence project in India. The project's main objective is to strengthen public health institutions' capabilities to do clinical trials & drug research in the country. The project will enable government hospitals to become the centers of excellence for clinical research in the country and move up in the value chain. Therefore, clinical trial activity in the country is expected to improve market growth.

Key Clinical Trials Support Services Company Insights

The key market players implement several strategic initiatives, such as expansion, acquisitions, partnerships and agreements, collaborations, etc., to increase market presence and gain a competitive edge, driving market growth. For instance, in January 2024, IQVIA launched technology-based platform One Home for Sites. It acts as a single dashboard for the systems & support clinical research site to perform all clinical trials.

Key Clinical Trials Support Services Companies:

The following are the leading companies in the clinical trials support services market. These companies collectively hold the largest market share and dictate industry trends.

- Charles River Laboratories International, Inc.

- Wuxi Apptec, Inc

- Iqvia Holdings, Inc

- Syneos Health, Inc.

- Eurofins Scientific

- PPD, Inc. (Pharmaceutical Product Development)

- Icon Plc

- Laboratory Corporation of America Holdings (Labcorp)

- Alcura

- Parexel International Corporation

Recent Developments

-

In July 2024, DocMode Health Technologies launched new clinical research services. The company aims to provide comprehensive solutions encompassing clinical trial management, regulatory compliance, data analysis, and more. The service will support pharmaceutical companies, healthcare providers, and researchers in conducting high-quality clinical studies efficiently and effectively.

Clinical Trials Support Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 25.62 billion |

|

Revenue forecast in 2030 |

USD 37.16 billion |

|

Growth rate |

CAGR of 7.72% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Phases, service, sponsor, region |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Sweden, Denmark, Norway, Japan, China, India, Thailand, South Korea, Australia, Brazil, Argentina, Colombia, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Charles River Laboratories International, Inc., Wuxi Apptec, Inc, Iqvia Holdings, Inc, Syneos Health, Inc., Eurofins Scientific, PPD, Inc. (Pharmaceutical Product Development), Icon Plc, Laboratory Corporation Of America Holdings (Labcorp), Alcura, Parexel International Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

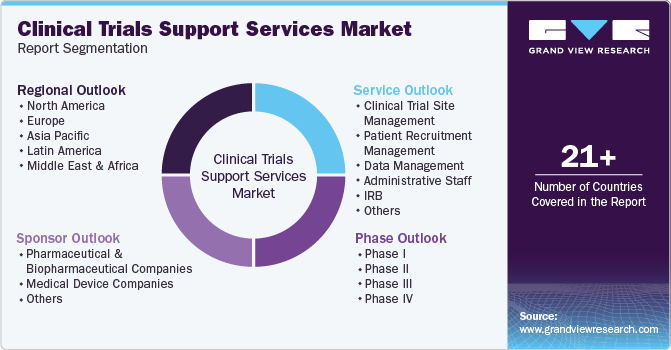

Global Clinical Trials Support Services Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Clinical Trials Support Services market report on the basis of phases, service, sponsor and region:

-

Phases Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Clinical Trial Site Management

-

Patient Recruitment Management

-

Patient recruitment & Registry Services

-

Patient retention

-

Others

-

Data Management

-

Administrative Staff

-

IRB

-

Others

-

-

Phase II

-

Clinical Trial Site Management

-

Patient Recruitment Management

-

Patient recruitment & Registry Services

-

Patient retention

-

Others

-

Data Management

-

Administrative Staff

-

IRB

-

Others

-

-

Phase III

-

Clinical Trial Site Management

-

Patient Recruitment Management

-

Patient recruitment & Registry Services

-

Patient retention

-

Others

-

Data Management

-

Administrative Staff

-

IRB

-

Others

-

-

Phase IV

-

Clinical Trial Site Management

-

Patient Recruitment Management

-

Patient recruitment & Registry Services

-

Patient retention

-

Others

-

Data Management

-

Administrative Staff

-

IRB

-

Others

-

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Trial Site Management

-

Patient Recruitment Management

-

Patient recruitment & Registry Services

-

Patient retention

-

Others

-

-

Data Management

-

Administrative Staff

-

IRB

-

Others

-

-

Sponsor Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & biopharmaceutical companies

-

Medical device companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical trials support services market size was estimated at USD 23.88 billion in 2024 and is expected to reach USD 25.62 billion in 2025.

b. The global clinical trials support services market is expected to grow at a compound annual growth rate of 7.72% from 2025 to 2030 to reach USD 37.16 billion by 2030.

b. North America dominated the clinical trials support services market with a share of 48.80% in 2024 owing to high number of clinical trials. Significant R&D investments and government support for clinical trials further promote market growth.

b. Some key players operating in the clinical trials support services market include Charles River Laboratories International, Inc., Wuxi Apptec, Inc, Iqvia Holdings, Inc, Syneos Health, Inc., Eurofins Scientific, PPD, Inc. (Pharmaceutical Product Development), Icon Plc, Laboratory Corporation Of America Holdings (Labcorp), Alcura, Parexel International Corporation

b. The global clinical trials support services market is projected to expand rapidly due to rising demand for trials in emerging economies, growing R&D investment, and an increasing number of contract research organizations (CROs).

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."