- Home

- »

- Medical Devices

- »

-

Clinical Trial Supply And Logistics Market Size Report, 2030GVR Report cover

![Clinical Trial Supply And Logistics Market Size, Share & Trends Report]()

Clinical Trial Supply And Logistics Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Logistics & Distribution, Storage & Retention), By Phase, By Therapeutic Area (Oncology, Cardiovascular Diseases), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-356-0

- Number of Report Pages: 119

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Clinical Trial Supply And Logistics Market Summary

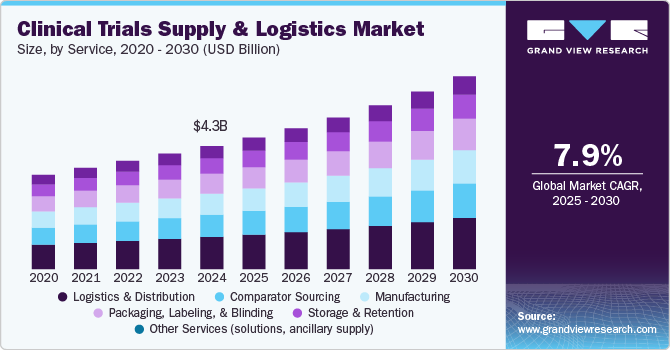

The global clinical trial supply and logistics market size was estimated at USD 4,287.8 million in 2024 and is projected to reach USD 6,722.9 million by 2030, growing at a CAGR of 7.97% from 2025 to 2030. Globalization, growing number of clinical trials, and increasing R&D expenditure by pharmaceutical & biopharmaceutical companies are major factors anticipated to drive the clinical trial supply & logistics market growth.

Key Market Trends & Insights

- North America dominated the market with a revenue share of 38.33% in 2024.

- The U.S. clinical trial supply and logistics market dominated in the North America region.

- By service, the logistics & distribution segment accounted for the largest share of 25.3% in 2024.

- By phase, the phase II segment is expected to grow lucratively over the forecast period.

- By therapeutic area, the cardiovascular diseases segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4,287.8 Million

- 2030 Projected Market Size: USD 6,722.9 Million

- CAGR (2025-2030): 7.97%

- North America: Largest market in 2024

Rapid technological advancements in supply chain management contributing to overall market growth. Increasing complexity of clinical studies is prompting the adoption of new technologies in supply chain management for rapid and efficient operations. The rising adoption of precision medicine, biologics, and decentralized trials has significantly increased supply chain complexity. Advanced therapies require stringent temperature controls, customized packaging, and real-time tracking to enhance product integrity. This has driven demand for specialized logistics providers capable of managing complex supply chains, thereby fostering market growth.Pharmaceutical and biotech companies are increasingly outsourcing supply chain operations to third-party logistics (3PL) providers to streamline operations and reduce costs. The shift enables sponsors to focus on core research while utilizing the expertise of logistics firms in managing supply chain risks and optimizing inventory. As a result, strategic partnerships and mergers within the logistics sector are expanding service portfolios, enhancing efficiency, and driving overall market expansion. For instance, in September 2024, Tower Cold Chain partnered with CRYOPDP, to broaden their offerings within the pharmaceutical supply chain, particularly in clinical research. This partnership aimed to deliver an expanded array of advanced temperature-controlled solutions and services to meet dynamic requirements of patients.

The growing complexity of clinical trials, driven by the rise of biologics, personalized medicine, and decentralized trials, is a key factor shaping the supply and logistics market. The increasing demand for temperature-sensitive therapies, stringent regulatory compliance, and global trial expansions require specialized logistics solutions. Advanced cold chain management, real-time tracking, and just-in-time supply models are gaining traction to ensure product integrity and timely delivery. In addition, the push for cost efficiency is prompting pharmaceutical companies to adopt strategic outsourcing models for supply chain optimization.

Also, there is rise in R&D investment and expansion in facilities by pharmaceutical and biotechnology firms for approval and launch of new drugs in the market. High investments in R&D and adequate supply and logistics facilities are likely to increase the possibility of successful drug/medicine. For instance, in July 2022, DHL Freight expanded its network in Germany with the purchase of a new terminal in Mettmann, close to Düsseldorf, Germany. This initiative was undertaken after a new facility was recently opened in Erlensee, close to Frankfurt, Germany, and a site was acquired from the logistics firm Leupold in Gochsheim, close to Würzburg, Germany.

Market Opportunities

The clinical trial supply and logistics market is anticipated for significant expansion owing to continuous advancements in personalized medicine, decentralized trials, and regulatory-driven supply chain developments. Increasing R&D investments, the growing complexity of biologics, and the adoption of digital solutions are reshaping logistics strategies. Companies that invest in innovation, automation, and sustainability will gain a competitive edge, addressing industry challenges while improving efficiency, compliance, and patient outcomes. The following key opportunities highlight areas driving future market growth.

The increasing demand for precision therapies, cell and gene treatments, and mRNA-based drugs is driving the need for specialized cold chain solutions and just-in-time delivery models. As biologics become more complex, investments in cryogenic storage, advanced packaging, and AI-driven supply chain optimization will enhance reliability, minimize waste, and streamline logistics.

Growing shift toward patient-centric trials has increased the need for direct-to-patient (DTP) drug deliveries and remote monitoring, reducing patient burden and improving recruitment. This advancement requires flexible logistics networks, real-time tracking solutions, and temperature-controlled last-mile delivery services. Future advancements in digital connectivity and automation will further enhance the efficiency, compliance, and accessibility of decentralized trials.

Stricter global regulations on drug traceability, GDP compliance, and serialization are prompting the adoption of blockchain-based tracking and automated compliance monitoring. Enhanced supply chain transparency and reduced counterfeiting risks will improve trial efficiency while ensuring seamless cross-border logistics. Companies investing in compliance-driven logistics solutions will benefit from greater regulatory adherence and improved trial success rates.

Digitalization is revolutionizing clinical trial logistics with predictive analytics, smart sensors, and automated inventory management. These technologies enable real-time tracking, predictive demand forecasting, and proactive risk mitigation, minimizing trial delays and supply chain disruptions. As AI and IoT adoption expands, logistics providers will gain enhanced operational efficiency, cost reductions, and improved visibility across global trial networks.

The rising demand for sustainable packaging, reusable temperature-controlled containers, and carbon footprint reduction strategies is reshaping supply chain practices. Green logistics initiatives support regulatory compliance and corporate sustainability goals as well as improve cost efficiency and long-term supply chain resilience. As companies shift towards eco-friendly solutions, they will drive industry-wide adoption of sustainable, efficient, and compliant clinical trial logistics services.

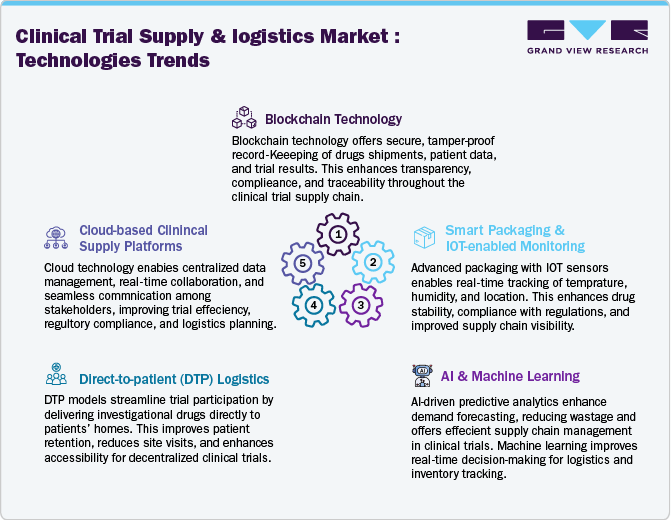

Technology Landscape

The clinical trial supply and logistics market is growing enormously with the integration of advanced digital technologies. Real-time tracking solutions through Internet of Things (IoT) and blockchain are enhancing supply chain transparency, end-to-end visibility, and mitigating risks related to temperature excursions and counterfeiting. In addition, artificial intelligence (AI) and machine learning (ML) are optimizing inventory management by predicting supply needs, reducing waste, and improving overall trial efficiency. These innovations enable pharmaceutical companies to streamline operations, lower costs, and enhance regulatory compliance.

Moreover, the adoption of decentralized clinical trial (DCT) logistics solutions will drive lucrative market growth opportunities in near future. The rise of direct-to-patient (DTP) deliveries, enabled by automated supply chain systems and smart packaging, is minimizing trial delays and improving patient engagement. Furthermore, robotic process automation (RPA) enhances operational efficiency in storage and distribution, while digital twins are being leveraged for real-time simulation of supply chain scenarios, reducing disruptions. As trials become more global and complex, companies investing in end-to-end digitalization and sustainable cold chain technologies will gain a competitive edge in the developing clinical trial supply & logistics market.

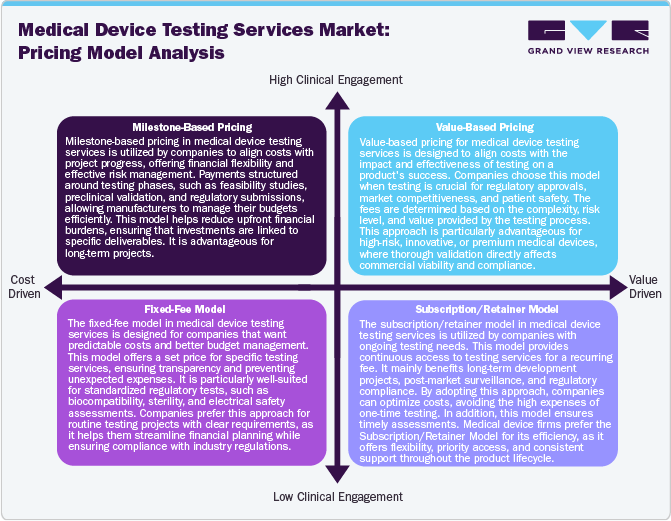

Pricing Model Analysis

The clinical trial supply & logistics industry depend on diverse pricing models to balance cost efficiency, service quality, and regulatory compliance. Cost-plus pricing guarantees transparency by adding a fixed margin to expenses but may lead to fluctuating costs. Value-based pricing aligns costs with service quality, justifying premium rates for specialized handling and compliance. Subscription-based pricing offers cost predictability through fixed recurring payments, ideal for long-term trials. Outcome-based pricing links payments to performance metrics, enhancing service accountability. Tiered pricing provides flexible options, catering to varied sponsor budgets and trial complexities. These models paradigm market competitiveness, influencing vendor selection and supply chain sustainability. Strategic pricing decisions optimize trial efficiency, ensuring reliable and compliant logistics for pharmaceutical and biotech companies.

Market Concentration & Characteristics

The bioanalytical testing services in CRO market showcase moderate innovation, with advancements in temperature-controlled packaging, real-time monitoring, and blockchain for traceability. Several industry players are integrating AI-driven forecasting and automation to enhance supply chain efficiency to drug integrity, reducing delays, and meeting the complex demands of decentralized and globalized clinical trials, thereby accelerating market growth.

The industry experiences moderately high M&A activity, as logistics providers seek to expand capabilties and geographic reach. Larger players are integrating specialized cold chain providers and regulatory compliance experts to strengthen global operations. M&A activities drive market consolidation, improving service efficiency while intensifying competition among key players offering end-to-end supply chain solutions.

The impact of regulations is expected to be significant on the clinical trial supply & logistics market. Stringent regulatory requirements, including Good Distribution Practices (GDP) and evolving compliance mandates, significantly influence logistics operations. Companies must adhere to region-specific guidelines for packaging, labeling, and temperature control to avoid disruptions. Regulatory shifts foster investment in compliance-focused infrastructure, boosting demand for specialized service providers with expertise in navigating complex regulatory landscape.

Clinical trial logistics firms are broadening service offerings to include direct-to-patient deliveries, risk-based monitoring, and predictive inventory management. Enhanced service portfolios ensure seamless trial execution, minimizing supply chain disruptions. Providers investing in end-to-end solutions, from warehousing to last-mile delivery, gain a competitive edge in meeting evolving trial requirements efficiently.

Globalization of clinical trials is driving logistics providers to expand into emerging markets, particularly in Asia-Pacific, Latin America, and Africa. Establishing regional distribution hubs, partnerships with local suppliers, and compliance expertise in diverse regulatory environments enhance supply chain resilience. Companies that optimize regional networks can capitalize on growing trial activities while ensuring cost-effective, timely deliveries.

Service Insights

The logistics & distribution segment accounted for the largest share of 25.3% in 2024. This is due to increasing trial complexity, globalization, and stringent regulatory requirements. Rising demand for temperature-controlled transportation, just-in-time deliveries, and real-time shipment tracking drives investment in advanced cold chain logistics. Expanding clinical trials across emerging markets requires regional distribution hubs, optimizing supply chain efficiency. In addition, regulatory compliance, including Good Distribution Practices (GDP), reinforces the need for specialized logistics providers. The shift toward direct-to-patient models and decentralized trials further fuels demand for flexible, end-to-end distribution solutions.

Manufacturing is anticipated to grow with a significant rate during the forecast period. The segment growth is driven by rising demand for biologics, gene therapies, and personalized medicine. Increased outsourcing to contract manufacturing organizations (CMOs) enhances scalability and cost efficiency. Regulatory-driven demand for GMP-compliant production, coupled with rapid clinical trial expansions, accelerates market growth, fostering innovation in formulation and packaging solutions.

Phase Insights

The phase III segment accounted for the largest share in the clinical trial supply & logistics market in 2024. The high segment growth is attributed to the rise in the number of clinical trial activities, its extensive patient enrollment, complex trial protocols, stringent regulatory requirements, and cost associated with this phase, and a high failure rate in this phase that leads to loss in terms of both financial as well as human life. High demand for temperature-controlled storage, global distribution networks, and risk mitigation strategies drives investment in specialized logistics.

The phase II segment is expected to grow lucratively over the forecast period. due to increased trial volumes, complex supply chain needs, and rising demand for temperature-sensitive biologics. Higher patient enrollment, stringent regulatory compliance, and the need for real-time monitoring drive logistics investments. Expanding decentralized trials and adaptive study designs further strengthen demand for efficient supply chain solutions in this phase.

Therapeutic Area Insights

Based on therapeutic area, the cardiovascular diseases segment held the largest market share in 2024. The rise in disease burden, a large number of companies focused on bringing novel and innovative medicines to treat heart diseases, and rising strategies to reduce the prevalence of heart attacks and stroke. According to the Center for Disease Control and Prevention, in the U.S., 702,880 people died due to heart disease in 2022.

The oncology segment is expected to grow lucratively over the forecast period. This is due to the rising demand for personalized cancer therapies, biologics, and cell & gene treatments. These trials require stringent cold chain logistics, real-time tracking, and regulatory compliance. Increasing global cancer prevalence and rapid drug development drive investment in specialized storage, handling, and distribution, fostering market expansion.

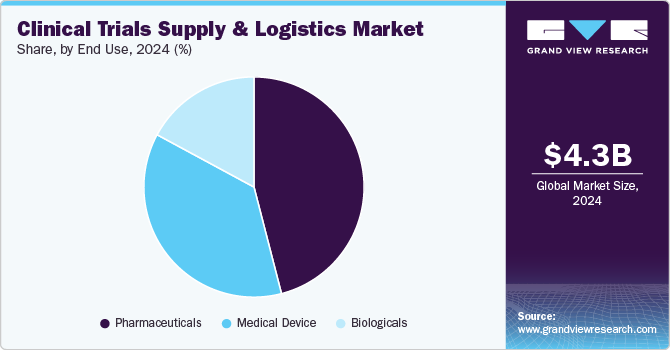

End Use Insights

Based on end use segment, the pharmaceutical segment held the largest share in 2024. The segment growth is owing to increasing R&D investments, and complex trial designs. Stringent regulatory compliance, temperature-sensitive drug requirements, and global trial expansions necessitate advanced logistics solutions. The globalization of clinical trials, increase R&D by the pharmaceutical companies, and large number of clinical trials studies conducted by them. For instance, ClinicalTrials.gov currently lists 20,739 active studies being performed in 208 countries.

The biologicals segment is projected to expand at the fastest growth rate over the forecast period. The main driver of the market is rising demand for biologics product such as vaccines, cell and gene therapies, and increase in investment for product manufacturing and development. Also, there is rise in demand for global vaccination to prevent COVID- 19 pandemic.

Regional Insights

North America dominated the market with a revenue share of 38.33% in 2024.The region accounts for the highest number of clinical trials conducted among all regions, which is a major driver for growth of clinical trial supply and logistics market. Significant increase in investments in clinical trials and rise in the number of players in clinical trial supply and logistics market are expected to contribute to growth.

U.S. Clinical Trial Supply & Logistics Market Trends

The U.S. clinical trial supply and logistics market dominated in the North America region. The high revenue growth is primarily driven by high R&D investments, a strong regulatory framework, and the strong presence of key pharmaceutical and biotech players. Integration of advanced cold chain solutions, decentralized trials, and digital supply chain innovations further strengthened market growth. Increasing clinical trial volumes and stringent FDA compliance further accelerate demand for specialized logistics providers.

Europe Clinical Trial Supply & Logistics Market Trends

The Europe clinical trial supply & logistics market is driven by stringent EU GDP (Good Distribution Practice) regulations, a robust pharmaceutical landscape, and increasing cross-border trials. Strong government support for R&D, rising demand for biologics, and expansion in emerging markets further accelerate logistics innovation. The presence of major logistics hubs, particularly in Germany, the UK, and Italy, strengthens market competitiveness and supply chain flexibility.

The Germany clinical trial supply & logistics market held the largest share in Europe in 2024 due to its strong pharmaceutical industry, advanced infrastructure, and strategic location as a logistics hub. Stringent GDP regulations and high investment in biologics and personalized medicine drive demand for specialized cold chain solutions. The country’s efficient regulatory framework, coupled with increasing decentralized trials and digital tracking adoption, enhances supply chain transparency. Germany's focus on innovation and automation further strengthens its position as a key market in clinical trial supply & logistics industry.

The clinical trial supply & logistics market in the UK is anticipated to grow at a significant CAGR over the forecast period. The market growth is due to a strong pharmaceutical ecosystem, government-funded R&D initiatives, and a well-regulated supply chain framework. Post-Brexit regulatory adaptations have increased demand for specialized logistics solutions to navigate new compliance requirements. Strategic investments in regional distribution hubs and partnerships with global logistics providers further position the UK as a key market in the clinical trial supply & logistics industry.

Asia Pacific Clinical Trial Supply & Logistics Market Trends

The Asia-Pacific region is expected to grow at a lucrative rate of during the forecast period due to rising clinical trial activities, lower operational costs, and a growing pharmaceutical sector. Countries such as China, India, and Japan are key hubs, attracting global sponsors with diverse patient populations and regulatory reforms. Increased demand for cold chain logistics, decentralized trials, and local regulatory expertise is driving market growth.

The China clinical trial supply & logistics market held the largest share in Asia Pacific in 2024. The market growth is owing to favorable regulatory reforms, growing biopharmaceutical investments, and a rising number of multinational trials. The China National Medical Products Administration (NMPA) has accelerated drug approval processes, boosting demand for specialized cold chain logistics and localized distribution networks. Rapid growth in cell and gene therapies, along with increasing domestic pharmaceutical innovation, drives the need for advanced temperature-controlled solutions. Expanding clinical research hubs in Beijing, Shanghai, and Guangzhou further strengthen market growth.

The clinical trial supply & logistics market in India is expected to grow at the fastest CAGR over the forecast period. The market growth is driven by cost-efficient operations, a large patient pool, and favorable regulatory reforms. Growing investments in biologics, biosimilars, and vaccine research are fueling demand for cold chain logistics and real-time monitoring solutions. The rise of clinical research outsourcing (CROs) and government initiatives promoting clinical trials enhance supply chain efficiency.

The clinical trial supply & logistics market in Japan is expected to grow at the fastest CAGR over the forecast period, driven by advanced pharmaceutical R&D, stringent regulations, and strong demand for personalized medicine. The country’s focus on regenerative therapies, cell & gene treatments, and aging-related research necessitates specialized cold chain logistics and real-time tracking.

Latin America Clinical Trial Supply & Logistics Market Trends

The Latin America region is expected to grow at a significant rate over the estimated timeframe. Latin America is one of the fastest-growing regions in terms of number of clinical trial sites owing to its diverse population, ease in access to patients, proximity to North America, and relatively low transportation cost. These factors are driving the market for clinical trials in this region. Colombia, Peru, Chile, Argentina, and Brazil accounted for 90.0% of the total clinical trials conducted in Latin America. Recent regulatory reforms to reduce clinical trial application approval period in Brazil, China, and Argentina are expected to boost the clinical trial supply and logistics market.

The Brazil clinical trial supply & logistics market held the largest share in Latin America in 2024. The market growth is owing to high clinical trial activities, low operational cost, ease in patient recruitment, and presence of a diverse patient population. Rising demand for vaccine trials, biologics, and biosimilars fuels the need for cold chain logistics and regional distribution networks. Growth in public-private partnerships and expanding research hubs in Sao Paulo and Rio de Janeiro further drive market growth opportunities.

Middle East & Africa (MEA) Clinical Trial Supply & Logistics Market Trends

Middle East and Africa is the emerging market for clinical trials supply and logistics. Growing demand for personalized healthcare and presence of diverse population in the region, which leads to ease in patient recruitment, are among factors contributing to market growth.

The South Africa clinical trial supply & logistics market held the largest share in Asia Pacific in 2024. South Africa is a key destination for multinational biopharmaceutical clinical trials due to its cost-effective operations, diverse patient pool, and adherence to ICH and FDA standards. A strong public healthcare infrastructure and a high number of doctors support trial execution. Regulatory requirements, including import licenses and MCC approvals, create logistical challenges, and drive demand for clinical trial supply & logistics services.

Clinical Trials Supply & Logistics Market Company Insights

Some of the players operating in the market include Thermo Fisher Scientific (Patheon), Catalent, Inc., Parexel, UPS Healthcare, Piramal Pharma Solutions, Almac Group, UDG Healthcare, FedEx, Movianto, DHL, and Packaging Coordinators Inc. The players are continuously involved in expanding their facilities, collaboration, and engaging in partnership, merger and acquisition of companies. These are key strategic initiatives that are influencing industry dynamics. For instance, in July 2024, Catalent, Inc. completed the expansion of its clinical supply facility in Schorndorf, Germany, strengthening its packaging, storage, and distribution capabilities. The facility enhanced clinical supply services to support global drug development and patient access to innovative treatments.

Key Clinical Trials Supply & Logistics Companies:

The following are the leading companies in the clinical trials supply & logistics market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- UPS Healthcare

- Piramal Pharma Solutions

- DHL

- Parexel International

- Almac Group

- Movianto

- UDG Healthcare

- FedEx

- Catalent, Inc.

Recent Developments

-

In June 2024, Thermo Fisher Scientific launched a new ultra-cold facility in Bleiswijk, Netherlands. The cGMP-compliant site supports cell and gene therapies, biologics, antibodies, and vaccines, enhancing contract manufacturing and specialty logistics. It offers biorepository solutions and critical material storage, catering to biotech and pharmaceutical firms across all clinical trial phases.

-

In March 2024, Myonex announced the acquisition of Creapharm’s Clinical Packaging & Distribution, Commercial Packaging, and Bioservices divisions, expanding its global presence. This acquisition strengthens Myonex’s clinical packaging, labeling, and distribution capabilities, while Creapharm adds expertise in commercial packaging and ATMP supply chain management. The deal enhanced both companies' market position in clinical trial supply & logistics market.

Clinical Trials Supply & Logistics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.58 billion

Revenue forecast in 2030

USD 6.72 billion

Growth rate

CAGR of 7.97% from 2025 to 2030

Actual estimates/Historical data

2018 - 2024

Forecast period

2025 - 2030

Market representation

Revenue in USD million and CAGR from 2025 to 2030

Segments covered

Service, phase, therapeutic area, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; Colombia; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; UPS Healthcare; Piramal Pharma Solutions; DHL; Parexel International; Almac Group; Movianto; UDG Healthcare; FedEx; Catalent, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Trial Supply And Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented clinical trials supply & logistics market on the basis of service, phase, therapeutic area, end use, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Logistics & Distribution

-

Storage & Retention

-

Packaging, Labeling, and Blinding

-

Manufacturing

-

Comparator Sourcing

-

Other Services

-

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiovascular Diseases

-

Respiratory Diseases

-

CNS and Mental Disorders

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Biologicals

-

Medical Device

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical trial supply and logistics market size was estimated at USD 4.29 billion in 2024 and is expected to reach USD 4.58 billion in 2025.

b. The global clinical trial supply and logistics market is expected to grow at a compound annual growth rate of 7.97% from 2025 to 2030 to reach USD 6.72 billion by 2030.

b. North America dominated the clinical trial supply and logistics market with a share of 38.33% in 2024. This is attributable to a high number of clinical trials, increased investment in healthcare R&D, integration of advanced technologies, and the strong presence of dominant market players in the region.

b. Some key players operating in the clinical trial supply and logistics market include Thermo Fisher Scientific Inc., UPS Healthcare, Piramal Pharma Solutions, DHL, Parexel International, Almac Group, Movianto, UDG Healthcare, FedEx, and Catalent, Inc.

b. Key factors that are driving the clinical trial supply & logistics market growth include rising clinical trial volumes, increasing demand for biologics and personalized medicine, regulatory reforms, advancements in cold chain logistics, and digitalization of supply chains.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.