- Home

- »

- Medical Devices

- »

-

Clinical Trial Biorepository & Archiving Solutions Market, 2033GVR Report cover

![Clinical Trial Biorepository And Archiving Solutions Market Size, Share & Trends Report]()

Clinical Trial Biorepository And Archiving Solutions Market (2026 - 2033) Size, Share & Trends Analysis Report By Service (Biorepository Services, Archiving Solution Services), By Product, By Phase, By Trials/Application, By Region, and Segment Forecasts

- Report ID: GVR-4-68039-532-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2027 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Clinical Trial Biorepository & Archiving Solutions Market Summary

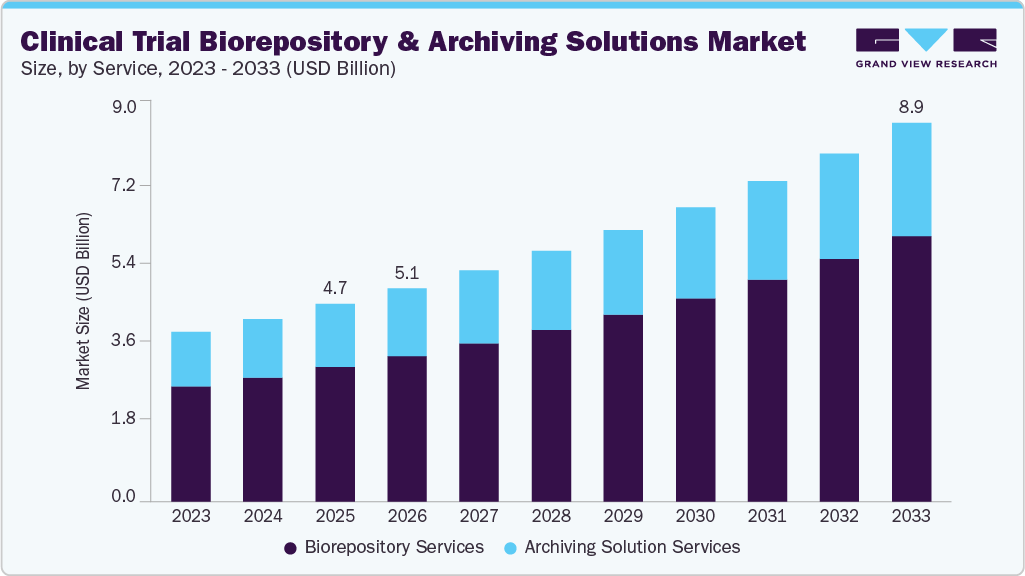

The global clinical trial biorepository and archiving solutions market size was estimated at USD 4.68 billion in 2025 and is projected to reach USD 8.98 billion by 2033, growing at a CAGR of 8.53% from 2026 to 2033. The growth of the market is mainly due to the growing number of pharmaceutical and biotechnology companies, growing disease variation and prevalence, increasing R&D investments and growth in the CRO market.

Key Market Trends & Insights

- North America clinical trial biorepository and archiving solutions market held the largest share of 38.15% of the global market in 2025.

- The clinical trial biorepository and archiving solutions in U.S. is expected to grow significantly over the forecast period.

- Based on service, the biorepository services segment held the largest market share of 68.10% in 2025.

- Based on product, the clinical products segment held the highest market share in 2025.

- Based on phase, the phase III segment held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 4.68 Billion

- 2033 Projected Market Size: USD 8.98 Billion

- CAGR (2026-2033): 8.53%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The growing number of pharmaceutical and biotechnology companies is increasing the focus on innovative drug discovery, resulting in a rising number of clinical trials. Expansion of biologics, biosimilars, personalized medicine, orphan drugs, and adaptive trial designs is driving demand for specialized biorepository and archiving solutions. Stringent regulatory requirements from ICH-GCP, FDA, and EMA mandate long-term storage of clinical data and biospecimens, while advanced technologies for sample storage, management, and retrieval are improving efficiency, reliability, and overall market growth.In addition, increasing pharmaceutical R&D investments are driving demand for clinical trial biorepository and archiving solutions as companies seek external expertise to accelerate drug development. Besides this, major investments by global players and rising drug innovation intensify the need for secure storage, management, and retrieval of biological samples and clinical data. In addition, advanced biorepository infrastructure supports data integrity, regulatory compliance, and personalized medicine development, while encouraging new entrants and technological innovation, thereby strengthening market growth over the forecast period.

Moreover, rising prevalence of chronic and emerging diseases is increasing demand for novel therapeutics, thereby accelerating global clinical trial activity. High incidence of cardiovascular and neurological disorders, along with growing disease diversity in emerging economies, is expanding research into common and rare conditions. Besides this, larger and more diverse patient populations enable faster recruitment and support targeted and orphan drug trials. Some of the regulatory incentives for orphan diseases further boost trial volumes, increasing the need for secure biorepository and long-term archiving solutions.

Furthermore, rising R&D spending and cost-efficiency goals are driving pharmaceutical companies to outsource complex, large-scale, and decentralized clinical trials to CROs. CROs manage patient recruitment, biospecimen handling, and data operations, generating large volumes of samples and documentation. The ICH-GCP and FDA regulations govern these materials require secure, traceable, long-term storage. In addition, continued CRO expansion, multi-regional trial execution, and offshore outsourcing benefits are increasing reliance on specialized biorepository and compliant archiving solutions, supporting sustained market growth.

Opportunity Analysis

The market for clinical trial biorepository and archiving solutions presents a compelling growth opportunity due to the rising complexity of trials, stringent regulatory scrutiny, increasing volumes of data, and a transition towards advanced therapies and device-oriented research. Besides this, sponsors are relying for specialized providers for biospecimen storage, metadata management, and long-term documentation, thereby evolving biorepositories into essential strategic partners instead of merely passive storage entities.

In addition, expansion of cell and gene therapies, personalized medicine, and decentralized global trials is driving the need for validated cryogenic storage, robust chain-of-identity tracking, real-time monitoring, and coordinated multi-regional repositories that are supported by integrated LIMS platforms. Cell therapy constitutes a high-value segment, as trials involving autologous and allogeneic approaches rely on unique, heavily regulated living materials. Similarly, medical device trials are creating new opportunities due to hybrid data requirements spanning biospecimens, device components, imaging, telemetry, and software logs. Increasing regulatory focus on data integrity, traceability, and long-term retention is driving demand for advanced digital archiving alongside physical storage.

Moreover, commercially providers that deliver integrated, value-added services such as logistics coordination, site training, regulatory support, and interoperable digital platforms gain higher margins, recurring revenue, and strong client retention.

Impact of U.S. Tariffs on Clinical Trial Biorepository and Archiving Solutions Market

U.S. tariffs can exert a moderate yet significant influence on the market for clinical trial biorepository and archiving solutions, mainly through increased expenses across supply chains and infrastructure investments. Besides this, tariffs on imported laboratory instruments, cryogenic refrigeration units, temperature-monitoring technology, IT hardware, and specialized storage materials may increase both capital and operational costs for biorepository service providers. These financial pressures could impact pricing strategies, especially for providers managing extensive, multi-regional trials that require sophisticated cold-chain logistics and digital archiving. In addition, for sponsors, rising service costs may hasten the trend towards outsourcing and long-term agreements to stabilize costs and ensure regulatory compliance. Furthermore, tariffs may also strengthen the localization of storage, data archiving, and sample management within the U.S., which would advantage domestic providers with existing infrastructure. Moreover, global sponsors could diversify biorepository networks across non-U.S. regions to mitigate tariff exposure.

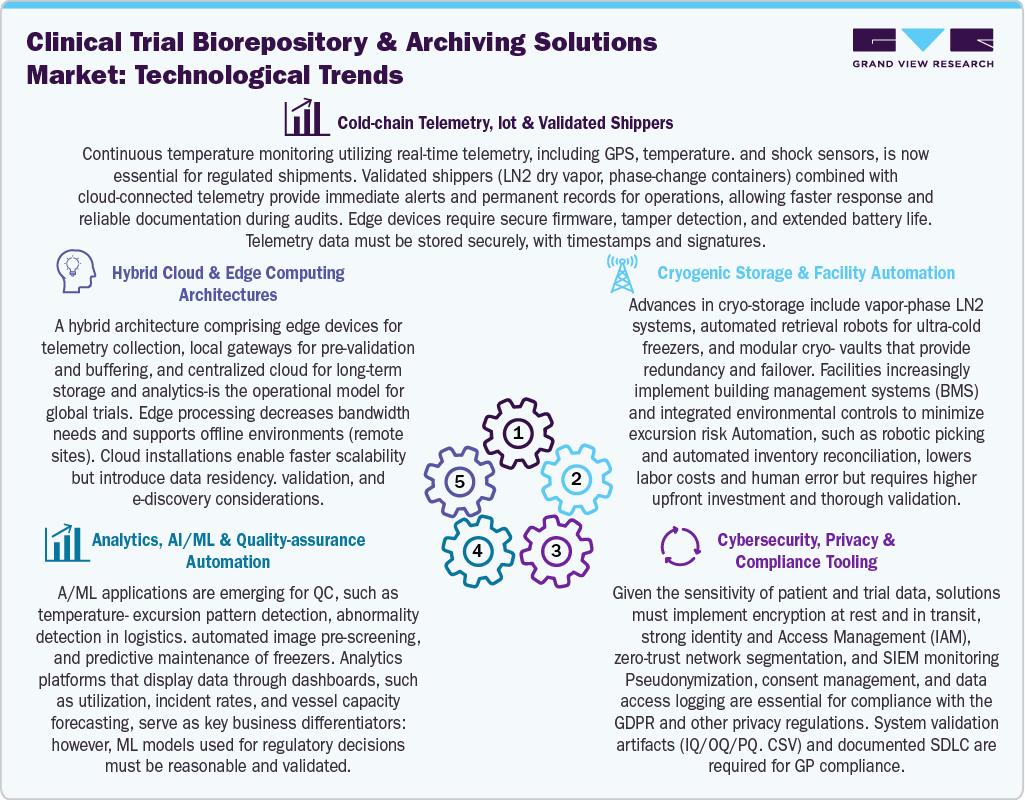

Innovations in cold-chain telemetry, cryogenic storage, and digital infrastructure are transforming biorepository and archiving solutions for clinical trials. The use of real-time IoT telemetry equipped with GPS, temperature, and shock sensors is now crucial for regulated shipments, alongside validated shipping solutions such as LN2 dry vapor and phase-change containers that allow for continuous monitoring, quick alerts, and documentation that is ready for audits. Besides this, advances in cryogenic storage involve vapor-phase LN2 systems, automated retrieval robots, and modular cryo-vaults, are enhanced by integrated building management systems to reduce excursion risks and enhance redundancy. Furthermore, cybersecurity and compliance tools necessitate the implementation of encryption, robust identity and access management, zero-trust architectures, and validated systems to comply with GxP and privacy standards. Moreover, AI and ML are increasingly utilized for ensuring quality, predictive maintenance, and detecting anomalies, complemented by analytics dashboards that assist in capacity and risk management.

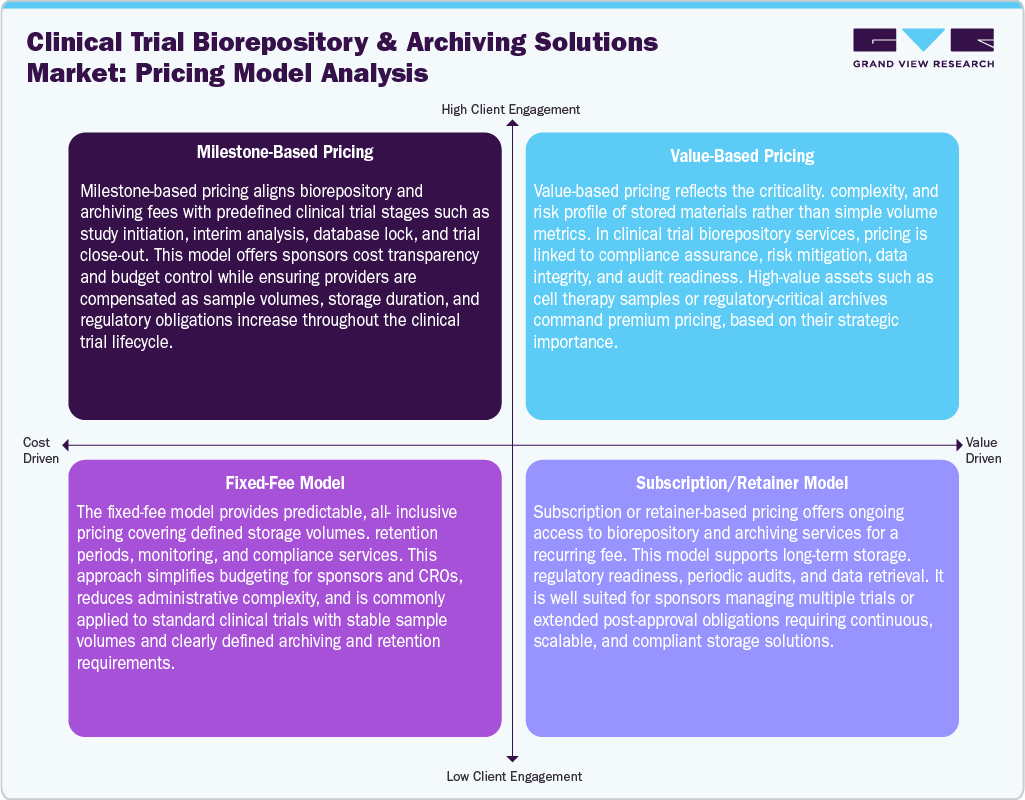

The clinical trial biorepository and archiving solutions providers are continuously implementing adaptable pricing models to match the growing complexity of trials, the demands of regulatory frameworks, and the expectations of sponsors. In milestone-oriented pricing ties service charges to essential phases of the trial, such as initiating the study, conducting interim analyses, locking the database, and finalizing the trial. This pricing framework enhances cost transparency while aligning payments with escalating sample quantities, durations of storage, and compliance obligations throughout the life of the trial. Besides this, value-focused pricing emphasizes the strategic significance and risk characteristics of the stored materials instead of merely considering volume metrics. In addition, high-value items, including samples from cell and gene therapies or crucial regulatory trial archives, attract premium pricing due to the assurance of compliance, traceability, data integrity, and readiness for audits that the provider offers.

Market Concentration & Characteristics

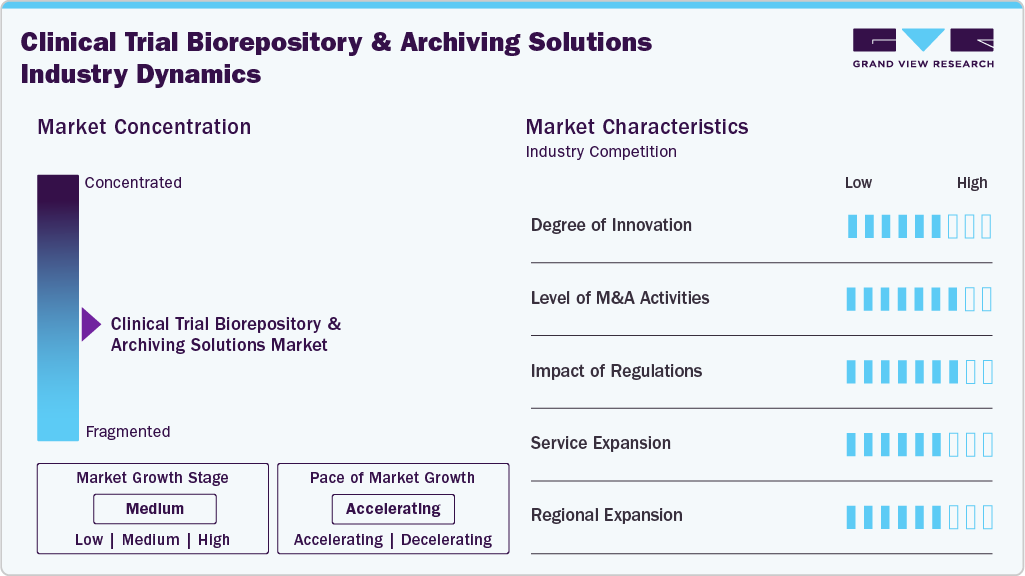

The clinical trial biorepository & archiving solutions market has moderately concentrated and pace is accelerating. The market is characterized by high regulatory intensity, recurring long-term revenue, and strong reliance on outsourced services. Demand is driven by complex global trials, advanced therapies, stringent data integrity requirements, and the need for scalable, compliant physical and digital storage infrastructure.

The clinical trial biorepository and archiving solutions market demonstrates a high degree of innovation driven by advanced cryogenic storage, IoT-enabled cold-chain monitoring, automation, AI-based quality control, and integrated digital archiving platforms. Providers increasingly differentiate through validated technologies that enhance sample integrity, traceability, regulatory compliance, and operational efficiency across complex, multi-regional clinical trials.

Regulatory requirements from authorities such as ICH-GCP, FDA, EMA, and GDPR significantly shape the market. Mandates for long-term data and biospecimen retention, audit readiness, traceability, and data integrity drive sustained demand for compliant biorepository and archiving services. Regulatory scrutiny increases outsourcing as sponsors seek validated, inspection-ready infrastructure.

M&A activity is moderate to high as providers pursue scale, geographic reach, and technology capabilities. Acquisitions of regional biorepositories, digital archiving firms, and cold-chain logistics specialists enable service integration, portfolio expansion, and improved competitiveness in serving global, multi-therapy clinical development programs.

Service expansion is focused on end-to-end offerings, including sample collection kits, logistics coordination, site training, regulatory documentation support, audit readiness, and integrated data management. Providers are moving beyond storage toward comprehensive lifecycle management solutions, increasing client integration, revenue per study, and long-term contractual relationships.

Regional expansion is accelerating as clinical trials increasingly move into Asia Pacific, Latin America, Eastern Europe, and the Middle East. Providers are building regional hubs, partnerships, and compliant infrastructure to support decentralized and multi-country trials, improve turnaround times, reduce logistics risk, and meet local regulatory requirements.

Service Insights

On the basis of service segment, the biorepository services segment held the largest market share of over 68.10% in 2025. The biorepository service is sub-segmented into transportation, warehousing & storage, sample processing, and others. The design and engineering firms have proved their abilities by meeting stringent regulatory requirements, even when the project is highly complex, diverse, and demanding. For instance, Q2 Solution offers a comprehensive range of biorepository services tailored to protocol and storage needs. The company maintains a network of 13 million specimens worldwide. In addition, the company routinely executes approximately 5,000 outbound shipments per month, with 60% in a scheduled manner and 40% of shipments based on an ad hoc manner. Also, the company manages specimens in varying volumes, ranging from 1 to 200,000, per single request. The growing requirement for biorepository services is anticipated to drive the market over the forecast period.

The archiving solution services is amongst the second fastest growing segment over the forecast period and play a critical role in securely managing and preserving physical and digital records in regulated industries, ensuring compliance, audit readiness, and long-term accessibility. Besides this, rising volumes of clinical, research, and regulatory data are increasing demand for secure storage, digitization, and lifecycle management platforms with encryption and disaster recovery. In addition, the globalization of clinical trials across emerging regions is driving demand for multi-site, real-time, and indexed archiving solutions, supporting sustained market growth.

Product Insights

On the basis of the product, the clinical products segment accounted for the largest market share in 2025. The clinical products comprises of human tissue, organs, cell therapy and other biospecimens. The market is driven by intense competition in drug development and rising demand for end-to-end global clinical services. The clinical services support specimen handling, clinical trials (Phase I-IV), storage, labeling, distribution, and regulatory-compliant archiving. In addition, growth is further supported by rising clinical trial registrations and the need for strict temperature control, traceability, and GCP-compliant data retention. Furthermore, the development of new pharmaceutical drugs and the expansion of the drug pipeline further strengthen segment growth. For instance, as of 2024, ClinicalTrials.gov reported that 500,000 studies had been registered from all 50 states and over 220 countries. Such factors are anticipated to drive the segment growth.

The medical device-generated digital data segment is expected to witness strong growth over the forecast period. They are vital within clinical trial biorepository solutions, enabling secure storage, indexing, and long-term management of data from imaging systems, wearables, and monitoring devices. Besides this, growing adoption of connected devices increases data volume and complexity, driving demand for advanced archiving platforms. in addition, these solutions ensure data integrity, traceability, and compliance with GCP and data protection regulations while supporting efficient retrieval, analytics, audits, and regulatory submissions, thereby strengthening data-driven decision-making and market growth.

Phase Insights

On the basis of phase segment, phase III segment held the largest share of the clinical trial biorepository & archiving solutions market in 2025. The segment is driven by large patient populations, long study durations, and high sample volumes. These trials require standardized processing, robust cold-chain storage, and strict chain-of-custody controls. Besides this, advanced storage technologies and compliant archiving ensure data integrity, long-term retention, and regulatory compliance, supporting safety monitoring, efficacy validation, and multi-site data consistency, thereby driving sustained segment growth.

The preclinical segment is the fastest growing segment over the forecast period. The segment supports drug discovery by ensuring secure, traceable storage of tissues, biofluids, cell lines, and genetic materials generated during early research. The rising pharmaceutical and biotechnology R&D investments and increased use of animal and in vitro models are driving demand for reliable infrastructure. Furthermore, technological advances such as automated handling, cryogenic storage, and digital inventory systems enhance sample integrity and efficiency. In addition, integrated archiving solutions ensure GLP-compliant data retention, reproducibility, and regulatory readiness, further supporting market growth

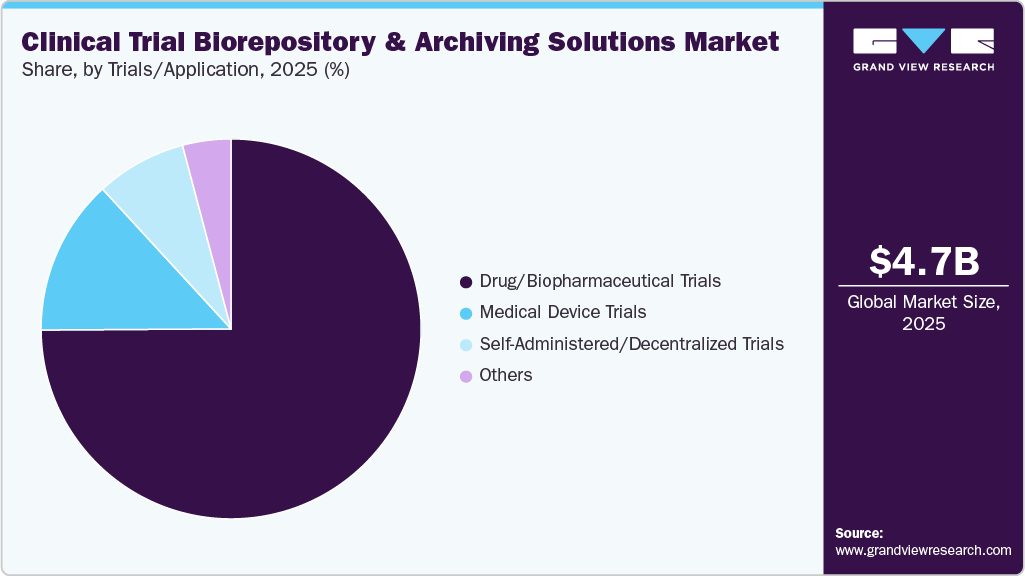

Trials/Application Insights

On the basis of the trials/application, the drugs/biopharmaceutical segment dominated the market in 2025. The segment includes cell therapy trials, gene therapy trials and others. These enable compliant, efficient management of biological samples and trial data across clinical development. Besides this, rising trial complexity, global site distribution, and increased use of biologics and personalized therapies drive demand for advanced storage, cryogenic systems, real-time monitoring, and chain-of-custody tracking. In addition, integrated archiving ensures secure, long-term retention of clinical and regulatory records in line with GCP and data protection requirements. Digital inventory systems and analytics enhance traceability, audit readiness, and operational efficiency, supporting market growth.

The self-administered and decentralized clinical trials rely on biorepository and archiving solutions to securely manage samples collected at home or remote locations. These solutions support temperature-controlled storage, traceability, and integrity of blood, saliva, and biomarker samples. In addition, growing adoption of patient-centric and digital trial models is increasing demand for flexible, scalable infrastructure.

Regional Insights

North America clinical trial biorepository and archiving solutions market held the largest revenue share of 38.15% in 2025. The region’s growth is driven by high clinical trial volumes, strong R&D activity, and rising demand for advanced therapies, generating large volumes of biological samples. The well-developed biobanking infrastructure, stringent regulatory oversight, and widespread adoption of automated storage, cryogenic systems, and digital archiving support growth. The strong presence of CROs and biopharmaceutical companies, along with continued technology investments such as Thermo Fisher Scientific’s 2024 U.S. laboratory expansion further strengthens regional demand for advanced biorepository and archiving solutions.

U.S. Clinical Trial Biorepository and Archiving Solutions Market Trends

U.S. dominated the North America region, due to high clinical trial volumes in precision medicine and rare diseases, alongside a strong presence of biorepository and archiving providers. Stringent regulations, cost-efficiency initiatives, and growing multi-center trials are increasing demand for centralized, validated sample management. In addition, advanced infrastructure investments support growth, exemplified by the University of Miami’s 6,500-square-foot automated biorepository launched in 2025 with USD 7.6 million NIH funding, enhancing large-scale sample storage and research capabilities.

Canada clinical trial biorepository and archiving solutions market is expected to grow at significant rate from 2026-2033, driven by strong outsourcing activity, high clinical trial productivity, and advanced biobank infrastructure. Government support, diverse patient populations, and facilities such as the Canadian Biosample Repository further strengthen demand, while sustained trial activity by global biopharmaceutical companies positions Canada as a key market for specialized biorepository and archiving service providers.

Europe Clinical Trial Biorepository and Archiving Solutions Market Trends

Europe is a leading market for clinical trial biorepository and archiving solutions, driven by rising clinical trial activity, advanced technologies, diverse patient populations, and strong regulatory frameworks. Besides this, centralized biobanking partners simplify global sample logistics and data management, reducing complexity for sponsors. The growth in advanced therapies is boosting demand, supported by investments such as Thermo Fisher’s GMP-certified ultra-cold facility launched in 2024. While Western Europe remains mature, Eastern Europe is expanding rapidly due to cost efficiency and faster patient recruitment.

The clinical trial biorepository and archiving solutions market in Germany is anticipated to grow over the forecast period owing to a strong pharmaceutical and biotechnology ecosystem, advanced research infrastructure, and rising clinical trial activity. The country’s role as a major CRO hub, supported by government initiatives, robust federal funding, and strong academic-industry collaboration, accelerates market growth. Increasing focus on oncology, rare diseases, and personalized medicine, along with strict compliance with EU CTR, GDPR, and GxP regulations, is encouraging sponsors to outsource to specialized, technologically advanced biorepository and archiving service providers.

The clinical trials, biorepository, and archiving solutions market in UK is driven by strong government support for life sciences, a mature regulatory framework, and rising clinical research activity. The presence of major biopharmaceutical companies, extensive clinical supply service providers, and growing NHS-led and academic-industry collaborations supports market growth. In addition, strict MHRA, GDPR, and GxP compliance encourages outsourcing to specialized providers.

Asia Pacific Clinical Trial Biorepository and Archiving Solutions Market Trends

Asia Pacific clinical trial biorepository and archiving solutions market is projected to grow at the fastest rate over the forecast period of 2026-2033, driven by rising pharmaceutical investments, expanding healthcare spending, and increasing clinical trial activity. Some of the countries such as China, Japan, and India support growth through large trial volumes and expanding manufacturing capabilities. Besides this, cost-efficient trial execution, strong CRO presence, government healthcare initiatives, and easy patient recruitment further fuel demand. In addition, growing scientific expertise, facility expansions, partnerships, and rapid adoption of advanced technologies are expected to sustain market growth during the forecast period.

The clinical trial biorepository and archiving solutions market in China is expected to grow over the forecast period as it is an attractive destination for pharmaceutical companies due to rising R&D activity, evolving regulatory frameworks, a large and diverse patient pool, and growing demand for high-quality drug and device testing. In addition, government initiatives, foreign investments, and strong emphasis on product development and quality control encourage outsourcing of clinical trials, increasing demand for biorepository and archiving solutions.

The clinical trial biorepository and archiving solutions market in Japan is expected to grow over the forecast period due to advanced R&D infrastructure, policy reforms, faster patient recruitment, and strong interest from global biopharmaceutical companies and CROs. Besides this, expanding pharmaceutical R&D, high healthcare spending, product safety focus, and rapid technological adoption increase demand for compliant sample and data management. In addition, streamlined drug review processes by the PMDA, faster trial approvals, and growing outsourcing partnerships further encourage clinical research activity, boosting demand for specialized biorepository and archiving solutions.

The clinical trial biorepository and archiving solutions market in India is anticipated to grow at the fastest CAGR over the forecast period owing to growing due to low operational costs, availability of skilled professionals, and WHO-cGMP-compliant facilities. Rising pharmaceutical and biotechnology investments, a large patient pool, and an expanding healthcare sector drive demand. The presence of CROs, such as KPS Clinical Services, and increasing international investments in clinical trials and storage infrastructure further support market growth. Government initiatives and awareness campaigns are also enhancing adoption of biorepository and archiving solutions across the country.

Latin America Clinical Trial Biorepository and Archiving Solutions Market Trends

The clinical trial biorepository and archiving solutions market in Latin America is projected to grow over the forecast period. The growth in the region is due to the growth of pharmaceutical and medical device industries and rising demand for analytical validation. Some of countries such as Brazil and Argentina contribute to expanding drug pipelines and cost-effective testing services. In addition, supportive government policies, innovation, and GCP-compliant study coordinators enhance patient recruitment and retention, improving trial success rates.

The clinical trial biorepository and archiving solutions market in Brazil is expected to grow over the forecast period. The country rapidly expanding due to growing clinical research, a diverse patient population, and rising pharmaceutical investments. In addition, focus on oncology, infectious diseases, and cardiology increases demand for compliant biospecimen storage and secure data archiving. Besides this, adoption of standardized biobanking, digital sample management, and regulatory oversight by ANVISA and GCP requirements further propel market growth.

Middle East and AfricaClinical Trial Biorepository and Archiving Solutions Market Trends

The Middle East & Africa are emerging as competitive regions in the clinical trial biorepository and archiving solutions market, driven by rising clinical research, healthcare investments, and interest from multinational sponsors. Saudi Arabia, UAE, South Africa, and Oman countries are emerging hubs for oncology, infectious disease, and vaccine trials, increasing demand for compliant biospecimen storage, temperature-controlled logistics, and long-term data archiving. The presence of CROs, attractive incentives, and ICH-GCP-compliant studies further drive outsourcing to specialized providers, supporting sustained market growth across the MEA region.

The South Africa clinical trial biorepository and archiving solutions market is witnessing growth due to robust research infrastructure, a diverse population, regulatory agencies, and ongoing clinical trials. Besides this, adoption of biorepository solutions enhances quality checks, analytical support, and product development. In addition, growing participation of small-scale pharmaceutical and medical device manufacturers, coupled with cost-effective trials and strategic partnerships such as Biocair’s SACRA membership further strengthens clinical research capabilities, supporting the demand for biorepository and archiving solutions and driving market growth over the forecast period.

Saudi Arabia clinical trial biorepository & archiving solutions market is driven by low-cost clinical resources, qualified investigators, and ease of patient recruitment. In addition, rising disease prevalence, technological advancements, faster regulatory approvals, and growing clinical trial partnerships-such as the King Abdullah International Medical Research Center and Flagship Pioneering collaboration further support market growth, enhancing the region’s capabilities in conducting advanced clinical trials.

Key Clinical Trial Biorepository and Archiving Solutions Company Insights

Several key players are adopting various strategic initiatives to strengthen their market position, offering clinical trial biorepository & archiving solutions for innovating various pharmaceutical vaccines and drugs. The prominent strategies companies adopt are agreements, new launches, partnerships, mergers & acquisitions/joint ventures, expansions, and others to increase market presence and revenue and gain a competitive edge, driving market growth. For instance, in November 2025, acCELLerate partnered with ATCC to deliver custom, authenticated cell banking solutions. The collaboration supported scalable master and working cell banks, increasing reliance on specialized biorepository infrastructure and cryogenic storage.

Key Clinical Trial Biorepository And Archiving Solutions Companies:

The following are the leading companies in the clinical trial biorepository and archiving solutions market. These companies collectively hold the largest Market share and dictate industry trends.

- Medpace

- American Type Culture Collection (ATCC)

- Cell&Co BioServices (Cryoport)

- Brooks Life Sciences (Azenta, Inc.)

- Patheon (Thermo Fisher Scientific, Inc.)

- Precision Medicine Group, LLC.

- Labcorp Drug Development

- Q2 Solutions

- LabConnect

- Charles River Laboratories

Recent Developments

-

In January 2025, Cryoport’s CRYOGENE partnered with Moffitt Cancer Center to establish on-campus biorepository services at Speros, accelerating cell and gene therapy research by providing integrated and secure biospecimen storage.

-

In January 2025, Azenta inagurated a new biorepository offering in Greater Boston active and archival clinical sample storage, improving same-day access, temperature flexibility, and quality-controlled management, supporting growing clinical trials.

-

In April 2024, LabConnect acquired a scientific consulting company, A4P Consulting Ltd (A4P). A4P Consulting Ltd specializes in biomarker strategy, biosample & bioanalytical project management, and logistics solutions for preclinical & clinical trials.

Clinical Trial Biorepository And Archiving Solutions Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 5.06 billion

Revenue forecast in 2033

USD 8.98 billion

Growth rate

CAGR of 8.53% from 2026 to 2033

Historical year

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, product, phase, trials/application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Oman; Qatar

Key companies profiled

Medpace; American Type Culture Collection (ATCC); Cell&Co BioServices (Cryoport); Brooks Life Sciences (Azenta, Inc.); Patheon (Thermo Fisher Scientific, Inc.); Precision Medicine Group, LLC.; Labcorp Drug Development; Q2 Solutions; LabConnect; Charles River Laboratories

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Trial Biorepository And Archiving Solutions Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global clinical trial biorepository and archiving solutions market based on service, product, phase, trials/application and region.

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Biorepository Services

-

Warehousing & storage

-

Transportation

-

Sample Processing

-

Others

-

-

Archiving Solution Services

-

Database Indexing and Management

-

Scanning & Destruction

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Preclinical Products

-

Clinical Products

-

Human Tissue

-

Organs

-

Cell Therapy

-

Stem Cell Therapy

-

Other Cell Therapy

-

-

Other biospecimens

-

-

Medical Device-Generated Digital Data

-

-

Phase Outlook (Revenue, USD Million, 2021 - 2033)

-

Preclinical

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Trials/Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Drug / Biopharmaceutical Trials

-

Cell Therapy Trials

-

Gene Therapy Trials

-

Others

-

-

Medical Device Trials

-

Self-Administered / Decentralized Trials

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global clinical trial biorepository & archiving solutions market size was estimated at USD 4.68 billion in 2025 and is expected to reach USD 5.06 billion in 2026.

b. The global clinical trial biorepository & archiving solutions market is expected to grow at a compound annual growth rate of 8.53% from 2026 to 2033 to reach USD 8.98 billion by 2033.

b. North America dominated the global clinical trial biorepository and archiving solutions market in 2025, accounting for a revenue share of 38.15%. The increase in the number of clinical trials and several market players in the region aiming to expand their existing services are further contributing to the growth of clinical trial biorepository & archiving solutions.

b. Some key players operating in the clinical trial biorepository & archiving solutions market include Medpace; American Type Culture Collection (ATCC); Cell&Co BioServices (Cryoport); Brooks Life Sciences (Azenta, Inc.); Patheon (Thermo Fisher Scientific Inc.); Precision Medicine Group, LLC.; LabCorp; Q2 Solutions; LabConnect; and Charles River Laboratories International, Inc.

b. Key factors driving the clinical trial biorepository & archiving solutions market growth include outsourcing R&D activities, the growing number of pharmaceutical and biotechnology companies, the high disease variation and prevalence rate, increasing R&D investments, and rising growth in the CRO market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.