- Home

- »

- Healthcare IT

- »

-

Clinical Risk Grouping Solution Market Size Report, 2030GVR Report cover

![Clinical Risk Grouping Solution Market Size, Share & Trends Report]()

Clinical Risk Grouping Solution Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Software, Services), By Application (Population Health Management, Chronic Disease Management), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-421-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

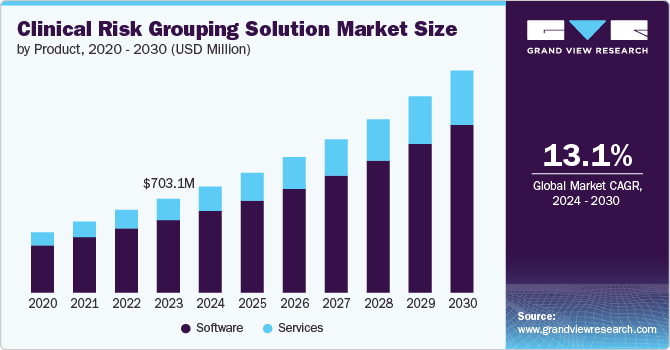

The global clinical risk grouping solution market size was estimated at USD 703.10 million in 2023 and is anticipated to grow at a CAGR of 13.13% from 2024 to 2030. The increasing prevalence of chronic diseases, the rising demand for effective population health management, the growing adoption of electronic health records (EHR), advancements in data analytics and technology, and the shift toward value-based care models collectively contribute to the need for sophisticated tools to identify high-risk patients, optimize resource allocation, and improve overall healthcare outcomes.

The increasing need for healthcare cost containment is a significant driver of the market. With the rising healthcare costs, payers and providers are looking for ways to reduce costs without compromising the quality of care. Clinical Risk Grouping Solutions help identify high-risk patients and provide targeted interventions, which can lead to cost savings. According to a Centers for Medicare and Medicaid Services (CMS) report, the projected growth rate of National Health Expenditure (NHE) at 5.6% is anticipated to surpass the average GDP growth rate of 4.3%, leading to a rise in the proportion of GDP allocated to healthcare spending. This growing expenditure may lead to an increased focus on cost containment, driving the demand for clinical risk grouping solutions.

Another significant factor is the growing emphasis on value-based care models within the healthcare industry. Unlike traditional fee-for-service models incentivizing volume over quality, value-based care focuses on delivering high-quality services that improve patient outcomes while managing costs effectively. Clinical risk grouping solutions support this shift by providing insights into patient populations’ health status and needs. Healthcare providers can customize their services to meet these individuals’ specific needs by identifying high-risk patients who may require more intensive management or intervention. This approach enhances patient satisfaction and aligns with payers’ goals to reward providers based on performance metrics rather than service quantity.

Market Characteristics & Concentration

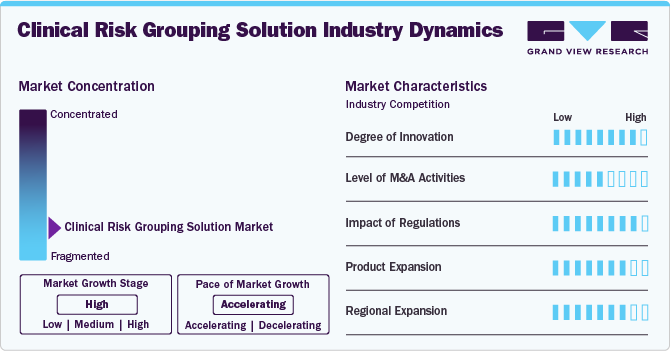

The market is experiencing a high degree of innovation, characterized by integrating advanced technologies such as artificial intelligence (AI) and machine learning (ML) to enhance data analytics capabilities. For instance, recent advancements in predictive analytics allow healthcare providers to identify high-risk patients more accurately, leading to better-targeted interventions. The ongoing focus on innovation is evident through new product launches, such as enhanced data visualization tools and risk reporting solutions, to improve clinical outcomes.

The level of merger and acquisition (M&A) activities in the market is identified to be at a medium level. Companies increasingly pursue strategic partnerships and acquisitions to expand their service offerings and enhance technological capabilities. For example, the acquisition of smaller tech firms specializing in data analytics and risk management by larger healthcare organizations is becoming common. This trend strengthens market positions and accelerates the development of integrated solutions that combine clinical risk grouping with other healthcare management tools, ultimately benefiting patient care.

The impact of regulations on the market is considered high, significantly shaping its operational landscape and compliance requirements. Regulatory bodies, such as the U.S. Centers for Medicare & Medicaid Services (CMS) and the National Committee for Quality Assurance (NCQA), impose stringent guidelines that govern risk assessment methodologies, data reporting, and quality standards. Complying with these regulations is essential for healthcare organizations to secure reimbursement and ensure the accuracy of their risk assessments.

Product expansion in the market is at a high level, with companies continuously introducing new and improved solutions to meet healthcare providers' evolving needs. The regulations governing the market profoundly impact healthcare delivery, reimbursement models, and patient outcomes. These regulations are designed to standardize the classification of patients based on their clinical risk profiles, influencing how healthcare providers are reimbursed for services rendered.

The regional expansion in the market is considered high, with significant growth opportunities emerging in Asia Pacific and Latin America. Companies are increasingly focusing on entering these markets due to the rising prevalence of chronic diseases and the need for adequate healthcare solutions. As healthcare systems in these regions evolve, the demand for clinical risk grouping solutions is expected to rise, prompting companies to expand their geographic presence and tailor their offerings to local market needs.

Product Insights

The software segment of the market held the largest revenue share, driven by increasing demand for advanced analytics and data management tools in healthcare. Software solutions enable healthcare providers to analyze vast amounts of patient data, identify high-risk individuals, and implement targeted interventions, improving patient outcomes and reducing costs. Integrating artificial intelligence (AI) and machine learning (ML) into these software solutions further enhances their capabilities, allowing for more accurate predictions and efficient healthcare delivery.

The services segment of the market is experiencing the fastest-growing CAGR due to the increasing demand for personalized healthcare, technological advancements, and a growing emphasis on value-based care. Moreover, the rising complexity of healthcare data and the need for personalized solutions to address specific organizational challenges further drive the demand for services in the market.

Application Insights

The population health management (PHM) segment held the largest revenue share, 33.20%, in 2023. The increasing emphasis on value-based care models propelled healthcare providers to adopt PHM strategies to improve patient outcomes while managing costs effectively. This shift is driven by regulatory changes and reimbursement policies that incentivize healthcare organizations to prioritize preventive care and chronic disease management.

The chronic disease management segment is estimated to record a lucrative CAGR of over 14.71% from 2024 to 2030. As healthcare systems shift towards value-based care, there is a heightened focus on preventive measures and long-term management of chronic conditions. This drives demand for innovative clinical risk grouping solutions to identify at-risk populations and tailor interventions accordingly. Additionally, technological advancements, including telehealth services and wearable health monitoring devices, facilitate continuous patient engagement and data collection, enabling healthcare providers to implement personalized care plans effectively.

End Use Insights

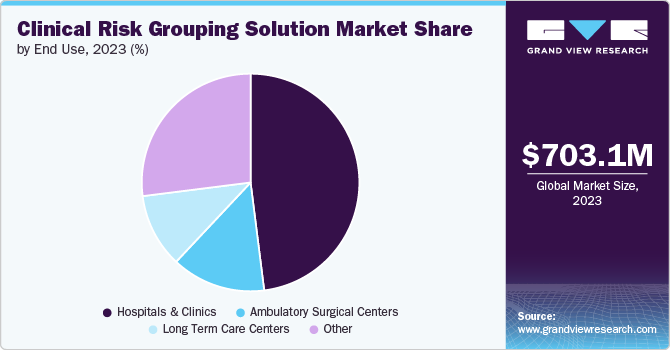

Hospital & clinics accounted for the largest revenue share of 48.30% in 2023 in the market. The increasing focus on value-based care emphasizes improved patient outcomes and cost efficiency. Hospitals and clinics leverage clinical risk grouping solutions to identify high-risk patients, allowing for targeted interventions that enhance care management and reduce healthcare costs. For instance, as healthcare costs continue to rise, the need for effective population health management solutions becomes critical. As per a WHO report, non-communicable diseases (NCDs) account for 74.0% of all deaths globally, highlighting the urgency for practical risk stratification tools in clinical settings.

The long-term care centresare estimated to record a CAGR of over 14.90% from 2024 to 2030. Technological advancements and data analytics also enabled long-term care centers to implement more effective risk assessment tools, enhancing patient outcomes and operational efficiency. For instance, facilities are increasingly adopting electronic health records (EHRs) integrated with clinical risk grouping systems to streamline patient information and improve decision-making processes.

Regional Insights

North America clinical risk grouping solutions market held the largest revenue share, primarily driven by advancements in AI and ML technologies. These innovations enable healthcare providers to analyze vast amounts of patient data more effectively, leading to improved risk stratification and management of chronic diseases. Integrating predictive analytics into clinical workflows is becoming increasingly common, allowing for proactive interventions to reduce hospital readmissions and improve patient outcomes. Moreover, regulatory changes to enhance value-based care push healthcare organizations to adopt these solutions more rapidly.

U.S. Clinical Risk Grouping Solution Market Trends

The clinical risk grouping solutions market in the U.S. is expected to experience strong growth in the coming years, driven by the rising demand for integrated healthcare solutions and the increasing adoption of EHR systems. The country's large patient population and the growing emphasis on population health management are key factors contributing to the market's expansion. Additionally, the U.S. market is witnessing the launch of innovative products and the entry of new players, further intensifying the competitive landscape. For instance, the prevalence of diabetes in the U.S. stood steadily increasing, with over 37 million Americans living with the condition as of 2022, according to the CDC.

Europe Clinical Risk Grouping Solution Market Trends

Europe clinical risk grouping solutions market is experiencing growth driven by the increasing emphasis on integrated healthcare systems and the adoption of advanced data analytics. European healthcare providers prioritize using clinical risk grouping solutions to improve patient outcomes and streamline care management. The European Union pushed for digital health initiatives, with the European Commission aiming to enhance healthcare efficiency through data-sharing frameworks. Additionally, the rise in chronic diseases, such as diabetes and cardiovascular conditions, necessitates effective risk management strategies, further propelling the demand for these solutions.

The clinical risk grouping solutions market in UK is characterized by a strong focus on innovation and integrating AI in healthcare. The National Health Service (NHS) is increasingly adopting AI-driven tools to enhance patient care and optimize resource allocation. Initiatives, such as the NHS Long Term Plan, emphasize the importance of data analytics in managing patient populations and improving health outcomes. Furthermore, the growing prevalence of chronic conditions, with over 15 million people in England living with a chronic illness as of 2024, underscores the need for effective clinical risk grouping solutions to manage these patients effectively.

France clinical risk grouping solutions market is characterized by a robust regulatory framework that encourages innovation while ensuring patient safety. The French government invested heavily in digital transformation within healthcare, aiming to create a more integrated system that utilizes electronic health records (EHRs) for better risk assessment. For instance, France unveiled a USD 710.06 million investment initiative to drive digital transformation within the healthcare sector. This funding is allocated across five key areas to effectively implement the country's digital health strategy.

Asia Pacific Clinical Risk Grouping Solution Market Trends

The clinical risk grouping solutions market in Asia Pacific witnessed a significant transformation due to an increasing focus on healthcare efficiency and patient-centered care. India and Australia invest heavily in digital health technologies to enhance clinical decision-making. The rise of telemedicine and remote monitoring solutions has also been notable, accelerating the adoption of innovative healthcare delivery models. Furthermore, there is a growing emphasis on personalized medicine and predictive analytics to manage chronic diseases effectively. For instance, AI advancements enable healthcare providers to analyze vast datasets for better risk stratification and managing diseases such as diabetes and cardiovascular conditions.

Japan clinical risk grouping solutions market witnesses a strong emphasis on innovation & technology integration in healthcare. The country has a rapidly aging population, with approximately 28.0% of its citizens aged 65 and older as of 2023, leading to a growing majority of chronic diseases. This demographic shift drives the demand for practical risk management tools to optimize healthcare delivery. Additionally, the government's commitment to improving healthcare efficiency further supports expanding these solutions in the Japanese market.

The clinical risk grouping solutions market in China experienced rapid growth due to the government's push for healthcare reform and digital transformation. The Chinese government implemented various initiatives to enhance healthcare accessibility and quality, including integrating advanced data analytics in patient management. Moreover, China's aging population is driving demand for innovative solutions to manage age-related diseases such as dementia and hypertension. As per a survey by NIH, the prevalence of chronic diseases among the national population is 81.1% (with a 95.0% confidence interval of 80.9 to 81.2), translating to approximately 179.9 million older adults in China.

Latin America Clinical Risk Grouping Solution Market Trends

Latin America clinical risk grouping solutions market experienced growth driven by increasing healthcare digitization. The government in this region is investing in digital health initiatives to improve healthcare delivery and patient outcomes. For instance, Brazil implemented the "Saúde Digital" program to enhance the use of digital technologies in healthcare. Additionally, there is a growing emphasis on chronic conditions management, particularly for diabetes and cardiovascular diseases, which are prevalent across the region.

The clinical risk grouping solutions market in Brazil is experiencing growth due to the combination of increasing chronic disease prevalence, digital transformation initiatives, technological advancements, and supportive regulations. The Brazilian government promoted technology integration in healthcare systems, including adopting clinical risk grouping solutions to improve patient care. According to an article, Digital Health is a strategy for continuously enhancing health services by providing and utilizing comprehensive, accurate, and secure information in Brazil. This approach aims to streamline and elevate healthcare quality and processes across all levels of government and the private sector, benefiting patients, citizens, healthcare professionals, managers, and health organizations.

Middle East & Africa Clinical Risk Grouping Solution Market Trends

MEA clinical risk grouping solutions market is growing due to increasing digital adaptation in healthcare and a rising focus on improving patient outcomes. Governments in the region are investing in healthcare infrastructure and technology to enhance service delivery. For instance, the UAE implemented various initiatives to integrate advanced technologies into healthcare systems. Additionally, the rise of healthcare startups focused on AI and ML technologies is noteworthy, as these innovations are incorporated into clinical risk assessments to improve predictive analytics capabilities.

The clinical risk grouping solutions market in Saudi Arabia is being shaped by the government's Vision 2030 initiative, which emphasizes the importance of digital health and improving healthcare services. This initiative aims to improve care quality by adopting innovative technologies, including clinical risk grouping solutions. Furthermore, with a growing population and rising prevalence of lifestyle-related conditions such as obesity and hypertension, there is an urgent need for effective clinical risk management strategies.

Key Clinical Risk Grouping Solution Company Insights

Several leading companies dominate a sizable portion of the market, concentrating on crafting cutting-edge solutions aimed at improving patient care and making healthcare operations more efficient. There's a noticeable shift in the market towards the adoption of sophisticated technologies, including data visualization and cloud computing, which are being progressively incorporated into healthcare infrastructures to enhance risk management and facilitate better decision-making.

Key Clinical Risk Grouping Solution Companies:

The following are the leading companies in the clinical risk grouping solutions market. These companies collectively hold the largest market share and dictate industry trends.

- Conduent Inc.

- HBI Solutions

- 3M

- Cerner (Oracle)

- Optum Inc.

- Reveleer

- Nuance Communications, Inc.

- Lightbeam

- Health Catalyst

Recent Developments

- In August 2022, Reveleer launched Risk 2.0, an AI-powered platform that automates clinical data acquisition and coding for health plans. Streamlining data collection, analysis, review, and submission enables plans to execute risk adjustment programs confidently.

Clinical Risk Grouping Solution Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 794.95 million

Revenue forecast in 2030

USD 1.67 billion

Growth Rate

CAGR of 13.13% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Conduent Inc.; HBI Solutions; 3M; Cerner (Oracle); Optum Inc.; Reveleer; Nuance Communications; Inc.; Lightbeam; Health Catalyst

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Risk Grouping Solution Market Report Segmentation

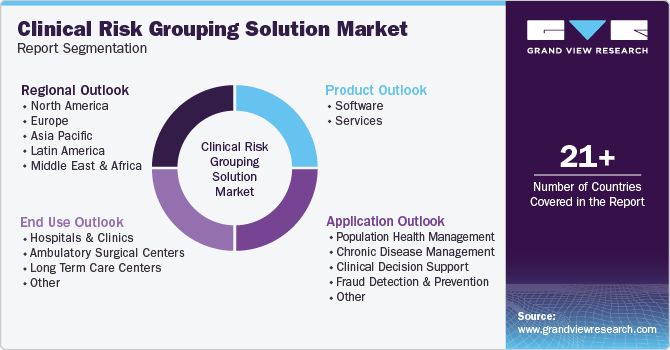

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clinical risk grouping solution market report based on product, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Private Cloud

-

Public Cloud

-

Hybrid Cloud

-

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Population Health Management

-

Chronic Disease Management

-

Clinical Decision Support

-

Fraud Detection And Prevention

-

Other

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

Long Term Care Centers

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical risk grouping solutions market was valued at USD 703.10 million in 2023 and is expected to reach USD 794.95 million in 2024.

b. The global clinical risk grouping solutions market is anticipated to grow at a compound annual growth rate (CAGR) of 13.13% from 2024 to 2030 to reach USD 1.6 billion by 2030.

b. The software segment of the clinical risk grouping solutions market held the largest revenue share, driven by increasing demand for advanced analytics and data management tools in healthcare.

b. Some key players operating in the clinical risk grouping solutions market include Conduent Inc., HBI Solutions, 3M, Cerner (Oracle), Optum Inc., Reveleer, Nuance Communications, Inc., Lightbeam, Health Catalyst.

b. Key factors driving the clinical risk grouping solutions market growth include rising implementation of big data solutions in healthcare facilities, the growing emphasis of caregivers on risk management, and the rising adoption of Artificial Intelligence (AI) and machine learning in the healthcare setups.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.