- Home

- »

- Pharmaceuticals

- »

-

Clinical Nutrition For Chronic Kidney Diseases Market Report, 2030GVR Report cover

![Clinical Nutrition For Chronic Kidney Diseases Market Size, Share & Trends Report]()

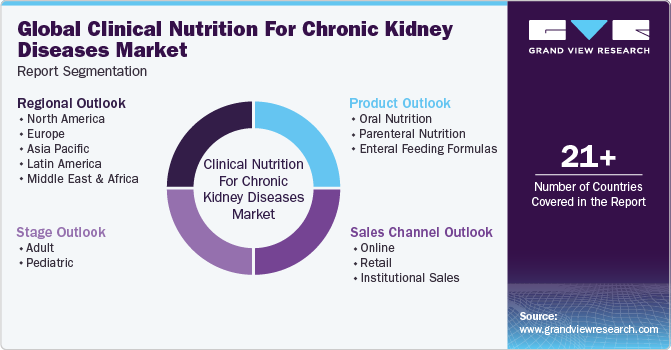

Clinical Nutrition For Chronic Kidney Diseases Market Size, Share & Trends Analysis Report By Product (Oral, Enteral Feeding Formulas, Parenteral Nutrition), By Stage, By Sales Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-281-1

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

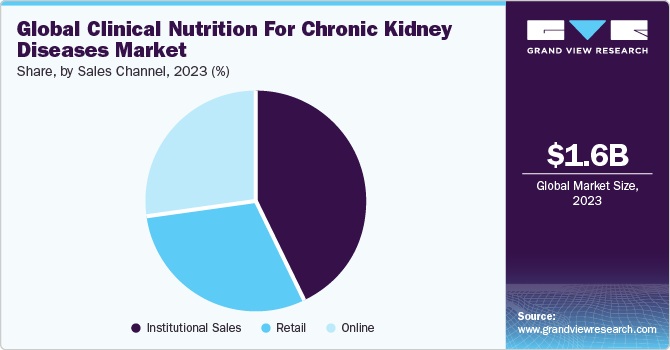

The global clinical nutrition for chronic kidney diseases market size was estimated at USD 1.57 billion in 2023 and is expected to register a CAGR of 6.03% from 2024 to 2030, owing to the increasing demand for clinical nutrition for individuals with chronic kidney diseases (CKD). CKDs pose a significant challenge, particularly in low- and middle-income countries that are ill-prepared to manage their effects. The condition has become one of the primary causes of death globally and is among the few non-communicable diseases that have seen a rise in related fatalities over the last two decades. The substantial number of people affected and the severe negative consequences of CKD necessitate increased initiatives for improved prevention and treatment.

High blood pressure and diabetes are the two most common causes of developing CKD. The rising prevalence of malnutrition among the adult population, increase in the instances of obesity, and rising chronic diseases such as cancer and diabetes are the major factors boosting the market growth. Oral clinical nutrition for CKD includes vitamins, proteins, carbohydrates in powder, liquid, and semi-solid forms. Key market players manufacturing oral clinical nutrition products are advancing them with the new flavors to enhance the taste, thereby capturing a larger customer base.

The rising awareness among the people and healthcare professionals to treat such deficiencies has increased the demand for oral clinical nutrition products. For instance, as per the NIH report of 2019, the sale of multivitamins and mineral supplements increased to 38% for adults in the U.S., which generated a revenue of USD 55.7 billion in 2020.

Unhealthy lifestyles have led to an increasing burden of health issues such as lack of nutrition, obesity, and poor immunity leading to the rise of chronic, neurological, and autoimmune diseases. In May 2022, Nestle Health Science agreed to acquire Puravida to expand the NHSc portfolio of nutrition segment in Brazil. The nutrition portfolio included minerals, herbals, and vitamins supplements, nutritional beverages using plant-based foods, aiming to enhance the nutritional content and quality of the supplements.

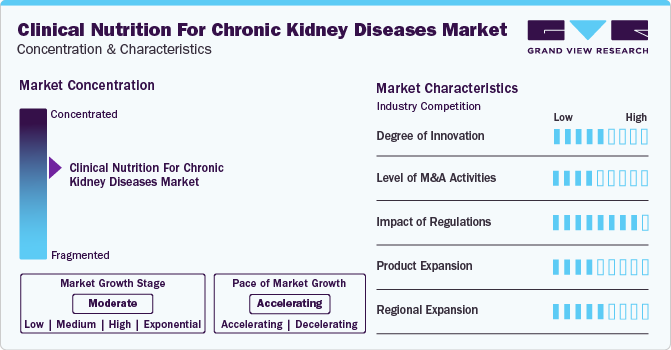

Market Concentration & Characteristics

The market growth is moderate, and the pace of market growth is accelerating. The global clinical nutrition market for CKDs is concentrated and is characterized by a moderate degree of innovation.

Research in natural compounds and nutraceuticals has expanded the scope for market growth. Some prominent examples include the use of medical foods comprising polyunsaturated fatty acids, phytosterols, and phenolic compounds. Moreover, according to a 2021 NCBI study, plant-derived compounds such as resveratrol and curcumin have been proven effective in reducing oxidative stress, thus slowing CKD progression and the consequent cardiovascular threats. For instance, in 2021, Vitaflo International Ltd. was conducting further research on its product, Renastart, which maintains nutritional balance in children with CKD.

Market participants have been involved in strategic initiatives such as mergers, collaboration, agreements, and acquisitions to expand the nutrition portfolio, propelling market growth globally. For instance, in January 2023, Baxter International Inc. unveiled a strategic plan involving spinning of their global Renal Care and Acute Therapies units into individual, publicly-traded companies, and streamlining the commercial and manufacturing footprint for their BioPharma Solutions arm. The company created this plan to drive long-term performance, enhance operational effectiveness, create value for stakeholders, and foster innovation.

To aid the proper adoption of CKD supplements, consumers and regulatory bodies follow regulatory practices in the market. Manufacturers need to adhere to varied factors associated with regulation, safety, efficacy, and consistency. For instance, in February 2023, the FDA approved the first successful oral treatment for anemia caused by CKD for adults on dialysis.

Companies in the clinical nutrition for CKDs market are expanding both globally and regionally to meet the increasing demand. The rise in CKD prevalence and higher geriatric population have increased the demand for innovative medical foods such as water-soluble vitamins. For instance, in November 2023, Bayer launched a digital patient support package in England designed to help people with type 2 diabetes look after the health of their kidneys and avoid the progression of CKD.

Product Insights

Oral clinical nutrition dominated the market in 2023, commanding over 50% of the market share. Increased preference for orally administered products, commercial viability, and supportive initiatives are key factors driving the demand for orally administered medical foods. Furthermore, the growing manufacturing of oral products in the form of pre-thickened products, powders, and pills is anticipated to fuel the segment.

Parenteral feeding formulas are expected to register the fastest growth over the forecast period. Patients with CKD might experience malnutrition and oral feeding challenges and would require parenteral nutrition as an alternative. With respect to acute or chronic renal failure, particularly for patients undergoing extracorporeal renal replacement therapies such as hemodialysis or peritoneal dialysis, parenteral nutrition may prove crucial due to the severity of the underlying condition and associated catabolism.

Stage Insights

Adults led the segment with over 85% of the market revenue share in 2023, owing to the increasing prevalence of nutritional deficiency and malnutrition among the adult population. Individuals in the adult age group may experience decreased muscle strength, vitamin, and calcium deficiencies, particularly among women over 30 years old. Furthermore, they can face apathy, weakened immunity, high blood pressure, and fatigue. These factors contribute to nutritional deficiencies within the adult population.

The adults segment is also anticipated to grow the fastest over the forecast period. According to NCBI, an estimated 843.6 million individuals affected by CKD stages 1-5 worldwide. Moreover, according to the CDC, CKD is more common in people aged 65 years or older (34%) than in people aged 45-64 years (12%) or 18-44 years (6%).Therefore, the growing incidence of CKDs worldwide underscores the importance of collaborative initiatives aimed at preventing and managing CKD and its associated complications at a global level.

Sales Channel Insights

The institutional sales segment dominated the market with over 40% revenue share in 2023. The sales channel includes commercial sales to government organizations, hospitals, and research institutes. The increased prevalence of CKDs globally contributes to a surge in patient visits to medical facilities seeking diagnosis and treatment options. Consequently, as patient awareness rises, the trend toward utilizing official hospital channels for acquiring CKD nutrition prescriptions has grown.

The online sales segment is anticipated to witness fastest growth over the forecast period. Advancements in telemedicine have enabled the global distribution of clinical nutrition products, allowing manufacturers to broaden their market reach and cater to underserved communities. Thus, online sales have surged due to the increasing customer demand for CKD supplements through various online platforms and stores.

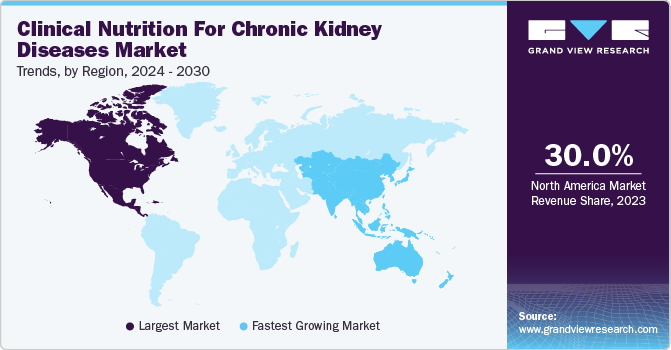

Regional Insights

North America dominated the market and accounted for over 30% of the revenue share in 2023. The growth in this region can be attributed to its well-developed healthcare infrastructure and supportive reimbursement policies. Moreover, significant public and private investments in healthcare have contributed to the market’s expansion in the area.

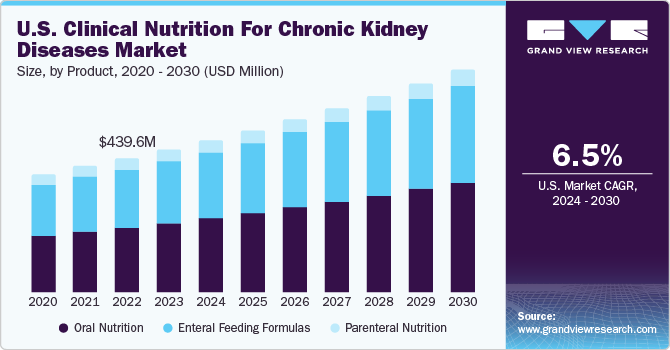

U.S. Clinical Nutrition For Chronic Kidney Diseases Market Trends

The U.S. clinical nutrition for CKDs market dominated the North American region with approximately 87% revenue share. Moreover, the country’s focus on research initiatives and its significant investment in developing supplemental alternatives has asserted its dominance in the market.

Europe Clinical Nutrition For Chronic Kidney Diseases Market Trends

Clinical nutrition for CKD market in Europe was the second-largest regional market in 2023. As per a 2022 publication by the European Parliament, Chronic Kidney Disease (CKD) imposes a substantial burden on society and individuals. According to the article, CKD affects around 100 million people, with projections indicating that it is expected to become the fifth leading cause of global mortality by 2040 in the region. Supplements for CKD in the region are regulated, mandated, and recommended by the European Society for Clinical Nutrition and Metabolism. Market growth in the region was positively impacted by the COVID-19 pandemic, and Spain, Italy, and UK were recorded to be major consumers of dietary supplements.

The UK clinical nutrition for CKD market occupied the largest revenue share in Europe and is anticipated to witness the fastest CAGR of approximately 6.5%. Lifestyle disorders such as obesity, heart disease, and obesity are anticipated to propel market growth in the country.

Germany clinical nutrition for CKD market was the second largest in Europe in 2023. It is anticipated to register lucrative growth in the Europe market over the forecast period. The country is known for its pharmaceutical prowess and high-quality standards. The German Society for Nutritional Medicine (DGEM) offers recommendations on the suitable application of vitamins and trace elements when regular enteral nutrition fails to fulfill daily requirements. In cases where supplemental parenteral nutrition becomes necessary, their guidance ensures appropriate usage.

Asia Pacific Clinical Nutrition For Chronic Kidney Diseases Market Trends

Clinical nutrition for CKD in Asia Pacific is anticipated to grow at the fastest CAGR of nearly 7% from 2024 to 2030. Moreover, Japan and China have a large elderly population, which is at a high risk of chronic conditions. Nutritional deficiencies are more common in the geriatric population, which is expected to boost the demand for medical foods in Asia Pacific. In the coming years, Asia Pacific is expected to become a crucial market due to the increasing prevalence of CKD among the elderly population and the continuous growth of healthcare infrastructure.

The clinical nutrition for CKD market in Chinadominated the market revenue share in Asia Pacific in 2023, and is expected to grow at the fastest CAGR over the forecast period. According to an NCBI systematic review and analysis, up to an estimated 434.3 million adults had CKD in Eastern, Southern, and South-Eastern Asia, with China having the highest number of people with CKD. Moreover, the presence of manufacturing facilities by major global players in the market in China has made the accessibility of CKD supplements easier.

Japan clinical nutrition for CKD market registered the second-largest revenue share in 2023 and is anticipated to witness lucrative growth over the forecast period. With the increase in per capita healthcare expenditure, patients with CKD in Japan have increased awareness concerning the nutrients required, and are thus opting for clinical nutrition supplements as self-care solutions.

Clinical nutrition for CKD market in India is anticipated to witness the fastest growth during the forecast period. Clinical nutrition is essential in India, mainly aiding diet adoption for patients with CKD. The expansion of global players in the region, such as Ajanta Pharma Limited; Hexagon Nutrition Limited; Nutricia Limited; RPG Life Sciences; Mankind Pharma Ltd.; and Nestle Health Science S.A., which manufacture and supply CKD supplements to the region, has contributed to market growth significantly.

Key Clinical Nutrition For Chronic Kidney Diseases Company Insights

The market is concentrated with global clinical nutrition companies accounting for a large share of the market. Companies in the global clinical nutrition for chronic kidney diseases market are collaborating with regional players and expanding globally to expand their services and product portfolios. Some key players operating in the global clinical nutrition for chronic kidney diseases market include Abbott Nutrition; Nestlé Health Science S.A.; Danone Nutricia.; Fresenius Kabi AG; and Mead Johnson & Company, LLC.

Companies in clinical nutrition for chronic kidney diseases market have resorted to varied strategic initiatives for sustained growth, such as mergers, collaborations, product development, and global and regional expansion. For instance, global players in the market are collaborating with local distributors and sales channels to expand their reach.

Key Clinical Nutrition For Chronic Kidney Diseases Companies:

The following are the leading companies in the clinical nutrition for CKD market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Nutrition

- Pfizer Inc.

- Bayer AG

- Nestle Health Science S.A.

- GlaxoSmithKline plc

- Baxter International Inc.

- Otsuka Holdings Co., Ltd.

- Mead Johnson & Company, LLC

- Danone Nutricia

- Victus, Inc.

Recent Developments

-

In February 2023, GlaxoSmithKline plc (GSK) announced the FDA’s approval of Jesduvroq (daprodustat), an oral hypoxia-inducible factor prolyl hydroxylase inhibitor (HIF-PHI), for the once-a-day treatment of anemia due to chronic kidney disease (CKD) in adults.

-

In February 2022, Amsino Medical Group announced FDA clearance for the PuggleEnteral Feeding Pump and Set, which is intended to deliver nutrition for both the pediatric and geriatric populations. Such initiatives will help in supporting market growth over the forecast period.

-

In October 2021, Otsuka Pharmaceutical Co., Ltd. announced submission of an initial marketing authorization application to the European Medicines Agency (EMA) for vadadustat, an investigational oral hypoxia-inducible factor prolyl hydroxylase (HIF-PH) inhibitor, for treating anemia associated with chronic kidney disease (CKD).

Clinical Nutrition For Chronic Kidney Diseases Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.67 billion

Revenue forecast in 2030

USD 2.37 billion

Growth rate

CAGR of 6.03% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, stage, sales channel, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott Nutrition; Pfizer Inc.; Bayer AG; Nestle Health Science S.A.; GlaxoSmithKline plc; Baxter International Inc.; Otsuka Holdings Co., Ltd.; Mead Johnson & Company, LLC; Danone Nutricia; Victus, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Nutrition For Chronic Kidney Diseases Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clinical nutrition for chronic kidney diseases market report based on product, stage, sales channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral Nutrition

-

Parenteral Nutrition

-

Enteral Feeding Formulas

-

-

Stage Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Pediatric

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Retail

-

Institutional Sales

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical nutrition for chronic kidney disease market size was estimated at USD 1.57 billion in 2023 and is expected to reach USD 1.67 billion in 2024

b. The global clinical nutrition for chronic kidney disease market is expected to grow at a compound annual growth rate of 6.03% from 2023 to 2030 to reach USD 2.37 billion by 2030.

b. North America dominated the clinical nutrition for chronic kidney disease market with a share of 33.8% in 2023. This is attributable to the increasing incidence of people suffering from chronic kidney disease. In addition, rising awareness about various nutritional requirements during different stages of CKD is expected to increase the demand for medical foods along with other clinical nutrition products over the forecast period.

b. Some key players operating in the clinical nutrition for chronic kidney disease market include Abbott Nutrition, Pfizer Inc., Bayer AG, Nestle, Otsuka Holdings Co., Ltd., Mead Johnson & Company, LLC, Danone S.A., Victus, Inc., etc.

b. Key factors driving the market growth include the increasing prevalence of chronic kidney disease, rising awareness of the use of clinical nutrition to treat CKD, and the availability of various clinical nutrition products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."