- Home

- »

- Pharmaceuticals

- »

-

Clinical Nutrition For Alzheimer's Disease Market Report 2030GVR Report cover

![Clinical Nutrition For Alzheimer's Disease Market Size, Share & Trends Report]()

Clinical Nutrition For Alzheimer's Disease Market Size, Share & Trends Analysis Report By Product (Oral, Enteral), By Stage (Adult, Pediatric), By Sales Channel (Online Sales Channels, Retail Sales Channel), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-327-7

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

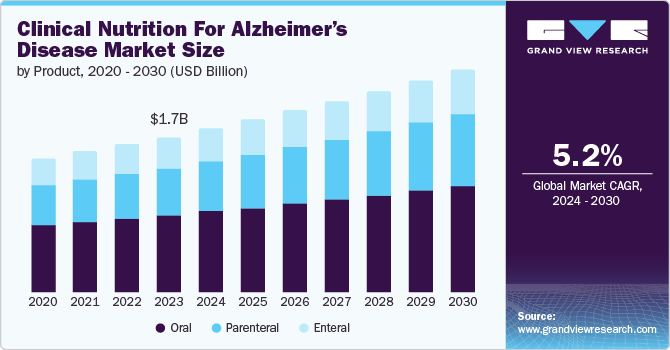

The global clinical nutrition for alzheimer's disease market size was estimated at USD 1.7 billion in 2023 and is expected to grow at a CAGR of 5.2% from 2024 to 2030. The market growth can be attributed to the increasing prevalence of Alzheimer’s and growing support from the government in the form of awareness programs. For instance, the U.S. National Plan to Address Alzheimer's Disease, launched in May 2012 as part of the National Alzheimer's Project Act (NAPA), aims to treat and prevent Alzheimer's by 2025 effectively. The plan focuses on improving care quality, including nutritional support and the use of medical foods, while promoting research and increasing public awareness & education on Alzheimer's management. Moreover, the growing R&D in dietary management of Alzheimer's patients contributes to market growth.

Alzheimer’s Disease (AD), a neurodegenerative disease, is responsible for approximately 80% of dementia incidents affecting individuals over 60 years of age. Global disease burden analysis revealed that, in 2016, AD impacted an estimated 43.8 million people worldwide, and projections suggest a surge to over 131 million by 2050, highlighting AD as a significant global health concern. Furthermore, the incidence of dementia, including AD, tends to be higher among females, with a 65-year-old woman having a 12% risk of developing AD compared to 6.3% for males. Overall, the lifetime risk of any dementia stands at 19% for women and 10.9% for men. Thus, the increasing prevalence of AD is expected to drive the demand for affordable and effective clinical nutritional products.

Moreover, the growing government support in the form of initiatives and funding is also contributing to the increasing demand for clinical nutrition in AD management. For instance, in June 2024, the National Institute on Aging (NIA) celebrated the Alzheimer's & Brain Awareness Month. The key focus of the program was to increase understanding of Alzheimer's disease within the Latino population. This included supporting individuals with dementia, their caregivers, and family members. Over the month, the NIA disseminated insights, findings, and tools related to dementia care, caregiver support, & clinical studies, making this information accessible in English and Spanish through a dedicated hashtag #NIAAlzheimers.

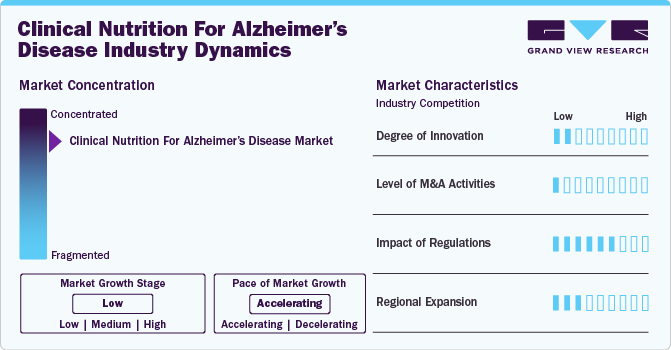

Industry Dynamics

The industry growth stage is low, and the pace of market growth is accelerating. The current trend includes increasing adoption of drugs for the management of AD. Pharmaceutical players are investing in clinical trials for drugs for managing Alzheimer's symptoms. For instance, in January 2024, Eisai Co., Ltd. and Biogen Inc. received approval in China for their humanized antisoluble aggregated amyloid-beta (Aβ) monoclonal antibody, LEQEMBI, as a treatment option for mild cognitive impairment associated with AD and mild AD dementia. Launch preparations for the drug are scheduled in the second quarter of Eisai's Fiscal Year 2024, from July 1 to September 30, 2024. However, clinical nutritional products for AD management are still emerging, as few notable players in the market offer such products. The growing awareness regarding the benefits of adopting clinical nutrition is anticipated to fuel the demand for effective & affordable products over the forecast period.

The degree of innovation is a significant factor due to advancements in scientific research, technology, and a deeper understanding of the disease. Formulations with high concentrations of Eicosapentaenoic Acid (EPA) and Docosahexaenoic Acid (DHA), essential omega-3 fatty acids with anti-inflammatory & neuroprotective properties, are being developed to support cognitive function and reduce inflammation.

Key players are implementing strategic initiatives such as mergers and acquisitions to strengthen their market presence. In March 2023, Danone acquired ProMedica, a Poland-based company that specializes in providing care services for patients in their homes. This acquisition strengthened Danone's presence in Poland through its lucrative specialized nutrition market expansion strategy.

Clinical nutrition is always mistaken for nutritional or functional foods not intended for treating any specific medical condition. In regions such as the U.S. and certain European countries, regulatory bodies clearly define clinical nutrition. However, in other parts of the world, the regulation for such products is still in progress. Most of the countries follow the Codex Alimentarius standard as the regulatory guidelines are under development. Due to ambiguous classification, the patent scenario for clinical nutrition is also unclear. These factors can hamper the growth of the clinical nutrition market.

Market players are focusing on geographic expansion to acquire untapped markets and enhance their customer base. For instance, in September 2023, Danone announced a EUR 50 million (USD 53.78 million) line expansion of its production facility at Opole, Poland, to meet the increasing demand for medical nutrition worldwide.

Product Insights

Oral clinical nutrition dominated the market with a share of 49.51% in 2023. Oral nutrition enhances cognitive function, supports overall health, and reduces symptoms like weight loss & malnutrition. It provides essential nutrients that may slow disease progression, improve quality of life, and enhance mood. Hence, the increasing demand for oral nutrition is encouraging manufacturers to develop effective oral formulas capable of reducing Alzheimer's symptoms. The parenteral clinical nutrition segment is anticipated to witness the fastest growth from 2024 to 2030. The development of technically advanced parenteral nutrition products with barcode assistance, growing preference for parenteral nutrition over Enteral Nutrition (EN) in patients, shorter hospital stays, and reduced risk of infection are some of the factors boosting product demand, thereby driving market growth. Furthermore, increasing government investment owing to growing public finances, robust institutional framework, and rising competitiveness among various global & domestic players in parenteral nutrition are a few factors driving the market growth over the forecast period.

Sales Channel Insights

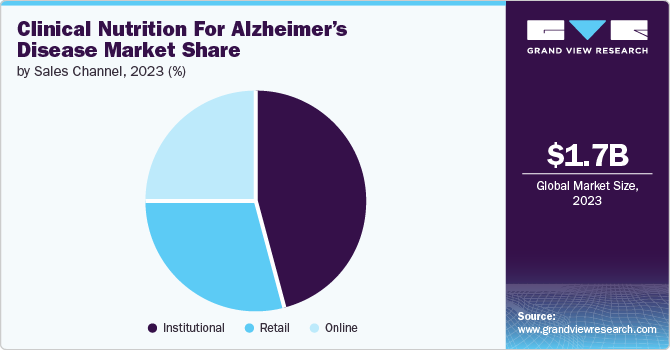

The institutional sales channel held the largest market share of 46.36% in 2023. Healthcare facilities such as hospitals, long-term care centers, hospices, and facilities for individuals with disabilities are the principal purchasers of clinical nutrition products. The buying decisions for these items are predominantly influenced by medical professionals, owing to the recommendation that their consumption occurs under medical supervision, which positions institutional sales as a key revenue driver. In addition, the segment's expansion is propelled by the increasing presence of private & public healthcare institutions worldwide and a rising patient demographic with AD. The 2023 data from the American Hospital Association indicates that 6,129 hospitals across the U.S. attend to 34,011,386 patients annually.

The online sales channel is expected to witness the fastest growth at a CAGR of 6.0% from 2024 to 2030. There is a growing inclination toward online procurement of clinical nutrition, which can be attributed to the convenience provided by e-commerce channels. A notable shift toward direct-to-consumer sales via digital platforms has been observed. Furthermore, the rise of telehealth and remote healthcare services has increased the demand for clinical nutrition products, particularly for managing AD. Online sites frequently suggest or prescribe nutritional strategies, prompting patients to utilize these platforms for acquiring prescribed clinical nutrition solutions. While these products are consumed under medical supervision, they are designed for sustained nutrition management, leading to an expansion in their e-commerce sales.

Stage Insights

The adult segment dominated the market in 2023 and is also estimated to grow at the fastest CAGR of 5.3% over the forecast period. On the basis of WHO data from March 2023, it is estimated that more than 55 million individuals globally live with dementia, with Alzheimer's accounting for 60% to 70% of these instances. The incidence is notably higher in the elderly, particularly those over 65, with a greater impact on females due to their extended longevity. While high-income nations exhibit the highest occurrence rates, rapid demographic aging is accelerating the global prevalence of Alzheimer's disease in low- and middle-income countries. In addition, the growing emphasis on developing clinical nutrition products specifically tailored to the needs of adult patients, which provide appropriate nutritional support to manage symptoms & enhance quality of life, is driving segment growth.

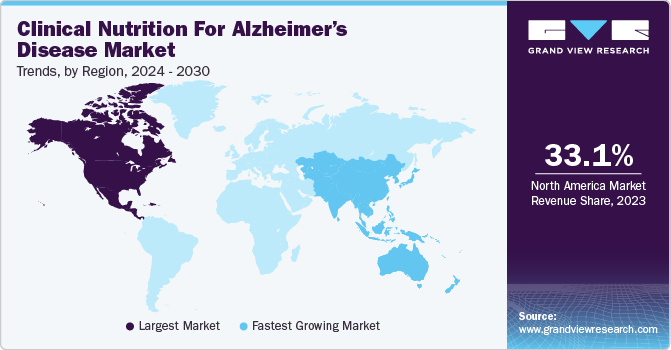

Regional Insights

The North America clinical nutrition for Alzheimer’s disease market accounted for the largest share of 33.08% in 2023. This growth can be attributed to the increasing prevalence of AD in the region. According to the Alzheimer's Association, in 2024, it is projected that approximately 6.9 million Americans aged 65 and older will be diagnosed with AD, with 73% of these individuals being 75 years of age or older. This equates to nearly 11% (1 in 9) of the population within this age group.

U.S. Clinical Nutrition For Alzheimer’s Disease Market Trends

The clinical nutrition for Alzheimer’s disease market in the U.S. is anticipated to grow at a CAGR of 5.5% over a forecast period. The country's focus on research and significant funding for creating nutritional alternatives has secured its position as a market leader. In addition, its advanced healthcare infrastructure, favorable reimbursement policies, and substantial healthcare investments from government & private entities have supported market growth in this sector.

Europe Clinical Nutrition For Alzheimer’s Disease Market Trends

The clinical nutrition for Alzheimer’s disease market in Europe is anticipated to grow at a significant CAGR over the forecast period. The growing emphasis on research and substantial financial support for developing nutritional alternatives have created growth opportunities for market players in the region. The enhanced healthcare infrastructure, supportive reimbursement policies, and significant healthcare investments by both government & private sectors contribute to market growth.

Asia Pacific Clinical Nutrition For Alzheimer’s Disease Market Trends

The clinical nutrition for Alzheimer’s disease market in Asia Pacific is anticipated to experience the fastest CAGR of 6.3% during the forecast period. The market is driven by a growing population and limited nutritional knowledge. Moreover, significant unaddressed healthcare demand, substantial direct healthcare expenditure, and an increase in purchasing power, which facilitates access to advanced healthcare technologies, are anticipated to propel the market growth during the forecast period.

Latin America Clinical Nutrition For Alzheimer’s Disease Market Trends

The clinical nutrition for Alzheimer’s disease market in Latin America held a significant share in 2023.Ongoing efforts by the government to improve healthcare and treatment access are expected to drive the market in Latin America. The increasing prevalence of AD and improving reimbursement scenarios are also key factors driving the market growth.

Middle East & Africa Clinical Nutrition For Alzheimer’s Disease Market Trends

The clinical nutrition for Alzheimer’s disease market in the Middle East and Africa held a significant share in 2023. Market growth in the region can be attributed to high economic development and the growing geriatric population. According to a joint report published by the United Nations Population Fund (UNFPA), Center for Studies on Aging (CSA), and Economic and Social Commission for Western Asia (ESCWA), the geriatric population in Arab countries is projected to grow from 4.1% in 2010 to 12% in 2050. Strategic initiatives undertaken by key providers of clinical nutrition products and increasing R&D activities are expected to propel the market growth over the forecast period.

Key Clinical Nutrition For Alzheimer's Disease Company Insights

Notable players such as Danone S.A. (Nutricia) and Pristine Organics are adopting strategies like new software launches, partnerships, geographical expansions, and mergers & acquisitions to increase their market share.

Key Clinical Nutrition For Alzheimer's Disease Companies:

The following are the leading companies in the clinical nutrition for alzheimer’s disease market. These companies collectively hold the largest market share and dictate industry trends.

- Danone S.A. (Nutricia)

- Pristine Organics

- Alfasigma USA, Inc.

Overall Prominent Participants In The Clinical Nutrition Market Include:

- Abbott Nutrition

- Pfizer Inc.

- Bayer AG

- Nestle

- Baxter International Inc.

- Otsuka Holdings Co. Ltd.

- Mead Johnson & Company LLC

- Danone (Nutricia)

- Victus Inc.

- Fresenius Kabi

- Meiji Holdings Co. Ltd.

- Abbvie (Allergan)

Recent Developments

-

In May 2024, Danone acquired Functional Formularies, a provider of whole foods tube feeding solutions in the U.S., from Swander Pace Capital. This acquisition is a strategic component of Danone's Renew Strategy, enhancing the company's medical nutrition offerings in the U.S. market by broadening its portfolio of enteral tube feeding products.

-

In January 2022, Danone launched a powder version of its medical nutrition drink, Souvenaid.

“The new innovation was developed to meet the needs of patients wanting more travel and storage friendly format and to provide a more affordable option, as price can be a barrier to purchase for patients, especially for the elderly on a basic pension. Souvenaid powder contains 12 daily serves per tin, making it a convenient format for travel and storage. It offers a more affordable option for consumers and is similar to the cost of a cup of coffee.” - Head of Innovation, Danone ANZ.

Clinical Nutrition For Alzheimer's Disease Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.8 billion

Revenue forecast in 2030

USD 2.4 billion

Growth rate

CAGR of 5.2% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, stage, sales channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.: Canada; Mexico; UK: Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India: Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Danone S.A. (Nutricia); Pristine Organics; AlfasigmaUSA, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country or regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Nutrition For Alzheimer's Disease Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clinical nutrition for Alzheimer's disease market report based on product, stage, sales channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Enteral

-

Parenteral

-

-

Stage Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Pediatric

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Sales Channels

-

Retail Sales Channel

-

Institutional Sales Channel

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical nutrition for alzheimer's disease market size was estimated at USD 1.7 billion in 2023 and is expected to reach USD 1.8 billion in 2024

b. The global clinical nutrition for alzheimer's disease market is expected to grow at a compound annual growth rate of 5.2% from 2024 to 2030 to reach USD 2.4 billion by 2030

b. North America accounted for the largest market share of 33.08% in 2023. The growth is attributed to the increasing prevalence of Alzheimer’s disease in the region. Also, the increasing focus on research and significant funding for creating nutritional alternatives, along with the advanced healthcare infrastructure and favorable reimbursement policies, is driving the market growth in North America.

b. Some of the key players operating in the clinical nutrition for alzheimer's disease market are Danone S.A. (Nutricia), Pristine Organics,etc.

b. Key factors driving the market growth are the increasing prevalence of Alzheimer’s, growing government support in the form of awareness programs, and growing R&D in the dietary management of Alzheimer's patients.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."