- Home

- »

- Medical Devices

- »

-

Clinical Chemistry Analyzers Market Size, Share Report 2030GVR Report cover

![Clinical Chemistry Analyzers Market Size, Share & Trends Report]()

Clinical Chemistry Analyzers Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Analyzers, Reagents), By Test (Basic Metabolic Panel, Electrolyte Panel), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-409-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Clinical Chemistry Analyzers Market Summary

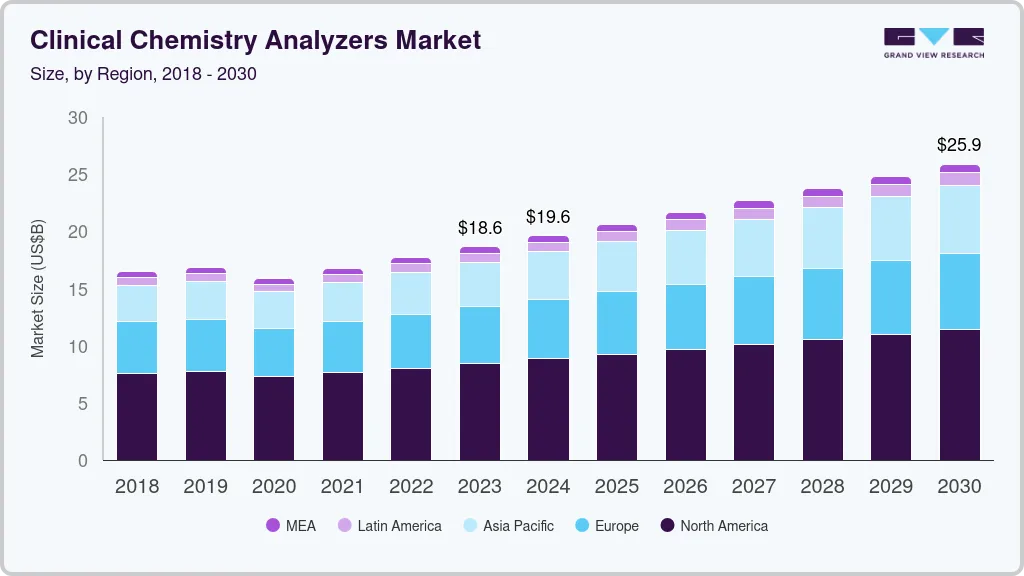

The global clinical chemistry analyzers market size was estimated at USD 18.63 billion in 2023 and is projected to reach USD 25.88 billion by 2030, growing at a CAGR of 4.7% from 2024 to 2030. The increasing prevalence of chronic diseases, such as diabetes, is predicted to be one of the high-impact drivers of this market.

Key Market Trends & Insights

- North America dominated the market with the revenue share of 35.6% in 2023.

- Asia Pacific region is anticipated to grow at the fastest CAGR during the forecast period 2024 to 2030.

- Based on product, the reagents segment led the market with the largest revenue share of 57.4% in 2023.

- Based on the test type, the basic metabolic panel (BMP) segment held a market with the largest revenue share of 29.56% in 2023.

- Based on end-use, the hospitals segment led the market in 2023 with the largest revenue share of 58.32%.

Market Size & Forecast

- 2023 Market Size: USD 18.63 Billion

- 2030 Projected Market Size: USD 25.88 Billion

- CAGR (2024-2030): 4.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

This subsequent increase in disease prevalence has triggered companies to produce advanced clinical chemistry solutions at a large scale, to aid in diagnosis. Consequently, the high need for clinical chemistry products led to unprecedented growth in new market entrants, resulting in high competition.The technological innovations in clinical chemistry products have led to early disease detection and specialized diagnosis in the areas of oncology, gynecology, & endocrinology and enabled testing on a larger scale. The advancements comprise better resolution, advanced modeling & parameter estimation, computer-assisted interpretation, improved pattern recognition, and artificial intelligence (AI).

The benefits of the abovementioned advancements and automated analyzers are automatic data acquisition, greater process control allowing real-time automation, efficient parameter monitoring, and automatic variable adjustment. These tools also offer analysis of a wide range of samples and facilitate immediate generation of results, reflecting their potential use in the intensive care unit, outpatient clinics, and emergency as well as surgical wards in the future. These benefits are estimated to drive physician preference for these solutions, thus creating high potential opportunities for growth during the forecast period.

However, one of the major restraints for laboratories, hospitals, and manufacturers in global market is the high capital investments required for these instruments which will lead to high cost of the tests, decreased affordability, and will increased the exit and entry barrier for new entrants. However, various steps are being taken to decrease the initial setup cost such as reagent rental agreements and cost-per-test which will help in a significant reduction of cost and help in growth of the market. Also, limited investments and reimbursements for these diagnostic tests and availability of cheaper diagnostic methods are expected to hinder the growth of the market.

Market Concentration & Characteristics

The market is currently experiencing a high growth stage, with an accelerating pace of expansion. This market is marked by innovation driven by technological advancements, including advanced analysis techniques. The continuous evolution in clinical chemistry analyzers is giving rise to applications, unsettling traditional approaches, and fostering the emergence of new paradigms within the healthcare industry.

The market is also characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. For instance, in July 2023 , Canon Medical Systems acquired Minaris Medical, including its subsidiaries. This move aims to enhance Canon Medical's in vitro diagnostics business by leveraging synergies between reagent technology and automated biochemical analyzer technology.

The market is also subject to increasing regulatory scrutiny. The regulatory challenges include the need to comply with stringent regulatory guidelines and quality standards. This includes implementing processes and procedures for design, manufacturing, and testing to ensure the safety and effectiveness of the analyzers.

There are a limited number of direct product substitutes for clinical chemistry analyzers. However, there are a number of substitutes for clinical chemistry analyzers including point-of-care testing devices, alternative diagnostic methods, emerging technologies such as biosensors, other laboratory analyzers, and traditional laboratory techniques depending on specific diagnostic needs and preferences.

The market sees a high degree of geographical expansion strategies, with key players such as HORIBA and Thermo Fisher Scientific employing this approach to broaden their service reach. This strategy enhances service availability across diverse geographic areas, ensuring a more extensive market presence. For instance, in September 2023 , HORIBA UK expanded its clinical chemistry portfolio with the POINTE G6PD Assay Kit for detecting Glucose-6-phosphate dehydrogenase deficiency. This enzymatic test, acquired from Pointe Scientific, streamlines G6PD testing with its 5-minute lysing step and compatibility with HORIBA's clinical chemistry analyzers. The addition aligns with HORIBA's strategy of enhancing its IVD market offerings.

Product Insights

Based on product, the reagents segment led the market with the largest revenue share of 57.4% in 2023. The substantial share is predicted to be a consequence of a wide array of reagents present in the market, catering to different requirements of clinicians. These reagents predominantly include enzymes, substrates, specific proteins, electrolytes, lipids, and others, which are imperative to obtain accurate results in analytical procedures. In addition, reagents are believed to be highly cost efficient, and possess optimum sensitivity, linearity, and precision, which thereby ensures minimized performance variation. The aforementioned benefits are predicted to be highly responsible for encouraging clinicians to use reagents for accurate diagnosis.

The analyzers segment is expected to grow the fastest CAGR over the forecast period, owing to the wide product range and extensive utilization in diagnosis of chronic diseases. Moreover, technological advancements and high R&D expenditure have resulted in development of advanced analyzers which offer advantages such as better resolution, quick diagnosis, improved point of care testing capabilities, computer assisted interpretation, and others. The above-mentioned advantages are expected to boost the analyzers market over the forecast period.

Test Insights

Based on the test type, the basic metabolic panel (BMP) segment held a market with the largest revenue share of 29.56% in 2023, owing to growing prevalence of lifestyle-induced diseases, such as obesity and other metabolic abnormalities. Rising importance of and awareness regarding point-of-care testing is also one of the key contributing factors toward the segment share. BMP comprises a set of tests that provide clinical information pertaining to problems caused by a chemical imbalance in the body to the medical examiners.

The associated benefits with this test have resulted in the high acceptance of the same, thereby widening the segment share over the years. Moreover, BMP is increasingly being used and accepted in a wide array of applications, such as in newborn screening, which facilitates early detection of congenital genetic as well as metabolic disorders. According to a research paper published in NCBI, it possesses the ability to detect 30 inherited metabolic disorders in a single dried filter paper blood spot.

End-use Insights

Based on end-use, the hospitals segment led the market in 2023 with the largest revenue share of 58.32%, owing to the high patient volume, frequent readmissions, and large sample volumes. Moreover, supportive infrastructure facilitates successful diagnostic procedures, thus resulting in a higher share of hospitals. The increasing number of government initiatives aimed at promoting efficient diagnostic facilities to generate quick results and improve overall efficiency also serves as key contributing factors to the substantial share of the segment.

In addition, in the current scenario, hospitals are increasingly inclined toward acquiring fully automated systems with built-in quality-assurance capabilities, possessing the ability to process a large number of samples. These factors are estimated to exert positive influence on segment growth. The diagnostic laboratories segment is expected to grow at fastest CAGR over the forecast period. Automated analyzers enhance efficiency, reducing turnaround times. Increasing public awareness fosters proactive health monitoring, amplifying diagnostic test volumes. Governments' emphasis on accurate diagnostics and healthcare infrastructure investments propel the adoption of advanced clinical chemistry analyzers. These factors collectively drive the growth of the segment during the forecasted period

Regional Insights

North America dominated the market with the revenue share of 35.6% in 2023, due to rising healthcare spending in country, such as the U.S. The healthcare infrastructure in the U.S. is well established, which has led to a huge adoption rate for clinical chemistry and reagents in laboratories and hospitals. Moreover, favorable healthcare reimbursement scenarios in such regions have also motivated greater penetration of automated chemistry analyzers.

The U.S. dominated the North America market in 2023 due to including the growing adoption of analyzers in healthcare settings, continuous technological advancements, and the presence of key market players. Some of the key market players include Beckman Coulter, Elitech Group, Horiba Ltd., Johnson & Johnson, Mindray Medical International Ltd., Ortho-Clinical Diagnostics, and Siemens AG. In July 2023 , Siemens Healthineers Atellica CI Analyzer received FDA clearance and is now available in major markets worldwide, marking its official launch, which is expected to boost the regional market growth. Additionally, the growing geriatric population in the U.S. is contributing to the market's growth, as the elderly population is more likely to require diagnostic tests and services.

Asia Pacific region is anticipated to grow at the fastest CAGR during the forecast period owing to the presence of a large target population and increasing penetration of leading clinical chemistry product manufacturers in countries, such as India and China. Furthermore, high R&D investment by the global players and the presence of unexplored opportunities in this region serve as high growth rendering drivers.

Japan's dominance in the Asia Pacific market is attributed to the high demand for diagnostic reagents and devices, driven by the largest aging population in the world. The increasing prevalence of chronic diseases and the need for advanced diagnostic solutions have contributed to the growth of this market in Japan. F. Hoffmann-La Roche is the leading manufacturer of clinical chemistry analyzers in Japan, further underlining the country's importance in this market.

Key Clinical Chemistry Analyzers Company Insights

Some of the leading players in the market include Thermo Fisher Scientific, Inc., F. Hoffmann-La Roche Ltd, and Abbott. Different strategies are taken by the players to strengthen their market positions. Companies are involved in expanding their market reach by signing agreements with other players in emerging economies. Product approval is another strategy adopted by these companies

Emerging players such as Shenzhen Mindray Bio-Medical Electronics Co., Ltd., and Horiba, Ltd. Are taking different strategic initiative such as collaborations & partnerships with key participants and other players in the industry to enhance their presence. Capturing niche areas of supply chain, such as distribution and delivery of products & solutions, to establish themselves.

Key Clinical Chemistry Analyzers Companies:

The following are the leading companies in the clinical chemistry analyzers market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these clinical chemistry analyzers companies are analyzed to map the supply network.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Thermo Fisher Scientific, Inc.

- Danaher Corporation (Beckman Coulter)

- Abbott

- Siemens Healthineers AG

- F. Hoffmann-La Roche Ltd

- Horiba, Ltd.

- ELITech Group

- QuidelOrtho Corporation

- Randox Laboratories Ltd.

Recent Developments

-

In July 2023 , Beckman Coulter Diagnostics receives FDA clearance for the DxC 500 AU Chemistry Analyzer, an automated system designed for small-to-medium-sized laboratories. The analyzer, featuring standardized assays, enhances clinical decision-making and patient outcomes with proven Six Sigma performance, supporting efficiency and reliability in diagnostic testing

-

In March 2023 , Thermo Fisher Scientific has completed the acquisition of The Binding Site Group for £2.3 billion (USD 2.8 billion). The addition of The Binding Site expands Thermo Fisher's Specialty Diagnostics segment, particularly in oncology testing for multiple myeloma

-

In May 2023 , Siemens Healthineers introduces the Atellica HEMA 570 and 580 Analyzers for high-volume hematology testing. These solutions feature intuitive interfaces, multi-analyzer automation connectivity, and rules-based testing to streamline workflows and provide fast and reliable results for physicians and patients

Clinical Chemistry Analyzers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 19.61 billion

Revenue forecast in 2030

USD 25.88 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Base year of estimation

2023

Historical period

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, test, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; UK; Germany; Spain; Denmark; Sweden; Norway; France; Italy; China; India; Japan; Thailand; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; Thermo Fisher Scientific, Inc.; Danaher Corporation (Beckman Coulter); Abbott, Siemens Healthineers AG; F. Hoffmann-La Roche Ltd; Horiba, Ltd.; ELITech Group; QuidelOrtho Corporation; Randox Laboratories Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Chemistry Analyzers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global clinical chemistry analyzers market report based on product, test, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Analyzers

-

Small

-

Medium

-

Large

-

Very Large

-

-

Reagents

-

Calibrators

-

Controls

-

Standards

-

Others

-

-

Others

-

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

Basic Metabolic Panel (BMP)

-

Electrolyte Panel

-

Liver Panel

-

Lipid Profile

-

Renal Profile

-

Thyroid Function Panel

-

Specialty Chemical Tests

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Academic Research Centers

-

Diagnostic Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical chemistry analyzers market size was estimated at USD 18.63 billion in 2023 and is expected to reach USD 19.61 billion in 2024.

b. The global clinical chemistry analyzers market is expected to grow at a compound annual growth rate of 4.73% from 2024 to 2030 to reach USD 25.88 billion by 2030.

b. North America dominated the clinical chemistry analyzers market with a share of 35.55% in 2023. This is attributable to rising healthcare spending in country, such as the U.S. The healthcare infrastructure in the U.S. is well established, which has led to a huge adoption rate for clinical chemistry and reagents in laboratories and hospitals.

b. Some key players operating in the clinical chemistry analyzers market include Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Thermo Fisher Scientific, Inc., Danaher Corporation (Beckman Coulter), and Abbott.

b. Key factors that are driving the market growth include increasing prevalence of chronic diseases such as diabetes, technological innovation by the key industry players, and demand for lab automation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.