- Home

- »

- Consumer F&B

- »

-

Clear Whey Protein Market Size, Industry Report, 2033GVR Report cover

![Clear Whey Protein Market Size, Share & Trend Report]()

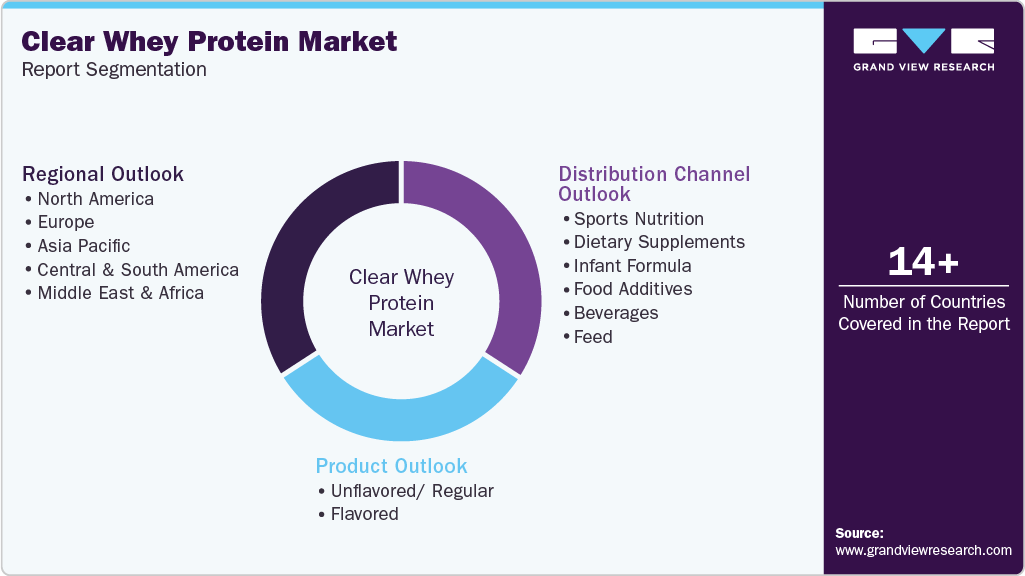

Clear Whey Protein Market (2025 - 2033) Size, Share & Trend Analysis By Product (Unflavored, Flavored), By Distribution Channel (Hypermarkets, Pharmacies & Drugstores, Specialty Stores, E-Commerce), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-369-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Clear Whey Protein Market Summary

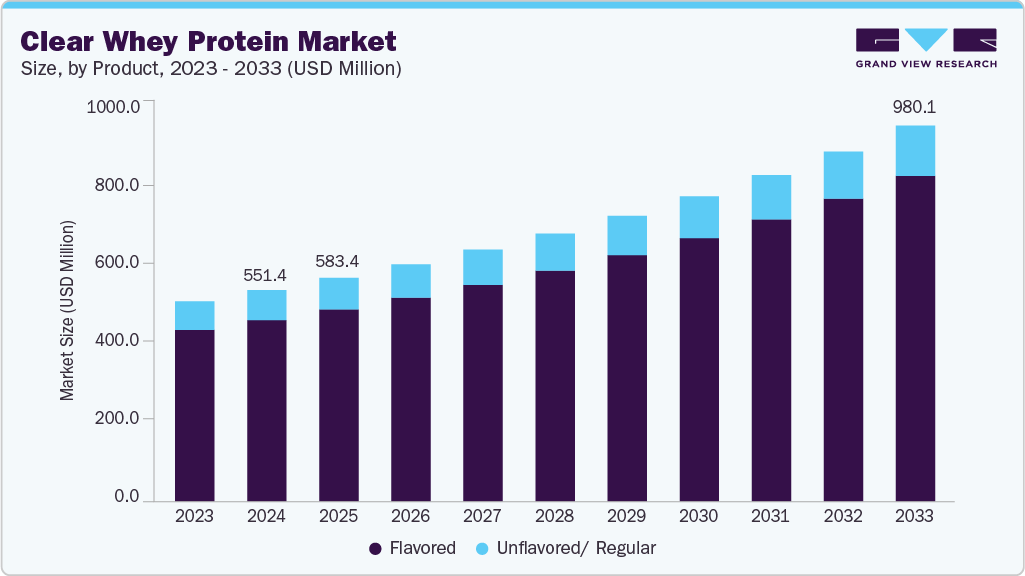

The global clear whey protein market size was estimated at USD 551.4 million in 2024 and is expected to reach USD 980.1 million by 2033, growing at a CAGR of 6.7% from 2025 to 2033. The clear whey protein market is experiencing significant growth due to increasing consumer demand for high-quality, easy-to-digest protein supplements.

Key Market Trends & Insights

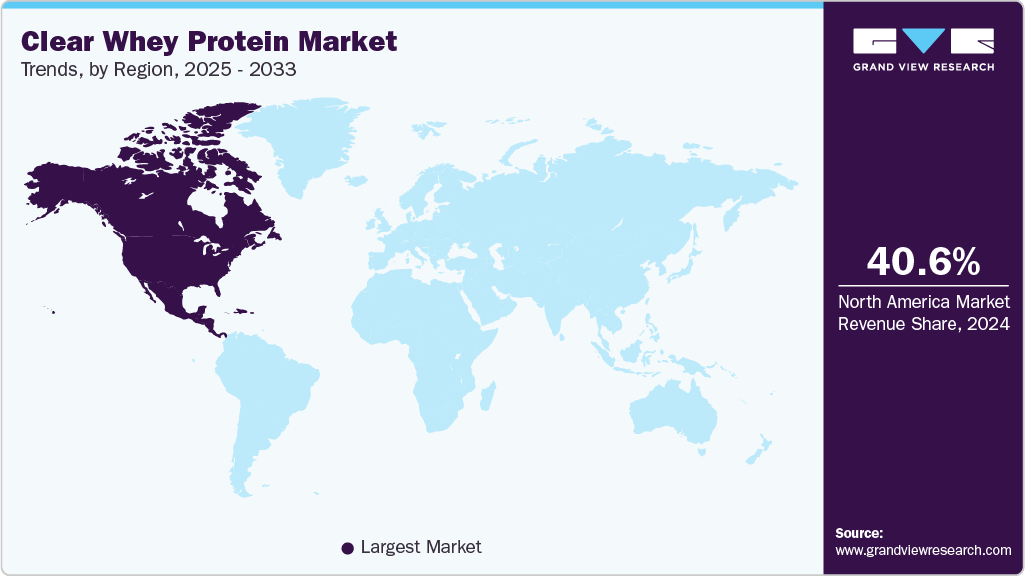

- North America led the market with a share of 40.6% in 2024.

- By product, the flavored clear whey protein market led the market and accounted for a share of 85.8% in 2024.

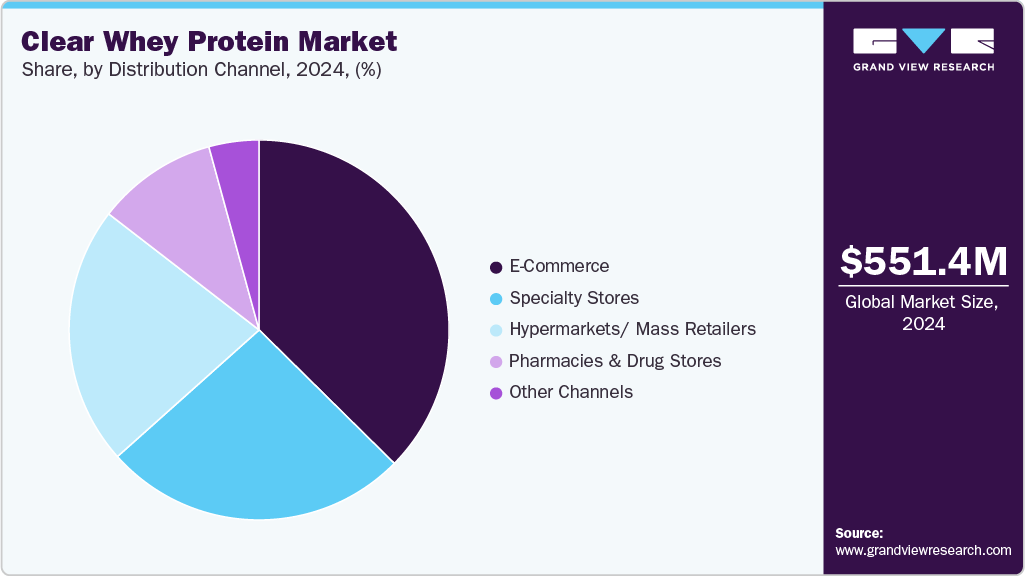

- By distribution channel, the e - e-commerce sales held a share of 37.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 551.4 Million

- 2033 Projected Market Size: USD 980.1 Million

- CAGR (2025-2033): 6.7%

Clear whey protein offers a lighter, more refreshing alternative to traditional, creamier whey protein powders, appealing to individuals who prefer a less thick and more beverage-like experience. This makes it an attractive choice for athletes, fitness enthusiasts, and health-conscious consumers looking for a convenient source of protein without the heaviness typically associated with regular protein shakes.Another key factor driving the market is the growing awareness about the benefits of whey protein in muscle recovery, weight management, and overall health. With more people adopting active lifestyles and fitness regimens, the demand for protein supplements has surged. Clear whey protein, with its superior solubility and transparent appearance, is also seen as a healthier option, as it often contains fewer calories, less fat, and less sugar compared to other protein products.

The rising popularity of transparent and clean-label products is a key factor driving the growth of the clear whey protein market. Consumers are increasingly looking for products that are simple, natural, and free from unnecessary additives, artificial ingredients, and preservatives. This trend is part of a broader shift towards health-conscious living, where individuals prioritize products with transparent labeling that clearly list all ingredients, sourcing information, and nutritional content. Clear whey protein, with its simple formulation and fewer added ingredients, aligns well with this demand, making it an appealing choice for consumers who seek a clean and transparent product. Amazon sales data shows that, in the UK alone, consumer purchases of clear protein powders increased by 216% in 2023 compared with 2022.

Additionally, the rise in fitness culture and the growing popularity of gym memberships, fitness influencers, and online workout communities have led to greater awareness of the benefits of protein supplementation, especially among active individuals. Clear whey protein, with its lighter texture and fewer calories compared to traditional whey protein powders, appeals to those who are focused on maintaining lean muscle mass without consuming unnecessary additives or excess sugar. This has helped position clear whey as a preferred choice among health-conscious consumers who prioritize both nutrition and taste.

For instance, in October 2023, Ascent Protein, a player in clean and high-quality sports nutrition products, launched its latest innovation: Clear Whey Protein Isolate. This product transforms the traditional protein beverage experience by providing a clear and refreshing alternative to typical milkshake-like drinks. Offered in two flavors-Pineapple Coconut and Orange Mango-Ascent’s Clear Whey Protein Isolate delivers 20 grams of clean, fast-digesting whey protein per serving to support muscle recovery, all while containing only 100 calories.

Consumer Demographic Insights

Product Insights

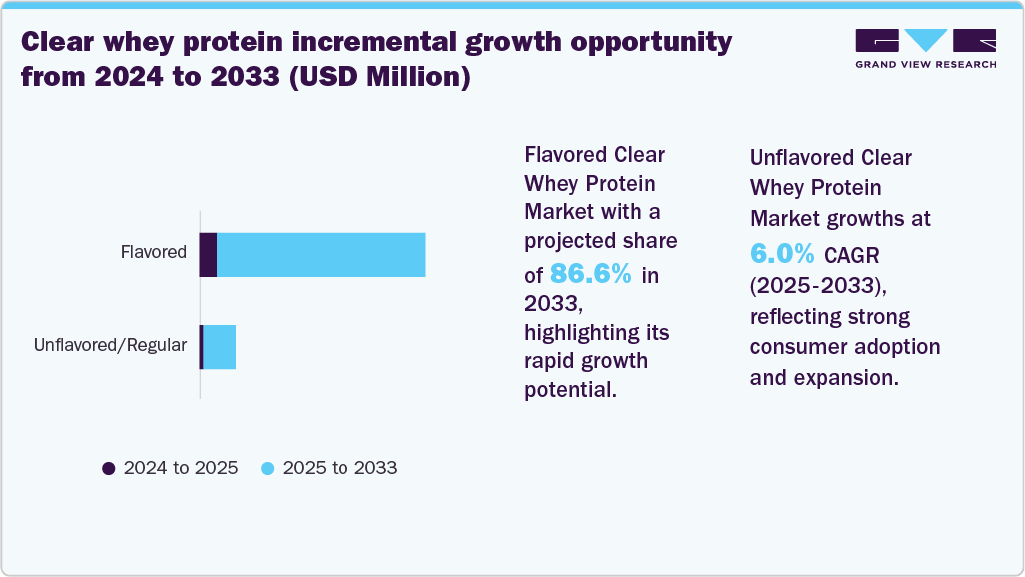

Flavored clear whey protein is the largest segment, accounting for a share of 85.8% in 2024. Flavored clear whey protein combines high-quality protein with refreshing, fruity flavors, making it a delightful way to meet daily protein needs. It is low in calories, carbs, and fat, making it ideal for individuals focused on weight management or lean muscle growth. The juice-like consistency makes it easier to consume compared to traditional creamy protein shakes, especially for those with a preference for lighter beverages. It’s rapidly absorbed, aiding in faster muscle recovery and reducing post-workout fatigue. For instance, in October 2024, Ascent Protein, a prominent brand in high-quality sports nutrition, announced Clear Whey Protein Isolate. This innovative product transforms the conventional protein shake experience by providing a clear, refreshing alternative to the traditional creamy milkshake-like options.

Unflavored clear whey protein is anticipated to witness a CAGR of 6.0% from 2025 to 2033. The unflavored clear whey protein market is driven by growing consumer demand for clean-label, allergen-free, and health-focused protein supplements with minimal contaminants and natural ingredients. For instance, WICKED Clear Whey Isolate is a Clean Label Project Certified protein, ensuring rigorous testing against over 400 contaminants, including heavy metals and pesticides. 23g of ultra-filtered whey protein isolate per serving supports muscle recovery and overall health. This all-natural, allergen-free protein is sugar-free, lactose-free, gluten-free, GMO-free, and keto-friendly, making it safe for long-term use. Designed to be such as juice, it offers a clean, refreshing, and health-focused alternative to traditional protein powders.

Distribution Channel Insights

The sales of clear whey protein through e-commerce accounted for a share of around 37.4% in 2024. E-commerce platforms offer a broader product range and detailed information, enabling informed decision-making. This accessibility and variety have made online channels a key driver in the clear whey protein market. Protyze showcases how online availability and discounts drive the online distribution channel in the clear whey protein market. Products are conveniently accessible with clear categorization, detailed descriptions, and a seamless purchasing process. Features such as flavor options, serving sizes, and nutritional breakdowns empower consumers to make informed decisions, further enhancing the appeal of online shopping. The easy navigation and quick checkout process ensure a hassle-free experience, boosting consumer preference for the online channel.

Sales of clear whey protein through hypermarkets/ mass retailers are expected to grow at a CAGR of 6.4% from 2025 to 2033. Hypermarkets and mass retailers serve as strategic distribution channels for clear whey protein due to their ability to enhance product visibility and drive consumer engagement. These stores provide prime shelf space and high foot traffic, enabling brands to showcase their products effectively to a wide audience. In addition, in-store promotions, such as discounts, product bundling, and sampling campaigns, encourage impulse purchases and create opportunities for customers to experience the product firsthand. This visibility, combined with promotional activities, helps build brand awareness, fosters customer trust, and drives sales growth in the clear whey protein market.

Regional Insights

The North America clear whey protein market accounted for a share of around 40.6% in 2024. The market is driven by the growing consumer demand for lighter, more refreshing protein supplements that align with health-conscious lifestyles and dietary preferences. According to data from Nutrition Integrated, 75% of new protein powder launches now feature clear whey protein, highlighting a significant shift in consumer preferences towards lighter, more refreshing protein supplements. This trend reflects the growing demand for alternatives to traditional milkshake-like protein drinks as consumers seek products that align with their health and lifestyle goals. The increased market share of clear whey protein indicates its rising popularity and acceptance among manufacturers and consumers. This shift is further evidenced by brands such as Ascent Protein introducing clear whey protein isolate products to meet consumer demand for light and refreshing protein beverages.

U.S. Clear Whey Protein Market Trends

The demand for clear whey protein market in the U.S. is expected to witness a CAGR of 6.3% from 2025 to 2033. In the U.S., clear whey protein manufacturers must comply with the regulations outlined by the U.S. Food and Drug Administration, particularly the Dietary Supplement Health and Education Act (DSHEA) of 1994. They must ensure that their products are not adulterated or misbranded. Manufacturers are responsible for the safety and labelling of their products before marketing. The FDA has the authority to act against products that do not meet these standards. Manufacturers must adhere to these guidelines to ensure their products are safe and accurately labeled for consumers.

Europe Clear Whey Protein Market Trends

The clear whey protein market in Europe is subject to various food safety and regulatory frameworks. The primary regulation governing food supplements, including those containing whey protein, is Directive 2002/46/EC. This directive establishes the use of vitamins and minerals in food supplements and sets out the rules for their labeling. Any nutrient or substance added to food supplements must be approved by the European Food Safety Authority (EFSA), which assesses the safety and bioavailability of ingredients. EFSA evaluates substances for their potential health risks and establishes tolerable upper intake levels (ULs) to ensure they do not pose a risk to consumers. Suppose a new substance, such as a novel whey protein formulation, is proposed for use in food supplements and has no history of safe use in the EU before 1997. In that case, it must undergo an assessment under Regulation (EC) No 2015/2283 on novel foods.

Asia Pacific Clear Whey Protein Market Trends

The Asia Pacific clear whey protein market is expected to witness a CAGR of 8.1% from 2025 to 2033. Rising consumer demand for innovative, low-sugar, and high-protein supplements with diverse flavor options to support fitness goals and muscle development drives the demand for clear whey protein in the Asia Pacific. For instance, in July 2023, Myprotein (THG Nutrition Limited) launched three new products in India that targeted the specific nutrition needs of Indian consumers. These products fall under the Clear Whey, Pre-workout, and Keventers verticals, catering to fitness enthusiasts looking to achieve their goals. The new offerings aim to supplement energy, muscle growth, and workout recovery, giving consumers more choices for their fitness routines. The Clear Whey protein range, offering 20g of protein per serving, will be available in a variety of exciting flavors, including Pineapple, Mango, Blood Orange, and Coconut.

Central & South America Clear Whey Protein Market Trends

Increasing investment in Central & South America is fueling the growth of the clear whey protein market by expanding production capacity and improving distribution channels. Companies invest in local manufacturing and strategic partnerships to enhance market reach and reduce costs. Moreover, investments in consumer education and targeted marketing are raising awareness of the benefits of clear whey protein. This growing financial commitment drives product innovation and increases availability, making it more accessible to a wider audience. In October 2023, Arla Foods invested in significantly upgrading its facility in Argentina to meet the rising demand for high-quality whey ingredients, regionally in Central & South America and globally.

Middle East & Africa Clear Whey Protein Market Trends

A rising health and fitness awareness drives the Middle East and Africa clear whey protein market. This trend is supported by increased participation in global fitness events and a growing focus on maintaining a healthy lifestyle. As a result, there is a higher demand for nutritious, high-protein products that cater to fitness enthusiasts. Clear whey protein, known for its clean taste and high protein content, aligns with this demand. In May 2024, Hyrox (Upsolut Sports GmbH) announced expansion into Africa with an event at the Cape Town Convention Centre in South Africa. This challenge included eight functional exercises combined with 1-kilometer runs, testing participants' endurance and strength.

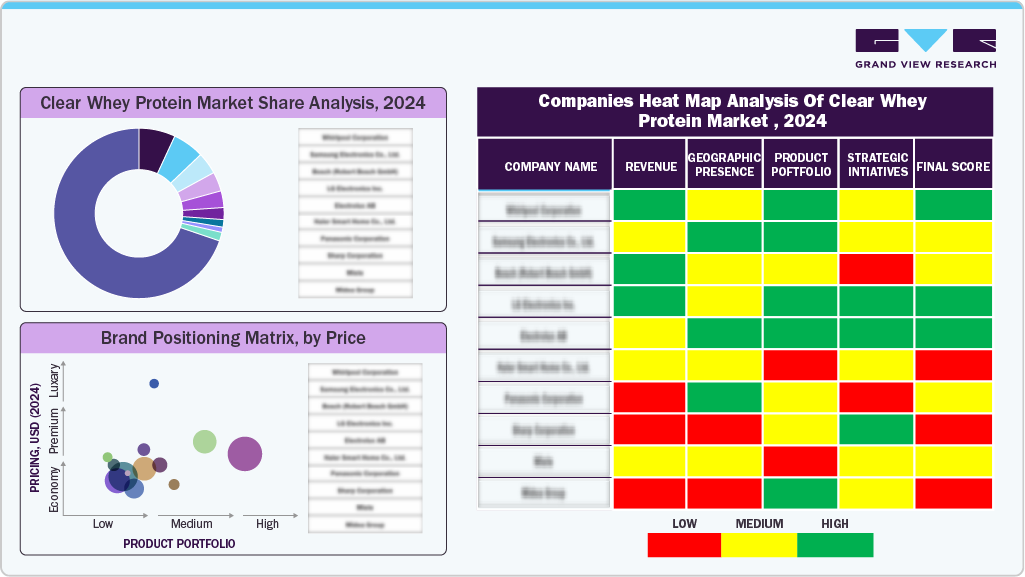

Key Clear Whey Protein Company Insights

Leading players in the clear whey protein market include Myprotein (THG Nutrition Limited), Dymatize Enterprises, LLC, and Isopure. The market remains highly competitive, with brands focusing on expanding their product reach through online and offline retail channels. Companies are investing in innovative formulation technologies to enhance solubility, taste, and absorption efficiency, catering to consumers seeking light, refreshing, and easily digestible protein options. Growing awareness about fitness, clean-label ingredients, and post-workout recovery benefits further drives demand, positioning the protein industry for strong growth in the coming years.

Key Clear Whey Protein Companies:

The following are the leading companies in the clear whey protein market. These companies collectively hold the largest market share and dictate industry trends.

- Myprotein (THG Nutrition Limited)

- Dymatize Enterprises, LLC

- Isopure

- Bulk (Sports Supplements Limited)

- Universal Nutrition

- MuscleBlaze

- MuscleTech

- NutraBio

- Evlution Nutrition

- Protyze

Recent Developments

-

In July 2024, Apollon Nutrition introduced clear whey protein in blue raspberry, kiwi strawberry, and watermelon flavors. Each 90-calorie serving provides 26.5g of whey protein isolate, yielding 22.42g of complete protein, with 0g fat and 1g carbohydrates. The product is sold in 20-serving tubs priced at USD 44.95.

-

In May 2024, SCI-MX (Supreme Imports Ltd) launched Clear Whey Protein Isolate, a post-workout supplement offering 21g of protein per serving with under 90 calories, no added sugar, and zero fat. It is available in Tropical Island Punch and Apple & Blackcurrant flavors and provides a refreshing alternative to traditional protein drinks.

-

In February 2024, Ghost LLC collaborated with YouTuber and fitness expert Sydney Cummings to launch their first clear whey protein isolate, "Summertime Punch," featuring 25g of protein per serving. This product is part of a broader lineup, including GHOST Legend, GHOST Greens, and GHOST Glow, all available in the Summertime Punch flavor.

Clear Whey Protein Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 583.4 million

Revenue Forecast in 2033

USD 980.1 million

Growth rate

CAGR of 6.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; UAE

Key companies profiled

Myprotein (THG Nutrition Limited); Dymatize Enterprises, Llc.; Isopure; Bulk (Sports Supplements Limited); Universal Nutrition; MuscleBlaze; MuscleTech; NutraBio; Evlution Nutrition; Protyze

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clear Whey Protein Market Report Segmentation

This report forecasts revenue growth at regional levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the clear whey protein market by product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million; Metric Tons, 2021 - 2033)

-

Unflavored/ Regular

-

Flavored

-

Citrus Flavors

-

Berry Flavors

-

Tropical Flavors

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million; Metric Tons, 2021 - 2033)

-

Hypermarkets/ Mass Retailers

-

Pharmacies & Drug Stores

-

Specialty Stores

-

E-Commerce

-

Other Channels

-

-

Regional Outlook (Revenue, USD Million; Metric Tons, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global clear whey protein market size was estimated at USD 551.4 million in 2024 and is expected to reach USD 583.4 million in 2025.

b. The global clear whey protein market is expected to grow at a compounded growth rate of 6.7% from 2024 to 2033 to reach USD 980.1 million by 2033.

b. Flavored clear whey protein dominated the clear whey protein market with a share of 85.8% in 2024. The consumer preference for taste and variety is expected to contribute to the popularity and adoption of the flavored clear whey protein over unflavored clear whey protein.

b. Some key players operating in clear whey protein market include Myprotein (THG Nutrition Limited); Dymatize Enterprises, Llc.; Isopure; Bulk (Sports Supplements Limited); Universal Nutrition; MuscleBlaze; MuscleTech; NutraBio; Evlution Nutrition; Protyze.

b. Key factors driving market is driven by increasing consumer demand for transparent, easily digestible protein supplements that support active lifestyles and fitness goals. Innovations in product formulation, health-conscious trends favoring cleaner nutritional options, and effective marketing strategies are key factors accelerating market growth globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.