Clear Aligners Market Size, Share & Trends Analysis Report By Age (Adults, Teens), By Material (Polyurethane, Plastic Polyethylene Terephthalate Glycol), By End-use, By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-960-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Clear Aligners Market Size & Trends

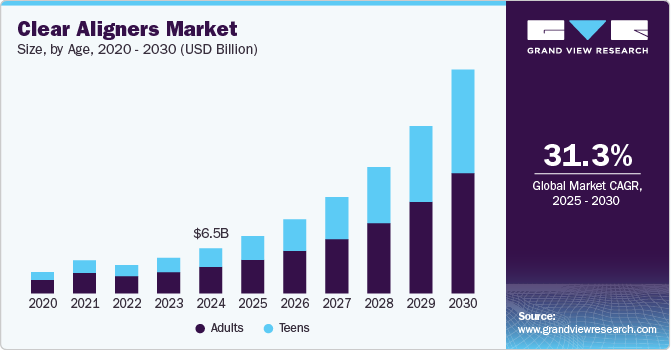

The global clear aligners market size was estimated at USD 6.49 billion in 2024 and is projected to grow at a CAGR of 31.3% from 2025 to 2030. Clear aligners are a series of tight-fitting custom-made mouthpieces or orthodontic systems that are useful in correcting misaligned or crooked teeth. Clear aligners are virtually discreet and removable alternatives to braces designed around patients’ convenience and flexibility. Factors such as the growing patient population suffering from malocclusions, rising technological advancements in dental treatment, and growing demand for customized clear aligners are driving the overall market growth.

The pandemic had a positive impact on the market globally and key players recovered with high revenues in 2020 as compared to previous years. For instance, according to Dental Tribune, Align Technology sold a record 1.6 million cases of clear aligners in 2020 as compared to 1.5 million cases in 2019. The company also stated that the adoption of Invisalign aligners by adults and teenagers increased by 36.7% and 38.7%, respectively in 2020 and the adoption of aligners among teens or younger patients was highest during the pandemic. The major factor for the growth of this market was that people were more reluctant to go to an orthodontist’s office to get traditional teeth braces, which increased the adoption of clear aligners. The advent of pandemics helped the industry prosper in terms of adoption, sales, and revenue, and this trend is expected to continue in the future.

In the advent of escalating dental disorders, advancements like 3D impression systems, additive fabrication, Nickel and Copper-Titanium Wires, digital scanning technology, CAD/CAM appliances, temporary anchorage devices, and incognito lingual braces, clear aligners are among the latest advancements that are making orthodontic treatments more efficient, predictable and effective. Dental treatments have become customized and technologies like a digital impression system like iTero by Align Technology is assisting in developing accurate and customized clear aligners systems to treat mild to moderate misalignment conditions.

These invisible aligners are developed through virtual digital models, computer-aided design (CAD-CAM), and thermoformed plastic materials like copolyester or polycarbonate plastic. Inconvenience caused by the metal and ceramic braces and the long-term gum sensitivity have caused an increased adoption of clear aligners by patients and dentists. The aligner is designed for the wearer’s comfort and is flexible. According to Dental Tribune, clear aligners technology has quickly become an increasingly popular alternative to fixed appliances for tooth straightening, since it is an aesthetically appealing and comfortable choice. Invisalign is the largest producer of clear aligners, and other brands include Clear Correct, Inman Aligner, and Smart Moves. However, factors like the high cost of clear aligners, less number of dentists in emerging areas, and limited insurance coverage for orthodontic treatments are likely to hinder the market growth.

The advent of COVID-19 was eminent on the dental market as the majority of elective procedures were postponed. As dentistry is considered an elective and high-contact service, most of the dental practices were closed. However, In the U.S., 27 states allowed dental offices to open for elective care by May 2020, and by June, around 48 states opened for elective dental care. The American Dental Association predicted spending projections to be more optimistic in the future due to resuming of dental practices and recovering patient volume. The ADA also predicted that dental expenditures will grow and bounce back completely to pre-pandemic levels or 80% of pre-pandemic volume by October 2020 or January 2021.

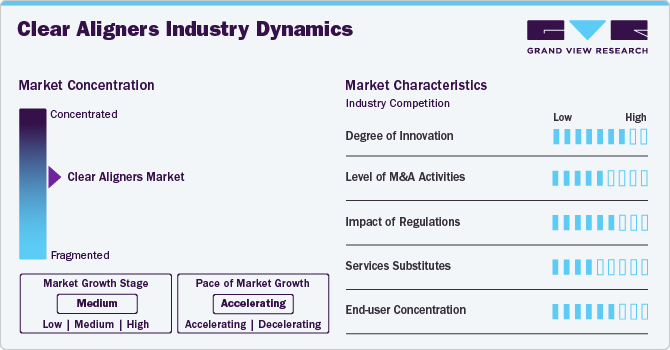

Market Characteristics & Concentration

The clear aligners market is currently in a high-growth stage with a rapidly accelerating pace of expansion. This dynamic market is marked by a notable level of innovation, largely propelled by swift technological advancements. Key factors driving this innovation include the widespread adoption of digital technologies, continuous developments in 3D printing, and an increasing demand for orthodontic solutions that blend comfort and aesthetic appeal. The surge in market growth can also be attributed to a growing awareness of dental aesthetics and a shift toward minimally invasive orthodontic treatments.

The market is also characterized by a high level of merger and acquisition (M&A) activity undertaken by the leading players. This is due to several factors, the rising focus on increasing the company’s products & services portfolio, the need to consolidate in a rapidly growing market, and the increasing strategic importance of aesthetic treatments. Several companies are undertaking this strategy to strengthen their portfolio. For instance, in October 2022, Align Technology introduced the iTERO Exocad connector for enabling doctors with advanced visualization in the field of digital orthodontics that includes the treatment of clean aligner.

The competitive landscape of the clear aligners market is vibrant, with companies actively differentiating themselves through ongoing research and development efforts. This includes advancements in material properties, aligner design, and treatment planning algorithms. Collaborations, partnerships, and strategic alliances between orthodontic companies and technology providers are becoming more prevalent, indicating the industry's commitment to sustained innovation.

Age Insights

The adults segment held the largest market share of 59.3% in 2024 and is expected to grow at a significant CAGR over the forecast period. Dental conditions such as malocclusion are widely prevalent amongst the population and apart from affecting the quality of life, it can also lead to problems such as impaired dentofacial aesthetics, disturbances of oral function, such as mastication, swallowing, and speech, and greater susceptibility to trauma and periodontal disease. Nowadays, acceptable aesthetic appearance, including dental appearance, plays a vital role in society. An increasing concern for dental appearance is seen more among the adolescent population. Aligner therapy is one of the fastest-growing areas in orthodontics, driven significantly by patients who regard it as a more comfortable, convenient, and discreet alternative to fixed appliances.

The teens segment is expected to reciprocate high growth over the forecast period. The FDA approved, Invisalign clear aligners developed by Align Technology, have been used in the treatment of 5 million people as of 2018 and worldwide Invisalign shipments to teenagers were about 87.1 thousand cases as of 2018. As per NCBI, the prevalence of Class I and Class II malocclusions are highest among the population, and the adoption of clear aligners that is effective in treating these conditions has gradually increased. This is because many teenagers prefer avoiding discomfort caused by the metal braces and also look aesthetically appealing. For these reasons, teenagers are highly opting for clear aligners to get treated for their dental conditions. To date, over 1 million teenagers have started orthodontic treatment with Invisalign clear aligners.

Material Type Insights

The polyurethane segment held the largest market share of 76.4% in 2024 owing to the presence of Invisalign clear aligners that are made of polyurethane material type. Polyurethane offers several advantages when employed as a component of an aligner. It can be used for both hard and soft parts because of its wide range of characteristics. This substance can be used to make products that are so powerful that teeth can be pushed into alignment. While still being soft enough to be worn for extended durations.

For aligners to work, it’s essential that patients keep them in and don’t remove them. These aligners also won’t get damaged from common processes such as grinding and biting. Furthermore, polyurethane (PU) PU foils are considered to offer more benefits than PETG when used for aligners production.

End-use Insights

The standalone practitioners segment held the highest market share of 52.9% in 2024 and is also reciprocating significant CAGR over the forecast period. Standalone practitioners are readily adopting clear aligners systems and are equipped with advanced digital technologies.

According to Today's RDH, a digital media company for Registered Dental Professionals, there are many benefits of choosing a private/standalone dental services and some of the benefits include a wider range of dental treatments, shorter wait times, specialist and quality service, as well as high adoption of latest equipment and quality materials for both diagnostics and treatment.

The dentistry news reported that almost half (46%) of NHS dentists are planning to move to private dentistry. In 2019, Dentistry Confidence Monitor surveyed more than 400 dentists working in NHS and in private settings and reported that 84% of private dentists were happy as they can provide the level of care they want, compared to 17% of NHS dentists. Moreover, 79% of private dentists said they could carry out their work without feeling overly stressed, compared to 8% of NHS dentists. Factors like flexibility, lesser administrative work, patient-centric customized service, and control over the practice is expected to boost the demand for standalone dental practices.

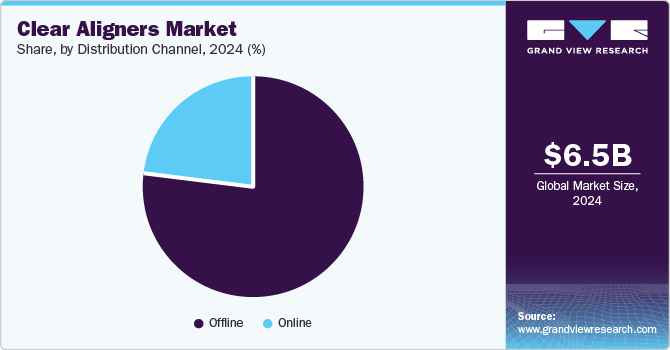

Distribution Channel Insights

The offline segment held the highest market share of 74.1% in 2024, since, Align Technology is the most dominant player in the global market, and the company carries out its sales operations solely through offline channels. Invisalign can offer discounts as high as 35%, encouraging dentists and orthodontists to actively sell as many teeth-straightening aligners as possible, which increases their per-patient profits.

However, due to the rise in the number of Direct-to-Consumer (DTC), clear aligner companies globally have resulted in high adoption of the online sales channel. SmileDirectClub, a D2C brand that operates through online channels, reported, based on one of its internal research in 2021, that its product and customer experience are competitive with Invisalign, and its products are 60% less expensive. Business-to-customer sale is the current trend in the market; however, the new trend that is gaining momentum is DTC sales. This is when the company directly sells its products to patients without a dental professional being involved. Clear aligners have become a more popular choice among consumers and expand access to treatment.

Regional Insights

North America clear aligners market dominated with a market share of 54.3% in 2024 and is expected to witness a significant CAGR over the forecast period. This is attributed to increasing R&D investments and the local presence of global players & their efforts to obtain new patents. A survey conducted by the American Dental Association stated that 85.0% of individuals in the U.S. truly value dental health and consider oral health an essential aspect of overall care. There are four million people in the U.S. wearing braces out of which 25.0% are adults and the advent of clear tray-style aligners has attracted the attention of many patients wanting to improve their smile but would prefer to avoid the metal-mouth look of braces. Factors such as increasing awareness regarding the recent development in dental hygiene, various convenient options available for treating teeth misalignment, and a surge in beauty standards have propelled people to opt for aligners , increasing the market growth in the region.

U.S. Clear Aligners Market Trends

The U.S.clear aligners market is expected to witness lucrative growth due to key factors such as rising disposable income, increasing esthetic consciousness, and presence of advanced infrastructure & technology, such as CAD/CAM software solutions & digital radiography. According to data published by the U.S Bureau of Economics in April 2020, personal income increased by USD 1.97 trillion (10.5%) and Disposable Personal Income (DPI) increased by USD 2.13 trillion. According to data published by the Bureau of Economic Analysis, in April 2022, personal income increased by USD 89.3 billion (0.4%) and Disposable Personal Income (DPI) increased by USD 48.3 billion.

Europe Clear Aligners Market Trends

Clear aligners market in Europe is the second largest contributor, holding a share of 23.1% in 2024. Key countries in the European region are Germany, the UK, Spain, France, Italy, Denmark, Sweden, and Norway. The growing importance of esthetics and improved self-confidence post-treatment are factors boosting market growth. Companies such as Dentsply Sirona have a long-established presence in the European market, especially in Germany, Sweden, France, and the UK.

UK clear aligners market is growing due to increased awareness and the societal pressure to conform to beauty standards. According to a report published by Dentaly.org in December 2023, idealized images portrayed on television and social media on the perception of perfect appearances contribute significantly to anxiety among adults in the UK about their smiles.

Clear aligners market in Germany is witnessing growth due to the easy availability of advanced dental facilities. Various factors such as growing adoption & awareness about aesthetic procedures, technological advancements, rising collaborations, availability of skilled professionals, and increasing beauty consciousness are driving the market.

Asia Pacific Clear Aligners Market Trends

APAC clear aligners market is expected to witness the highest CAGR over the forecast period due to increasing demand for clear aligners in developing economies, namely India and China. The surge is also due to the aesthetic appeal of the aligner systems. Moreover, dental tourism in India is flourishing, and according to Indian Dental Association (IDA) estimates, dental tourism constitutes more cost-effectiveness for foreign patients, shorter patient waiting time, a large pool of experienced practitioners, availability of quality accommodations, and visa-on-arrival at 14% of the total medical tourism industry.

Japan clear aligners market is considered as a major market for orthodontic treatment in Asia Pacific region. A study conducted on Japanese adolescents, published in Journal of the World Federation of Orthodontics, revealed that out of the surveyed population, 46.5% of the children had malocclusion and girls were 1.56 times more likely to develop malocclusion than boys. Such large teen patient pool is likely to boost the market growth.

Clear aligners market in China is considered one of the favorable emerging markets around the world, mainly because of its large population, low cost of manufacturing, and strong R&D in the country. Chinese contemporary culture greatly values physical appearance of women and lays strong emphasis on ideal beauty standards. Therefore, the country has become a hub for esthetic dentistry procedures, driving the market.

India clear aligners market is growing due to the introduction of innovative technologies which enhance patient compliance and treatment efficiency with reduced wear time. For instance, in September 2024, OrthoFX launched NiTime Aligners in India, introducing a revolutionary orthodontic solution that requires only 9-12 hours of daily wear compared to the typical 22 hours with conventional clear aligners. Powered by proprietary HyperElastic polymer and AirShell technology, the aligners deliver precise forces for effective tooth movement, improving patient compliance and treatment predictability.

Latin America Clear Aligners Market Trends

The Latin America clear aligners market is anticipated to grow at a CAGR of 28.4% over the forecast period. Key markets identified in Latin America are Brazil, Mexico, and Argentina. This market is expected to exhibit lucrative growth due to availability of dental cosmetic procedures at cheaper costs as compared to North America and Europe.

Brazil clear aligners market is a country with a booming medical tourism sector and affordable treatment with respect to esthetic procedures and plastic surgeries. Nowadays, millennials are very conscious of their appearance and easily adopt advanced esthetic procedures. The high prevalence of malocclusion among adolescents in Brazil, with issues such as dental crowding and severe misalignment, highlights a significant need for orthodontic treatments, driving demand for clear aligners in Brazil.

Middle Eastern Clear Aligners Market Trends

Middle Eastern countries such as the UAE and Saudi Arabia have a highly developed healthcare infrastructure and high accessibility to healthcare services. High demand for high-quality products with advanced technology and user emphasis on quality aspects are expected to be some of the key factors positively influencing the growth of the market.

Saudi Arabia clear aligner market is witnessing demand for personalized orthodontic care, driven by the increasing influence of social media and technological advancements. In December 2024, Shanghai Smartee Denti-Technology Co., Ltd. Denti-Technology expanded its presence in the Middle East by showcasing its innovative Clear Mandibular Repositioning Technology at major orthodontic events in Riyadh.

Key Clear Aligners Company Insights

Some of the key players operating in the market include Dentsply Sirona, Institut Straumann AG, Ormco Corporation (Envista), Henry Schein, Inc., Align Technology, Inc., 3M.

Institut Straumann AG is a provider of implant dentistry products. It operates its business through three segments: replacement, digital, and regenerative solutions. Furthermore, the company develops and manufactures prosthetics & dental implants essential for tooth replacement in collaboration with various leading dental clinics, research institutes, & universities.

3M is a global company that offers diversified technology in varied business segments—industrial, safety & graphics, electronics & energy, health care, and consumer goods. The company’s health care segment offers medical & surgical products, drug delivery products, skin care & infection prevention products, food safety products, health information systems, and dental & orthodontic products, among others.

Key Clear Aligners Companies:

The following are the leading companies in the clear aligners market. These companies collectively hold the largest market share and dictate industry trends.

- Align Technology

- Dentsply Sirona

- Institute Straumann

- Envista Corporation

- 3M ESPE

- Argen Corporation

- Henry Schein Inc

- TP Orthodontics Inc

- SmileDirect Club

- Angel Aligner

Recent Developments

-

In May 2023, SmileDirect Club declared the US launch of patented SmileMaker platform that will expand the technology for teeth straightening. This platform uses AI for capturing 3D scan of teeth, thus making it easier for consumers to undertake the clear aligner treatment.

-

In May 2022, Straumann Group acquired PlusDental for expanding its position in the field of consumer orthodontics, and providing clear aligner treatments to potential patients.

-

In December 2021, Henry Schein Inc. launched Studio Pro 4.0 which is a treatment planning software for clear aligners. This software allows dental practitioners to customize, visualize, and communicate plans for the treatment of clear aligner.

Clear Aligners Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 8.29 billion |

|

Revenue forecast in 2030 |

USD 32.35 billion |

|

Growth rate |

CAGR 31.3% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Market representation |

Revenue in USD million/billion & CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Age, material type, end-use, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; South America; MEA |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Brazil; Argentina; China; India; Japan; Australia; South Korea; Thailand; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Align Technology; Dentsply Sirona; Institute Straumann; Envista Corporation; 3M ESPE, Argen Corporation; Henry Schein Inc; TP Orthodontics Inc; SmileDirect Club; Angel Aligner |

|

15% free customization scope (equivalent to 5 analysts working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Clear Aligners Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the clear aligners market report based on age, material type, end-use, distribution channel, and region:

-

Age Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Teens

-

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyurethane

-

Plastic Polyethylene Terephthalate Glycol

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Stand Alone Practices

-

Group Practices

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clear aligners market size was estimated at USD 6.49 billion in 2024 and is expected to reach USD 8.3 billion in 2025.

b. The global clear aligners market is expected to grow at a compound annual growth rate of 31.3% from 2025 to 2030 to reach USD 32.35 billion by 2030.

b. North America accounted for a leading 54.26% share of the clear aligners market in 2024. Increasing R&D investment, and the presence of global players operating from the region were some of the driving factors.

b. Some key players operating in the clear aligners market include Align Technology; Dentsply Sirona; Patterson Companies Inc.; Institute Straumann; Danaher Corporation; 3M EPSE; Argen Corporation; Henry Schein Inc.; TP Orthodontics Inc.

b. Key factors that are driving the clear aligners market growth include the increasing number of patients suffering from malocclusions, the advent of technologically advanced dental treatment procedures and devices, and the growing demand for personalized clear aligners.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."