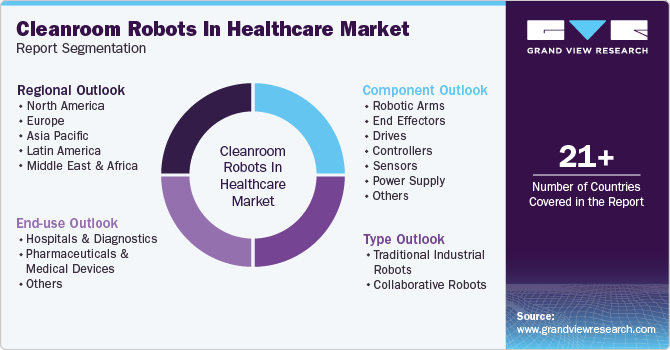

Cleanroom Robots In Healthcare Market Size, Share & Trends Analysis Report By Type (Traditional Industrial Robots, Collaborative Robots, Controllers, Sensors, Power Supply), By Component, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-915-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

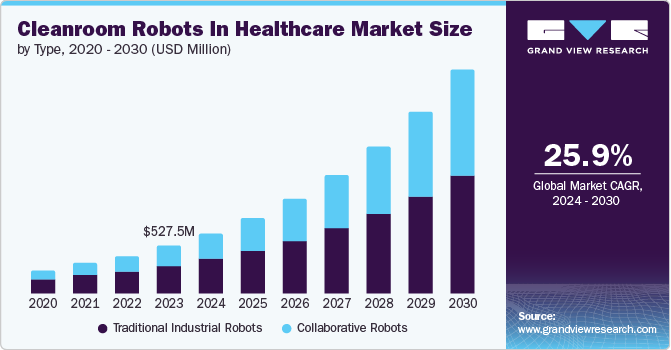

The global cleanroom robots in healthcare market size was estimated at USD 673.87 million in 2024 and is projected to grow at a CAGR of 25.68% from 2025 to 2030, due to the increasing demand for sterile and contamination-free environments in healthcare facilities, the rise of minimally invasive surgical procedures, the need for efficient cleaning and disinfection protocols, and the increasing adoption of robotic technology in healthcare. For instance, in February 2023, the OMRON, an electronics company, introduced its new i4H SCARA robots, designed specifically for electrostatic discharge ESD and cleanroom environments. These robots are optimized for use in industries such as healthcare, digital and automotive sectors, including semiconductor manufacturing.

The increasing need for high precision and consistency in medical and pharmaceutical processes drives the adoption of cleanroom robots. These robots play a critical role in ensuring contamination-free handling of products, which is essential for maintaining patient safety and the effectiveness of medical treatments. By minimizing human intervention, cleanroom robots reduce the risk of contamination and ensure a sterile environment, providing the high standards required in the healthcare and pharmaceutical industries. Their ability to consistently perform delicate and precise tasks makes them important in these settings, contributing to the quality and reliability of medical and pharmaceutical products.

In addition, advancements in robotics technology have significantly expanded the capabilities of cleanroom robots. Innovations such as enhanced sensor capabilities, improved dexterity, and AI integration have enabled these robots to perform complex tasks with greater accuracy and efficiency. Enhanced sensors allow for precise detection and manipulation of objects, while improved dexterity ensures the robots can handle delicate tasks without compromising the sterile environment. AI integration further enhances their functionality by enabling adaptive learning and decision-making processes, making these robots more versatile and reliable. For instance, in June 2022, FANUC America expanded its lineup by introducing three SCARA robot models. These new models are designed to assist companies in automating their assembly, packaging, pick and place, and inspection processes.

Furthermore, stringent regulatory requirements from global health authorities mandate the use of cleanroom environments for producing pharmaceuticals and medical devices. Cleanroom robots are crucial in maintaining these environments by minimizing human intervention, thereby reducing the risk of contamination. For instance, in September 2022, Swiss tech company SEED Biosciences announced that its pipetting robot, DISPENCELL, has received approval for use in cleanrooms and sterile environments. This adherence to regulations ensures that the highest standards of cleanliness and safety are met, which is essential for the integrity and effectiveness of medical products.

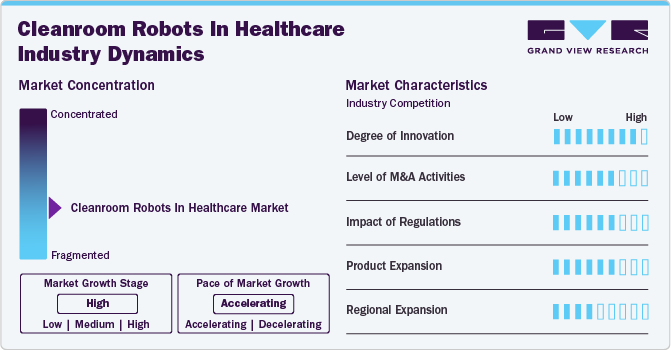

Market Concentration & Characteristics

The global cleanroom robots in the healthcare industry is characterized by a high degree of innovation. Technological advancements such as AI integration, enhanced sensor technologies, and improved dexterity are revolutionizing these robots' capabilities. These innovations enable cleanroom robots to perform complex and precise tasks with greater efficiency and reliability, minimizing human intervention and contamination risks. This continual technological progress is essential for maintaining stringent sterility standards in healthcare and pharmaceutical applications. For instance, in July 2024, ChargePoint Technology, a liquid and powder transfer specialist, introduced a new robotic material handling solution to enhance safety and efficiency in manufacturing solid dosage drugs. This solution addresses risks linked to manual intervention by mitigating ergonomic and manual handling issues while reducing the likelihood of cross-contamination from personnel.

Mergers and acquisitions (M&A) activities in the cleanroom robots in the healthcare market are currently robust. Companies are strategically acquiring or merging with others to enhance their technological capabilities, expand market reach, and integrate specialized expertise in sterile automation solutions. For instance, in October 2022, igus acquired Commonplace Robotics, a company that specializes in intuitive control systems, software, and power electronics for robotics, catering to both industrial and educational sectors. This trend reflects the sector's dynamic growth and the importance of innovation in healthcare robotics.

Regulations significantly impact the market by mandating strict sterility and contamination control standards. Compliance with these regulations drives the adoption of cleanroom robots, as they effectively minimize human intervention and contamination risks, ensuring the production of safe and high-quality medical and pharmaceutical products.

Product expansion in the market involves the introduction of advanced robotic systems tailored for sterile environments. For instance, in July 2022, Comau launched its latest six-axis articulated robot, the Racer-5SE, designed specifically for industries such as healthcare. It is certified with IP67 for ingress protection and meets high standards for cleanroom environments with ISO 5 classification (ISO 14644-1). Companies are developing robots with enhanced precision, improved contamination control features, and integration of AI for autonomous operation.

Type Insights

By type, the traditional industrial robots segment held the largest share of 58.07% in 2024, driven by key players. These companies are innovating by integrating advanced technologies such as cleanroom-compatible materials, enhanced contamination control features, and precision motion control systems. For instance, in March 2024, igus is introducing a new energy supply system tailored for SCARA robots operating in cleanroom environments. Constructed from tribologically optimized high-performance plastics, this system operates with minimal particle emission, meeting ISO Class 2 standards even during high-speed operations. These innovations cater specifically to the stringent cleanliness standards required in pharmaceutical and medical device manufacturing. Traditional industrial robots are increasingly deployed for tasks such as assembly, packaging, and handling of sensitive materials, supporting the industry's demand for reliable and efficient automation solutions in sterile environments.

The collaborative robots segment is expected to witness significant CAGR growth over the forecast period. These robots are designed to work alongside humans in sterile environments, enhancing flexibility and efficiency in medical and pharmaceutical settings. Their advanced safety features and ease of integration allow for seamless interaction with healthcare professionals, contributing to increased productivity and operational flexibility within cleanroom environments. This trend underscores the growing adoption of collaborative robotics to meet evolving healthcare industry demands.

Component Insights

By component, the robotic arms segment held the largest share of 45.02% in 2024, expanding with significant contributions from key players. These companies are driving innovation by integrating advanced features such as cleanroom-compatible materials, precision motion control, and enhanced sterilization capabilities. For instance, in April 2024, Roborock revealed the upcoming launch of its highly anticipated robotic cleaner, the S8 MaxV Ultra. Previously acclaimed at CES 2024, this advanced model has captured attention for its intelligent features. Robotic arms are increasingly utilized for critical tasks in pharmaceutical and medical device manufacturing, including precise assembly, packaging, and handling of sensitive materials. This segment's growth is fueled by the rising demand for automation solutions that ensure stringent cleanliness standards and operational efficiency in healthcare environments.

The motors segment is expected to witness significant CAGR growth over the forecast period, owing to advancements in technology. Innovations such as brushless DC motors, precision servo motors, and compact, high-efficiency designs are enhancing the performance and reliability of cleanroom robots. These advanced motors provide superior control, reduced maintenance, and lower contamination risks, which are crucial for sterile environments. Key players such as Maxon Motors and Faulhaber are leading this segment by developing motors that meet the stringent requirements of healthcare applications.

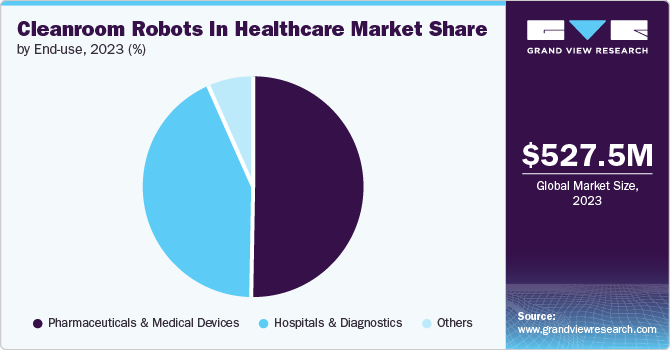

End-use Insights

By end use, the pharmaceuticals & medical devices segment held the largest market share of 50.20% in 2024, due to increased healthcare investment. This surge in funding drives the demand for automation to enhance precision, efficiency, and sterility in production processes. Cleanroom robots are essential for maintaining contamination-free environments, ensuring high-quality manufacturing standards. Consequently, key players are focusing on innovative robotic solutions to meet the stringent requirements of this expanding sector.

Hospitals & diagnostics segment is expected to grow at a fastest rate over the forecast period. This expansion is driven by the increasing need for sterile environments and precise diagnostic procedures. Cleanroom robots are crucial in hospitals for tasks such as automated medication dispensing, surgical assistance, and laboratory automation, reducing human error and contamination risks. As healthcare facilities invest in advanced technologies to improve patient care and operational efficiency, the demand for cleanroom robots in this segment continues to rise, propelling market growth.

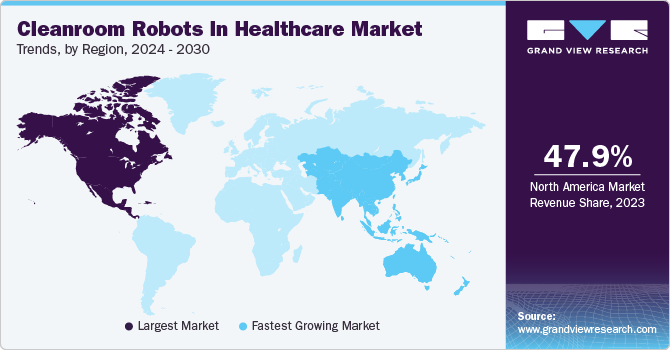

Regional Insights

North America cleanroom robots in healthcare market dominated the overall global market and accounted for the 47.54% revenue share in 2024. Strategic partnerships are pivotal in this region, as companies collaborate to enhance technological capabilities and market reach. For instance, in September 2022, iRobot Corp. launched the Roomba Combo j7+, an advanced robot vacuum and mop, accompanied by the iRobot OS 5.0 updates. This model is ideal for health centers with a mix of carpets, rugs, and hard floors, offering the convenience of both vacuuming and mopping in a single session. These alliances focus on integrating advanced robotics with healthcare processes to meet stringent regulatory standards, improve efficiency, and ensure contamination-free environments, thereby boosting the adoption of cleanroom robots in the healthcare sector.

U.S. Cleanroom Robots In Healthcare Market Trends

TheU.S. cleanroom robots in healthcare marketheld a significant share in the North America market in 2024, driven by increasing investments in healthcare automation and stringent regulatory standards. The demand for precision and contamination-free environments in medical and pharmaceutical industries significantly boosts market expansion.

Europe Cleanroom Robots In Healthcare Market Trends

The Europe cleanroom robots in healthcare market is experiencing significant growth, propelled by advancements in technology. Innovations such as AI integration, enhanced sensors, and precision control systems are improving the efficiency and reliability of cleanroom robots. These technological advancements ensure stringent contamination control, meeting the high standards required in pharmaceutical and medical device manufacturing. European companies are increasingly adopting these advanced robotic solutions to enhance productivity and maintain sterility in healthcare environments.

The UK cleanroom robots in healthcare market is one of the major markets in the European region, is experiencing considerable growth. Furthermore, rise in launches of new products, and growing adoption of these robots by healthcare and pharmaceutical organization. For instance, in August 2023, UK-based startup United Robots introduced a fleet of AI-powered industrial cleaning robots designed for large, crowded spaces. This London-based company launched its new autonomous robots to enhance the efficiency and effectiveness of industrial cleaning in expansive and busy environments. These companies leverage AI and advanced technology to enhance robotic precision, efficiency, and contamination control. Innovations include AI-driven diagnostics, real-time monitoring, and adaptive learning capabilities. These advancements ensure high standards of sterility and operational efficiency, making cleanroom robots essential in the UK's pharmaceutical and medical device industries.

Asia Pacific Cleanroom Robots In Healthcare Market Trends

The Asia Pacific cleanroom robots in healthcare market is experiencing significant growth is driven by technological advancements and substantial government initiatives. Significant investments are being made to integrate advanced robotics in healthcare settings, enhancing precision and efficiency. Moreover, the Chinese government's support for automation and smart manufacturing, along with increased funding for healthcare innovation, is driving market in this region.

The Japan cleanroom robots in healthcare market is characterized by continuous innovation. Key advancements include the integration of advanced robotics with AI for enhanced precision and efficiency in sterile environments. In addition, government initiatives aimed at promoting healthcare technology adoption, along with growing investments in AI and robotics, are further fueling market growth.

Latin America Cleanroom Robots In Healthcare Market Trends

The Latin Americacleanroom robots in healthcare marketis experiencing growing demand due to increasing requirements for sterile manufacturing environments in pharmaceutical and medical device sectors. This trend is driving adoption of cleanroom robots to ensure high standards of cleanliness and operational efficiency. Moreover, the growing recognition of robotics as a tool to address healthcare challenges is escalating the expansion of cleanroom robots in the healthcare industry.

The Brazil cleanroom robots in healthcare market is expanding with significant investments in healthcare infrastructure and shortages of healthcare resources and high demand for services are supplementing market growth. Government initiatives and funding to support the development and deployment of AI-driven healthcare technologies are further driving growth.

MEA Cleanroom Robots In Healthcare Market Trends

The cleanroom robots in healthcare market in MEA is experiencing growth. There is increasing adoption of cleanroom robots to maintain sterile environments essential for pharmaceutical and medical device manufacturing, ensuring high standards of safety and quality. In the Middle East, countries such as the UAE, Saudi Arabia, and Qatar are making substantial investments in healthcare infrastructure and technological advancements, including robotics, to improve healthcare delivery and patient care.

The Saudi Arabia cleanroom robots in healthcare market is expanding rapidly due to growing demand within the healthcare sector and increased healthcare investments. The adoption of cleanroom robots is crucial for maintaining sterile conditions in pharmaceutical and medical device manufacturing. This growth reflects the country's commitment to enhancing healthcare infrastructure and meeting stringent regulatory requirements for cleanliness and safety in healthcare settings.

Key Cleanroom Robots In Healthcare Company Insights

Key participants in the cleanroom robots in healthcare market focus on developing innovative business growth strategies through mergers and acquisitions, partnerships and collaborations, product portfolio expansions, and business footprint expansions:

Key Cleanroom Robots In Healthcare Companies:

The following are the leading companies in the cleanroom robots in healthcare market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Denso Corporation

- FANUC Corporation

- Kawasaki Heavy Industries, Ltd.

- Yaskawa Electric Corporation

- Aerotech, Inc.

- Nachi Fujikoshi Corporation

- Avidbots Corp.

- LionsBot International Pte Ltd.

Recent Developments

-

In April 2024, LionsBot International, a Singapore-based company specializing in robotic cleaning solutions, inaugurated its state-of-the-art robot factory. This facility, the largest of its kind in Southeast Asia dedicated to manufacturing and research and development of advanced cleaning robotics technology, represents a major achievement for Singapore in positioning itself as a global leader in this sector.

-

In April 2024, Avidbots, a company based in Ontario specializing in robotics, introduced Kas, a fully autonomous floor scrubber designed to cater to the retail, healthcare, and education sectors.

-

In November 2023, Syrius Technology announced a strategic partnership with SoftBank Robotics and IRIS OHYAMA to introduce a new commercial cleaning robot. This collaboration aims to enhance cleaning services with improved efficiency, convenience, eco-friendliness, and high-quality results for the public.

Cleanroom Robots In Healthcare Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 857.31 million |

|

Revenue forecast in 2030 |

USD 2,688.02 million |

|

Growth rate |

CAGR of 25.68% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast data |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, component, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

ABB Ltd.; Denso Corporation; FANUC Corporation; Kawasaki Heavy Industries, Ltd.; Yaskawa Electric Corporation; Aerotech, Inc.; Nachi Fujikoshi Corporation; Avidbots Corp.; LionsBot International Pte Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cleanroom Robots In Healthcare Market Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the cleanroom robots in healthcare market report on the basis of type, component, end-use and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Traditional Industrial Robots

-

Articulated Robots

-

SCARA Robots

-

Parallel Robots

-

Cartesian Robots

-

-

Collaborative Robots

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Robotic Arms

-

End Effectors

-

Drives

-

Controllers

-

Sensors

-

Power Supply

-

Motors

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Diagnostics

-

Pharmaceuticals & Medical Devices

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."