- Home

- »

- Plastics, Polymers & Resins

- »

-

Cleanroom Films And Bags Market Size, Share Report, 2030GVR Report cover

![Cleanroom Films And Bags Market Size, Share & Trends Report]()

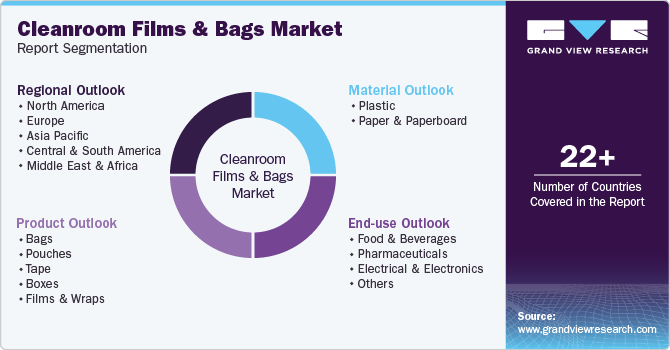

Cleanroom Films And Bags Market Size, Share & Trends Analysis Report By Product (Bags, Pouches, Tape, Boxes, Films & Wraps), By Material, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-133-0

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Cleanroom Films And Bags Market Trends

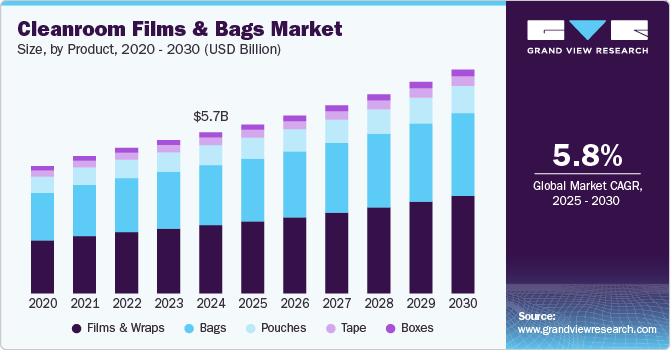

The global cleanroom films and bags market size was estimated at USD 5.71 billion in 2024 and is expected to grow at a CAGR of 5.8% from 2025 to 2030. The growing emphasis on contamination-free products and manufacturing environments in end use industries such as pharmaceuticals and food & beverage is expected to contribute to rising demand for cleanroom films and bags over the forecast period.

The cleanroom films and bags market is primarily driven by the increasing demand for contamination-free environments in industries such as pharmaceuticals, biotechnology, semiconductors, and electronics. Cleanrooms, which are highly controlled environments, require specialized packaging materials such as films and bags to ensure the sterility of components, equipment, and raw materials. As pharmaceutical production grows due to the rising demand for vaccines, biopharmaceuticals, and personalized medicine, the need for cleanroom packaging is significantly increasing. Additionally, the growing regulatory pressure for maintaining high standards of cleanliness and reducing contamination risk is pushing industries to adopt cleanroom films and bags, which offer exceptional protection.

The expanding semiconductor and electronics industries also play a crucial role in driving this market. The production of microchips and electronic components requires a pristine environment, as even minute contaminants can lead to defective products. As consumer demand for electronics rises and industries transition to more advanced technologies, such as 5G, IoT, and AI, the demand for cleanroom environments and their associated packaging, such as films and bags, is projected to increase during the forecast period.

Moreover, the global trend of miniaturization in various industries is fueling the market growth. As components become smaller and more sophisticated, they require better contamination protection, further driving the adoption of high-quality cleanroom packaging solutions. This trend is particularly relevant in healthcare, where smaller, more precise medical devices are being developed. Cleanroom films and bags that meet stringent standards ensure that these devices remain sterile and uncontaminated during manufacturing, transport, and storage.

Moreover, sustainability is becoming an important factor in the cleanroom packaging market. Companies are increasingly looking for eco-friendly options that reduce waste and environmental impact. As regulations and consumer awareness around environmental concerns grow, manufacturers of cleanroom films and bags are innovating to develop sustainable materials that meet the strict requirements of cleanroom standards while addressing ecological concerns.

Product Insights

Based on product, the global cleanroom films and bags market is segmented into bags, pouches, tape, boxes, and film & wraps. The films & wraps segment recorded the largest revenue share of over 42.0% in 2024. Cleanroom films and wraps are flexible, contamination-resistant materials used to cover surfaces or wrap equipment and products in cleanrooms. The increasing use of automation and robotics in manufacturing environments where contamination control is essential is driving the demand for cleanroom films and wraps.

Cleanroom bags are specially designed to ensure the containment and safe transportation of sensitive materials in cleanroom environments. They come in various sizes and are used for storing components, tools, and other critical materials in industries such as pharmaceuticals, electronics, and biotechnology.

Cleanroom pouches are flexible packaging products designed to provide a protective barrier for products used in cleanroom environments. These pouches are often heat-sealable and made from materials that maintain the sterility and cleanliness of their contents. The rise of e-commerce in healthcare and the growing demand for pre-packaged sterile products in hospitals and labs are boosting the usage of cleanroom pouches.

Material Insights

Based on type, the global cleanroom films & bags market is segmented into plastic and paper & paperboard. The plastic segment accounted for the largest market share of over 85.0% in 2024. This positive outlook is due to its excellent flexibility, strength, and lightweight nature. The ability of plastics to form airtight seals and resistance to chemicals further enhances their utility in cleanrooms, where stringent hygiene and protection from particulates are essential. The rising demand for electronics and healthcare applications, which require sterile environments, is further propelling the use of plastic cleanroom films and bags.

Paper and paperboard cleanroom films and bags are preferred in applications that require minimal environmental impact, as these materials are biodegradable and renewable. These are typically used for single-use packaging in cleanrooms and for applications where low particulate shedding is crucial. The paper and paperboard segment is driven by growing environmental concerns and the demand for sustainable packaging solutions.

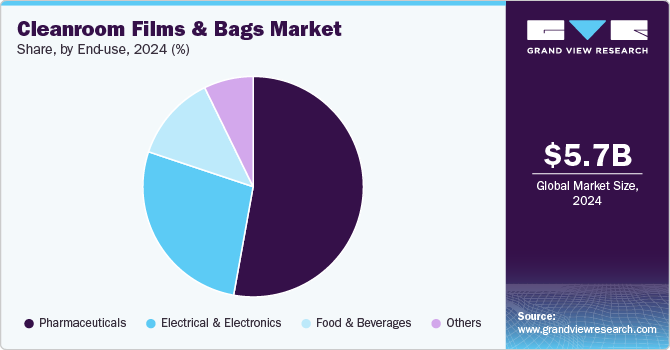

End Use Insights

Based on end use, the global cleanroom films and bags market is segmented into food & beverages, pharmaceuticals, electrical & electronics, and others. The pharmaceuticals segment recorded the largest revenue share of over 52.0% in 2024. The pharmaceuticals segment dominates the market, as these products are critical in maintaining the sterility and safety of drugs, medical devices, and sensitive biologics. The use of cleanroom films and bags ensures that pharmaceuticals are protected from contamination and degradation during production, storage, and transportation, adhering to strict regulatory standards.

In the cleanroom films and bags market, the food & beverages segment plays a crucial role due to stringent hygiene and safety standards in food processing and packaging. These materials are used to maintain sterility and prevent contamination during the handling, storage, and transportation of food products. The growth of this segment is driven by increasing consumer demand for safer, contamination-free food products. Stricter government regulations regarding food safety, especially in packaged and processed foods, also drive the need for sterile packaging solutions.

In the electrical & electronics sector, cleanroom films and bags are essential to protect sensitive components, such as semiconductors, circuit boards, and other electronic parts, from dust, static, and contamination during production and assembly. The integrity of these components is crucial for the performance and longevity of electronic devices. The growth of this segment is driven by the increasing demand for advanced electronic devices, miniaturization of components, and the rapid expansion of the semiconductor industry.

Region Insights

North America cleanroom films and bags market dominated the market and accounted for the largest revenue share of over 34.0% in 2024. The region’s dominance in the cleanroom films and bags market is primarily driven by its robust pharmaceutical and biotechnology industries. The U.S. consists of some of the largest pharmaceutical companies such as Pfizer, Johnson & Johnson, and Merck, which require extensive cleanroom facilities for drug manufacturing and research. These companies maintain stringent cleanliness standards in accordance with FDA regulations, necessitating high-quality cleanroom consumables including specialized films and bags for material handling and storage.

U.S. Cleanroom Films And Bags Market Trends

The U.S. cleanroom films and bags market is primarily driven by its robust semiconductor and electronics manufacturing industry. Companies such as Intel, Micron Technology, and Texas Instruments maintain strict cleanroom environments where specialized films and bags are essential for protecting sensitive components from contamination. For example, wafer carriers and chip packaging materials require ultra-clean storage solutions with properties such as static dissipation and particle control, making high-grade cleanroom films indispensable, thus driving the market growth in the country.

Europe Cleanroom Films And Bags Market Trends

The region's growth in this market is primarily driven by its robust pharmaceutical and biotechnology sectors, with countries such as Germany, Switzerland, and France hosting major pharmaceutical manufacturers such as Novartis, Roche, and Sanofi. These companies maintain strict cleanroom requirements for their manufacturing processes, creating substantial demand for specialized films and bags. For example, many European pharmaceutical facilities require multiple grades of cleanroom packaging materials that comply with EU GMP (Good Manufacturing Practice) guidelines, particularly for sterile manufacturing processes.

The UK cleanroom films and bags market is primarily driven by its growing semiconductor and electronics manufacturing industry, particularly in regions such as South Wales and the East of England. Companies in these regions require specialized cleanroom packaging solutions for sensitive electronic components and microchips. Additionally, the UK's emphasis on research and development, supported by institutions such as the National Physical Laboratory and numerous university research facilities, drives innovation in cleanroom material technology, leading to the development of advanced films with enhanced barrier properties and improved chemical resistance.

Asia Pacific Cleanroom Films And Bags Market Trends

Asia Pacific's competitive advantage in manufacturing costs, coupled with supportive government policies promoting high-tech industries, has attracted significant foreign investment in sectors requiring cleanroom environments. Countries such as Vietnam and Malaysia are emerging as key players in electronic component manufacturing, while Singapore is positioning itself as a biomedical hub. These developments are complemented by the region's growing focus on quality standards and regulatory compliance, particularly in Japan and South Korea. The stringent cleanliness requirements in industries such as medical device manufacturing and food processing have created sustained demand for high-quality cleanroom films and bags in these markets.

The China cleanroom films and bags market is primarily driven by its massive semiconductor and electronics manufacturing industry. Cities such as Shenzhen, Shanghai, and Suzhou host numerous high-tech manufacturing facilities that require cleanroom environments. For example, major players such as Semiconductor Manufacturing International Corporation (SMIC) and Yangtze Memory Technologies (YMTC) have significantly expanded their fabrication facilities, directly increasing the demand for cleanroom consumables including specialized films and bags.

Key Cleanroom Films And Bags Company Insights

The cleanroom films and bags market operate in a highly competitive environment characterized by the presence of several major players, who compete primarily on product quality, innovation, and compliance with stringent industry standards. Competition focuses on developing advanced materials with superior cleanliness levels, electrostatic discharge (ESD) properties, and particle control capabilities. Market players are increasingly investing in R&D to develop sustainable and recyclable materials in response to environmental concerns, while also expanding their geographic presence through strategic partnerships and acquisitions.

-

In March 2024, Cleanroom Film & Bags (CFB) announced its new CFB CleanTronics Advanced Packaging solution, specifically designed for the semiconductor and microelectronics industries. This innovative packaging aims to enhance the efficiency and performance of semiconductor devices by integrating advanced packaging techniques.

-

In January 2024, Tekni-Plex, Inc. announced an expansion of its capabilities with a new multilayer blown film manufacturing line in a cleanroom environment at its facility in Puurs, Belgium. This addition complements the existing monolayer lines that produce cleanroom bags within ISO Class 7 cleanrooms.

Key Cleanroom Films And Bags Companies:

The following are the leading companies in the cleanroom films and bags market. These companies collectively hold the largest market share and dictate industry trends.

- Cleanroom Film & Bags (CFB)

- Tekni-Plex, Inc.

- AeroPackaging, Inc.

- Fruth Custom Packaging

- Pristine Clean Bags

- Nelipak

- PPC Flex Company Inc

- Degage Corp.

- Plitek

- VWR International, LLC.

- Origin Pharma Packaging

- Cleanroom World

- Arquimea

- SteriPackGroup

View a comprehensive list of companies in the Cleanroom Films And Bags Market

Cleanroom Films And Bags Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.98 billion

Revenue forecast in 2030

USD 7.93 billion

Growth Rate

CAGR of 5.8% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, material, end use, region

States scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; South Korea; Southeast Asia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Cleanroom Film & Bags (CFB); Tekni-Plex, Inc.; AeroPackaging, Inc.; Fruth Custom Packaging; Pristine Clean Bags; Nelipak; PPC Flex Company Inc; Degage Corp.; Plitek; VWR International, LLC.; Origin Pharma Packaging; Cleanroom World; Arquimea; SteriPackGroup

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cleanroom Films And Bags Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cleanroom films and bags market report based on product, material, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bags

-

Pouches

-

Tape

-

Boxes

-

Films & Wraps

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyamide (PA)

-

Others (PS, PVC, EVA)

-

-

Paper & Paperboard

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Pharmaceuticals

-

Electrical & Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global cleanroom films and bags market was estimated at around USD 5.71 billion in the year 2024 and is expected to reach around USD 5.98 billion in 2025.

b. The global cleanroom films and bags market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2030, reaching around USD 7.93 billion by 2030.

b. Pharmaceuticals emerged as a dominating end-use industry, with a value share of around 52.8% in 2024, owing to the continuous development and manufacturing of pharmaceutical drugs and biologics, which is fueling the demand for cleanroom packaging.

b. The key market players in the cleanroom films and bags market include CFB Cleanroom Film and Bags, Tekni-Plex, Inc., AeroPackaging, Inc., Fruth Custom Packaging, Pristine Clean Bags, Nelipak Corporation, PPC Flexible Packaging LLC, Degage Corp., Plitek, and Production Automation Corporation.

b. The healthcare industry, including pharmaceutical and medical device manufacturing, requires cleanroom packaging to ensure the sterility and integrity of products. With the global healthcare sector expanding due to an aging population and increased healthcare spending, the demand for cleanroom films & bags is on the rise.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."