- Home

- »

- Medical Devices

- »

-

Cleanroom Equipment Market Share & Growth Report, 2030GVR Report cover

![Cleanroom Equipment Market Size, Share & Trends Report]()

Cleanroom Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Equipment (HVAC, Cleanroom Air Filters), By Type Of Cleanroom, By End-use (Compounding & Manufacturing Pharmacies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-045-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

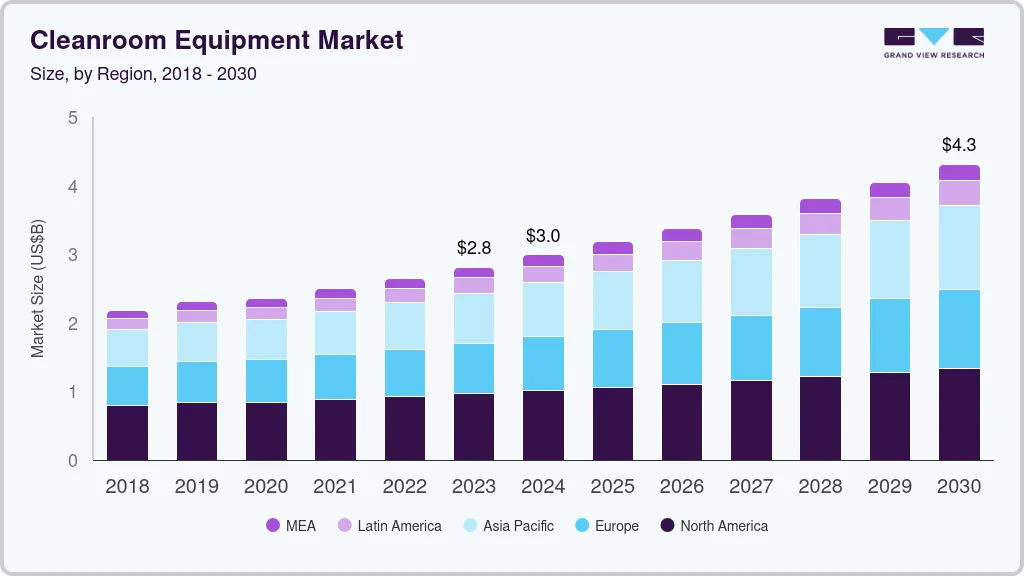

The global cleanroom equipment market size was valued at USD 2.8 billion in 2023 and is projected to reach USD 4.3 billion by 2030, growing at a compound annual growth rate (CAGR) of 6.3% from 2024 to 2030. Cleanroom equipment is specifically engineered and designed to prevent pollution and contamination of highly sensitive cleanroom environments. Cleanrooms are majorly classified based on their size and the amount of particulate matter allowable per volume of air. Regulatory standards, such as ISO Standard, British Standard 5295, Federal Standard 209, and Pharmaceutical Cleanroom Classifications, are used for classifying various types of cleanrooms. Moreover, there has been an increase in the need for standardizing cleanroom classifications due to the presence of a wide range of classifications used by different countries, owing to which the International Standards Organization has established standardized classifications.

Increased demand for cleanroom technology in manufacturing units across several industries is one of the key reasons projected to fuel industry growth over the forecast period. Various sources of contamination, such as product flow, raw materials, machinery, and personnel, are likely to contaminate the overall production cycle, which may result in the contamination of the end product.

The growing adoption of cleanroom technology is expected to ensure the sterility of the final product and the overall manufacturing processes. Cleanroom technology is one of the integral parts of the biotechnology and healthcare industries. The rising number of healthcare and biotechnology companies is positively impacting the market growth. For instance, as per IBEF, in India, the startup registrations of biotech companies have increased, with around 1,128 new startups registered in 2021, which is the highest in a single year since 2015. High commercial availability of raw materials for developing cleanrooms and a smaller number of joints & seams to reduce biological contamination are some of the advantages of conventional cleanroom constructions.

Moreover, the availability of fire-resistant cleanrooms and a wide range of finishing products, such as epoxy, fire-reinforced plastics, & vinyl sheeting with heat-molded steams, are some of the other considerable advantages of conventional cleanroom constructions. In addition, recent advances in cleanroom design include computer-aided engineering for placement and process mapping. This helps maximize workflow and equipment efficiency and extends the life of the equipment. Moreover, it can reduce worker fatigue, minimize errors, and increase yield, thereby resulting in higher production. Thus, technological advancements in cleanrooms are anticipated to boost the market over the forecast period.

In recent years, the incidence of healthcare-Acquired Infections (HAIs) has increased. As per the WHO, out of every 100 patients in acute care hospitals, 15 patients in middle- and low-income countries and 7 patients in high-income countries will be affected with at least one HAI during their hospitalization, and on average, 1 in every 10 affected patients will die from HAI. As per a new study published by researchers with the CDC, hospitals in the U.S. observed a significant increase in HAI in 2020, largely as a result of the COVID-19 pandemic. Thus, the need for the installation of cleanrooms in hospitals has significantly increased to overcome the growing incidence of HAIs.

Within hospitals, cleanrooms are integrated into burn units, surgery suits, isolation areas, and, in certain cases, corridors, which are regularly exposed to biohazardous material. The COVID-19 pandemic boosted industry growth due to the increased demand for cleanroom technologies. The growing need to maintain a contamination-free environment during sample collection & testing of COVID-19 suspected cases and rising R&D activities to develop vaccines against COVID-19 have driven biopharmaceutical & pharmaceutical companies to significantly invest in the market to maintain a contamination-free environment In addition, government initiatives undertaken to escalate the production of protective masks during the COVID-19 pandemic contributed to the growth of the market.

Equipment Insights

On the basis of equipment, the cleanroom air filters segment held the largest share of more than 36.35% in 2022. To ensure good quality air in cleanroom and maintain cleanliness, the air is filtered using High-Efficiency Particulate Air Filters (HEPA), Efficiency Particulate Air Filters (EPA), and Ultra Low Particulate Air Filters (ULPA). The air passing through these filters has to comply with the set standards. The key trends driving this market are the growth of industries, such as electronics and pharmaceuticals, along with stringent regulatory standards and increasing demand for quality products.

The laminar airflow unit segment is anticipated to grow at a significant CAGR from 2023 to 2030. Some of the factors propelling the demand for laminar air flow units are the rising risk of communicable diseases, increasing R&D activities in biotechnology & pharmaceutical companies, and the spike in demand amid the COVID-19 pandemic. In addition, the rising R&D expenditure due to the increasing prevalence of infectious & chronic diseases is likely to drive the laminar airflow units segment over the forecast period. Some of the key players manufacturing laminar air flow units are DencoHappel, ProCleanrooms, Terra Universal, Integrated Clean Room Technologies Pvt. Ltd., GMP Technical Solutions, Clean Air Products, UltraPure Technology, and Skan, Inc.

Type of Cleanroom Insights

The traditional or stick-built cleanrooms segment dominated the market with a revenue share of 79.65% in 2022. The growth is attributed to the convenience of traditional cleanroom building costs, which can be spread out throughout the construction process rather than being incurred all at once, which is advantageous. In addition, the building materials (studs, wallboard, etc.) used in traditional structures are very common and often inexpensive, which contributes to the segment’s dominant position in the market. Modular cleanrooms are expected to register the fastest CAGR over the forecast period.

The modular cleanroom is economical and an attractive choice for various industries that require flexibility, easy construction, and a space that can be altered in the future as required. Since modular systems offer ready-to-install cleanroom doors and hardware, it reduces installation time. Moreover, construction and installation cycles are drastically shortened as a result of important components being manufactured and assembled offsite, which reduces onsite intrusions and disturbances. Such capabilities of modular cleanrooms are projected to fuel the segment during the forecast period.

End-use Insights

The compounding & manufacturing pharmacies end-use segment dominated the industry growth with the largest revenue share of more than 84.65% in 2022. Compounding pharmacies are increasingly necessary in the U.S. and Europe due to the rising demand for sterile compounding drugs. Since these sterile substances are highly susceptible to contamination, there has been an increase in the demand for cleanrooms in recent years. In addition, past cases of fungal infections due to cross-contamination in compounding pharmacies have led to the introduction of strict regulations for compounding pharmacies. Cleanroom technology is important for sensitive processes in biotechnology, such as biocontamination control, pilot studies, R&D, and production. This is expected to boost the installation of cleanrooms over the forecast period.

For instance, as per a study published in 2019, about 15,000 pharmaceutical cleanrooms were expected to be installed by 2030. The hospital segment is projected to register the fastest CAGR over the forthcoming year. The demand for hygiene and infection control is high in hospitals. Hospital laboratories process biological samples, such as urine, serum, plasma, and tissue section. It is important to keep processing instruments contamination-free to gain accurate testing results. Therefore, a growing number of hospitals are adopting cleanroom technologies to reduce airborne particles and maintain a safe antimicrobial environment. In addition, the adoption of cleanrooms is growing in U.S. hospitals to overcome the increasing incidence of HAIs. As per the CDC, in the U.S., around 1.7 million HAIs and 99,000 associated deaths are witnessed every year.

Regional Insights

North America held the largest revenue share of 34.65% in 2022. The region has the most advanced healthcare facilities, which boosts the adoption rate of the equipment. The existence of well-developed healthcare infrastructure, the ease of implementation of facilities, and an increase in the number of medical & surgical procedures that require standards are factors contributing to the growth of the regional market. Furthermore, the region’s manufacturing regulations and guidelines require pharmaceutical and biotech manufacturers to conduct all aseptic manufacturing processes in a cleanroom environment, which has resulted in increased cleanroom adoption in the region. Such factors are contributing to the region’s growth.

On the other hand, Asia Pacific is anticipated to register the fastest growth rate over the forecast years. The expanding pharmaceutical, biotechnology, & medical device industries; favorable healthcare guidelines; and rising healthcare spending are the primary factors driving the regional market of Asia Pacific. Furthermore, due to the COVID-19 pandemic, governments in various countries are undertaking initiatives to ensure that their economies remain stable. Several countries are focusing on mitigating the economic and health issues caused by the pandemic. As a result of the increased emphasis on drug and vaccine development, the market is expected to grow rapidly in the coming years.

Key Companies & Market Share Insights

The key players are focusing on developing new tools and solutions to meet the growing demand for cleanroom equipment in the healthcare and life science industry. Furthermore, partnerships, mergers & acquisitions, and regional expansions are key strategic undertakings these players adopt. For instance, in February 2022, MECART announced a partnership with Fountainhead Control Rooms and Diversified. This partnership will allow the company to offer custom and premium control room environments and turnkey solutions. Some of the prominent players in the global cleanroom equipment market include:

-

Angstrom Technology

-

Terra Universal, Inc.

-

MECART

-

Cleanrooms Depot, Inc.

-

Clean Air Products

-

Labconco

-

Integrated Cleanrooms Technologies Pvt. Ltd.

-

Abtech

-

HVAX

-

Airomax Airborne LLC

Cleanroom Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.9 billion

Revenue forecast in 2030

USD 4.3 billion

Growth rate

CAGR of 6.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segment Covered

Equipment, type of cleanroom, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; Sweden; Norway; Denmark; Japan; China; India; South Korea; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia; Kuwait

Key companies profiled

Angstrom Technology; Terra Universal, Inc.; MECART; Cleanrooms Depot, Inc.; Clean Air Products; Labconco; Integrated Cleanrooms Technologies Pvt. Ltd.; Abtech; HVAX; Airomax Airborne LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs.Explore purchase options

Global Cleanroom Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global cleanroom equipment market report on the basis of equipment, type of cleanroom, end-use, and region:

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Heating Ventilation and Air Conditioning System (HVAC)

-

Cleanroom Air Filters

-

Air Shower and Diffuser

-

Laminar Air Flow Unit

-

Others

-

-

Type Of Cleanroom Outlook (Revenue, USD Million, 2018 - 2030)

-

Modular cleanrooms

-

Traditional or Stick Built Cleanrooms

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Compounding & Manufacturing Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

Sweden

-

Norway

-

Denmark

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cleanroom equipment market size was estimated at USD 2.6 billion in 2022 and is expected to reach USD 2.8 billion in 2023.

b. The global cleanroom equipment market is expected to grow at a compound annual growth rate of 6.3% from 2023 to 2030 to reach USD 4.3 billion by 2030.

b. North America dominated the cleanroom equipment market with a share of 34.7% in 2022. The region has most advanced healthcare facilities which boost the adoption rate of the equipment.

b. Some key players operating in the cleanroom equipment market include Angstrom Technology; Terra Universal, Inc.; MECART; Cleanrooms Depot, Inc.; Clean Air Products; Labconco; Integrated Cleanrooms Technologies Private Limited; Abtech; HVAX; Airomax Airborne LLC.

b. Key factors that are driving the market growth include increased demand for cleanroom technology in manufacturing units across several industries and increase in the need for standardizing cleanroom classifications due to the presence of a wide range of classifications used by different countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.