Cleaning Robot Market Size, Share & Trends Analysis Report By Type, By Product (In-House, Outdoor), By Charging (Automatic Charging, Manual Charging), By Operation Mode, By Distribution Channel, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-937-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Cleaning Robot Market Size & Trends

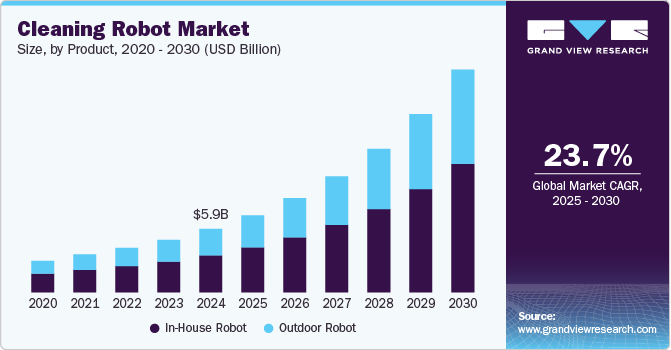

The global cleaning robot market size was estimated at USD 5.98 billion in 2024 and is projected to grow at a CAGR of 23.7% from 2025 to 2030. The market is experiencing rapid growth, driven by increasing demand for automation and smart home technologies. Consumers are prioritizing convenience and efficiency, making robotic cleaning solutions a preferred alternative to manual labor. Advances in artificial intelligence (AI) and machine learning have enhanced the adaptability and performance of cleaning robots, further accelerating market expansion.

In addition, the rise of interconnected smart home ecosystems powered by the Internet of Things (IoT) has increased demand for remotely controlled cleaning robots. The growing affordability of entry-level models has further broadened consumer adoption. Moreover, as sustainability gains importance, manufacturers are focusing on energy-efficient and eco-friendly designs, aligning with consumers’ rising environmental consciousness.

One of the key trends in the cleaning robot industry is the increasing integration of artificial intelligence (AI) and smart technology. Cleaning robots are becoming more intelligent and capable of mapping and navigating complex environments through advanced algorithms. AI allows these robots to improve their cleaning efficiency by learning from their surroundings and adapting to various surfaces. Smart features, such as remote control via smartphones and voice assistant integration (e.g., Alexa or Google Assistant), are enhancing the convenience of these devices. As the cleaning robot industry evolves, AI and smart technology will continue to drive the market, providing users with more efficient, automated, and customizable cleaning experiences.

The growing trend toward home automation is significantly driving market growth. Consumers are increasingly adopting smart home solutions that allow for seamless control of household tasks through interconnected devices. Cleaning robots are perfectly aligned with this trend, offering hands-free cleaning that integrates into a broader home automation ecosystem. With the rise of IoT-enabled devices, cleaning robots are becoming part of a smart home setup, where users can schedule, monitor, and control cleaning tasks remotely. This shift toward home automation is transforming the cleaning robot industry, making it an essential part of modern homes and expanding its market reach.

Another prominent trend in the market is the increasing affordability and accessibility of robotic cleaners. As technology has advanced and production costs have decreased, more brands are offering budget-friendly models that maintain high performance. This shift has made cleaning robots more accessible to a wider range of consumers, especially in emerging markets. The affordability of cleaning robots is opening new opportunities in regions where these devices were previously considered a luxury. As the cleaning robot industry continues to innovate, more affordable models will likely continue to drive the market's growth, making robotic cleaning solutions a common household tool.

The trend toward multi-functional cleaning robots is gaining momentum in the market. Consumers are increasingly looking for robots that can handle multiple tasks, such as vacuuming, mopping, and even window cleaning. The cleaning robot industry is responding by developing hybrid robots that can perform a combination of these tasks, reducing the need for multiple devices in the home. These versatile robots are becoming more popular due to their ability to save time and increase convenience for users. As demand for all-in-one cleaning solutions continues to rise, manufacturers in the cleaning robot industry are focusing on innovation to offer more efficient and multi-functional products.

Subscription-based models and software updates are emerging as a trend in the cleaning robot industry. Manufacturers are beginning to offer software and firmware updates on a subscription basis, allowing users to receive regular improvements and new features for their cleaning robots. This model also extends to maintenance services, where consumers can pay for regular check-ups, repairs, or upgrades. The cleaning robot industry is adopting this approach to create recurring revenue streams and build stronger relationships with consumers. As this trend grows, it ensures that clean robots remain up-to-date with the latest technology, making them even more reliable and user-friendly.

An important trend in the cleaning robot industry is the development of advanced navigation and mapping technologies. Modern cleaning robots are equipped with sensors, LiDAR (Light Detection and Ranging), and cameras that help them scan and map out the layout of a home or office. These technologies allow robots to clean more efficiently by ensuring that every area is covered without repeating or missing spots. The cleaning robot industry is focusing on improving these technologies to create robots that are not only more accurate but also faster and smarter at navigating obstacles. As this trend continues, robots will be able to clean more complex spaces, further enhancing their appeal in both residential and commercial markets.

Type Insights

The floor-cleaning robot segment captured the largest market share of 41% in 2024. The growth is primarily driven by increasing urbanization and the adoption of automation in households and commercial spaces. Consumers, particularly working professionals, are drawn to these robots for their ability to save time and effort. The integration of AI, IoT, and machine learning technologies has enhanced their functionality, enabling features such as real-time mapping, obstacle detection, and voice assistant compatibility. A key trend in this segment is the rising demand for multi-functional robots that combine vacuuming and mopping capabilities. Floor-cleaning robots are increasingly integrated with smart home systems, allowing users to control them via apps or voice commands. The commercial sector, including offices and healthcare facilities, is also adopting these robots to maintain high hygiene standards efficiently.

The pool-cleaning robot segment is expected to witness a significant CAGR of 25.2% from 2025 to 2030, fueled by growing health consciousness and the need for maintaining clean swimming environments in residential and commercial spaces such as hotels and resorts. These robots offer an efficient solution for removing debris, algae, and contaminants from pools without manual intervention, aligning with public health priorities. Advanced pool-cleaning robots equipped with AI-driven navigation and energy-efficient motors are gaining traction. Features such as smartphone control and scheduling are increasingly popular among users. In addition, solar-powered pool cleaners are emerging as a trend for eco-conscious consumers seeking sustainable cleaning solutions.

Product Insights

The in-house robot segment held the largest revenue share in 2024. The segmental growth is driven by the growing demand for time-saving and convenient cleaning solutions in residential spaces. As urbanization increases and lifestyles become busier, consumers are increasingly looking for automated devices to help with daily chores like vacuuming and mopping. In addition, the rise of smart homes, where devices are interconnected through IoT, has further boosted the popularity of in-house cleaning robots, as they can be controlled remotely via smartphones or voice assistants. With advancements in artificial intelligence (AI) and improved navigation technologies, these robots are becoming more efficient, user-friendly, and capable of cleaning complex spaces, which is driving their adoption among tech-savvy consumers.

The outdoor robot segment is expected to record the fastest CAGR from 2025 to 2030. The outdoor cleaning robot segment is driven by the growing need for automated solutions in large-scale commercial and industrial environments. As cities expand and infrastructure projects increase, there is a greater demand for efficient cleaning of outdoor spaces such as streets, parking lots, and large public areas. In addition, with the rise in demand for maintenance in residential outdoor spaces such as gardens, pools, and driveways, robotic lawnmowers and pool cleaners are gaining popularity. The commercial sector, particularly in tourism-heavy regions, is also driving demand for outdoor robots, as businesses in hospitality, retail, and public service industries seek to reduce operational costs and improve the efficiency of outdoor cleaning tasks, such as sweeping and scrubbing.

Charging Insights

The automatic charging segment accounted for the largest revenue share in 2024. Consumers and businesses are seeking robots that can operate autonomously without the need for manual intervention, including charging. With automatic charging, cleaning robots can dock themselves to recharge when their battery runs low, ensuring that they are always ready for the next cleaning session. This feature is particularly popular in residential and commercial markets, where users prioritize ease of use and uninterrupted performance. The trend is moving toward even smarter automatic charging systems, with robots that can return to specific charging stations or recharge themselves more quickly. As these robots become more efficient and affordable, automatic charging is expected to become the standard in both residential and commercial cleaning solutions.

The manual charging segment is expected to record the fastest CAGR from 2025 to 2030, primarily driven by a preference for more cost-effective and simpler robotic cleaning solutions, especially in lower-priced models. Manual charging requires the user to place the robot on a charging dock to recharge, which may appeal to consumers who do not mind performing this small task in exchange for a lower initial purchase price. While manual charging may be less convenient than automatic charging, it is still widely used in entry-level cleaning robots. Trends in this segment include the continued use of manual charging for budget-conscious consumers and in regions where affordability is a higher priority than advanced features. In addition, manual charging robots are often more straightforward in design, making them a more accessible option for consumers who prefer a basic, no-frills cleaning solution.

Operation Mode Insights

The self-drive segment held the largest revenue share in 2024, primarily driven by the increasing demand for fully autonomous, hands-off cleaning solutions. Consumers and businesses prefer robots that can navigate and clean spaces on their own without requiring manual intervention or remote control. This feature is particularly popular in both residential and commercial environments, as it offers convenience and efficiency. The trend is leaning toward robots with advanced AI and sensor technologies that enable them to map, plan, and clean in complex environments. Self-drive robots are becoming more sophisticated, with capabilities such as real-time navigation, obstacle detection, and even smart scheduling, allowing users to set cleaning routines and leave the robots to handle tasks autonomously. As technology improves, self-drive robots are expected to dominate the market due to their ease of use and increasing effectiveness.

The remote control segment is expected to record the fastest CAGR from 2025 to 2030, fueled by the preference for greater user control and customization, where consumers and businesses can direct the robot’s movements and cleaning tasks. While self-drive robots are becoming more popular, remote-controlled robots still appeal to users who want more manual input or control over specific areas of cleaning. This mode is particularly prevalent in industrial and commercial settings, where cleaning robots might need to be directed in more specialized ways or to clean specific zones. The trend in this segment is toward the development of more intuitive and user-friendly remote-control interfaces, often integrated with smartphone apps or advanced remotes. In addition, remote control robots are also appealing to those who may want to supervise the cleaning process or intervene in areas that require more detailed attention.

Distribution Channel Insights

The online segment held the largest revenue share in 2024. The segmental growth is driven by the growing preference for convenience, competitive pricing, and the wide variety of options available to consumers. E-commerce platforms offer a convenient shopping experience where customers can compare different brands, read reviews, and access promotional discounts, making it easier to find cleaning robots that suit their needs. The trend is toward increased reliance on online platforms, especially with the rise of direct-to-consumer sales models from leading robot manufacturers. In addition, the growing influence of online retailers such as Amazon and specialized home automation stores has expanded access to cleaning robots globally, further accelerating adoption. With home delivery services and easier return policies, online shopping has become the preferred method for purchasing cleaning robots.

The offline segment is expected to record the fastest CAGR from 2025 to 2030. The segmental growth is driven by consumers' preference for hands-on interaction and the ability to physically examine products before purchase. In traditional brick-and-mortar stores, customers can receive direct support and demonstrations from sales personnel, which can be particularly valuable for those unfamiliar with robotic technology. This is especially important in regions where consumers prioritize trust in the product and wish to see the robot in action before buying. The trend in offline sales is also supported by the growing presence of consumer electronics retailers and department stores, where cleaning robots are being integrated into product displays.

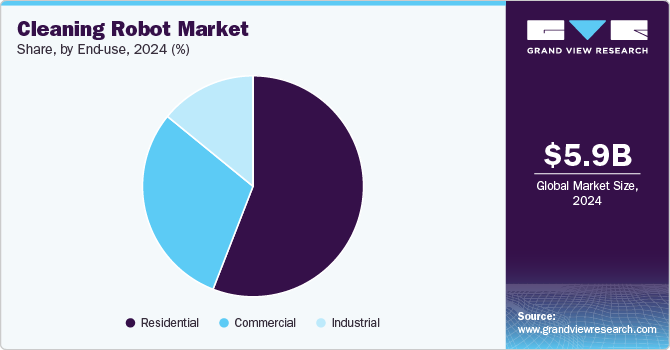

End-use Insights

The residential segment accounted for the largest revenue share in 2024. driven by the increasing demand for convenience and time-saving solutions as modern lifestyles become busier. Consumers are seeking automated cleaning devices that can efficiently handle daily chores, such as vacuuming, mopping, and even window cleaning, without the need for constant supervision. In addition, the growing adoption of smart home technologies, where robots can be integrated with voice assistants and controlled remotely via smartphones, is driving market growth. As these robots become more affordable, compact, and capable of handling complex tasks, the trend toward automation in homes is expected to continue, with many consumers preferring models that offer advanced navigation systems, improved cleaning performance, and multi-functional capabilities.

The industrial segment is expected to record the fastest CAGR from 2025 to 2030, fueled by the increasing need for automation in large-scale manufacturing, warehouse, and logistics operations, where cleaning tasks are often labor-intensive and require high efficiency. As companies seek to reduce operational costs and improve workplace safety, they are turning to robots to handle hazardous cleaning tasks, such as those involving chemicals or heavy machinery. The trend in this segment is the adoption of highly specialized robots, such as floor scrubbing machines and robotic sweepers, designed for harsh industrial environments. In addition, advancements in AI, robotics, and sensor technologies are enabling these robots to navigate complex spaces, operate autonomously, and enhance productivity, which is making them increasingly attractive to industrial operators.

Regional Insights

The cleaning robot industry in North America generated the largest revenue share globally in 2024, accounting for over 30%. The market growth is driven by the high adoption rates of smart home technologies, increasing disposable incomes, and a growing demand for automation in household chores. The region benefits from advanced technological infrastructure, including widespread 5G networks and IoT integration, which significantly enhances the functionality of cleaning robots. In addition, in North America, heightened hygiene standards in workplaces have led to partnerships and collaborations aimed at leveraging advanced technologies for maintaining cleanliness and safety.

U.S. Cleaning Robot Market Trends

The cleaning robot industry in the U.S. held a dominant position in the regional market in 2024. The U.S. market is driven by advancements in automation technologies, increasing demand for time-saving solutions, and the widespread adoption of smart home ecosystems. Urban consumers, particularly those with busy lifestyles, are embracing cleaning robots for their ability to operate autonomously and efficiently, reducing the need for manual intervention. In addition, the National Institute for Occupational Safety and Health (NIOSH) in the U.S. has been actively working on robotics safety through its Center for Occupational Robotics Research.

Europe Cleaning Robot Market Trends

The Europe cleaning robot industry was identified as a lucrative region in 2024. Market growth is driven by increasing investments in robotics and automation across residential, commercial, and industrial sectors. The region's focus on digital transformation and smart technologies, such as IoT and AI, has accelerated the adoption of cleaning robots. Rising awareness about hygiene and cleanliness, especially post-pandemic, has further fueled demand for these solutions in homes, offices, healthcare facilities, and public spaces.

The cleaning robot industry in the UK is driven by the increasing demand for automation and cost-efficiency in both commercial and residential spaces. With the rise of dual-income households and busy urban lifestyles, there is a growing preference for time-saving solutions like cleaning robots. In addition, the UK has a high adoption rate of smart home technologies, which drives the integration of robotic cleaners into connected home ecosystems.

Germany’s cleaning robot industry is largely driven by the country’s robust industrial and manufacturing sectors, where automation is highly valued to improve operational efficiency. German businesses, particularly in manufacturing, logistics, and healthcare, are increasingly adopting robotic cleaners to reduce labor costs and ensure consistent cleanliness in large facilities. The country’s strong focus on technological innovation also contributes to the market's growth, as businesses are quick to adopt the latest advancements in robotics for both commercial and residential cleaning applications.

Asia-Pacific Cleaning Robot Market Trends

The cleaning robot industry in the Asia Pacific region is expected to grow at the fastest CAGR of over 24.4% from 2025 to 2030. The APAC region is witnessing a surge in demand for advanced cleaning robots equipped with AI-driven navigation, real-time mapping, and voice assistant compatibility. In densely populated cities across China and South Korea, compact and efficient cleaning robots are becoming increasingly popular due to space constraints. Japan is leading the trend of specialized robots, such as window-cleaning robots for high-rise buildings. The commercial sector across APAC is also adopting disinfection robots in response to heightened hygiene standards post-pandemic, particularly in healthcare and hospitality industries.

The cleaning robot industry in China is driven by the country's strong manufacturing base and rapid urbanization. Chinese consumers are increasingly adopting cleaning robots due to their growing disposable incomes and preference for smart home technologies. A key trend in China is the increasing popularity of high-end models equipped with AI-powered navigation and real-time mapping, catering to a tech-savvy consumer base.

The cleaning robot industry in India is driven by rising disposable incomes, increasing urbanization, and a growing awareness of automated solutions for household chores. Indian consumers are particularly drawn to robotic vacuum cleaners that are affordable and capable of handling diverse floor types common in Indian homes. A key driver is the post-pandemic focus on hygiene, which has encouraged households and businesses to adopt cleaning robots for enhanced sanitation. Another notable trend in India is the growing presence of international brands such as iRobot alongside local players offering budget-friendly options.

Key Cleaning Robot Company Insights

Some of the key players operating in the market include iRobot Corporation and LG Electronics

-

iRobot Corporation is a leader in the home cleaning robot industry, best known for its Roomba series of robotic vacuum cleaners. The company focuses on delivering autonomous cleaning solutions with intelligent navigation and mapping features. Over the years, iRobot has expanded its portfolio to include other robots, such as mopping robots (Braava). With its strong brand presence, iRobot continues to dominate the global market and innovate with new, advanced cleaning technologies.

-

LG Electronics is a well-established player in the consumer electronics sector, offering a range of robotic cleaning products, including the LG CordZero robotic vacuum series. Their cleaning robots are equipped with AI-powered sensors and advanced navigation systems for efficient and precise cleaning. LG also integrates smart home features into their robots, making them compatible with voice assistants like Google Assistant and Alexa. With a focus on smart, energy-efficient devices, LG remains a dominant force in the cleaning robot industry.

Ecovacs Robotics Inc. and Neato Robotics Inc are some of the emerging participants in the cleaning robot industry.

-

Ecovacs Robotics Inc. is an emerging player known for its Deebot series of robotic vacuums and mops, which have gained popularity in recent years due to their affordability and effective performance. The company emphasizes the integration of advanced features like AI-driven navigation and real-time mapping. Ecovacs has also developed cleaning robots for more specialized tasks, such as window and pool cleaning. With a growing global footprint, Ecovacs is rapidly positioning itself as a significant competitor in the robotic cleaning space.

-

Neato Robotics Inc is an innovative company that specializes in the design of D-shaped robotic vacuums that provide superior edge-cleaning capabilities compared to traditional round-shaped models. Their products feature laser-guided mapping and advanced navigation, allowing them to clean large areas with precision. Neato is also focused on developing robots that are easy to maintain, with features such as washable filters. Though newer to the market, Neato’s focus on design and efficiency has made it stand out in the cleaning robots industry.

Key Cleaning Robot Companies:

The following are the leading companies in the cleaning robot market. These companies collectively hold the largest market share and dictate industry trends.

- Ecovacs Robotics Inc.

- ILIFE Robotics Technology

- iRobot Corporation

- LG Electronics

- Maytronics

- Milagrow Business and Knowledge Solutions Pvt. Ltd.

- Neato Robotics Inc.

- Nilfisk Group

- Pentair Plc

- Samsung Electronics Co. Ltd.

Recent Developments

-

In February 2025, Nilfisk launched its next generation of vacuum cleaners, including the VP300 and VP400 compact canister vacuums, engineered for high performance with intuitive controls and easy maneuverability, and the VU200 cordless stick vacuum, designed for quick and efficient spot cleaning. These vacuums, certified for professional use, offer enhanced filtration systems, user-friendly designs, and are part of Nilfisk’s wide range of next-generation solutions launching throughout 2025.

-

In January 2025, Ecovacs Robotics, Inc. introduced its latest innovations at CES 2025, including the DEEBOT X8 PRO OMNI with advanced self-washing mopping technology and the GOAT A3000 LiDAR robotic lawn mower featuring multi-technology navigation. The company also expanded its WINBOT series for enhanced window cleaning. The DEEBOT X8 PRO OMNI and T50 MAX PRO were launched in February.

-

In December 2024, Skyline Robotics partnered with Alimak Group to automate building maintenance using Alimak’s access solutions and Skyline’s robotics technology. The collaboration aims to focus on autonomous window cleaning, starting with Skyline's Ozmo robot, to improve efficiency, sustainability, and address labor shortages in the construction industry. Alimak Group has also invested in Skyline to support this initiative.

Cleaning Robot Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 7.25 billion |

|

Revenue forecast in 2030 |

USD 21.01 billion |

|

Growth rate |

CAGR of 23.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, Volume in thousand units, and CAGR from 2025 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Type, product, charging, operation mode, distribution channel, end-use, region |

|

Regional Scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country Scope |

U.S.; Canada; UK; Germany; China; India; Japan; South Korea; Brazil; Mexico; Saudi Arabia; UAE |

|

Key companies profiled |

Ecovacs Robotics Inc.; ILIFE Robotics Technology; iRobot Corporation; LG Electronics; Maytronics; Milagrow Business and Knowledge Solutions Pvt. Ltd.; Neato Robotics Inc.; Nilfisk Group; Pentair Plc; Samsung Electronics Co. Ltd. |

|

Pricing and purchase options |

Free re Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cleaning Robot Market Report Segmentation

This report forecasts and estimates revenue and volume growth at the global, regional, and country levels and analyzes the latest market trends in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global cleaning robot market report based on type, product, charging, operation mode, distribution channel, end-use, and region:

-

Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Floor-Cleaning Robot

-

Pool-Cleaning Robot

-

Window-Cleaning Robot

-

Lawn-Cleaning Robot

-

Others

-

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

In-House

-

Outdoor

-

-

Charging Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Automatic Charging

-

Manual Charging

-

-

Operation Mode Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Self-Drive

-

Remote Control

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

End-use Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Rest of Asia

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global cleaning robot market size was estimated at USD 5.98 billion in 2024 and is expected to reach USD 7.25 billion in 2025.

b. The global cleaning robot market is expected to grow at a compound annual growth rate of 23.7% from 2025 to 2030 to reach USD 21.01 billion by 2030

b. North America dominated the cleaning robot market with a share of nearly 31 % in 2024. This is attributable to the high demand for cleaning robots and the wide availability of various distribution channels such as online stores, retail stores, hypermarkets, and supermarkets.

b. Some key players operating in the cleaning robot market include Ecovacs Robotics, Inc.; ILIFE Robotics Technology; iRobot Corporation; LG Electronics; Maytronics; Milagrow Business and Knowledge Solutions (Pvt.) Limited; Neato Robotics, Inc.; Nilfisk Group; Pentair plc; and Samsung Electronics Co., Ltd.

b. Key factors that are driving the cleaning robot market growth include penetration of automation in household appliances and the development of AI-enabled and voice-controlled smart cleaning robots.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."