- Home

- »

- Food Additives & Nutricosmetics

- »

-

Clean Label Mold Inhibitors Market Size, Share Report, 2030GVR Report cover

![Clean Label Mold Inhibitors Market Size, Share & Trends Report]()

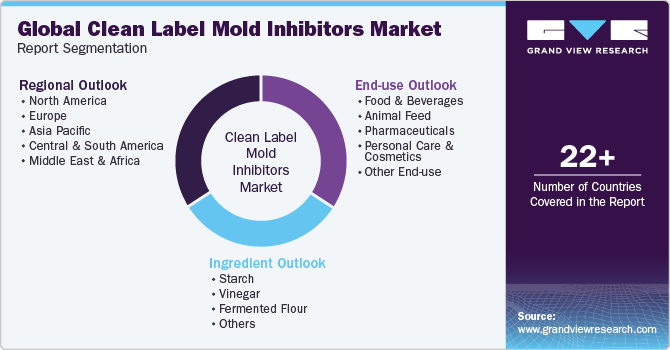

Clean Label Mold Inhibitors Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredient (Starch, Vinegar, Fermented Flour, Whey), By End-use (Food & Beverages, Animal Feed, Pharmaceuticals, Personal Care & Cosmetics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-176-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Clean Label Mold Inhibitors Market Summary

The global clean label mold inhibitors market size was estimated at USD 1.03 billion in 2023 and is projected to reach USD 1.63 billion by 2030, growing at a CAGR of 6.9% from 2024 to 2030. This growth is attributed to the increasing demand for products with natural ingredients, combining good flavor and sustainable properties.

Key Market Trends & Insights

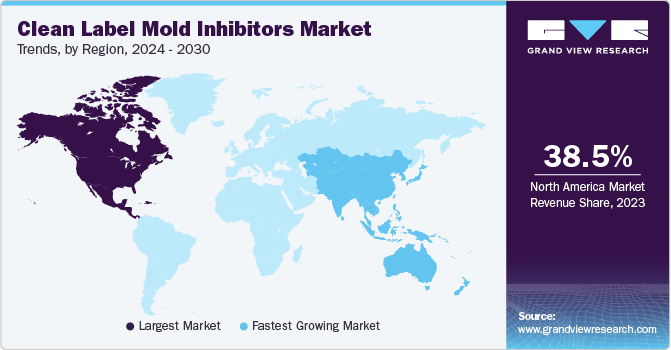

- North America held the largest revenue share of around 38.5% in 2023.

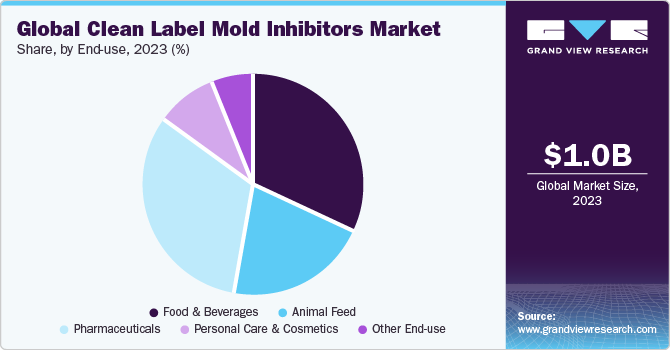

- Based on end use, the pharmaceutical segment accounted for the largest revenue share of 32.3% in 2023.

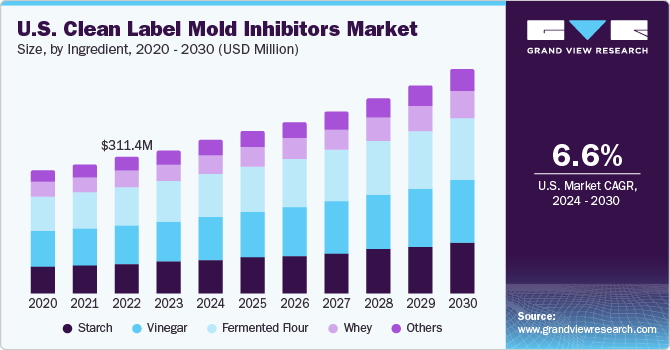

- Based on ingredient, the starch segment accounted for the largest revenue share of around 22.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.03 Billion

- 2030 Projected Market Size: USD 1.63 billion

- CAGR (2024-2030): 6.9%

- North America: Largest market in 2023

The extensive usage of clean label mold inhibitors as natural stabilizer in food industry to increase shelf-life, acts as a major driver for their consumption. The increasing consciousness among customers regarding the ingredients used in making food products has shifted their preference towards actively seeking out cleaner labels. This phenomenon has increased the demand for natural ingredients in food & beverages. The inhibitors such as propionic acids and other organic acids are added as feed additives to serve this purpose.

Several factors driving the growth of the U.S. clean label mold inhibitors market include the increasing consumer demand for clean and natural products and health concerns associated with usage of synthetic preservatives. As consumers become more aware of these potential risks, they are seeking safer alternatives. Clean label mold inhibitors offer a natural and safe solution for food preservation.

The regulatory environment plays a crucial role in shaping the growth and development of clean label mold inhibitors in the U.S. The U.S. Food and Drug Administration (FDA) and other regulatory bodies have established regulations and guidelines to ensure the safety and quality of food products. GMP regulations outlined the standards and practices that food manufacturers must adhere to, covering various aspects of production, including the handling, storage, and use of inhibitors.

Advances in technology and research have led to the development of more effective and efficient solutions for varied applications in the end-user industries. Sensors can detect changes in temperature, moisture, and other factors that contribute to mold growth. Moreover, advancements in sensor technology have enabled real-time monitoring of food products and their environments. Sensors can detect changes in temperature, moisture, and other important factors.

End-use Insights

The pharmaceutical segment accounted for the largest revenue share of 32.3% in 2023. This is attributed to the use of product in pharmaceuticals often include natural antimicrobial agents such as essential oils, plant extracts, and organic acids. These ingredients inhibit the growth of microorganisms, ensuring the integrity and shelf life of pharmaceutical products. For instance, essential oils like oregano oil, thyme oil, and tea tree oil have antimicrobial properties and can be used as natural mold inhibitors in pharmaceutical formulations.

Clean label mold inhibitors are also utilized in the animal feed industry to prevent mold growth and maintain the quality and safety of feed products. Mold-contaminated feed can lead to various health issues in animals, including mycotoxicosis, reduced feed intake, and decreased productivity. These inhibitors have wise usage of clean label inhibitors such as natamycin and vinegar, which are used in products such as cheese, yogurt, baked goods, and processed meats to prevent spoilage.

Ingredient Insights

The starch segment accounted for the largest revenue share of around 22.5% in 2023. This is attributed to the use of starch as a thickening agent and the ingredient that provides structure to food products. In the context of inhibition, starch can help to create a barrier that prevents moisture absorption, essential for mold growth. By reducing moisture availability, starch can effectively inhibit its development and extend the shelf life of food products.

Vinegar, particularly white vinegar or acetic acid, is another ingredient used in clean label mold inhibitors. Vinegar has long been recognized for its antimicrobial properties, including its ability to inhibit the growth of microorganisms. It is often used as a preservative and flavor enhancer in pickled products, dressings, sauces, and marinades. Its inhibiting properties make it a valuable ingredient in clean label formulations, as it provides a natural alternative to synthetic inhibitors.

Fermented flour is gaining attention as a clean label ingredient for mold inhibition. Fermentation involves the breakdown of carbohydrates by microorganisms, such as yeast or lactic acid bacteria, resulting in the production of organic acids and other metabolites. Fermented flour can be used in various baked goods, including bread, cakes, and pastries, to extend their shelf life and inhibit growth of microbes.

Regional Insights

North America held the largest revenue share of around 38.5% in 2023. This share is attributed to a well-established food and beverage industry, stringent regulations regarding food safety, and a growing demand for clean label ingredients. These factors contribute to the adoption of clean label mold inhibitors in North America. The well-established food and beverage industry in the region is a major consumer of inhibitors, as these ingredients are used to prevent mold growth and extend the shelf life of food & beverage products.

Asia Pacific is a significant region in the clean label mold inhibitors industry, as there is a growing trend of organic ingredients and natural food preservatives. This region has a large population, increasing disposable income, and a growing awareness of food safety and quality. These factors, coupled with the demand for clean label products, are driving the adoption of inhibitors in this region.

Europe is another major market that has stringent regulations regarding food safety and labeling, which have driven the demand for clean label ingredients, including inhibitors. The Europe market has a strong focus on sustainability and natural products, further contributing to the adoption of clean label mold inhibitors.

Key Clean Label Mold Inhibitors Company Insights

The development of environmentally sustainable and cost-effective products would offer major growth opportunities for key market players. In addition, the firms are focusing on producing clean label mold inhibitors through environment-friendly processes. The global market is currently dominated by key industry leaders such as Kemin Industries, Inc., Tate & Lyle PLC, and Cargill.

Major manufacturers operate in this market with diverse strategy initiatives such as expansion, product launches, mergers & acquisitions, innovation and certifications for their products. For instance, in July 2023, BioVeritas, LLC, a food technology firm unveiled a new clean label mold inhibitor made out of vegetable oil extracts via proprietary upcycling process. The product is developed as an alternative to calcium propionate in bakery applications, providing the same flavor and texture.

Key Clean Label Mold Inhibitors Companies:

The following are the leading companies in the clean label mold inhibitors market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these clean label mold inhibitor companies are analyzed to map the supply network.

- Kemin Industries, Inc.

- Corbion N. V.

- Ara Partners

- BioVeritas

- Ribus, Inc.

- Lesaffre Corporation

- Puratos Group

- Kerry Group plc

- Cargill

- Tate & Lyle PLC

Clean Label Mold Inhibitors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.09 billion

Revenue forecast in 2030

USD 1.63 billion

Growth rate

CAGR of 6.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue Forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Kemin Industries, Inc.; Corbion; Ara Partners; BioVeritas; Ribus, Inc.; Lesaffre Corporation; Puratos Group; Kerry Group plc; Cargill; Tate & Lyle PLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clean Label Mold Inhibitors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clean label mold inhibitors market report based on ingredient, end-use, and region:

-

Ingredient Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Starch

-

Vinegar

-

Fermented Flour

-

Whey

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Animal Feed

-

Pharmaceuticals

-

Personal Care & Cosmetics

-

Other End-use

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global clean label mold inhibitors market size was estimated at USD 1.03 billion in 2023 and is expected to reach USD 1.09 billion in 2024.

b. The global clean label mold inhibitors market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 1.63 billion by 2030.

b. North America dominated the clean label mold inhibitors market with a share of 38.5% in 2023. This is attributable to a well-established food and beverage industry, stringent regulations regarding food safety, and a growing demand for clean label ingredients. These factors contribute to the adoption of clean label mold inhibitors in North America.

b. Some key players operating in the clean label mold inhibitors market include Kemin Industries, Inc., Corbion, Ara Partners, BioVeritas, Ribus, Inc., Lesaffre Corporation, Puratos Group, Kerry Group plc, Cargill, Tate & Lyle PLC.

b. Key factors that are driving the market growth include the increasing demand for products with natural ingredients, combining good flavor and sustainable properties. Its extensive usage as natural stabilizer in food industry to increasing shelf-life acts as a major driver for the clean mold inhibitor consumption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.