- Home

- »

- Food Safety & Processing

- »

-

Clean Label Ingredients Market Size & Share Report, 2030GVR Report cover

![Clean Label Ingredients Market Size, Share & Trends Report]()

Clean Label Ingredients Market Size, Share & Trends Analysis Report By Form (Powder, Liquid), By Type (Natural Colors), By Application, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-103-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global clean label ingredients market size was estimated at USD 120.03 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. The growth is driven by high consumer demand for natural and sustainably sourced foods. Clean-label ingredients are derived from natural and organic sources, contain a minimum number of ingredients, and are free of artificial or chemical ingredients. The demand for clean-label ingredients is being fueled by consumer concerns regarding the potential health risks associated with artificial additives. This presents a significant market opportunity for businesses to cater to this demand by offering products that minimize or eliminate the use of artificial colors, flavors, preservatives, and sweeteners.

Clean-label ingredients comprising natural alternatives like herbs, spices, natural extracts, and plant-based ingredients, are ideal for enhancing flavor profiles, extending shelf life, and improving product stability. Incorporating these clean-label ingredients into product formulations enables businesses to target health-conscious consumers and gain a competitive edge in the market.

Also, the consumer preference for organic food is experiencing an upward trajectory owing to a rise in the number of consumers adopting healthier diets. The trend is also supported by rising expenditures on health and extensive marketing efforts toward chemical-free products. As per the International Food Information Council (IFIC), in 2021, 20% of consumers in America consumed food and beverages labeled as clean.

Food & beverage manufacturers are responding to the trend of clean-label products by offering organically sourced ingredients that can be utilized in several applications. The ingredients can be used in a wide variety of vegan foods, ready-to-eat meals, and dressings. For instance, in March 2023, Ingredion announced the launch of texturizers in its clean-label product portfolio. The texturizer is made of peels of citrus limes and lemons. The ingredients are ideal for use in gluten-free baked goods, tomato-based condiments, and processed meats.

The demand for clean-label ingredients is also driven by rising awareness among consumers toward sustainability and ethically sourced food products. Manufacturers operating in the industry are actively working towards sourcing ingredients from regenerative sources to improve the production process to minimize the impact on the environment. In February 2021, BENEO announced the launch of functional native rice starch Remypure S52 P which is ideal for the production of clean label foods such as sauces, dressings, and bakery fillings.

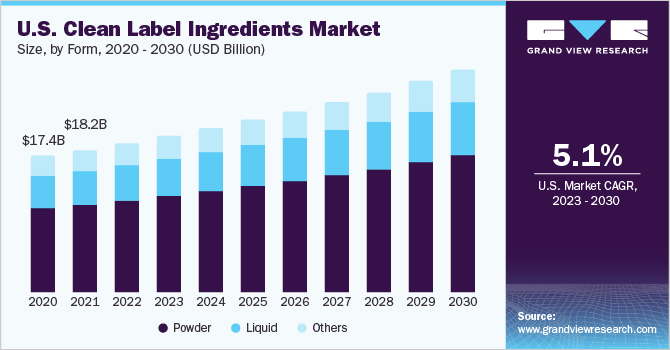

Form Insights

The powder segment held the largest share of 61.6% in terms of revenue in 2022. Factors such as longer shelf life and ease of storage are the major factors fueling the demand for powder-based clean-label ingredients. Powdered clean label ingredients can be easily blended into dry mixes, dough, and batters enabling precise control over the ratio of ingredients and achieving a suitable texture for the product. Additionally, powders also provide versatility in terms of dispersion in liquids thereby allowing manufacturers to provide different product formulations. In July 2022, Givaudan partnered with Manus Bio to announce the launch of BioNooKatone, a sustainably sourced citrus flavor sourced from natural citrus extracts.

On the other hand, the liquid segment promises a significant CAGR of 3.9% during the forecast period. Factors such as dispersion and ease of use in food and beverage applications are fueling the demand for the segment. Liquid ingredients disperse uniformly resulting in a consistent distribution of the product leading to improved flavor and texture. In October 2020, Kerry Group announced the launch of natural citrus extracts made of orange, tangerine, lime, and lemon. The citrus extracts are ideal to use in ready-to-drink beverages and sparkling drinks.

Type Insights

The natural flavor segment held the largest share of 19.6% in 2022. Several consumers are seeking healthier alternatives to artificial flavors, leading to a surge in demand for flavors sourced from natural sources. In addition, favorable regulatory scenario and government support toward the usage of natural flavors in diverse application is fueling the demand for the segment. Rising innovations and product developments in natural food flavor sources have also profited the natural flavor industry. In September 2022, Belgium-based Solvay announced the launch of three naturally sourced flavor ingredients Sublima, Delica, and Alta. The flavors are sourced from vanillin.

The fruit & vegetable ingredients segment is expected to showcase a CAGR of 7.1% during the forecast period. Consumers are increasingly concerned about artificial additives, preservatives, and synthetic ingredients in their food. Fruits and vegetables are natural ingredients that can enhance the appeal of clean-label products. Also, the rising demand for plant-based food and beverages is driving the demand for naturally sourced fruit and vegetable ingredients. In March 2023, Ingredion Incorporated announced the launch of citrus-based texturizers FIBERTEX CF 102 and FIBERTEX CF 502 in its clean-label ingredient portfolio. The citrus fibers are sourced from peels of citrus fruits and can be used in dressings, sauces, baked goods, and meat alternatives.

Application Insights

The food segment held the largest market share of 39.3% in 2022. The growing consumer interest in minimally processed ingredients has prompted manufacturers to revamp their product portfolios to meet clean label standards. In July 2022, as per Ingredion’s study, 71% of consumers are willing to pay higher prices for clean-label products.

The COVID-19 pandemic has further amplified the significance of clean-label food products, as consumers have become more cautious about the food products they purchase. Consumers are prioritizing clean labels as they seek greater assurance about the safety and quality of the food they consume. As a result, clean label renovation has become a key priority for many manufacturers, aligning their offerings with consumer expectations and preferences.

The dairy, non-dairy, and fermented beverages segment is expected to showcase the fastest CAGR of 4.9% during the forecast period. Factors such as the high prevalence of allergies coupled with the demand for beverages free from additives and synthetic chemicals are the major factors driving the demand for clean-label beverages. In September 2021, Clean Energy, a provider of sports nutrition products announced the launch of on-the-go smoothie packs sourced from organic vegetables and fruits. The pack is available in flavors such as strawberry, blueberry, spinach, and flaxseed.

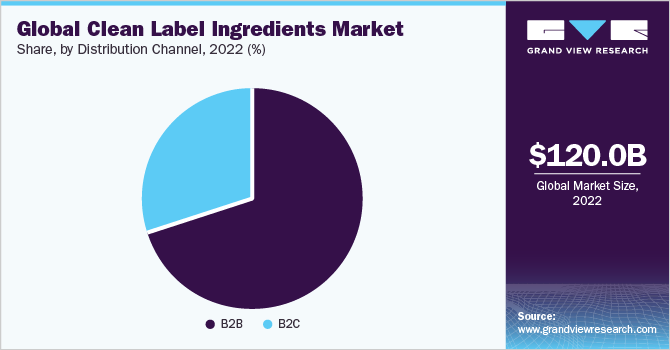

Distribution Channel Insights

Based on distribution channel, the clean label ingredient market is bifurcated into B2B and B2C. The B2B segment held the largest share of 70.2% in 2022. Food manufacturers and ingredient suppliers are placing a stronger emphasis on the use of sustainably sourced ingredients owing to the changing consumer landscape. Utilization of clean-label ingredients enables B2B businesses to provide their customers with the assurance that their products adhere to specific quality standards and cater to consumer preferences. Furthermore, stricter labeling regulations is also encouraging B2B business to offer products that are minimally processed.

The B2C segment is anticipated to grow at a CAGR of 4.6% during the forecast period. The B2C segment includes online channels, supermarkets, hypermarkets, specialty stores, and other convenience stores. The rise in the number of companies offering clean-label food and beverages coupled with the wider availability of newer brands through online channels and supermarkets is boosting the demand for the B2C segment. Manufacturers are increasingly utilizing the use of social media and marketing techniques to garner interest from consumers.

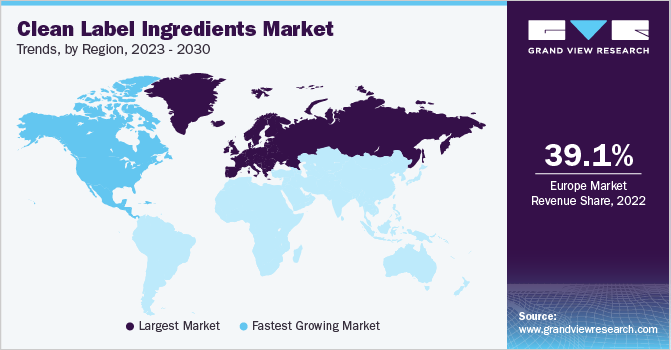

Regional Insights

The Europe region held a dominant revenue share of 39.09 % in 2022. Factors such as the presence of key clean-label ingredient manufacturers coupled with increasing initiatives towards R&D and the launch of innovative products are driving the demand for clean-label ingredients in the region. Additionally, favorable government initiatives regarding the negative health impacts linked to the consumption of synthetic food additives and flavors are also fueling demand for clean-label products.

France’s clean label ingredients market is expected to showcase the fastest CAGR of 5.05% over the forecast period. Favorable initiatives by the government coupled with rising consumer demand for organically sourced products are favoring the demand for clean-label ingredients in the country.

The North America clean label ingredients market is expected to grow at the fastest CAGR of 4.8% over the forecast period. The demand for clean-label ingredients in the region is being bolstered by the increasing consumer interest in plant-based foods and healthier beverages. This growing demand for clean label ingredients presents a promising market opportunity for companies to explore and provide innovative products to consumers in the region.

Asia Pacific is expected to witness a steady CAGR of 8.2% during the forecast period, owing to the increasing demand for fast food products. The growing demand for plant-based diets and the rise in the number of health-conscious consumers are fueling the demand for organic products in the region. For instance, in November 2022, India-based Vecan Foods announced the launch of plant-based meals. In response to changing consumer trends, several companies are expanding their product portfolios to gain a competitive advantage.

Key Companies & Market Share Insights

Key players in the market include Cargill; Archer Daniels Midland; Koninklijke DSM N.V; Dupont De Nemours and Company; Kerry Group Plc; Tate & Lyle Plc; Corbion Inc.; Frutarom; Kerry Group PLC; and Sensient Technologies. Manufacturers of clean label ingredients are constantly innovating products and utilizing technological advancements to meet consumer needs. In October 2021, Cargill Incorporated launched a clean-label rice flour Simpure which provides texture, and functionality as maltodextrin. Some prominent players in the global clean label ingredients market include:

-

Cargill

-

Archer Daniels Midland

-

Koninklijke DSM N.V

-

Dupont De Nemours and Company

-

Kerry Group Plc

-

Tate & Lyle Plc

-

Corbion Inc.

-

Frutarom

-

Kerry Group PLC

-

Sensient Technologies

-

Ingredion Incorporated

Clean Label Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 124.75 billion

Revenue forecast in 2030

USD 168.3 billion

Growth Rate (Revenue)

CAGR of 4.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilo tons, revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Form, type, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy;Spain; China; India; Japan;Australia & New Zealand,South Korea; Brazil; Argentina; South Africa; UAE

Key companies profiled

Tate & Lyle; Ingredion Incorporated; Cargill; Archer Daniels Midland; Koninklijke DSM N.V; Dupont De Nemours and Company; Kerry Group Plc; Corbion Inc.; Frutarom; Kerry Group PLC; Sensient Technologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clean Label Ingredients Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global clean label ingredients market report based on form, type, application, distribution channel, and region:

-

Form Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

Powder

-

Liquid

-

Others

-

-

Type Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

Natural Colors

-

Natural Flavors

-

Fruit & Vegetable Ingredients

-

Starch & Sweeteners

-

Flour

-

Malt

-

Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

Food

-

Bakery

-

Confectionery

-

Cereals & Snacks

-

Processed Food

-

Others

-

-

Pet Food

-

Dairy, Non-Dairy, and Fermented Beverages

-

Others

-

-

Distribution Channel Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

B2B

-

B2C

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global clean label ingredients market size was estimated at USD 120.03 billion in 2022 and is expected to reach USD 124.7 billion in 2023.

b. The global clean label ingredients market is expected to grow at a compound annual growth rate of 4.3 % from 2023 to 2030 to reach USD 168.3 billion by 2030.

b. The Europe market held a dominant revenue share of 39.2% in 2022 owing to the rise in the number of health-conscious consumers coupled with high demand for organic foods.

b. Some of the major players in the clean label ingredients market include Cargill, Archer Daniels Midland, Koninklijke DSM N.V, Dupont De Nemours and Company, Kerry Group Plc, Tate & Lyle Plc, Corbion Inc., Frutarom, Kerry Group PLC, and Sensient Technologies

b. The rising popularity of plant-based diets coupled with the popularity of clean-label ingredients among all age groups is supporting the demand for the market.

b. Growing awareness of the nutritional benefits and versatility of clean label ingredients in the China has led to rising demand for clean label foods among consumers in the country

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."