Circular Polymers Market Size, Share & Trends Analysis By Polymer Type (PE, PP, PET, PVC, PA), By Form (Pellets, Flakes), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-158-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Circular Polymers Market Size & Trends

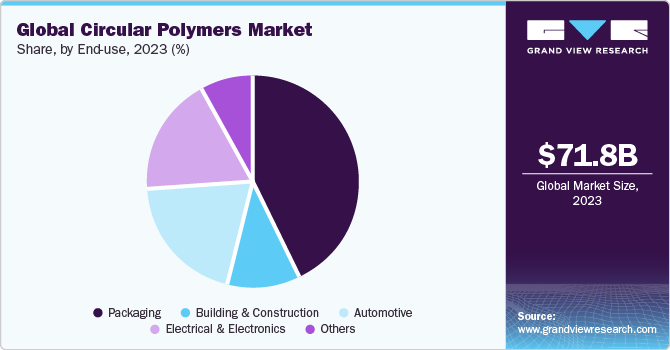

The global circular polymers market size was estimated at USD 71.84 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.5% from 2024 to 2030. This market is witnessing rising growth at a propulsive rate owing to increasing strategic initiatives such as new product launches, production expansions, mergers & acquisitions, among others. For instance, in November 2023, Ascend Performance Materials, a polymer manufacturer, announced its set of nine sustainability targets to reduce waste by 40% and its scope 1 emissions by 90%. Attributes of circular polymers are similar to traditional polymer resins, including high impact resistance, toughness, lower hardness, and low density. These resins are widely used across applications such as food packaging, adhesives & sealants, interior & exterior components of vehicles, wires & cables, among others.

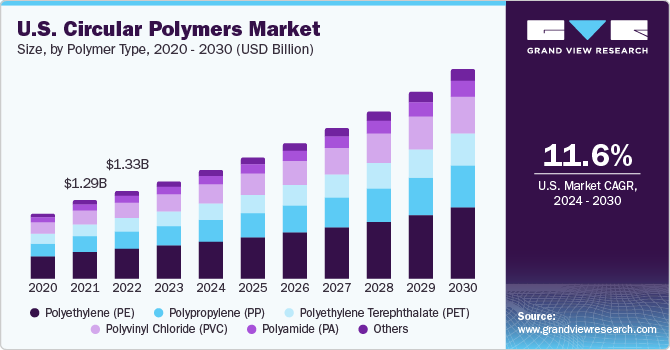

Demand for circular polymers like polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and polyvinyl chloride (PVC) is expected to grow across the U.S. from 2024 to 2030, owing to increasing demand for manufacturing packaging for food, adhesives & sealants, wires & cables for electrical purposes, and interior & exterior components such as bumpers, dashboard, and others for automotive.

In addition, increasing production of vehicles across the U.S. is anticipated to propel demand for circular polymers. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), in 2022, the U.S. recorded a production of 1.06 million vehicles, a 10% increase compared to that of 2021.

Furthermore, heavy investments from current government for infrastructural development across the U.S. is among the major factor for propulsion of market growth across the country. In 2023, the U.S. government announced an investment of over USD 220.0 billion, which is anticipated to support building & construction projects across the country, which in turn, is expected to boost the circular polymers industry.

Market Dynamics

Packaging, automotive, and building & construction are preponderance for circular polymers industry. Government initiatives such as taxes on packaging, especially plastics-based, are expected to propel demand for circular polymers globally. For instance, UK government has imposed taxes on utilization of plastic-based packaging. However, plastic packaging incorporating 30% or additional recycled plastics is not chargeable. It is expected to propel the growth of circular polymers across UK and other associated countries.

Furthermore, across building & construction industry, circular polymers are utilized for manufacturing of adhesives & sealants, construction safety equipment, window tints, and various others. Investments in infrastructural development across emerging economies such as China and India are anticipated to propel market growth across these countries. For instance, in 2023, the Indian government invested USD 15.62 billion (INR 1,300 billion) for infrastructural development across the country. Such initiatives are anticipated to propel demand for circular polymers across the country.

Polymer Type Insights

Polyethylene (PE) segment dominated the global market in 2023 across polymer type segmentation, with a revenue share above 32.0%, owing to growing demand from key end-use industries such as packaging, automotive, building & construction, and others. Furthermore, increasing packaging demand for food & beverages and cosmetics & toiletries industry is expected to drive utilization of polyethylene segment over the forecast period.

Followed by polypropylene (PP) owing to a market share of above 20.0% in 2023. Polypropylene is majorly utilized for manufacturing of films & sheets for packaging industry, owing to its high resistance to chemicals, abrasion, mildew, and thermal bonding, is anticipated to propel demand for polypropylene across the packaging industry.

End-use Insights

Packaging dominated the global market in 2023 across end-use segmentation, owing to a market share above 43.0%, followed by automotive industry with a market revenue share above 19.0%. Circular polymers are utilized in various applications across automotive industry, which include front & rear bumper, interior dashboard & console, window shades, and various other components.

Furthermore, these polymers are being utilized across electrical & electronics industry for manufacturing of wires & cables, printed circuit boards, television & mobile cases, and others. Since these polymers provide high durability, flexibility, tensile strength, chemical resistance, thermal resistance, and other attributes, these are likely to witness a rise in demand from electrical & electronics industry during the forecast period.

Form Insights

Based on form, pellets segment dominated the global market in 2023 with a revenue share above 53.0%. Circular plastics are widely manufactured and supplied in pellet form to plastic product manufacturers, where these pellets are treated at extremely high temperatures, melted, and then molded into desirable end products. Furthermore, circular plastics in form of pellets are easy to transport in bulk quantities compared to plastics in resin or liquid form.

Flakes form for circular plastics owes a market share of above 46.0%. Circular plastics in form of flakes generally provide highly efficient sorting options due to the presence of a variety of shapes and sizes for producing aesthetic-looking plastic-based products.

Application Insights

Food packaging dominated the global market in 2023 across application segmentation, owing to a market share above 43.0%. Durability and seal ability of circular plastics have increased demand for circular plastic-based packaging across food & beverage industry. Furthermore, utilization of circular plastics has resulted in a reduction in expenditure for new packaging from food & beverage industry. It is anticipated to propel demand for circular polymers during the forecast period.

Furthermore, growing tourism industry across countries such as India, Spain, and others has increased usage of takeaway plastic food packaging. This type of food packaging provides safety and non-contamination attributes to packaged foods, increasing demand for circular polymers. According to Spanish government, the country recorded a footfall of 37.5 million tourists in 2023, which propelled plastic-based packaging consumption across the country.

Regional Insights

Asia Pacific region dominated the market with a revenue share of over 46.0% in 2023. Asia Pacific is a highly clustered region in terms of population across emerging economies such as India and China. Hence, rising disposable income, increasing adoption of e-vehicles, and demand for lightweight components have propelled demand for circular polymers across Asia Pacific.

As electric vehicles require components to provide fuel efficiency and reduce weight, circular polymers provide an advantage to automotive manufacturers. Exterior & interior components utilize circular polymers for their manufacturing. Hence, rising demand for e-vehicles is anticipated to propel market growth across Asia Pacific during the forecast period.

Key Companies & Market Share Insights

Research activities across circular polymers industry are focused on new materials that combine several properties and are projected to gain wide acceptance in this industry in coming years. Furthermore, strategic initiatives such as mergers & acquisitions, joint ventures, production, expansion, and others are carried out by key players across market space to maintain market competitiveness.

-

In July 2023, Saudi Arabian Oil Co. (Aramco) and TotalEnergies, petroleum refinery companies, along with SABIC, a polymer manufacturer, produced circular polymers utilizing plastic pyrolysis oil alternatively, known as plastic waste-delivered oil (PDO).

Key Circular Polymers Companies:

- LyondellBasell Industries Holdings B.V.

- SABIC

- Ascend Performance Materials Operations, LLC

- Advanced Circular Polymers

- Borealis AG

- Veolia

- Exxon Mobil Corporation

- The Shakti Plastic Industries

- Chevron Phillips Chemical Company, LLC

- Suez Group

Circular Polymers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 79.66 billion |

|

Revenue forecast in 2030 |

USD 152.75 billion |

|

Growth rate |

CAGR of 11.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion and CAGR (%) from 2024 to 2030. |

|

Report coverage |

Revenue and volume forecast, company profiles, competitive landscape, growth factors, and trends. |

|

Segments covered |

Polymer type, form, application, end-use |

|

Region scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Netherlands; Spain; China; India; Japan; South Korea; Australia; Indonesia; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; United Arab Emirates (UAE); South Africa |

|

Key companies profiled |

LyondellBasell Industries Holdings B.V.; SABIC; Ascend Performance Materials Operations, LLC; Advanced Circular Polymers; Borealis AG; Veolia; Exxon Mobil Corporation; The Shakti Plastic Industries; Chevron Phillips Chemical Company, LLC; Suez Group |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Circular Polymers Market Report Segmentation

This report forecasts revenue and volume growth at global, regional & country levels and provides an analysis of industry trends in each of the sub-segments from 2024 to 2030. For this study, Grand View Research has segmented the global circular polymers market report based on polymer type, form, application, end-use, and region:

-

Polymer Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyethylene Terephthalate (PET)

-

Polyvinyl Chloride (PVC)

-

Polyamide (PA)

-

Others

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pellets

-

Flakes

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food packaging

-

Adhesives & sealants

-

Interior & exterior components

-

Wires & cables

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Building & construction

-

Automotive

-

Electrical & electronics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Netherlands

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global circular polymers market is estimated to be USD 71.84 billion in 2023 and is anticipated to grow to 79.66 billion in 2024.

b. The global circular polymers market is estimated to grow at a CAGR of 11.5% from 2023 to 2030 to reach USD 8.88 billion by 2030 owing to increasing strategic initiative such as new product launches, production expansions, merger & acquisition, among others.

b. Polyethylene (PE) across polymer type segmentation witnessed highest revenue market share of 32.29% in 2023.

b. Major key players present across the market space include LyondellBasell Industries Holdings B.V.; SABIC; Ascend Performance Materials Operations LLC; Advanced Circular Polymers; Borealis AG; Veolia; Exxon Mobil Corporation; The Shakti Plastic Industries; Chevron Phillips Chemical Company LLC; and Suez Group.

b. Attributes of circular polymers are similar to traditional polymer resins including high impact resistance, toughness, lower hardness, and low density. Hence these polymers find higher utilization across applications such as food packaging, adhesives & sealants, interior & exterior components of vehicles, and wires & cables.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."