Cigar And Cigarillos Market Size, Share & Trends Analysis Report By Product (Mass Cigar, Premium Cigar), By Flavor, By Distribution Channel (Hypermarkets/Supermarkets, Specialty Store, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-075-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Cigar And Cigarillos Market Size & Trends

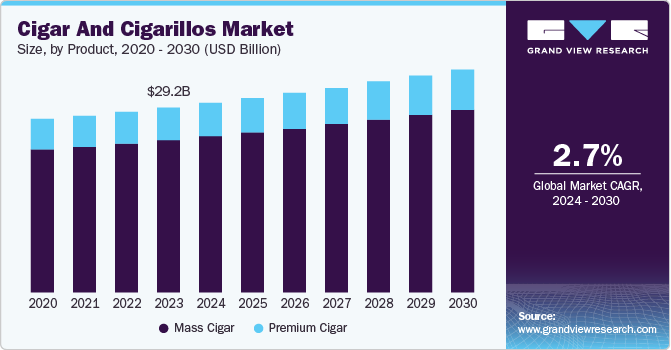

The global cigar and cigarillos market size was valued at USD 29.21 billion in 2023. It is expected to grow at a CAGR of 2.7% during 2024 to 2030. The increasing number of hotels and bars with smoking zones is driving the market growth. After the ban on smoking in public places, several hotels and bars across the world have made dedicated spaces for smoking. For instance, the Lanesborough Hotel of London offers its visitors ‘The Garden Room’, dedicated cigar lounge. In January 2024, Great Wall Cigar flagship lounge opening ceremony, organized by China Tobacco Sichuan Co., Ltd., was held in Hong Kong. The area is of around 200 ㎡ and is divided into brand culture & product exhibition hall, tasting area and walk-in humidor.

Cigars are available in several flavors such as fruit, mint, chocolate and vanilla to cover the harsh taste of tobacco, increasing the popularity of cigars in youngsters. Flavored product is the most popular variety among premium cigars. Additionally, tobacco manufacturing companies are aiming to improve the product quality and provide innovative flavors through research and development.

Increasing disposable income and the influence of western culture on young consumers have driven the market demand in recent years. Also, penetration of tobacco products in urban areas of developing countries has significantly contributed to the market growth. Earlier, cigar and cigarillos were premium products consumed by middle aged consumers. However, these products are now very popularly consumed by young adults in clubs. There are separate cigar clubs gaining popularity in developing countries such as china and India.

Product Insights

Mass cigars dominated the market by capturing revenue share of 82.4% in 2023. These products are popularly consumed by young consumers due to reasonable prices and several attractive flavors such as mint, menthol and chocolate. Mass cigars are machine made and less expensive compared to the premium segment which are handmade products. Easier availability, mass production and innovative flavors are driving the segmental growth.

The premium cigar segment is expected to grow at the fastest CAGR of 3.0% from 2024 to 2030 owing to their increasing demand from premium clubs, hotels and bars. Premium cigars are handmade and popular due to their unique aroma and quality. Premium cigars are made with great attention to details and cater uniform taste and blend to consumers. In countries such as UK, the U.S. and China there is a culture to consume these handmade cigars in company of friends and family.

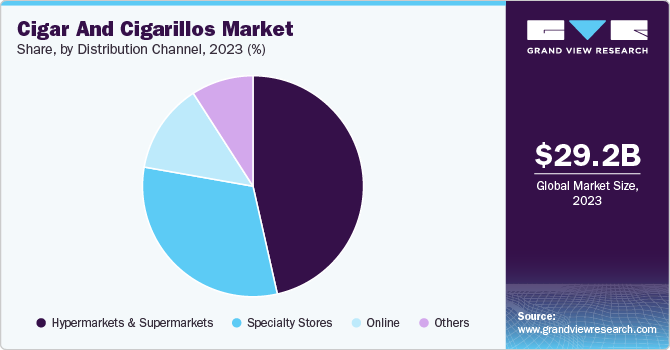

Distribution Channel Insights

The hypermarket and supermarket segment dominated the market with 45.9% share in 2023. Availability of wide range of premium and rare cigars in discounted pricing is the key factor supporting the segment growth. Also, as hypermarkets and supermarkets provide ideal refrigeration and temperature conditions to maintain freshness of the cigars, consumers prefer this option.

The online stores segment is expected to grow at the fastest CAGR of 3.3% over the forecast period. The increasing penetration of smartphones and internet in developed as well as developing countries is the key driver of market. The large inventory capacities of online stores offer a wide variety of options to choose from.

Flavor Insights

The tobacco / no flavor segment dominated the market with a largest revenue share of 71.0% in 2023. Popularity of these products in European consumers is driving the market. Middle aged consumers prefer the conventional products over the flavored cigars.

The flavored products segment is anticipated to grow at the fastest CAGR of 2.8% from 2024 to 2030. The growing popularity of these products in young consumers is driving the market growth. Additionally, increasing number of women consumers is expected to boost the market in coming years. Among the various flavors, fruit-based flavors are the most preferred, but the sale of non-descriptive flavors such as wine, tea, and Jazz is expected to witness substantial growth in coming years.

Regional Insights

North America held the largest market share of 58.2% in 2023, attributed to the growing demand for premium cigars from luxury hotels and bars in the U.S. According to the Cigar Association of America, the U.S. imported an estimated 467.6 million premium cigars in 2023.

U.S. Cigar And Cigarillos Market Trends

A wide range of cigars available in affordable and premium categories has expanded the scope of U.S. cigar market. Additionally, increased spending capacity of young population in the country has fostered the market growth. Growing trend among young students and working population to visit bars and clubs have also boosted the growth.

Europe Cigar And Cigarillos Market Trends

Europe is expected to grow at a CAGR of 1.4% over the forecast period. Increasing preference by women is projected to drive the regional market. An increasing number of female smokers in the countries such as UK and France are expected to boost the demand in Europe.

Asia Pacific Cigar And Cigarillos Market Trends

Asia Pacific region is expected to grow at the fastest CAGR of 9.3% from 2024 to 2030. The demand for Cuban cigars is growing in the region. China was the largest regional market and held a 48.4% share of Asia Pacific cigar and cigarillos market. Cigar is considered a luxury product to accompany drinks and meals. The moments of meals with family and friends are considered vital in the Chinese tradition and people organize ceremonial meals for celebrating important occasions.

Key Companies & Market Share Insights

The global market is characterized by products in all ranges and flavors. Some of the dominant companies operating in the market are Altria Group Inc., Habanos S.A., Scandinavian Tobacco Group A/S, Grukha Cigars, Swisher International Inc. and others. Companies are emphasizing to expand customer base by launching new flavors in their existing portfolio.

-

Scandinavian Tobacco Group A/S offers a wide range of tobacco products such as cigars and piped tobacco, in more than 100 markets. The portfolio includes 200 brands that cater to premium cigars and crafted products.

Key Cigar And Cigarillos Companies:

The following are the leading companies in the cigar and cigarillos market. These companies collectively hold the largest market share and dictate industry trends.

- Altria Group Inc.

- Habanos S.A.

- Scandinavian Tobacco Group

- Grukha Cigars

- Swisher International Inc.

- Agio Cigars

- Swedish Match AB

- OETTINGER DAVIDOFF AG

- Drew Estate

- Imperial Brands PLC

Recent Developments

-

In July 2024, Scandinavian Tobacco Group (STG) agreed to acquire Mac Baren Tobacco Company. The transaction was expected to be financed by debt and cash at hand. Mac Baren portfolio includes brands including Mac Baren, Holger Danske, Amphora, Choice, Amsterdamer, and Opal.

-

In March 2024, Oliva announced the opening on new cigar lounge in Germany. The cigar shop named Whisky & Cigar Salon, now under its roof, has an Oliva-branded smoking lounge.

Cigar And Cigarillos Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 29.2 billion |

|

Revenue forecast in 2030 |

USD 35.1 billion |

|

Growth rate |

CAGR of 2.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, flavor, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, and South Africa |

|

Key companies profiled |

Altria Group Inc., Habanos S.A., Scandinavian Tobacco Group, Grukha Cigars, Swisher International Inc, Agio Cigars, Swedish Match AB, OETTINGER DAVIDOFF AG, Drew Estate, Imperial Brands PLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cigar And Cigarillos Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cigar and cigarillos market report based on product, flavor, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass Cigar

-

Premium Cigar

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Tobacco / No Flavor

-

Flavored

-

Fruit

-

Mint

-

Chocolate

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."