- Home

- »

- Advanced Interior Materials

- »

-

Chromium Market Size, Share, Growth & Trends Report 2030GVR Report cover

![Chromium Market Size, Share & Trends Report]()

Chromium Market (2023 - 2030) Size, Share & Trends Analysis Report By Material (Ferrochromium, Chromium Chemicals, Chromium Metals, Others), By Application (Metallurgy, Chemicals, Refractory, Others), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-305-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Chromium Market Summary

The global chromium market size was estimated at USD 21.5 billion in 2022 and is projected to reach USD 33.09 billion by 2030, growing at a CAGR of 5.5% from 2023 to 2030. Increasing demand from the stainless steel industry for various end-use markets such as automotive, aerospace, defense, marine, building and construction, and electronics is expected to be the key growth factor.

Key Market Trends & Insights

- Asia Pacific dominated the market with a share of 50.7% in 2022.

- By material, the ferrochromium segment accounted for the largest revenue share of 82.2% in 2022.

- By chromium, the chromium market is expected to grow significantly over the forecast period.

- By application, the metallurgy segment held the largest revenue share of 92.4% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 21.5 Billion

- 2030 Projected Market Size: USD 33.09 Billion

- CAGR (2023-2030): 5.5%

- Asia Pacific: Largest market in 2022

- Europe: Fastest growing market

In addition, significant demand from Asia Pacific is anticipated to fuel the market over the forecast period. China was the largest consumer of the product as it is one of the largest manufacturers of stainless steel and other specialty steel products. Chromium is an essential alloying element in the formulation of stainless steel. Thus, augmented demand for stainless steel is a major driver propelling demand in the global market. Approximately 18.0% of the total composition of stainless steel is comprised of chromium in order to enhance its hardness and resistance to oxidation, thereby protecting steel from corrosion.

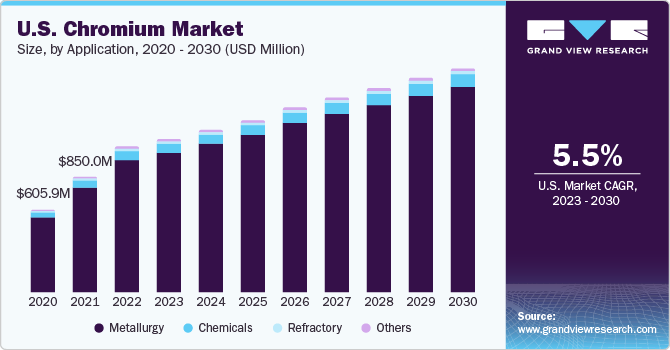

Being a major stainless steel manufacturing country, the U.S. is also a major global manufacturer of chromium-based chemicals, and chromium ore is extensively used for refractory applications. The primary source of chromium supply is in the form of imported and domestically mined chromium ore. Increasing infrastructural development activities in the country are likely to fuel demand over the forecast period.

However, carcinogenic properties and volatility in prices are posing a challenge to the growth of the market. Chromium is toxic and found in the environment in two forms: trivalent (Cr III) and hexavalent (Cr VI). Cr III is considered to be lesser toxic than Cr VI in case of acute as well as chronic exposure. Prolonged exposure to Cr VI has a severe impact on the respiratory system in humans. It can lead to various irritations such as shortness of breath, coughing, wheezing, as well as neurological and gastrointestinal effects.

Material Insights

The ferrochromium segment accounted for the largest revenue share of 82.2% in 2022. Ferrochromium is an alloy composed primarily of iron (Fe) and chromium (Cr). It is commonly used in the production of stainless steel, as it imparts desirable properties such as corrosion resistance, hardness, and high-temperature strength. Ferrochromium is created by smelting chromite ore, which is a mineral containing chromium, along with other elements such as iron, silicon, and carbon. The demand for ferrochromium is influenced by various factors such as industrial growth, rising construction activity, and growing global stainless steel production.

The chromium chemicals segment is projected to grow at a CAGR of 5.7%, in terms of revenue, over the forecast period. The largest driver of chromium chemicals demand is the production of stainless steel. Chromium is a crucial element in stainless steel manufacturing, as it provides corrosion resistance and enhances the strength and durability of the steel. Chromium chemicals find applications in various chemical processes and industries. They are used in the production of pigments, dyes, catalysts, and surface treatment chemicals.

Chromium Market Trends

The chromium market is expected to grow significantly over the forecast period owing to the rising production levels of stainless steel-related products. Chromium is an essential element in the formulation or manufacturing of stainless steel grade for commercial use and is mostly employed as an additive to harden steel as well as enhance corrosion protection.

Increasing applications such as decorative plating from the finishing and plating industry for automotive is driving the demand for chromium. Corrosion and wear resistance coupled with the ability to improve the exterior appearance of a vehicle are some of the major advantages of chromium-plated automotive components. These advantageous properties are expected to drive market growth over the forecast period. However, the growing environmental awareness and accompanying stringent regulations for the chromium plating process may pose a challenge to the growth of the market over the forecast period.

However, the market witnessed deep disturbance with the occurrence of COVID-19 around the globe in 2020. The industry witnessed a sudden drop in demand from its key application sectors owing to the imposed restrictions set by the regulatory bodies. The industrial production levels improved in FY 2021 leading to a sudden surge in demand for chromium and associated products. The price levels increased further in FY 2022 owing to the increment in the energy cost.

Application Insights

The metallurgy segment held the largest revenue share of 92.4% in 2022. Stainless steel and high-resistance steel manufacturers are major consumers in the metallurgy segment. Chromium is used in the form of ferroalloys, metals, and scrape of stainless steel in metallurgical applications. It is an important alloy element used in the manufacturing of high-strength steel due to its excellent mechanical, high oxidative, high hardness, and corrosion resistance properties. It has no substitute in stainless steel or any other superalloys and scrap can be used as an alternative to ferrochromium in some metallurgical end uses.

The chemicals segment is anticipated to register a CAGR of 4.6% over the forecast period. The main product containing chromium in the chemical industry is sodium dichromate, which is widely used as a process material for surface treatment of various metals and feed material for the production of other chrome chemicals in the chemical industry. Chromium-based chemicals include chrome oxide, chromic acid, and potassium dichromate.

Regional Insights

Asia Pacific dominated the market with a share of 50.7% in 2022. The production of stainless steel is increasing at a rapid rate on account of huge demand arising from application industries such as automotive, aerospace, defense, electronics, and building & construction. Rapid industrial growth in developing countries, such as China and India, is one of the factors driving the growth of the global stainless steel market. According to data from the International Stainless Chromium Chemicals Forum (ISSF), India's stainless steel production reached 3.3 million tons by the end of 2016. Furthermore, by the end of 2017, the overall production had increased to 3.6 million tons.

Europe is expected to grow at the second fastest CAGR of 5.6% during the forecast period. Increasing applications such as decorative plating from the finishing and plating industry for automotive is driving the demand for chromium in the region. Corrosion and wear resistance coupled with the ability to improve the exterior appearance of a vehicle are some of the major advantages of chromium-plated automotive components. These advantageous properties are expected to drive market growth over the forecast period. However, the growing environmental awareness and accompanying stringent regulations for the chromium plating process may pose a challenge to the growth of the market over the forecast period.

Key Companies & Market Share Insights

The competition in the global market is highly intense and the overall nature of the vendor landscape is fragmented, with the presence of several key players. The degree of rivalry varies depending on product demand, innovation in technology, regulatory compliance, and distribution network. For instance, the market is concentrated in North America; whereas, in the Asia Pacific, there is intense competition among players.

Key Chromium Companies:

- Glencore

- Samancor Chrome

- Assmang Proprietary Limited

- Odisha Mining Corporation Ltd.

- Hernic Ferrochrome (Pty) Ltd.

- CVK Group

- Al Tamman Indsil FerroChrome L.L.C

- Gulf Mining Group LLC

- MVC Holdings LLC

Recent Developments

-

In June 2023, the Indian government implemented export limitations in order to restrict the export of chromium ores and concentrates, which are utilized in various industries including stainless steel production. During the 2022-23 period, India exported chromium ores and concentrates valued at USD 10.96 million, with the majority being sent to China. Under the new regulations, exporters are required to obtain a license from the Directorate General of Foreign Trade (DGFT) for chromium shipments.

-

In June 2023, in a scientific development, researchers introduced an innovative method known as ion enrichment chip–laser-induced breakdown spectroscopy (IEC-LIBS). This method links laser-induced breakdown spectroscopy with an ion enrichment chip, enabling the sensitive and swift discovery of chromium in different oxidation states present in soil and water. The study, published in the Journal of Analytical Atomic Spectrometry, highlights the efficacy of this approach, which offers simplicity, environmental friendliness, and potential for practical field applications. The IEC-LIBS method contributes to monitoring in accordance with environmental quality standards by efficiently detecting trace levels of chromium in water and soil samples.

-

In May 2023, African Chrome Fields announced the upcoming opening of its innovative aluminothermic smelting factory in Zimbabwe. This facility is built with an investment of around USD 40 million and is set to commence operations within the next two months. The plant utilizes proprietary state-of-the-art technology that eliminates the need for external power in the reduction process of chrome ore to ferrochrome. By supporting the company's mineral beneficiation activities, the plant will serve the interests of both its South African and international customers who rely on its top-quality ferrochrome products for their stainless steel production needs.

Chromium Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 22.70 billion

Revenue forecast in 2030

USD 33.09 billion

Growth Rate

CAGR of 5.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilo tons, revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; China; Japan; India; Australia; South Korea; Thailand; Malaysia; Indonesia; Brazil; Saudi Arabia; South Africa; UAE

Key companies profiled

Glencore; Samancor Chrome; Assmang Proprietary Limited; Odisha Mining Corporation Ltd.; Hernic Ferrochrome (Pty) Ltd.; CVK Group; Al Tamman Indsil FerroChrome L.L.C; Gulf Mining Group LLC; MVC Holdings LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chromium Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global chromium market based on material, application, and region:

-

Material Outlook (Volume, Kilo Tons, Revenue, USD Million, 2018 - 2030)

-

Ferrochromium

-

Chromium Chemicals

-

Chromium Metals

-

Others

-

-

Application Outlook (Volume, Kilo Tons, Revenue, USD Million, 2018 - 2030)

-

Metallurgy

-

Chemicals

-

Refractory

-

Others

-

-

Regional Outlook (Volume, Kilo Tons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global chromium market size was estimated at USD 21.50 billion in 2022 and is expected to reach USD 22.70 billion in 2023

b. The global chromium market is expected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 33.09 billion by 2030.

b. Asia Pacific dominated the chromium market with a share of 50% in 2023. This is attributable to presence of major stainless steel manufacturing units in countries such as China, India, and Japan.

b. Some key players operating in the chromium market include Kermas Group Ltd., Glencore PLC, Eurasian Natural Resources Corporation, Samancor Chrome, Assmang Proprietary Limited, Odisha Mining Corporation, Hernic Ferrochrome (Pty) Ltd., CVK Group, Al Tamman Indsil FerroChrome LLC, and Gulf Mining Group LLC.

b. Key factors that are driving the market growth include increasing demand from the stainless steel industry for various end-use markets such as automotive, aerospace, defense, marine, building and construction, and electronics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.