- Home

- »

- Healthcare IT

- »

-

Chromatography Software Market Size & Share Report, 2030GVR Report cover

![Chromatography Software Market Size, Share & Trends Report]()

Chromatography Software Market (2024 - 2030) Size, Share & Trends Analysis By Type (Standalone, Integrated), By Deployment Model (On Premise, Web & Cloud Based), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-297-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Chromatography Software Market Trends

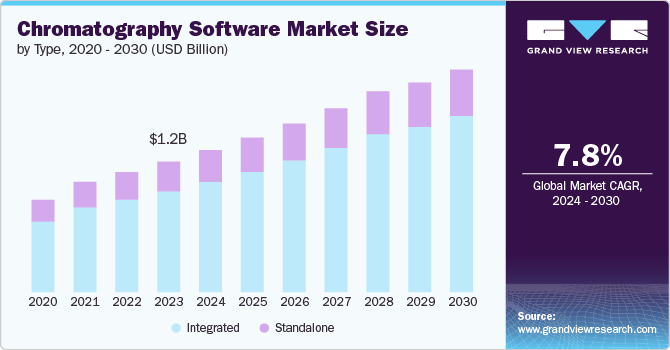

The global chromatography software market size was estimated at USD 1.2 billion in 2023 and is estimated to grow at a CAGR of 7.8% from 2024 to 2030. The rising demand for precise and reliable testing methods for drug quality and safety, along with an increase in pharmaceutical research and development activities are majorly driving the market growth.

There is a growing need for automation and advanced analytical techniques in laboratories, which enhances efficiency and accuracy in data processing and analysis. Furthermore, environmental testing has become increasingly important, with chromatography techniques being essential for monitoring contaminants in water and air, thus driving the demand for sophisticated software solutions. Technological advancements and the integration of chromatography software with laboratory information management systems (LIMS) also play a crucial role in market growth.

These integrations facilitate seamless data management and workflow automation, leading to higher productivity and compliance with stringent regulatory standards.Moreover, the shift towards cloud-based solutions offers enhanced flexibility, real-time data access, and cost-effective storage solutions, further boosting the adoption of chromatography software. For instance, in February 2024, Thermo Fisher Scientific introduced the Thermo Scientific Dionex Inuvion Ion Chromatography (IC) system to enhance ion analysis capabilities across various applications. This innovative instrument offers simplified and intuitive operation for laboratories of all scales, enabling efficient analysis of ionic and small polar compounds. With its adaptable design, the Inuvion IC system provides users a versatile solution, ensuring consistent and dependable results in a single platform.

The increasing research and development activities driven by the expanding application of chromatography techniques are expected to bolster the growth and adoption of chromatography software. Rising concerns related to environmental safety, drug quality, and forensic testing needs are significantly propelling the market for chromatography technology. In addition, supportive government initiatives aimed at enhancing research and development, along with increased investments by market players in pharmaceutical, biotechnology, and environmental testing, are anticipated to further stimulate the growth of the chromatography software market during the forecast period. For instance, the Horizon 2020 program, a major EU funding initiative for research and innovation, offered substantial grants to advance technologies, including chromatography techniques. This support spans industries like pharmaceuticals and environmental sciences, funding projects aimed at enhancing chromatographic analysis and software adoption through improved technology and data management.

Market Concentration & Characteristics

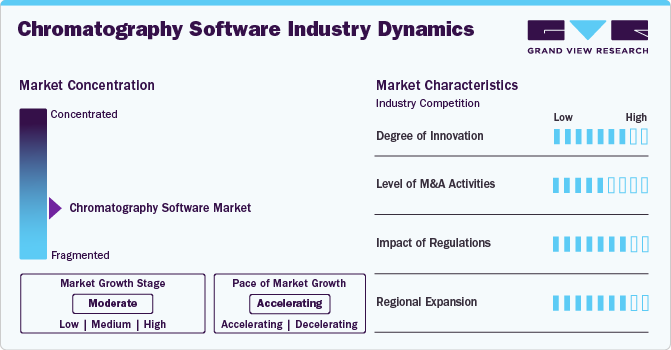

The market is characterized by a high degree of innovation driven by rapid technological advancements. Innovations in chromatography software include advancements in data analysis, automation of workflows, integration with other analytical instruments, and improvements in user interface for better usability and efficiency. Integration of AI and machine learning algorithms to enhance peak detection, data interpretation, and predictive analytics is further driving the market growth.

The market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. Mergers and acquisitions (M&A) within the chromatography software sector have been notable for shaping market dynamics and technological advancements. The mergers and partnerships of Agilent Technologies and Advanced Chemistry Development, Thermo Fisher Scientific and Dionex Corporation, PerkinElmer, and Labtronics Inc. are a few significant activities in the chromatography software that helped enhance data analysis and workflow efficiency for customers.

The market is subject to increasing regulatory scrutiny. Regulations ensure data integrity, traceability, and security in handling sensitive analytical data. Regulatory standards such as FDA guidelines in pharmaceuticals and Good Laboratory Practices (GLP) in research laboratories influence the development and use of chromatography software. The U.S. Food and Drug Administration (FDA) has implemented the Quality Metrics Program to encourage the adoption of advanced analytical methods, including chromatography, in the pharmaceutical industry. This program aims to enhance drug quality and manufacturing processes by requiring companies to report specific data on their operations. This initiative drives the demand for sophisticated chromatography software to ensure compliance and improve the accuracy and efficiency of data reporting

Regional expansion ranges from medium to high, with players strategically expanding their global presence. Companies tailor their software solutions to meet local regulatory requirements and industry standards, such as FDA guidelines in the U.S. or European Pharmacopoeia standards in Europe. This localization includes translating software into local languages and adapting features to suit regional user preferences and regulatory expectations, enhancing user adoption and satisfaction.

Type Insights

The integrated segment held the largest market share of 77.3% in 2023 and is also expected to grow at the fastest CAGR of 8.1% during the forecast period. Integrated chromatography software offers robust capabilities for managing and analyzing complex chromatographic data, empowering researchers to derive meaningful insights. Key features include automated peak detection, spectral analysis, and multivariate data analysis, which enhance data interpretation and support informed decision-making in research and development.

In addition, advanced reporting tools enable customizable reports, crucial for meeting regulatory requirements in industries like pharmaceuticals, where precise analysis and documentation ensure regulatory compliance and product quality assurance. For instance, in May 2023, SCIEX launched the BioPhase 8800 driver for Empower software, facilitating integration with Waters' Empower Chromatography Data System, enabling direct control of the BioPhase 8800 system, which streamlines workflows, minimizing method development, and expediting drug development timelines.

As technological advancements continue to drive innovation and efficiency in analytical processes, integrated solutions are poised to remain at the forefront, meeting the evolving needs of laboratories and industries worldwide. This trend emphasizes the importance of seamless integration, comprehensive functionality, and regulatory compliance in the development and adoption of chromatography software solutions. Integrated software solutions are preferred because they can interface with a wide range of chromatography instruments from different manufacturers, ensuring compatibility and ease of use. They streamline data acquisition, processing, and analysis, offering comprehensive solutions that cater to the needs of laboratories and research facilities. For instance, in August 2023, Repligen Corporation and Sartorius AG jointly launched a bioreactor system combining Repligen XCell ATF technology with Sartorius' Biostat STR bioreactor, aimed at making intensified seed train and N perfusion more accessible for biopharmaceutical firms, as reported by both companies.

Deployment Model Insights

Web & cloud based deployment models held the largest market share in 2023 and are also expected to grow at the fastest CAGR of 7.9% during the forecast period. With increasing globalization and remote work trends, web and cloud-based solutions facilitate seamless remote access to chromatography data and analysis tools. Researchers and analysts can collaborate in real-time across different locations, enhancing productivity and accelerating decision-making processes. In addition, artificial intelligence (AI) and machine learning capabilities in cloud environments enable advanced data analytics, predictive modeling, and anomaly detection, thereby enhancing analytical insights and efficiency.

Moreover, web and cloud-based platforms provide scalability and cost efficiency, enabling companies to adjust resources based on demand without substantial upfront investments in infrastructure. This scalability is particularly beneficial for smaller laboratories or research institutions with fluctuating workload requirements, allowing them to optimize resource allocation and minimize operational costs. For instance, in November 2021, PerkinElmer Inc. announced its PKeye Workflow Monitor, a cloud-based solution empowering laboratory staff to oversee and control their PerkinElmer instruments and workflows from anywhere. With this platform, scientists and researchers gain round-the-clock accessibility and insight into their laboratory operations, facilitating real-time monitoring and management. The PKeye Workflow Monitor ensures seamless connectivity and visibility, enabling efficient workflow optimization and enhancing overall laboratory productivity and performance.

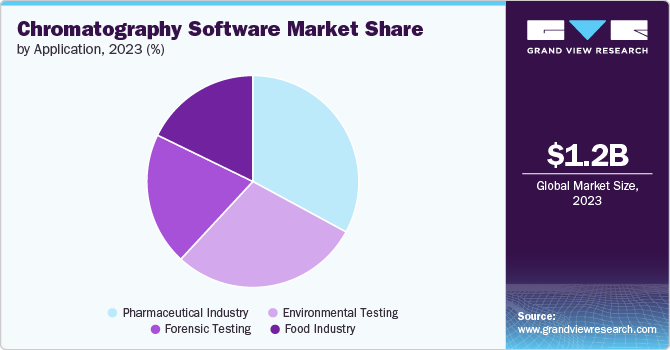

Application Insights

The pharmaceutical industry segment held the largest revenue share of 32.9% in 2023. Pharmaceutical companies heavily rely on chromatography techniques like HPLC (High-Performance Liquid Chromatography) and GC (Gas Chromatography) for rigorous quality control throughout drug development and manufacturing. Chromatography software plays a crucial role in enhancing these processes by automating data analysis, ensuring consistency, and enabling real-time monitoring of critical parameters. Given the pharmaceutical industry's stringent regulatory environment, ensuring data reliability in QA and QC workflows is paramount to ensuring the release of safe and effective products.

For instance, in March 2023, Waters Corporation introduced the Alliance is High-Performance Liquid Chromatography (HPLC) System. This system revolutionized QC analyses by simplifying operations and enhancing instrument intelligence, thereby reducing potential errors by up to 40%. Integrated with Waters Empower Chromatography Software and eConnect HPLC Columns, the system enables laboratories to manage operational risks effectively, minimize disruptions, and enhance overall productivity. Its user-friendly touchscreen interface provides real-time system health checks, guided troubleshooting, and maintenance support, empowering analysts to meet critical product release deadlines effortlessly.

The environmental testing segment is expected to grow at the fastest CAGR of 9.6% during the forecast period. Increasing environmental regulations globally, particularly related to water quality, air pollution, soil contamination, and hazardous waste management, drive the demand for precise and reliable analytical solutions. Growing concerns over emerging contaminants such as pharmaceuticals, pesticides, industrial chemicals, and microplastics in the environment necessitate advanced analytical techniques. Chromatography software plays a critical role in ensuring compliance with these stringent regulatory requirements by facilitating accurate detection and quantification of pollutants and contaminants.

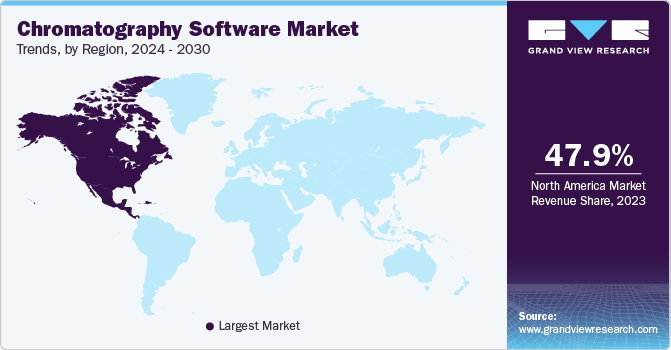

Regional Insights

The North America chromatography software market dominated the market and accounted for the largest revenue share of over 47.9% in 2023, owing to the higher adoption of technology in laboratory testing and the policies supporting the deployment of these technologies to ensure accurate results. In addition, the growing digital literacy, development of technologically advanced infrastructure, and the presence of key market players in the region such as Agilent Technologies, Inc., Bruker Corporation, Gilson Inc., Restek Corporation, Thermo Fisher Scientific Inc., and Waters Corporation are fueling the market growth.

U.S. Chromatography Software Market Trends

The chromatography software market in the U.S. held the largest revenue share in 2023. This can be attributed to the growing adoption of technological advancements to revolutionize the healthcare landscape. The rising demand from pharmaceutical and biotechnology sectors for drug development and quality control further fuels market expansion. In addition, the market sees a growing influx of smaller niche players specializing in specific chromatography techniques or applications, intensifying competition and driving continuous advancements in software functionalities, usability, and integration with other analytical tools.

This dynamic landscape fosters innovation and customer-centricity as companies strive to differentiate themselves and capture market opportunities. For instance, in June 2023, Agilent Technologies Inc. introduced two systems, the Agilent 6495D LC/TQ and Revident LC/Q-TOF, along with their latest software solutions, Agilent MassHunter Explorer Profiling and Agilent ChemVista library manager, with the Agilent 6495 LC/TQ system boasting remarkable sensitivity and intelligent features crucial for facilitating a smooth transition from research to high-volume sample analysis, thereby enabling significant scientific advancements.

Europe Chromatography Software Market Trends

The Europe chromatography software market is expected to grow significantly from 2024 to 2030. The expanding pharmaceutical and biotechnology industries in Europe demand precise analytical tools for drug development, quality control, and regulatory submissions. Additionally, increasing research and development activities across various fields, including academia and environmental sciences, contribute to market growth by requiring advanced data analysis and management capabilities.

The chromatography software market in the UK is expected to grow profitably from 2024 to 2030. The demand from the pharmaceutical and biotechnology sectors in the UK for precise analytical tools is significantly driving the growth. The UK's regulatory framework plays a crucial role in driving the adoption of advanced chromatography software. The Medicines and Healthcare Products Regulatory Agency (MHRA) oversees the regulation of pharmaceuticals and medical devices, ensuring that companies comply with Good Laboratory Practice (GLP) and Good Manufacturing Practice (GMP) standards. Chromatography software must support compliance with these regulations by providing accurate data analysis, secure data storage, and comprehensive reporting capabilities.

Asia Pacific Chromatography Software Market Trends

The Asia Pacific chromatography software market is anticipated to grow at a remarkable CAGR of 9.0% during the forecast period, driven by several key factors. Rapid industrialization, coupled with increased research and development activities, is fueling the demand for advanced analytical tools across various sectors, including pharmaceuticals, biotechnology, environmental sciences, and food and beverage industries. Countries like China, India, and Japan are investing heavily in R&D and infrastructure, enhancing the adoption of sophisticated chromatography software solutions.

Moreover, the regulatory landscape in the Asia Pacific is becoming more stringent, with authorities emphasizing the need for compliance with Good Laboratory Practice (GLP) and Good Manufacturing Practice (GMP) standards. Regulatory bodies such as the China Food and Drug Administration (CFDA), the Pharmaceuticals and Medical Devices Agency (PMDA) in Japan, and the Central Drugs Standard Control Organization (CDSCO) in India are enforcing stringent regulations to ensure product safety and efficacy. Chromatography software that offers robust data management, audit trails, and secure data storage is essential for meeting these regulatory requirements.

The chromatography software market in Japan is expected to grow significantly, driven by several factors. Japan's strong emphasis on research and development across various sectors, including pharmaceuticals, biotechnology, environmental sciences, and food and beverage industries, is a major contributor. The country is home to leading pharmaceutical companies and research institutions that require advanced analytical tools for drug development, quality control, and regulatory compliance. The increasing prevalence of chronic diseases and the aging population in Japan are also driving the demand for advanced pharmaceuticals, which in turn boosts the need for reliable chromatography software. These tools ensure the quality and safety of pharmaceutical products by providing precise data analysis and comprehensive reporting capabilities.

China chromatography software market is expected to grow significantly due to several driving factors. China's rapid industrialization and robust economic growth have led to increased research and development activities across various sectors, including pharmaceuticals, biotechnology, environmental sciences, and food and beverage industries. These sectors demand advanced analytical tools to enhance productivity, accuracy, and compliance, which in turn drives the adoption of sophisticated chromatography software solutions.

Key Chromatography Software Company Insights

The market players are focusing on the technological development of chromatography products and systems including its automation for accurate and effective performance. For instance, in June 2021, Water Corporation launched the Waters Arc Premier System, a liquid chromatography system designed to help increase the consistency, speed, and confidence of the scientist in deriving the analytical results. The rising adoption of technology in research activities for better results, performance, quick access to data, and facilitating the integration of workflow for quick and accurate results and information is likely to support market growth.

Key Chromatography Software Companies:

The following are the leading companies in the chromatography software market. These companies collectively hold the largest market share and dictate industry trends.

- Agilent Technologies Inc.

- Bruker Corporation

- Cytiva,

- DataApex

- Gilson Inc.

- KNAUER

- Restek Corporation

- Scion Instruments

- Shimadzu Corporation

- Waters Corporation

Recent Developments

-

In April 2024, Waters Corporation introduced the Alliance iS Bio HPLC System, a cutting-edge solution designed to boost efficiency and minimize errors in biopharma quality control (QC) laboratories. This advanced system integrates state-of-the-art bio-separation technology with intelligent instrument features, aiming to reduce up to 40% of common errors.

-

In February 2024, Thermo Fisher Scientific introduced the Dionex Inuvion Ion Chromatography (IC) system, a versatile and user-friendly instrument for ion analysis, offering a comprehensive solution for determining small and ionic polar compounds.

Chromatography Software Market Report Scope

Report Attribute

Details

market size value in 2024

USD 1.3 billion

Revenue forecast in 2030

USD 2.1 billion

Growth rate

CAGR of 7.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, deployment model, application, region

Regions covered

North America; Europe; Asia Pacific; Latin America, MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Agilent Technologies Inc.; Bruker Corporation; Cytiva; DataApex; Gilson Inc.; KNAUER; Restek Corporation; Scion Instruments; Shimadzu Corporation; Waters Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chromatography Software Market Report Segmentation

This report forecasts revenue growth at the regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global chromatography software market based on the type, deployment model, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 -2030)

-

Standalone

-

Integrated

-

-

Deployment Model Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Web & Cloud-Based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Industry

-

Forensic Testing

-

Environmental Testing

-

Food Industry

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global chromatography software market size was estimated at USD 1.2 billion in 2023 and is expected to reach USD 1.3 billion in 2024.

b. The global chromatography software market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 2.1 billion by 2030.

b. North America dominated the chromatography software market with the largest market share of 47.9% in 2023. This is attributable to the higher adoption of technology in laboratory testing and the policies supporting the deployment of these technologies to ensure accurate results. In addition, the presence of key market players in the region, such as Agilent Technologies, Inc., Bruker Corporation, Gilson Inc., Restek Corporation, Thermo Fisher Scientific Inc., and Waters Corporation, is fueling the market growth of the chromatography software.

b. Some key players operating in the chromatography software market include Agilent Technologies Inc., Bruker Corporation, Cytiva, DataApex, Gilson Inc., KNAUER, Restek Corporation, Scion Instruments, Shimadzu Corporation, and Waters Corporation.

b. Key factors driving the chromatography software market growth include the rising demand for precise and reliable testing methods for drug quality and safety, along with an increase in pharmaceutical research and development activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.