- Home

- »

- Clinical Diagnostics

- »

-

Cholesterol Testing Products And Services Market Report, 2030GVR Report cover

![Cholesterol Testing Products And Services Market Size, Share & Trends Report]()

Cholesterol Testing Products And Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Testing Kits, Testing Strips), By Test, By Age Group, By Application, By Service Provider, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-762-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

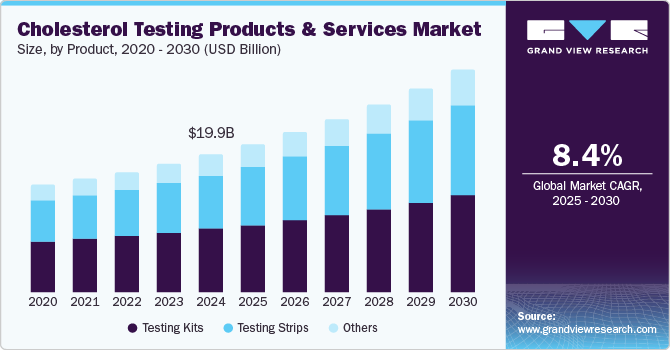

The global cholesterol testing products and services market size was estimated at USD 19.85 billion in 2024 and is projected to grow at a CAGR of 8.4% from 2025 to 2030. Critical demographic trends and a heightened emphasis on preventive healthcare influence market growth worldwide. Recent studies indicate a decline in the age-adjusted prevalence of clinical high cholesterol (defined as LDL levels of 160 mg/dL or higher) among U.S. adults, decreasing from 12.4% in 1999-2000 to 6.1% in 2017-2020. However, concerns persist for older adults aged 65 and above, many of whom remain untreated and unaware of their elevated low density lipoprotein (LDL) levels. This highlights the critical need for enhanced awareness and accessibility of cholesterol screenings, particularly for underserved populations.

Health organizations such as the CDC further reinforce the necessity for routine cholesterol screening, which recommends testing every four to six years, particularly for men aged 35 and older and women aged 45 and older, who are at heightened risk for coronary heart disease. Furthermore, the Cardiologist Society of India has updated its guidelines to advise lipid profiling starting at age 18, emphasizing early detection and proactive management. Alarmingly, 34.6% of uninsured adults aged 20 to 64 have never been tested, highlighting a significant opportunity for market expansion through targeted outreach and educational initiatives.

Technological advancements have significantly transformed the cholesterol testing landscape. The emergence of innovative point-of-care devices and home testing kits facilitates rapid results, empowering consumers to manage their health more effectively. Enhanced testing methods, such as non-fasting assays, increase patient comfort and accuracy, catering to diverse consumer preferences. The United Nations forecasts that the global population aged 60 and older will rise from 12% in 2015 to 22% by 2050. Thus, addressing the healthcare needs of this demographic is crucial, thereby increasing demand for cholesterol testing services.

Favorable regulatory environments and reimbursement policies are promoting the wider adoption of cholesterol testing. As market expansion accelerates, particularly in emerging regions such as Asia Pacific, the establishment of diagnostic centers and improved healthcare infrastructure will further drive demand. The combination of increasing health concerns regarding cholesterol levels, technological advancements, and supportive healthcare policies positions the cholesterol testing market for substantial growth in the coming years.

Product Insights

Testing kits led the market and accounted for a share of 45.8% in 2024. Testing kits provide convenience and user-friendliness, enabling individuals to perform tests at home without laboratory visits. This accessibility empowers health-conscious consumers to monitor cholesterol levels regularly. Furthermore, the affordability of these kits compared to traditional methods enhances their popularity among patients seeking proactive health monitoring solutions.

Testing strips are expected to grow at the fastest CAGR of 9.3% over the forecast period due to their convenience and simplicity, enabling quick at-home cholesterol monitoring without laboratory visits. Increased awareness of cardiovascular health and lifestyle-related diseases and advancements in digital and multi-use strips enhance their appeal and affordability in the market.

Test Insights

Total cholesterol tests dominated the market with a revenue share of 38.6% in 2024. Total cholesterol tests offer a thorough evaluation of an individual’s cholesterol levels, including high density lipoprotein (HDL), LDL, and triglycerides. This test is vital for assessing cardiovascular risk, making it a preferred option for healthcare providers during routine check-ups. Growing awareness of cardiovascular health and its integration into standard assessments drive demand and popularity.

Low density lipoprotein (LDL) cholesterol tests are expected to register the fastest CAGR of 8.7% over the forecast period. LDL cholesterol, known as "bad" cholesterol, is associated with a higher risk of heart disease and stroke. The increasing rates of obesity, poor dietary choices, and sedentary lifestyles have raised awareness regarding LDL monitoring. Consequently, healthcare providers now advocate for regular LDL testing as a preventive health measure, boosting demand among patients.

Age Group Insights

The geriatric segment held the largest revenue share of 46.9% in 2024, aided by the rising prevalence of high cholesterol and cardiovascular diseases (CVDs) among older adults. Increased susceptibility to dyslipidemia with age necessitates regular cholesterol monitoring. Furthermore, heightened awareness of preventive healthcare, routine screenings, and government initiatives promoting health checks for seniors are amplifying demand within this demographic.

Adults are expected to witness the fastest growth of 9.9% over the forecast period. Adults represent a rapidly growing target demographic due to the escalating prevalence of lifestyle-related diseases, particularly cardiovascular conditions. The American Heart Association reports that 32.8% of U.S. males and 36.2% of females have cholesterol levels exceeding 200 mg/dL, indicating significant prevalence among adults, underscoring the need for increased monitoring and management strategies. Regular cholesterol testing is advised, especially for those with risk factors such as obesity and inactivity. Increased awareness of preventive healthcare and government initiatives further enhance the focus on cholesterol testing services and products within this segment.

Application Insights

Cardiovascular diseases led the market with a revenue share of 35.5% in 2024, supported by the rising incidence of CVDs, a leading cause of global mortality. Increased awareness of the relationship between cholesterol levels and heart health encourages regular testing, while healthcare providers prioritize cholesterol management in preventive care, driving demand for screenings among at-risk populations and facilitating timely risk assessment.

Obesity is projected to grow at the fastest rate of 9.2% over the forecast period. The global rise in obesity, closely associated with elevated cholesterol levels, underscores the importance of cholesterol management. For instance, in Europe, one in six adults is classified as obese, and over 50% are overweight, highlighting the urgent need for effective public health interventions. As unhealthy lifestyles become prevalent, healthcare providers advocate regular cholesterol testing for obese individuals, driving demand for cholesterol testing products, supported by government initiatives targeting obesity-related health challenges.

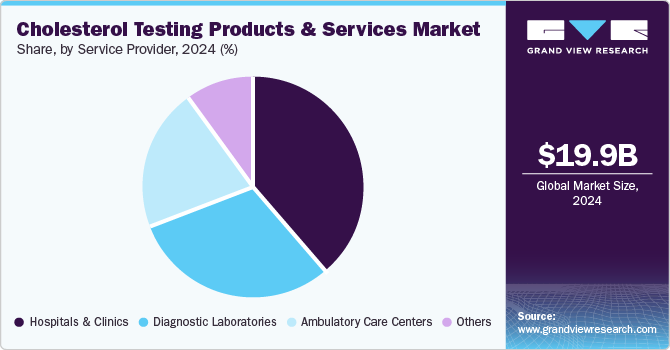

Service Provider Insights

Hospitals and clinics dominated the market, accounting for a share of 39.1% in 2024. These facilities utilize advanced diagnostic technologies and are staffed by trained professionals to ensure accurate and efficient cholesterol testing. The rising incidence of lifestyle-related diseases and an aging population enhance the demand for cholesterol testing, supporting early detection and management as part of preventive healthcare strategies against CVDs.

Diagnostic laboratories are projected to grow at the fastest CAGR of 9.2% over the forecast period. These laboratories employ advanced technologies and skilled professionals to deliver precise results for complex cholesterol assessments. The rising prevalence of CVDs necessitates regular monitoring, positioning diagnostic labs as the preferred choice for healthcare providers, and enhancing their role in facilitating timely and effective patient care for at-risk individuals.

Regional Insights

North America cholesterol testing products and services market dominated the global market with a revenue share of 39.6% in 2024. The region hosts advanced healthcare infrastructure and a high prevalence of CVDs. The aging population boosts the demand for regular cholesterol screenings, while substantial investments in R&D and increased awareness and government initiatives further spur developments in testing technologies.

U.S. Cholesterol Testing Products And Services Market Trends

The cholesterol testing products and services market in U.S. dominated the North America market with a revenue share of 90.6% in 2024. The rising incidence of high cholesterol and associated CVDs in the aging population fuels the demand for regular screenings. Moreover, innovations such as point-of-care testing devices improve convenience and efficiency, while public health campaigns promote awareness of the critical importance of monitoring cholesterol levels for better health outcomes.

Europe Cholesterol Testing Products And Services Market Trends

Europe cholesterol testing products and services market held a substantial market share in 2024. The European market is expanding due to an emphasis on preventive healthcare and early CVD diagnosis. Established healthcare systems and heightened awareness of heart health among patients, coupled with technological advancements in non-invasive testing and home testing kits, enhance accessibility and support government initiatives to reduce lifestyle-related diseases.

The cholesterol testing products and services market in Germany is expected to grow rapidly in the forecast period. Germany prioritizes preventive health measures, resulting in heightened screening rates within its population. The country’s commitment to research and development promotes innovations in cholesterol testing technologies. Furthermore, the increasing prevalence of CVDs compels healthcare providers to implement effective monitoring solutions, driving growth in this market segment.

Asia Pacific Cholesterol Testing Products And Services Market Trends

Asia Pacific cholesterol testing products and services market is expected to register the fastest CAGR of 9.7% in the forecast period. The region is witnessing heightened awareness of cardiovascular health alongside a rising incidence of lifestyle-related diseases. Rapid urbanization and evolving dietary habits lead to increased cholesterol levels. Moreover, healthcare infrastructure and technology advancements enhance access to testing services, supported by government initiatives promoting preventive healthcare practices and fostering market expansion.

The Japan cholesterol testing products and services market dominated the Asia Pacific cholesterol testing products and services market in 2024, owing to its aging population, which necessitates effective cardiovascular health monitoring solutions. The country features advanced healthcare systems that promote access to innovative testing technologies. Enhanced public awareness of health risks related to high cholesterol encourages routine screenings, aided by advancements in point-of-care devices and home testing kits.

Key Cholesterol Testing Products And Services Company Insights

Some key companies operating in the market include Quest Diagnostics Incorporated, Eurofins Scientific, Spectra Laboratories, Inc. (Fresenius Medical Care), and Novartis AG, among others. Strategic initiatives encompass substantial investments in research and development, innovative product launches, and collaborations with healthcare institutions to enhance market reach and testing accuracy while utilizing mergers and acquisitions to strengthen market position and expand product portfolios. For instance, in March 2024, Laboratory Corporation of America Holdings announced its acquisition of select assets from BioReference Health’s diagnostics business for USD 237.5 million, enhancing its laboratory services network and expanding access to high-quality testing nationwide.

-

Spectra Laboratories, a subsidiary of Fresenius Medical Care, provides laboratory services for dialysis patients. The cholesterol testing market provides reference materials for calibration verification, ensuring the accuracy and reliability of cholesterol assays and supporting quality assurance in clinical laboratories.

-

Laboratory Corporation of America Holdings (Labcorp) offers a range of cholesterol testing, including lipid panels to measure total cholesterol, HDL, LDL, and triglycerides. Its comprehensive testing capabilities enable healthcare providers to diagnose and manage cardiovascular health effectively.

Key Cholesterol Testing Products And Services Companies:

The following are the leading companies in the cholesterol testing products and services market. These companies collectively hold the largest market share and dictate industry trends.

- Quest Diagnostics Incorporated

- Eurofins Scientific

- Spectra Laboratories, Inc. (Fresenius Medical Care)

- Novartis AG

- Cell Biolabs, Inc.

- Randox Laboratories Ltd.

- SYNLAB AG

- BioReference Health, LLC

- Laboratory Corporation of America Holdings

- Thermo Fisher Scientific Inc.

- Clinical Reference Laboratory, Inc.

- Elabscience Bionovation Inc.

Recent Developments

-

In October 2024 In October 2024, Novartis launched an innovative therapy in the Philippines, effectively reducing LDL cholesterol to help prevent heart attacks, addressing the critical issue of cardiovascular disease in the Philippines.

-

In October 2024, Verichem Laboratories launched liquid-stable reference materials for cholesterol assay calibration, enhancing laboratory quality assurance for total cholesterol, HDL, and LDL tests.

-

In September 2024, Quest Diagnostics Incorporated finalized its acquisition of certain laboratory assets from Allina Health, improving access to high-quality, affordable lab services for patients in Minnesota and western Wisconsin, U.S.

-

In August 2024, Novartis AG announced positive Phase III V-MONO study results for Leqvio, demonstrating significant LDL cholesterol reduction, positioning it for potential expansion as a preventive treatment for atherosclerotic CVD.

-

In March 2024, Laboratory Corporation of America Holdings launched its Weight Loss Management portfolio, including accessible cholesterol testing and comprehensive health indicators to assist individuals and physicians in informed weight loss management decisions and treatments.

Cholesterol Testing Products And Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.35 billion

Revenue forecast in 2030

USD 31.98 billion

Growth rate

CAGR of 8.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, test, age group, application, service provider, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Quest Diagnostics Incorporated; Eurofins Scientific; Spectra Laboratories, Inc. (Fresenius Medical Care); Novartis AG; Cell Biolabs, Inc.; Randox Laboratories Ltd.; SYNLAB AG; BioReference Health, LLC; Laboratory Corporation of America Holdings; Thermo Fisher Scientific Inc.; Clinical Reference Laboratory, Inc.; Elabscience Bionovation Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cholesterol Testing Products And Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cholesterol testing products and services market report based on product, test, age group, application, service provider, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Testing Kits

-

Testing Strips

-

Others

-

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

Total Cholesterol Tests

-

High Density Lipoprotein (HDL) Cholesterol Tests

-

Low Density Lipoprotein (LDL) Cholesterol Tests

-

Triglyceride Tests

-

Others

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Geriatric

-

Adult

-

Pediatric

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Diseases

-

Diabetes

-

Obesity

-

Hyperlipidemia

-

Others

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Diagnostic Laboratories

-

Ambulatory Care Centers

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.