Chocolate Syrup Market Size, Share & Trends Analysis Report By Type (Conventional, Organic), By Distribution Channel (B2C, B2B), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-005-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Chocolate Syrup Market Size & Trends

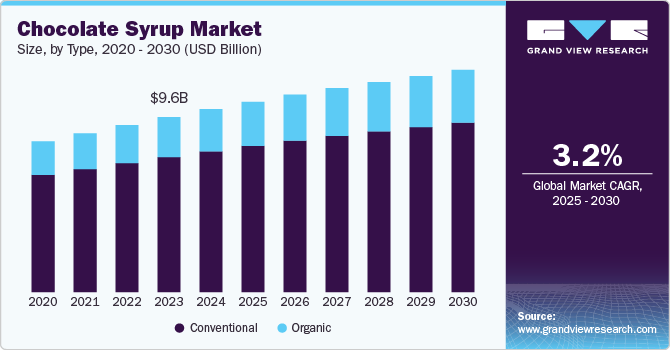

The global chocolate syrup market size was estimated at USD 10.03 billion in 2024 and is expected to grow at a CAGR of 3.2% from 2025 to 2030. In recent years, the demand for products such as flavor enhancers and toppings in various recipes such as pancakes, cakes, and pastries has gained immense popularity among consumers across the globe. Consumers are now seeking high-quality chocolate flavors in different variants, which is driving the product demand.

Growth of the market can largely be attributed to the growing application of the product as topping or dessert sauce in a wide range of ice creams, pudding, dishes, and bakery & confectionery products as consumers began to cook at home. Evolving consumer patterns and panic buying during the pandemic led to a surge in demand for convenient, ready-to-eat (RTD), and packaged foods, owing to which the consumption of the product increased through B2C channels. However, the B2B channel was negatively impacted owing to the temporary closure of food service outlets, cafés, and restaurants.

The growing popularity of desserts and beverages, such as ice cream, pancakes, and milkshakes, has created a strong demand for chocolate syrup as a key topping or flavoring agent. In addition, increasing disposable income in many regions has led to higher spending on premium and gourmet products, further fueling the growth of the chocolate syrup segment, as consumers are seeking richer and more luxurious dessert experiences. Moreover, the expanding foodservice industry, including cafés and restaurants, has also contributed to the market’s growth, as these establishments frequently use chocolate syrup in various offerings.

There is a noticeable shift towards healthier and more sustainable products. Manufacturers are increasingly developing chocolate syrups made with organic ingredients, reduced sugar, and vegan or dairy-free options to cater to health-conscious consumers. The rise of clean-label products is also influencing purchasing decisions, with consumers showing a preference for syrups free from artificial additives and preservatives.

Type Insights

The conventional chocolate syrup market accounted for a share of 87.3% of the global revenue for 2024. The growth of the segment is characterized by an increase in interest in RTD, flavorful, and convenient syrups and sweeteners. The growing availability of several variants, such as almonds and hazelnuts, in conventional products is driving the consumption of conventional ones. The product is immensely gaining popularity among countries including China and India owing to changing taste preferences and evolving demand for innovative packaged products. Millennials and younger consumers are the major consumers of conventional syrup owing to growing interest in international flavors and products such as gourmet chocolates and confectioneries.

The organic chocolate syrup market is anticipated to grow at a CAGR of 3.7% from 2025 to 2030. The growth of the segment is characterized by a growing consumer inclination towards health-oriented syrups and sweeteners, which has resulted in a surge in demand in the market. In addition, health and wellness associated with gluten-free, organically sourced, vegan, zero-sugar syrups have gained popularity in recent years. Further, market players such as Organic Midnight Moo, Wildly Organic, and Walden Farms are a few prominent manufacturers of organic products. Europe is the prominent consumer of natural and organic chocolate-flavored syrups owing to growing concerns related to overall health and the environment.

Distribution Channel Insights

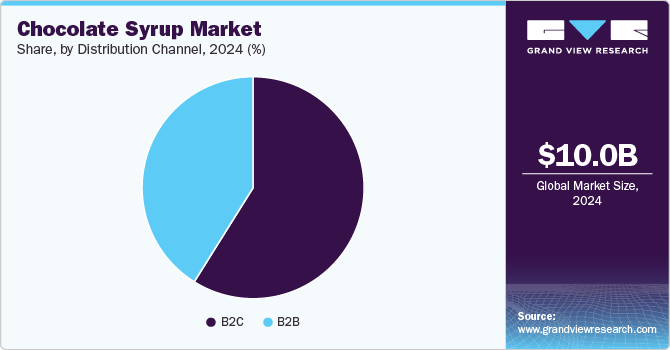

Sales of chocolate syrup through B2C channels accounted for a share of 58.9% in 2024. An increasing number of offline and online retailers, such as supermarkets and hypermarkets and e-commerce platforms, offer these products in different flavors and variants, such as dark chocolate and hazelnut, among other formats, propelling the segment's growth.

Major supermarket chains such as Kroger are offering their own lines of chocolate-flavored products through supermarket chains owing to the growing interest in syrups and additives for confectioneries. For instance, major supermarket chains such as Walmart, Kroger, Tesco, Target Brands Inc., Hy-Vee, Inc., Instacart, Ubuy, Alibaba, Safeway, Amazon, Sainsbury’s, and Asda, among others, offer a variety of products from international and local brands for consumers to choose from.

Sales of chocolate syrup through the B2B channels are anticipated to grow with a CAGR of 3.6% over the forecast period. Foodservice outlets, cafés, eateries, cake shops, chocolate stores, restaurants, bakeries, and others form the B2B channels. In recent years, the segment has witnessed immense product adoption as consumers such as to experience different flavors of the product on confectioneries, cakes, puddings, pastries, donuts, and desserts offered by these outlets. Segment growth was negatively impacted by the temporary closures induced during the COVID-19 pandemic. Several food service outlets, including Cruisin Coffee, Handel's Ice Cream, The Ice Cream Parlor, and The Cone Of West Chester, have reported using Hershey’s syrups in their products. Such instances are such asly to bode well for market growth.

Regional Insights

The chocolate syrup market in North America accounted for a share of 28.3% of the global revenue in 2024. The North America chocolate syrup market is driven by the high consumption of desserts and beverages such as ice cream, pancakes, and milkshakes, where chocolate syrup is commonly used as a topping or flavor enhancer. The U.S. holds a dominant share due to the strong presence of large foodservice chains and widespread consumer preference for indulgent products. The rising trend of home baking, fueled by social media and DIY culture, also boosts sales. Health-conscious consumers are seeking low-sugar and organic alternatives, pushing manufacturers to innovate and offer cleaner, more sustainable options.

U.S. Chocolate Syrup Market Trends

The chocolate syrup market in the U.S. is projected to grow at a CAGR of 2.3% from 2025 to 2030. The U.S. leads the chocolate syrup market in North America, benefiting from a well-established food and beverage industry. Major market drivers include the popularity of ready-to-use toppings for desserts, the rising trend of premiumization in the food sector, and a shift towards organic and natural ingredients. Increasing demand for plant-based and dairy-free alternatives has pushed companies to diversify their offerings. In addition, the U.S. has a high number of quick-service restaurants, cafés, and ice cream parlors, which significantly contributes to the market’s growth.

Europe Chocolate Syrup Market Trends

The chocolate syrup market in Europe is projected to grow at a CAGR of 1.9% from 2025 to 2030. Europe presents a diverse chocolate syrup market, with demand being driven by the region’s love for chocolate-based desserts and beverages. The market is heavily influenced by the growing consumer trend towards clean-label, organic, and healthier products. European consumers are showing an increasing preference for chocolate syrup with reduced sugar, made from natural ingredients. The region’s well-established café culture and increasing penetration of international dessert chains have further stimulated demand across Europe.

The chocolate syrup market in the UK accounted for a share of 21.4% of Europe's revenue in 2024. In the UK, the chocolate syrup market is expanding due to the rising popularity of dessert-centric cafés and the influence of social media trends on home baking. Consumers are gravitating toward premium and artisan chocolate syrups, with a growing interest in organic and sustainably sourced products. The market is also seeing a rise in plant-based and low-calorie alternatives as the UK's health-conscious population demands more options aligned with their dietary preferences.

The Germany chocolate syrup market is projected to grow at a CAGR of 1.9% from 2025 to 2030. Germany’s chocolate syrup market is supported by the country’s strong tradition of confectionery consumption. Germans have a penchant for high-quality, often artisanal, chocolate products, and this trend is reflected in the syrup market as well. The demand for healthier and organic products is rising, in line with Germany's focus on sustainability and eco-friendly consumption. In addition, chocolate syrup is widely used in baked goods and hot beverages, further boosting demand in the foodservice sector.

Asia Pacific Chocolate Syrup Market Trends

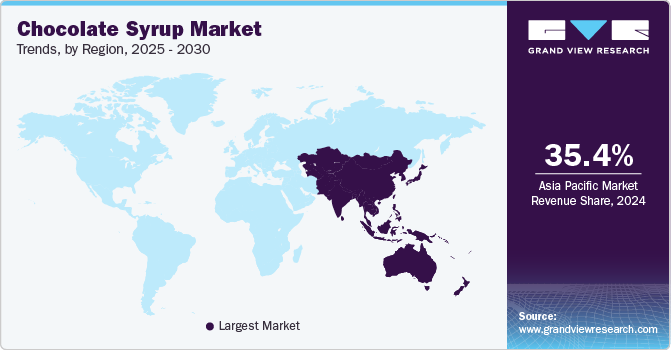

The chocolate syrup market in Asia Pacific accounted for a share of 35.4% of the global revenue in 2024. In the Asia Pacific region, the chocolate syrup market is witnessing significant growth, driven by the increasing westernization of eating habits and the rising popularity of desserts, particularly among the younger population. Countries such as China and Japan have seen an influx of international dessert chains, contributing to higher consumption of chocolate syrup. In addition, as disposable incomes rise and lifestyles become more fast-paced, the demand for convenient and ready-to-use dessert products, including chocolate syrup, has increased across the region.

The chocolate syrup market in China accounted for a share of 39.5% of the Asia Pacific market in 2024. China's chocolate syrup market is expanding as a result of urbanization, rising disposable income, and the increasing adoption of Western culinary trends. The growing café culture, especially in urban centers, has led to increased demand for chocolate syrup in beverages and desserts. Health-conscious consumers are also driving demand for premium and low-sugar options, pushing manufacturers to diversify their product portfolios to cater to evolving preferences.

The Japan chocolate syrup market is projected to grow at a CAGR of 2.0% from 2025 to 2030. Japan’s chocolate syrup market is influenced by its strong dessert culture and high demand for innovative and premium food products. Japanese consumers are particularly receptive to high-quality, aesthetically appealing products, which has led to a growing demand for artisanal and gourmet chocolate syrups. In addition, health-conscious trends have prompted manufacturers to offer low-calorie and sugar-free alternatives to cater to the country’s aging population and health-focused younger consumers.

Central and South America Chocolate Syrup Market Trends

The chocolate syrup market in Central and South America is projected to grow at a CAGR of 8.3% from 2025 to 2030. The market is in its nascent stage, with growth primarily driven by urbanization and the increasing penetration of Western food service outlets in Central & South American countries. Rising disposable incomes and expanding retail channels have improved access to chocolate syrup products. While the market is relatively small, there is potential for growth as more consumers embrace indulgent desserts and beverages, influenced by global food trends.

Middle East & Africa Chocolate Syrup Market Trends

The chocolate syrup market in the Middle East & Africa is projected to grow at a CAGR of 6.6% from 2025 to 2030. The Middle East and African chocolate syrup market is characterized by diverse consumption patterns influenced by cultural and religious factors. While alcohol consumption is restricted in some Middle Eastern countries, the region is witnessing a growing interest in craft chocolate syrups and alternative alcoholic beverages among expatriates and younger demographics. In Africa, chocolate syrup consumption is on the rise, driven by urbanization and a burgeoning middle class. Traditional chocolate syrup styles coexist with the emergence of craft breweries, offering a variety of flavors and styles. As the market evolves, local breweries are focusing on innovative products that cater to changing consumer preferences, and distribution channels, including off-trade and e-commerce, are expanding to meet growing demand.

Key Chocolate Syrup Company Insights

The market is characterized by the presence of some large multinational companies with a strong presence across the globe. Some of the key players are The Hershey's Company, Nestlé, The Kroger Co., The J.M. Smucker Company, Torani, Bosco, Hollander Chocolate, Inc., Walder Farms, Amoretti, and Gold's Pure Foods, LLC. These companies have been implementing various expansion strategies, such as mergers and acquisitions, capacity expansion, strengthening of online presence, and new product launches, to gain a competitive advantage. These manufacturers are adopting various strategies, including new product launches, expansion of product portfolios, and mergers & acquisitions. For instance:

-

In March 2024, the Hershey Company was honored as one of the World’s Most Ethical Companies by Ethisphere, a global leader in promoting ethical business practices that fostered corporate integrity, marketplace trust, and overall business success.

-

In March 2024, Nestlé launched two new initiatives in collaboration with suppliers Cargill and ETG | Beyond Beans, as part of its commitment to achieve net zero emissions by 2050. These projects aimed to reduce and eliminate carbon emissions within its supply chains. Over a five-year period, they focused on promoting agroforestry, accelerating the transition to regenerative agriculture, and supporting the reforestation of degraded lands in cocoa farming communities.

Key Chocolate Syrup Companies:

The following are the leading companies in the chocolate syrup market. These companies collectively hold the largest market share and dictate industry trends.

- The Hershey's Company

- Nestlé

- The Kroger Co.

- The J.M. Smucker Company

- Torani

- Bosco

- Hollander Chocolate, Inc

- Walder Farms

- Amoretti

- Gold's Pure Foods, LLC.

Chocolate Syrup Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 10.43 billion |

|

Revenue forecast in 2030 |

USD 12.19 billion |

|

Growth rate |

CAGR of 3.2% from 2025 to 2030 |

|

Actuals |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Belgium; China; Japan; India; Australia & New Zealand: Brazil; Argentina; South Africa |

|

Key companies profiled |

The Hershey's Company; Nestlé; The Kroger Co.; The J.M. Smucker Company; Torani; Bosco; Hollander Chocolate, Inc; Walder Farms; Amoretti; Gold's Pure Foods, LLC. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Chocolate Syrup Market Report Segmentation

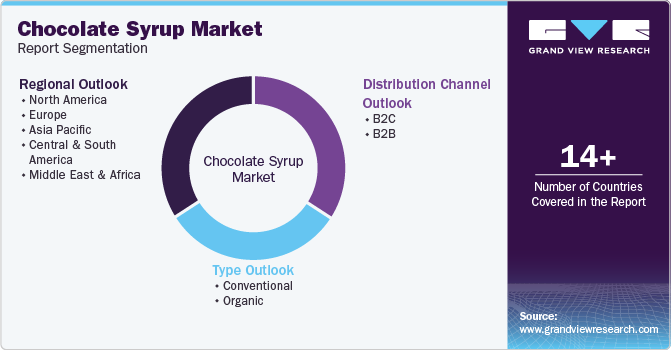

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the chocolate syrup market on the basis of type, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Organic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2C

-

Hypermarkets/Supermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

-

B2B

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Belgium

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global chocolate syrup market size was estimated at USD 10.03 billion in 2024 and is expected to reach USD 10.43 billion in 2025.

b. The global chocolate syrup market is expected to grow at a compound annual growth rate of 3.2% from 2025 to 2030, reaching USD 12.19 billion by 2030.

b. Asia Pacific dominated the chocolate syrup market with a share of 35.4% in 2024. This is attributable to growing consumer interest in sweet dishes and gourmet confectioneries. Further, younger consumers and millennials in the region are keen to try new and international sweet dishes such as donuts, cookies, gourmet sweets, and pancakes.

b. Some key players operating in the telemedicine market include The Hershey's Company; Nestlé; The Kroger Co.; The J.M. Smucker Company; Torani; Bosco; Hollander Chocolate, Inc; Walder Farms; Amoretti; Gold's Pure Foods, LLC

b. Key factors that are driving the market growth include increasing demand for chocolate syrup as a flavor enhancer and topping in various recipes such as pancakes, cakes, and pastries. Consumers are now seeking for high quality chocolate flavors in different variants, which is driving the chocolate syrups demand.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."