- Home

- »

- Water & Sludge Treatment

- »

-

Chlorine Dioxide Market Size, Share & Trends Report, 2030GVR Report cover

![Chlorine Dioxide Market Size, Share & Trend Report]()

Chlorine Dioxide Market Size, Share & Trend Analysis Report; By Application (Paper & Pulp, Industrial, Food & Beverages); By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-354-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Chlorine Dioxide Market Size & Trends

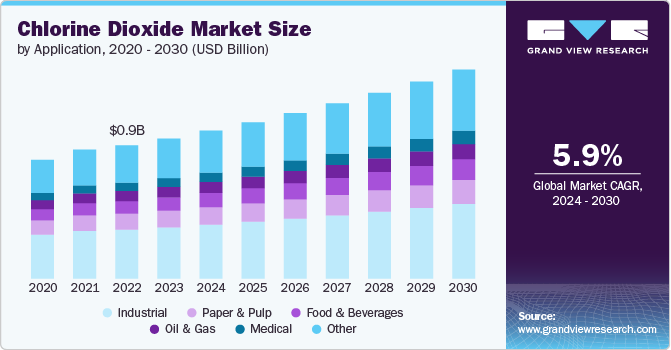

The global chlorine dioxide market size was estimated at USD 1.04 billion in 2023 and is projected to expand at a CAGR of 5.9% from 2024 to 2030. The market is experiencing significant growth due to increased demand from industries, particularly for treating wastewater. This surge is driven by heightened water consumption across diverse industrial sectors, including oil & gas, pharmaceuticals, and chemicals, which is expected to propel market expansion.

Growing environmental awareness and strict governmental regulations concerning industrial wastewater management are key drivers boosting the demand for chlorine dioxide. Additionally, there is expected to be a substantial increase in chlorine dioxide usage within the food & beverage sector, driven by the global demand for processed food products.

Drivers, Opportunities & Restraints

Rapid industrialization and the global shift towards ready-to-eat and fast food have significantly increased the demand for chlorine dioxide in the food & beverage sector. It is increasingly used as an antimicrobial agent for washing fruits and vegetables and in poultry processing, owing to its effective performance without altering taste profiles. This versatility makes chlorine dioxide a preferred choice across various food processing applications, driving its anticipated growth in the industry.

Despite these advantages, chlorine dioxide's reactive and flammable properties pose significant fire and explosion risks, which may temper its demand. This risk limits its widespread adoption despite its effectiveness in various applications within the food & beverage and water treatment sectors. Additionally, regulatory constraints and safety concerns surrounding its handling and storage further impede market growth.

Increasing global demand for safe drinking water and the rising adoption of antimicrobial agents in food processing. Rapid urbanization in developing economies such as China, India, and Brazil, coupled with government initiatives to improve water quality, presents significant opportunities for chlorine dioxide usage in water treatment applications. Moreover, its unique properties, including its effectiveness in disinfection without affecting taste, make it a preferred choice in various industrial and consumer applications.

Application Insights & Trends

“Industrial held the largest revenue share of over 45% in 2023.”

The industrial segment holds a significant dominance in the chlorine dioxide market, driven by extensive applications in wastewater treatment across various industries such as oil & gas, pharmaceuticals, and chemicals. With growing environmental concerns and stringent regulatory standards worldwide, industries are increasingly adopting chlorine dioxide for efficient and compliant wastewater management.

This demand is bolstered by chlorine dioxide's effectiveness in disinfection and oxidation processes, ensuring water quality and regulatory compliance while supporting sustainable industrial operations. Moreover, technological advancements enhancing chlorine dioxide's efficiency and safety profiles are further driving its adoption in wastewater treatment applications, fostering its accelerated growth within the market.

Regional Insights

“China dominated the revenue share of the Asia Pacific chlorine dioxide market.”

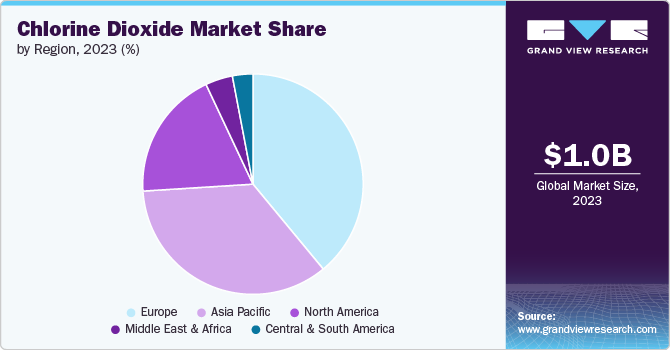

North America chlorine dioxide market is leading, bolstered by robust economic indicators including high per capita income and substantial manufacturing output. Stringent regulatory frameworks governing wastewater disposal from industrial sectors, alongside increasing demand from the oil & gas industry, primarily in the United States, are pivotal drivers propelling market expansion in the region. Currently, the U.S. holds the largest share of the North American chlorine dioxide market.

U.S. Chlorine Dioxide Market Trends

The chlorine dioxide market of the U.S. is expanding significantly. The revival of the manufacturing sector in the U.S. is fueling substantial demand for industrial water treatment, spurred by heightened priorities on water conservation and stringent environmental mandates. Consequently, there is a growing requirement for water treatment solutions, significantly driving the chlorine dioxide market.

Asia Pacific Chlorine Dioxide Market Trends

Asia Pacific chlorine dioxide market dominated the global revenue share of the global market in 2023 and is anticipated to continue over the forecast period. Due to robust demand across its key industries, China holds a substantial portion of the Asia-Pacific chlorine dioxide market.

Factors driving the market include increased demand for industrial wastewater treatment solutions, challenges posed by adverse weather conditions, and decreasing freshwater availability. As a rapidly expanding economy, China's major sectors, including chemicals, power generation, mining, and food processing, contribute significantly to the growth of the market in the region.

Europe Chlorine Dioxide Market Trends

Europe's well-established automotive sector, a leader globally, is driving demand for biocides, thereby boosting the chlorine dioxide market. The adoption of advanced technologies like electric vehicles and sustainable practices, such as water reuse, presents ample growth opportunities for chlorine dioxide in supporting automotive industry operations.

Key Chlorine Dioxide Company Insights

Some of the key players operating in the market include Scotmas Group and ProMinent.

-

Scotmas Group, headquartered in the United Kingdom, is a prominent player in the chlorine dioxide market, specializing in advanced water treatment solutions. With a strong focus on environmental sustainability and innovation, Scotmas Group provides comprehensive chlorine dioxide systems tailored for diverse applications, including water purification, industrial processes, and agriculture.

-

ProMinent, headquartered in Germany, is a leading supplier in the global chemical dosing and water treatment market, with a significant presence in the chlorine dioxide sector. Leveraging decades of expertise and a wide portfolio of precision-engineered equipment, ProMinent offers state-of-the-art chlorine dioxide generators and dosing systems tailored for municipal water treatment, industrial processes, and healthcare applications. The company has established ProMinent as a trusted partner for ensuring water quality, efficiency, and sustainability worldwide.

Key Chlorine Dioxide Companies:

The following are the leading companies in the chlorine dioxide market. These companies collectively hold the largest market share and dictate industry trends.

- Accepta

- Bio-Cide International

- CDG Environmental LLC

- Dioxide Pacific

- Ecolab

- Evoqua

- Grundfos

- HES Water Engineers (India) Pvt Ltd.

- Iotronic Elektrogeratebau GmBH

- ProMinent

- Scotmas Group

- Superior Plus Corp.

- Tecme Srl

- The Sabre Companies LLC

- Vasu Chemicals

Recent Developments

-

In June 2024, Boulder iQ's division has boosted its chlorine dioxide sterilization capabilities for medical devices due to heightened demand following the EPA's recent regulatory update. The method is recognized for its effectiveness, efficiency, and long-standing reliability in sterilization practices within the industry.

-

In January 2024, Scotmas Group, a prominent provider of chlorine dioxide-based water treatment systems worldwide, has entered into a Memorandum of Understanding (MoU) with ACWA Power, a globally recognized developer, investor, and operator in power generation, desalination, and green hydrogen projects. The agreement signifies their commitment to advancing "Green Desalination" technologies through collaborative efforts.

Chlorine Dioxide Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.09 billion

Revenue forecast in 2030

USD 1.54 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in Kilotons, Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East; Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Accepta; Bio-Cide International; CDG Environmental LLC; Dioxide Pacific; Ecolab; Evoqua; Grundfos; HES Water Engineers (India) Pvt Ltd.; Iotronic Elektrogeratebau GmBH; ProMinent; Scotmas Group; Superior Plus Corp.; Tecme Srl; The Sabre Companies LLC; Vasu Chemicals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chlorine Dioxide Market Report Segmentation

This report forecasts revenue and volume growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global chlorine dioxide market report based on application, and region.

-

Application Outlook (Volume, Kil0tons; Revenue, USD Billion; 2018 - 2030)

-

Paper & Pulp

-

Industrial

-

Food & Beverages

-

Oil & Gas

-

Medical

-

Others

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global chlorine dioxide market size was estimated at USD 1.04 billion in 2023 and is expected to reach USD 1.09 billion in 2024.

b. The global chlorine dioxide market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 1.54 billion by 2030.

b. By application, industrial dominated the market with a revenue share of over 47.0% in 2023.

b. Some of the key vendors of the global chlorine dioxide market are Accepta, Bio-Cide International, CDG Environmental LLC, Dioxide Pacific, Ecolab, Evoqua, Grundfos, HES Water Engineers (India) Pvt Ltd., Iotronic Elektrogeratebau GmBH, ProMinent, Scotmas Group, Superior Plus Corp., Tecme Srl, The Sabre Companies LLC, Vasu Chemicals among others.

b. The key factor driving the growth of the global chlorine dioxide market is attributed to the growing application in paper & pulp, food & beverage, biomedical, and water treatment sectors.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."