- Home

- »

- Plastics, Polymers & Resins

- »

-

China Thermoplastic Vulcanizates Market Size Report, 2030GVR Report cover

![China Thermoplastic Vulcanizates Market Size, Share & Trends Report]()

China Thermoplastic Vulcanizates Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Automotive, Fluid Handling, Consumer Goods, Medical Devices), By Grade (General Purpose, Molding & Extrusion, Specialty), And Segment Forecasts

- Report ID: 978-1-68038-993-7

- Number of Report Pages: 94

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

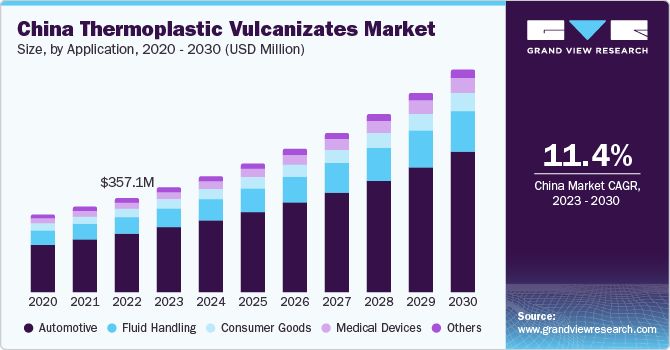

The China thermoplastic vulcanizates market size was valued at USD 357.1 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.4% from 2023 to 2030.Rising demand for lightweight automotive components along with rising automotive sales is expected to remain the key driving factor for market growth over the forecast period. They are widely used in various end-use applications due to the beneficial properties of thermoplastic in various end-use industries such as the automotive industry, industrial, electrical, and appliances, building and construction, and packaging industries.

Thermoplastic materials are used at various levels and are preferred over traditional products since they are durable, easy to replace, renewable, and cost-effective. Automotive applications dominated the market owing to the high demand for lightweight components intended to reduce overall motor vehicular weight and promote fuel savings, thereby reducing carbon emissions into the environment.

Major OEMs have shifted their manufacturing facilities to China due to favorable manufacturing conditions such as low capital investment, availability of skilled labor, and cheap raw material availability. Government policies in terms of liberalizing foreign direct investment (FDI) are further anticipated to fuel automotive industry growth over the forecast period. The industry has grown at a rapid pace in the past few years, and the trend is expected to continue, in terms of both production and demand. The market promises brisk growth driven by the consecutive increase in industrial output, trade activity, consumer spending, and capital venture for over two decades.

Specialty niche products, such as polyisobutylene (PIB), chlorinated olefins, and novel transparent thermoplastic vulcanizates (TPVs), are increasingly gaining popularity in several automotive, construction, and consumer goods applications. The development of innovative products, such as Infuse by the Dow Chemical Company, allows manufacturers to produce enhanced products with flow, impact resistance, and compression characteristics that are able to compete with conventional materials.

Growing environmental concerns and stringent government policies are expected to boost investments in alternative bio-based resources and substitutes for plastics, rubber, and petrochemicals. The development of bio-based TPEs by major market participants, such as DuPont & ExxonMobil, further contributes to the declining market prices, since the majority of manufacturers are likely to adopt bio-based resources for production.

Application Insights

The automotive segment accounted for the largest revenue share of 62.3% in 2022. It is widely used in automotive seals, dust covers, air intake systems & ducts, pass-thru seals, and cooler hoses among other components. The material is rapidly replacing other rubbers such as EPDM under-the-hood applications of vehicles owing to its better heat and fluid resistance.

Automotive was followed by fluid handling application, which accounted for 18.1% of the overall revenue in 2022. It is also used as a fluid handling agent and is utilized across a wide range of end-use industries such as oil & gas, petrochemicals, industrial manufacturing, and foundry. Over the recent past, there has been tremendous growth in these industries, particularly in the Chinese market.

The medical devices segment is expected to grow at the fastest CAGR of 12.1% during the forecast period. This is due to the wide range of applications of TPV in the medical device sector. TPV is used in the making of tubing, seals, gaskets, connectors, and grips. These components are used in a variety of medical devices, including catheters, syringes, IV sets, respiratory masks, and surgical instruments. TPVs provide the necessary flexibility and sealing properties required for these applications.

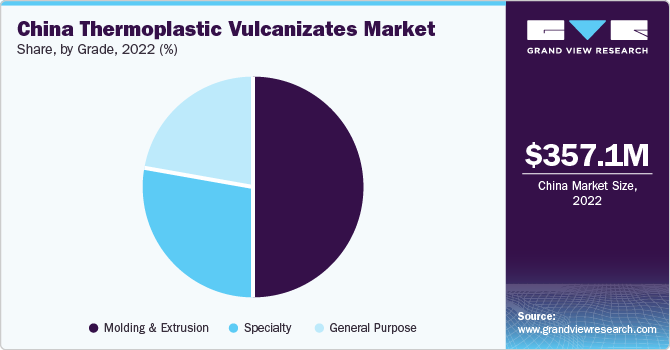

Grade Insights

The molding & extrusion segment accounted for the largest revenue share of 50.5% in 2022 and is expected to grow at the fastest CAGR of 11.5% during the forecast period. Factors such as the growing automotive industry, increasing construction activities, the expanding consumer goods sector, and technological advancements are expected to drive the market. According to the Ministry of Industry and Information Technology, in China, approximately 26 million vehicles, including 21.48 million passenger cars, were sold in 2021, an increase of 7.1% from the previous year.

The China thermoplastic vulcanizates (TPV) market has a considerable presence of a large number of TPV processing companies also involved in polymer derivation and TPE/TPV production. Some of the key companies operating in the China thermoplastic vulcanizates market include:

-

Exxon Mobil Corporation

-

Teknor Apex

-

RTP Company

-

Mitsui Chemicals, Inc.

-

Nanjing Jinling Opta Polymer Co.,LTD.

-

TSRC

Recent Development

-

In June 2022, Teknor Apex, as part of its ongoing commitment to sustainability, unveiled its new Sarlink R2 3180B TPV featuring 25% recycled content. This multipurpose TPV functions and processes like its virgin counterpart and contains good-quality Post-Industrial Recycled (PIR) content.

-

In June 2022, Mitsui Chemicals, Inc. developed MILASTOMER, an environmentally conscious grade TPV through the use of recycled polyolefin as the main ingredient of the thermoplastic elastomer.

-

In December 2021, Celanese Corporation announced that it had successfully acquired Exxon Mobil Corporation's Santoprene TPV elastomers division. This acquisition is expected to solidify Celanese’s existing portfolio and the engineering solutions they offer the clients.

China's Thermoplastic Vulcanizates Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 839.9 million

Growth Rate

CAGR of 11.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilo tons, revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, grade

Country scope

China

Key companies profiled

Exxon Mobil Corporation; Teknor Apex; RTP Company; Mitsui Chemicals, Inc.; Nanjing Jinling Opta Polymer Co.,LTD.; TSRC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Thermoplastic Vulcanizates Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the China thermoplastic vulcanizates market based on application and grade:

-

Application Outlook (Volume in Kilo Tons; Revenue in USD Million, 2018 - 2030)

-

Automotive

-

Fluid Handling

-

Consumer Goods

-

Medical Devices

-

Others

-

-

Grade Outlook (Volume in Kilo Tons; Revenue in USD Million, 2018 - 2030)

-

General Purpose

-

Molding & Extrusion

-

Specialty

-

Frequently Asked Questions About This Report

b. The China thermoplastic vulcanizates market size was estimated at USD 357.1 million in 2022 and is expected to reach USD 395.14 million in 2023.

b. The China thermoplastic vulcanizates market is expected to grow at a compound annual growth rate of 11.4% from 2023 to 2030 to reach USD 839.9 million by 2030.

b. The automotive segment dominated the China thermoplastic vulcanizates market with a share of 62.3% in 2022. This is attributable to rising demand in applications such as automotive seals, dust covers, air intake systems & ducts, pass-thru seals, and cooler hoses.

b. Some key players operating in the China thermoplastic vulcanizates market include ExxonMobil, Teknor Apex, RTP Company, Mitsui Chemicals, Jiangsu Jinling Opta Polymer Co.Ltd., Chemtura Corporation, DuPont, and Dexco polymers.

b. Key factors that are driving the China thermoplastic vulcanizates market growth include rising demand for lightweight automotive components and favorable manufacturing conditions such as low capital investment, availability of skilled labor, and cheap raw material availability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.