- Home

- »

- Medical Devices

- »

-

China Orthopedic Devices Market Size & Share Report, 2030GVR Report cover

![China Orthopedic Devices Market Size, Share, & Trends Report]()

China Orthopedic Devices Market (2024 - 2030) Size, Share, & Trends Analysis Report By Product (Joint Replacement/ Orthopedic Implants, Trauma, Orthobiologics), By End Use (Hospitals, Outpatient Facilities), And Segment Forecasts

- Report ID: GVR-4-68040-452-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

China Orthopedic Devices Market Trends

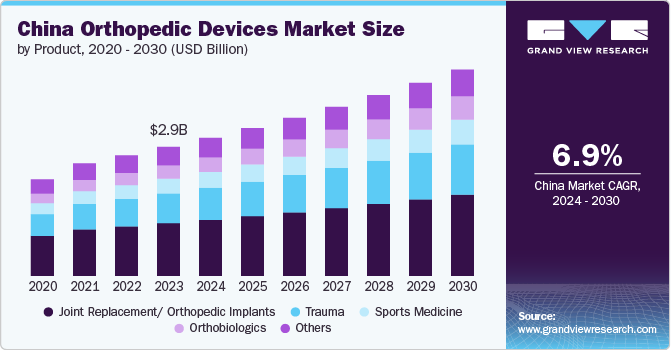

The China orthopedic devices market size was estimated at USD 2.86 billion in 2023 and is projected to grow at a CAGR of 6.9% from 2024 to 2030. Increasing adoption of robots for orthopedic surgeries is driving market growth. In July 2023, the National Medical Products Administration (NMPA) of China approved the Tirobot Recon, a surgical robot developed by Beijing Tinavi Medical Technologies Co. Ltd., for performing total knee replacement surgeries. This approval expanded the company's product line to include spine, trauma, and orthopedic joint surgeries.

Similarly, in November 2021, Interventional Systems announced that Micromate, the smallest medical robot designed for comprehensive treatment, has officially entered the Chinese market as a result of a collaborative investment with Ningbo Hicren, a company based in China specializing in spine and sports medical equipment. The robotics-assisted orthopedic procedures are less invasive and provide consistent precision, which shortens hospital stays and accelerates healing, thereby fostering market growth.

The increasing adoption of remote surgeries is supplementing market growth. In October 2023, Suzhou MicroPort OrthoBot Co., Ltd., a subsidiary of Shanghai MicroPort MedBot (Group) Co., Ltd., completed a remote arthroplasty using the Honghu Orthopedic Surgical Robot (Honghu). The surgery connected experts in Shanghai, Kunming, and Huizhou with the assistance of 5G technology. This marked the first 5G remote joint replacement surgery performed using a Chinese-developed surgical robot. Throughout the operation, the remote teams utilized MicroPort MedBot’s 5G interconnectivity platform, which facilitated real-time high-definition audiovisual transmission.

Additionally, according to a study involving patients from China published in BioMed Central Ltd in 2023, the incidence of periprosthetic joint infection (PJI) following primary total hip and total knee replacement is between 0.3% and 1.9%. This rate can reach as high as 10% in revision cases. The increasing infection rate after orthopedic surgeries has driven research and development activities to develop advanced products that prevent infection. In December 2023, a significant advancement was achieved in the field of knee and hip replacements by Australian and Chinese researchers. A team from Flinders University in South Australia and the Shandong First Medical University unveiled their innovative orthopedic implant technology, which demonstrates enhanced capabilities in preventing infection and promoting bone growth following surgery. This technology incorporates Silver-Gallium (Ag-Ga) nano-amalgamated particles that are administered onto the surface of medical devices, enabling the gradual release of silver and gallium ions. Such advancements in orthopedic surgeries are escalating market growth.

Furthermore, improvement in life expectancy has led to a significant increase in the geriatric population. Aging causes major changes in the skeletal and neuromuscular systems, leading to conditions such as arthritis, weakened ligaments, and other orthopedic injuries. The senior population is increasing rapidly, leading to a rise in demand for surgeries. The government data, indicates that in 2023, approximately 297 million people in China were aged 60 and over, accounting for 21.1% of the total population. This places the country in the category of a "super-aged society" according to World Bank criteria. Additionally, it is projected that this demographic will exceed 500 million by 2050.

Moreover, the demand for minimally invasive procedures is increasing because these procedures result in less trauma and quicker recovery than invasive ones. As the recovery time is shorter, patients’ hospital stay is reduced, resulting in lower costs associated with surgery & hospital stay. For instance, in the case of knee replacement surgeries, traditional open surgeries involve making a vertical incision of about 8 to 10 inches to expose the joint. Owing to the following factors, minimally invasive surgeries are replacing open/invasive surgeries:

-

Lesser incision wounds lead to higher patient satisfaction

-

Economically viable due to the short duration of hospital stays

-

Lesser cases of postsurgical complications and low mortality

Thus, adoption of minimally invasive procedures in orthopedic surgeries is driving market growth.

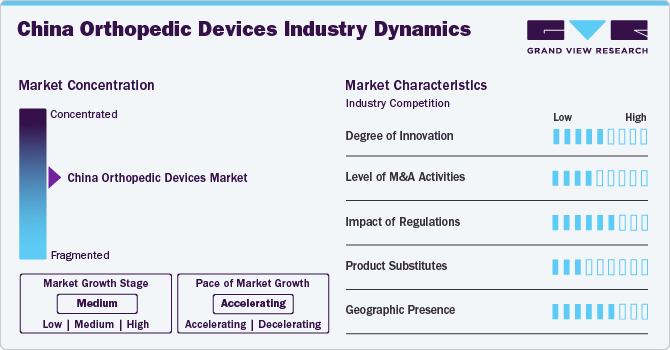

Market Concentration & Characteristics

The China orthopedic devices market has experienced a remarkable degree of innovation in recent years, driven by advancements in technology and a growing focus on improving patient outcomes. Modern orthopedic devices now incorporate cutting-edge materials such as bio-compatible polymers and advanced metals that offer enhanced strength and flexibility. Innovations like 3D printing have revolutionized custom implant manufacturing, allowing for personalized solutions that better fit individual anatomical needs.

The China orthopedic devices market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for orthopedic devices. In November 2021, approval was granted by China's National Medical Products Administration (NMPA) for a zirconium-niobium alloy femoral head developed by MicroPort Orthopedics to undergo the 'Green Path' entry process, which is reserved for innovative medical devices.

The Chinese government has created a special approval process for 'innovative medical devices,' giving priority to these devices at various application stages and allowing easier communication with government authorities. According to public reports, from 2014 to September 2020, 279 products have sought access to this special pathway, and 89 have been granted approval for sale. Almost half of the innovative and approved products are high-value medical consumables, including orthopedic, cardiovascular, dental items, and ophthalmic.

Physical therapy and rehabilitation equipment can act as replacements for orthopedic devices. These tools consist of balance boards, therapy balls, and exercise bands, which are specifically crafted to improve strength, flexibility, and range of motion. The progress of technology has also resulted in the creation of wearable devices and mobile apps that provide users with personalized rehabilitation programs, offering convenience and easy access.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising product approvals create more opportunities for market players to enter new regions. In May 2023, the Brazilian Health Surveillance Agency (ANVISA) approved the market entry of the Honghu Orthopedic Surgical Robot, nicknamed "SkyWalker," which was developed by MicroPort MedBot and its subsidiary Suzhou MicroPort NaviBot Co., Ltd.

Product Insights

In 2023, the joint replacement/ orthopedic implants segment dominated the China orthopedic devices market and accounted for the largest revenue share of 40.90%. The increasing occurrence of musculoskeletal disorders, reduced bone density, and weakened bones, along with the rising risk of degenerative bone disorders, is fueling the demand for orthopedic implants. Furthermore, the rapid development of healthcare infrastructure and the availability of advanced orthopedic implants are expected to have a positive influence on market growth. The growing availability and awareness of minimally invasive surgical techniques, which offer multiple benefits, are another key factor driving market growth. Additionally, the increasing participation in sports and physical activities directly impacts the rising number of sports injuries requiring medical assistance, which is expected to affect market development.

The orthobiologics segment in the China orthopedic devices market is anticipated to witness significant growth over the forecast period. The growing adoption of strategic initiatives by key market players is driving segmental growth. In March 2022, CGbio, a company that focuses on regenerative medicine, signed a five-year agreement valued at USD 7.5 million with a Chinese dental equipment company, Kerunxi Medical, for the export of a bone graft material, Bongros Dental. Through this agreement, CGbio improved its brand reputation while simultaneously strengthening Bongros' position in the Chinese dental bone replacement market.

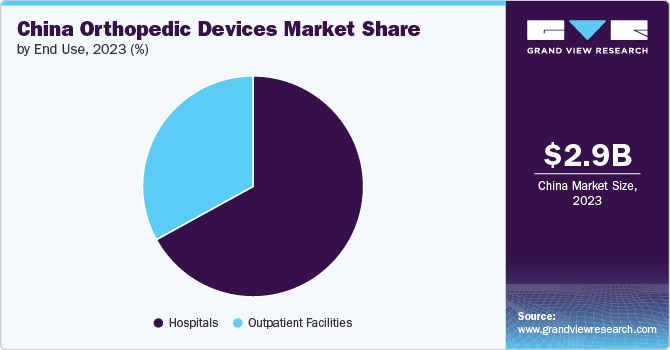

End Use Insights

In 2023, the hospitals segment dominated the China orthopedic devices market and accounted for the largest revenue share of 67.5%. The market growth is attributed to the high preference for hospitals in case of any injury. Additionally, the increasing volume of individuals being hospitalized for injuries and bone fractures resulting from road accidents is projected to drive market growth. Furthermore, favorable reimbursement protocols for individuals receiving care in hospitals and the abundant presence of hospitals and primary care centers in China are essential factors contributing to the substantial demand for hospital services. For instance , according to CEIC Data, the number of hospitals in China was reported at 38,400 units in 2023, which shows an increase from the previous 36,976 units in 2022.

The outpatient facilities segment is expected to experience the fastest growth during the forecast period. This can be attributed to the increased preference for ambulatory surgery centers and day care centers for surgical procedures. The rising number of new product innovations and FDA clearance have also contributed to the market growth. These facilities offer added advantages to the patients such as adequate postoperative pain control, minimal side effects, rapid patient discharge, and overall cost containment. Additionally, reduced surgery time, faster recovery times, and less discomfort from keyhole surgeries are expected to increase the demand for ambulatory surgery centers.

Key China Orthopedic Devices Company Insights

Key participants in the China orthopedic devices market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key China Orthopedic Devices Companies:

- Medtronic

- Stryker

- Zimmer Biomet

- Smith+Nephew

- Aesculap, Inc. - a B. Braun company

- CONMED Corporation

- DePuy Synthes (Johnson & Johnson)

- Enovis (formerly known as DJO)

- Wright Medical Group N.V.

- Orthofix Medical Inc.

Recent Developments

-

In December of 2023, Wedo Bio-Medical Technology Co, Ltd., a medical company based in China, reported that their newly developed 3D printed spinal implant had received official approval for the China market. The 3D printed WedoCage was granted the Class III Medical Device Registration Certificate by the National Medical Products Administration.

-

In May 2023, SpineGuard and XinRong Medical Group expanded their collaboration with three agreements: exclusive distribution of SpineGuard products in China, funding for SpineGuard's product registration, and potential co-development of a Smart Screw system for the Chinese spinal surgery market.

-

In February 2021, a partnership was formed between Ortho Development Corporation (ODEV) and Changzhou Waston Medical Appliance Co., Ltd. (WASTON) to establish a joint venture company in the People's Republic of China. WASTON, based in Changzhou, Jiangsu Province, specializes in manufacturing orthopedic devices. The company's main focus is on producing and selling trauma fracture repair and spinal fixation products. Its sales network spans over 1,400 hospitals in 234 cities across China.

China Orthopedic Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.06 billion

Revenue forecast in 2030

USD 4.58 billion

Growth rate

CAGR of 6.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use

Country scope

China

Key companies profiled

Medtronic; Stryker; Zimmer Biomet; Smith+Nephew; Aesculap, Inc. - a B. Braun company; CONMED Corporation; DePuy Synthes (Johnson & Johnson); Enovis (formerly known as DJO); Wright Medical Group N.V.; Orthofix Medical Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Orthopedic Devices Market Report Segmentation

This report forecasts revenue and volume growth at country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the China orthopedic devices market report based on product and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Joint Replacement/ Orthopedic Implants

-

Lower Extremity Implants

-

Knee Implants

-

Hip Implants

-

Foot & Ankle Implants

-

Spinal Implants

-

Dental

-

Dental Implants

-

Craniomaxillofacial Implants

-

Upper Extremity Implants

-

Elbow Implants

-

Hand & Wrist Implants

-

Shoulder Implants

-

Trauma

-

Implants

-

Accessories (Plates, Screws, Nails, Pins, Wires)

-

Instruments

-

Sports Medicine

-

Body Reconstruction & Repair

-

Accessories

-

Body Monitoring & Evaluation

-

Body Support & Recovery

-

Orthobiologics

-

Viscosupplementation

-

Demineralized Bone Matrix

-

Synthetic Bone Substitutes

-

Bone Morphogenetic Protein (BMP)

-

Stem Cell Therapy

-

Allograft

-

Others

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

Frequently Asked Questions About This Report

b. The China orthopedic devices market size was estimated at USD 2.86 billion in 2023 and is expected to reach USD 3.06 billion in 2024.

b. The China orthopedic devices market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 4.58 billion by 2030.

b. In 2023, the joint replacement/ orthopedic implants segment dominated the China orthopedic devices market and accounted for the largest revenue share of 40.90%. The increasing occurrence of musculoskeletal disorders, reduced bone density, and weakened bones, along with the rising risk of degenerative bone disorders, is fueling the demand for orthopedic implants.

b. Some of the key players are Medtronic, Stryker, Zimmer Biomet, Smith+Nephew, Aesculap, Inc. – a B. Braun company, CONMED Corporation, DePuy Synthes (Johnson & Johnson), Enovis (formerly known as DJO), Wright Medical Group N.V., and Orthofix Medical Inc.

b. Increasing adoption of robots for orthopedic surgeries is driving market growth. In July 2023, the National Medical Products Administration (NMPA) of China approved the Tirobot Recon, a surgical robot developed by Beijing Tinavi Medical Technologies Co. Ltd., for performing total knee replacement surgeries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.