- Home

- »

- Pharmaceuticals

- »

-

China Lung Cancer Therapeutics Market Size, Report, 2030GVR Report cover

![China Lung Cancer Therapeutics Market Size, Share & Trends Report]()

China Lung Cancer Therapeutics Market Size, Share & Trends Analysis Report By Disease Type (Non-small Cell Lung Cancer, Small Cell Lung Cancer), By Therapeutic Class (Chemotherapy, Immunotherapy), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-447-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

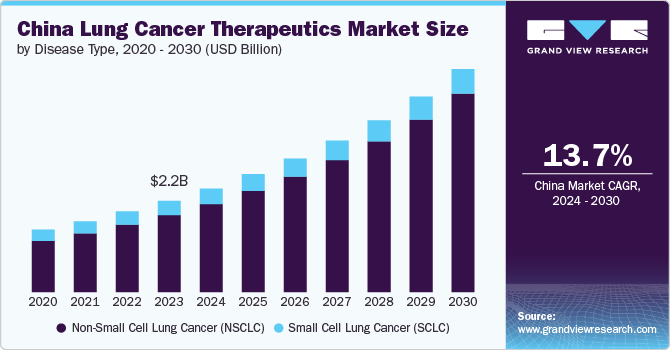

The China lung cancer therapeutics market size is estimated at USD 2.18 billion in 2023 and is projected to grow at a CAGR of 13.7% from 2024 to 2030. The increasing incidence of lung cancer, growing awareness and screening initiatives, and adoption of targeted therapies in the country, In November 2023, China granted approval for Inaticabtagene autoleucel, marking it as the first CAR-T cell therapy specifically for leukemia. This treatment entails altering a patient's T cells to enhance their ability to identify and target cancer cells more effectively. The recent approvals of Inaticabtagene autoleucel and Glofitamab in China signify important advancements in this field. In addition, Glofitamab received approval in China just five months after it was authorized in the U.S.

Moreover, according to Greenberg Traurig, LLP report published in March 2024, a total of 121 medications were added to the National Reimbursement Drug List (NRDL) following their successful preliminary review in 2023. Among these, 70% retained their original pricing, while 31 drugs experienced price reductions. The average decrease in price for these drugs was 6.7%.

There is an increasing awareness among both healthcare professionals and patients regarding cancer diagnosis and treatment options. This heightened awareness leads to earlier detection and treatment initiation, further propelling market growth. Chinese Anti-Cancer Association (CACA) is dedicated to bringing together individuals from various fields of oncology and others who share a common goal of combating. CACA focuses on several key initiatives, including organizing scientific collaborations and conferences, facilitating international non-governmental exchanges, offering a range of training courses and seminars, and nurturing scientific, technological, and medical professionals within the oncology sector. In addition, the association is involved in compiling and publishing academic journals while also encouraging community engagement in the promotion and dissemination of knowledge related to the prevention of this disease.

The Chinese government has recognized the growing burden of cancer and has taken significant steps to enhance funding and support for research. Initiatives from organizations such as the National Natural Science Foundation of China (NSFC) and the National Major Scientific and Technological Special Project for “Significant New Drugs Development” aim to foster fostering innovation in drug development. This governmental backing is crucial in driving advancements in cancer therapeutics.

The increasing number of clinical trials is further driving the market growth in China. For instance, in June 2023, LUNAR Phase 3 clinical trial was conducted by Zai Lab and Novocure, focused on evaluating the efficacy of a treatment regimen for patients suffering from metastatic non-small cell lung cancer (NSCLC) who have previously undergone platinum-based therapies. The trial aimed to assess whether the new treatment could extend overall survival compared to existing standard care options.

LUNAR Phase 3 Clinical Trial Results And Findings:

The results indicated a statistically significant improvement in overall survival for patients treated with the investigational therapy compared to those receiving standard care. This finding suggests that the new treatment not only prolongs life but also provides clinically meaningful benefits to patients who have limited options following platinum-based chemotherapy.

Statistical analyses showed that the hazard ratio for overall survival favored the investigational group, indicating that patients receiving this new therapy had a lower risk of death compared to those in the control group. Additionally, secondary endpoints such as progression-free survival (PFS) and quality of life measures were also assessed, further supporting the potential benefits of this treatment approach.

Market Concentration & Characteristics

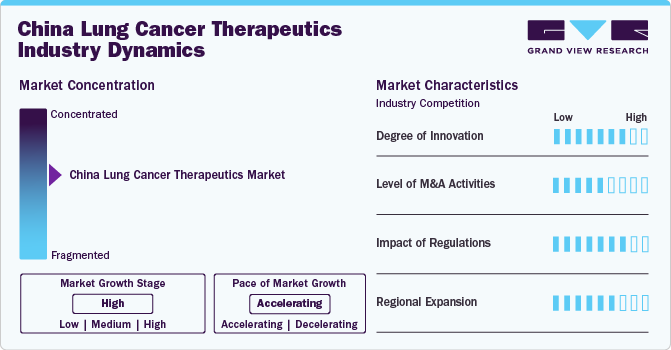

The industry exhibits a high level of concentration. The industry is characterized by a significant concentration of R&D efforts focused on specific types which has the highest incidence and mortality rates in the country. Furthermore, local biotech firms are increasingly engaged in clinical trials for therapies, reflecting a competitive landscape that prioritizes rapid development and market entry. The industry showcases continuous innovation and expansion fueled by rising healthcare expenditure and the growing adoption of healthcare solutions.

The market is characterized by a high degree of innovation. There is a rise in targeted therapies and immunotherapies that address the unique genetic mutations prevalent among Chinese patients, such as EGFR mutations. For instance, drugs such as osimertinib (Tagrisso) have shown promising results when combined with chemotherapy for treating NSCLC. Furthermore, integrating nanomedicine into therapeutic strategies has emerged as a revolutionary approach to enhance drug delivery and minimize side effects associated with traditional chemotherapy.

Regulations significantly impact the industry by ensuring patient safety, product quality, and efficacy. The regulations governing cancer therapeutics are primarily overseen by the National Medical Products Administration (NMPA), which is responsible for approving and regulating drugs and medical devices. The Chinese government has also implemented policies to improve access to essential medications through national health insurance schemes, thereby facilitating broader patient access to effective treatments. Furthermore, guidelines established by professional organizations provide recommendations on treatment protocols, including chemotherapy regimens and targeted therapies, ensuring that healthcare providers adhere to evidence-based practices.

Mergers and acquisitions (M&A) in China are on the rise, driven by the demand for research and development, which highlights the industry's dynamic character. Companies are utilizing M&A strategies to foster innovation and provide advanced solutions that align with the changing requirements of healthcare professionals. For instance, in December 2023, AstraZeneca, announced its agreement to acquire Gracell Biotechnologies Inc., a Chinese firm specializing in innovative cell therapies for cancer and autoimmune diseases. The acquisition is valued at up to USD 1.2 billion, which includes an upfront payment of approximately USD 1 billion and potential contingent value rights that could add another USD 200 million based on the achievement of specific regulatory milestones.

The industry is undergoing significant global growth. Companies are adopting a range of strategies, including distribution agreements, expanding into new regions, and developing new products, to enhance their market presence. For instance, in October 2023, the National Medical Products Administration (NMPA) in China approved the use of Tagrisso in conjunction with chemotherapy as a first-line treatment for patients diagnosed with EGFR-mutated advanced lung cancer. This decision is based on clinical trial data demonstrating improved efficacy and survival rates when combining these two modalities compared to using either treatment alone.

Disease Type Insights

Based on disease type, the NSCLC segment led the market with the largest revenue share of 84.27% in 2023. NSCLC encompasses a variety of cancers that exhibit similar characteristics, including squamous cell carcinoma and adenocarcinoma. NSCLC is the more prevalent type which is anticipated to contribute to growth in this segment. NSCLC is characterized by the abnormal proliferation of cells within the lung tissues, leading to the formation of tumors. This disease type accounts for approximately 85% of cases and is categorized into three primary subtypes: adenocarcinoma, squamous cell carcinoma, and large cell carcinoma. The primary driver of NSCLC is smoking. The longer and more intensively a person smokes, the greater their risk becomes. Smoking is responsible for approximately 85% of cases, including NSCLC.

In June 2024, Bayer announced that the Center for Drug Evaluation (CDE) of China’s National Medical Products Administration (NMPA) has awarded Breakthrough Therapy designation to BAY 2927088. This new targeted therapy is intended for adult patients with unresectable or metastatic NSCLC who have tumors with activating HER2 (ERBB2) mutations and have previously undergone systemic therapy.

The small cell lung cancer (SCLC) segment is expected to grow at a considerable CAGR over the forecast period. It is primarily caused due to genetic mutations that lead to the uncontrolled growth of cancer cells. The most prevalent driver mutations associated with SCLC include alterations in the TP53 and RB1 genes. These mutations disrupt normal cell cycle regulation and apoptosis, contributing to the aggressive nature of SCLC.The rapid progression and high metastatic potential of SCLC are also influenced by its neuroendocrine characteristics, which play a role in tumor behavior and response to treatment.

Therapeutic Class Insights

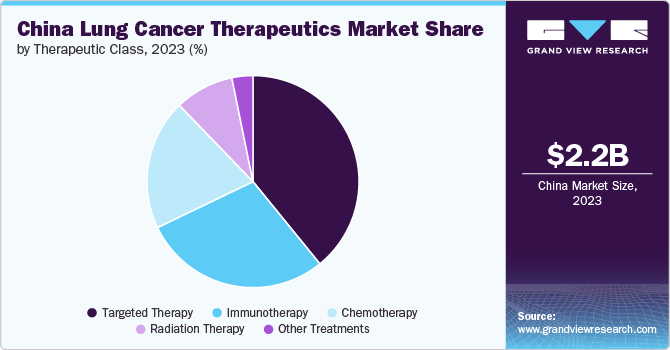

Based on therapeutics class, the targeted therapy segment led the market with the largest revenue share of 39.1% in 2023. The increasing prevalence of cancer within the population has created an urgent need for more effective treatment options. With nearly 40% of the world’s cancer cases reported in China and a significant number of new patients diagnosed daily, the healthcare system is under pressure to improve survival rates. Moreover, advancements in genetic testing have enabled personalized medicine approaches, allowing oncologists to tailor treatments based on specific gene mutations found in patients’ tumors. Furthermore, government initiatives such as the “Healthy China 2030” plan aim to enhance healthcare outcomes, including raising cancer survival rates significantly by 2030. The introduction of national Medicare coverage for targeted therapeutic drugs has also made these treatments more accessible and affordable, leading to broader acceptance among patients and healthcare providers.

The immunotherapy segment is anticipated to grow at the fastest CAGR over the forecast period. The increasing incidence of cancer, which has become a significant public health issue, drives the demand for innovative treatment options. Moreover, advancements in research and development have positioned Chinese companies at the forefront of immuno-oncology. Many domestic firms focus on immune checkpoint inhibitors and CAR T-cell therapies, with a notable increase in clinical trials and approvals for these treatments.

Key China Lung Cancer Therapeutics Company Insights

The market is highly co, to increase product awareness and regional expansions and partnerships to strengthen their market share and marketing strategies, increase product awareness, and strengthen their market share through regional expansions and partnerships. Market players are also involved in conducting clinical testing of their products, patent applications, and increasing product penetration.

Key China Lung Cancer Therapeutics Companies:

- AstraZeneca

- Roche

- Pfizer

- Novartis

- Merck & Co.

- Bristol-Myers Squibb

- Eli Lilly and Company

- Boehringer Ingelheim

- Johnson & Johnson (Janssen Pharmaceuticals)

- BeiGene

- Innovent Biologics

- Jiangsu Hengrui Medicine Co., Ltd.

- China National Pharmaceutical Group (Sinopharm)

- Shanghai Junshi Biosciences Co., Ltd.

Recent Developments

-

In March 2024, Innovent Biologics and AnHeart Therapeutics jointly announced that the National Medical Products Administration (NMPA) of China has accepted their second New Drug Application (NDA) for Taletrectinib. This drug is being evaluated for its efficacy as a first-line treatment option for patients diagnosed with ROS1-positive lung cancer. The acceptance of this NDA marks a significant step in the regulatory process, indicating that the NMPA recognizes the potential therapeutic benefits of Taletrectinib

-

In January 2024, MSD (Merck & Co., Inc.) announced its definitive agreement to acquire Harpoon Therapeutics for USD 23.00 per share in cash, amounting to an approximate total equity value of USD 680 million. This acquisition aims to enhance MSD’s oncology pipeline by integrating Harpoon’s innovative T-cell engagers, particularly focusing on HPN328, which targets delta-like ligand 3 (DLL3). DLL3 is notably expressed in SCLC and neuroendocrine tumors

-

In January 2023, Takeda revealed that the National Medical Products Administration (NMPA) of China has granted approval for EXKIVITY (mobocertinib). This medication is intended for adult patients suffering from locally advanced or metastatic non-small cell lung cancer (NSCLC) characterized by epidermal growth factor receptor (EGFR) Exon20 insertion mutations, particularly in cases where the disease has progressed following platinum-based chemotherapy

China Lung Cancer Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.47 billion

Revenue forecast in 2030

USD 5.34 billion

Growth rate

CAGR of 13.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Disease type, therapeutic class

Country scope

China

Key companies profiled

AstraZeneca; Roche; Pfizer; Novartis; Merck & Co.; Bristol-Myers Squibb; Eli Lilly and Company; Boehringer Ingelheim; Johnson & Johnson (Janssen Pharmaceuticals); BeiGene; Innovent Biologics; Jiangsu Hengrui Medicine Co., Ltd.; China National Pharmaceutical Group (Sinopharm); Shanghai Junshi Biosciences Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Lung Cancer Therapeutics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the China lung cancer therapeutics market report based on disease type, and therapeutics class:

-

Disease Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-small Cell Lung Cancer (NSCLC)

-

Small Cell Lung Cancer (SCLC)

-

-

Therapeutics Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemotherapy

-

Radiation Therapy

-

Immunotherapy

-

Targeted Therapy

-

Other Treatments

-

Frequently Asked Questions About This Report

b. The China lung cancer therapeutics market size was estimated at USD 2.18 billion in 2023 and is expected to reach USD 2.47 billion in 2024.

b. The China lung cancer therapeutics market is expected to grow at a compound annual growth rate of 13.7% from 2024 to 2030 to reach USD 5.34 billion by 2030.

b. Based on disease type, the NSCLC held the largest market share of 84.27% in 2023. This can be attributed to its high prevalence, increased prevalence of smoking and growing awareness.

b. Some of the key players in the China lung cancer therapeutics market are AstraZeneca; Roche; Pfizer; Novartis; Merck & Co.; Bristol-Myers Squibb; Eli Lilly and Company; Boehringer Ingelheim; Johnson & Johnson (Janssen Pharmaceuticals); BeiGene; Innovent Biologics; Jiangsu Hengrui Medicine Co., Ltd.; China National Pharmaceutical Group (Sinopharm); and Shanghai Junshi Biosciences Co., Ltd.

b. Key factors that are driving the China lung cancer therapeutics market growth include increasing incidence of lung cancer, growing awareness and screening initiatives, and adoption of targeted therapies in the country.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."