- Home

- »

- Pharmaceuticals

- »

-

China Liver Cancer Drug Market Size, Industry Report, 2030GVR Report cover

![China Liver Cancer Drug Market Size, Share & Trends Report]()

China Liver Cancer Drug Market Size, Share & Trends Analysis Report By Therapy (Targeted Therapy, Immunotherapy), By Type (Hepatocellular Carcinoma), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-458-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

China Liver Cancer Drug Market Size & Trends

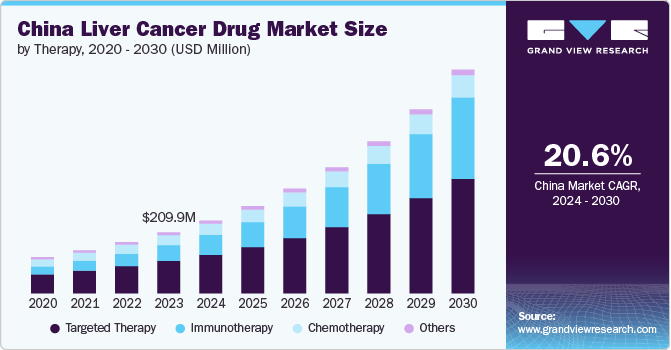

The China liver cancer drug market size was valued at USD 209.91 million in 2023 and is projected to grow at a CAGR of 20.6% from 2024 to 2030, driven by the increasing incidence of the disease, advancements in treatment modalities, growing awareness, and early diagnostic practices in the country. In addition, the rising healthcare expenditures, technological innovations, and increased investment in research and development (R&D) coupled with government initiatives aimed at enhancing access to care are expected to drive the market growth over the forecast period.

The increasing incidence of metastatic disease in China is a significant driver of market growth. According to the Global Cancer Observatory, in 2022, nearly 367,657 new liver cancer cases were diagnosed, accounting for 7.6% of all cancer cases in China. The 5-year prevalence of the disease was 483,407 people, with approximately 34 individuals out of every 100,000 in China being diagnosed with hepatic cancer. Although China accounts for less than 20% of the world's population, it experiences nearly half of all new liver cancer cases. Hepatocellular carcinoma (HCC), which accounts for about 90% of all primary liver cancer cases, primarily develops in individuals with cirrhosis caused by chronic hepatitis B. Jiangsu Province in East China is at the center of the country's liver cancer epidemic, due to its high incidence of hepatitis B and a warm, humid climate that further elevates the risk. As more individuals are diagnosed with the disease, the demand for effective treatment options escalates, prompting pharmaceutical companies to innovate and expand their product offerings.

China has a significantly elevated age-standardized rate (ASR) of mortality due to the disease, with male individuals exhibiting an ASR that was 1.7 times higher than the global average. Additionally, while the global age-standardized rate for disability-adjusted life years (DALYs) peaked at the age range of 75 to 79 years, this peak occurred earlier within the Chinese population. The primary etiology globally was attributed to the hepatitis B virus, accounting for 39.5% of cases. In China, this figure was notably higher, with hepatitis B virus responsible for 62.5% of the cases, followed by contributions from hepatitis C virus and alcohol consumption.

There is a growing interest in combining different therapies to improve outcomes. Ongoing clinical trials are testing novel combinations of targeted therapies, immunotherapies, and locoregional treatments. New drugs and treatment modalities, including gene therapies and cell therapies, are also under investigation. Sorafenib and lenvatinib are the standard first-line treatments for advanced liver cancer in China. Regorafenib, cabozantinib, and ramucirumab are approved as second-line treatments. These therapies work by inhibiting tumor growth and angiogenesis.

The below table highlights some of the major milestones for liver cancer therapies in mainland China.

Regulatory Agency

Therapy

Drug

Launch

Food and Drug Administration (2003-2018)

Chemotherapy

Cisplatin

1976

Food and Drug Administration (2003-2018)

Chemotherapy

Lobaplatin

2005

Food and Drug Administration (2003-2018)

Targeted Therapy

Sorafenib

2006

Food and Drug Administration (2003-2018)

Chemotherapy

Folfox-4

2013

National Medical Products Administration (2018-present)

Targeted Therapy

Regorafenib

2017

National Medical Products Administration (2018-present)

Targeted Therapy

Lenvatinib

2018

National Medical Products Administration (2018-present)

Immunotherapy

Tislelizumab

2021

National Medical Products Administration (2018-present)

Immunotherapy

Sintilimab + Bevacizumab Biosimilar

2021

The increasing development of new and more effective treatment modalities, including targeted therapies and immunotherapies, has revolutionized the management of the disease. These advancements not only improve patient outcomes but also foster increased investment in the oncology sector. Techniques like Trans arterial Chemoembolization (TACE), Trans arterial Radioembolization (TARE), and radiofrequency ablation (RFA) are commonly used for patients who are not candidates for surgery. TACE is the most widely used locoregional therapy in China due to its effectiveness in controlling tumor growth and extending survival for intermediate-stage liver cancer patients. As treatment options become more sophisticated, healthcare providers are better equipped to offer personalized care, further driving market growth.

Moreover, rising government initiatives and implementation of policies and initiatives aimed at improving access to cancer care and treatment are also driving the market. These initiatives include subsidies for cancer medications, funding for research projects, and the establishment of specialized cancer centers. The Ministry of Health has invested heavily in research related to viral hepatitis and hepatocellular carcinoma (HCC) to improve the prevention and treatment of the disease. Further, the Chinese Academy of Sciences has set up a national tumor research center in Shanghai to advance HCC research. Furthermore, the Chinese Liver Cancer Society, the China Anti-Cancer Association, and the Chinese Medical Association released a series of guidelines for liver cancer and hepatitis to help physicians across the country treat patients with these diseases more effectively. Such efforts not only enhance patient access to necessary treatments but also encourage pharmaceutical companies to invest in the market.

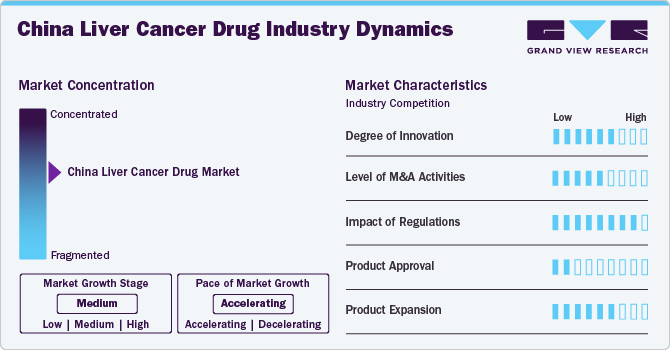

Market Concentration & Characteristics

The China liver cancer drug industry is experiencing a high degree of innovation, driven by advancements in the emergence of novel drug formulations, targeted therapies, and personalized medicine approaches that enhance treatment efficacy and patient outcomes. A high degree of innovation typically signifies a dynamic market with ongoing research and development efforts, fostering competition and potentially leading to improved treatment options for patients.

The China liver cancer drug industry has seen a notable level of M&A activity, with companies seeking to enhance their service offerings and technological capabilities. A high level of M&A led to increased market concentration, as larger firms acquire smaller ones to enhance their product portfolios, expand their market reach, and achieve economies of scale. This trend may also impact competition and innovation, as consolidated entities may have greater financial and technological resources to invest in research and development.

Regulations significantly impact the China liver cancer drug industry. In China, regulatory agencies such as the National Medical Products Administration (NMPA) play a crucial role in ensuring drug safety and efficacy. Stringent regulations pose challenges for market entry and may slow down the approval process for new therapies.

Product approval is a critical aspect of the liver cancer drug industry, as it determines the availability of therapeutic options for patients. Manufacturers are involved in gaining approval to be at the forefront of innovation in the market. For instance, in October 2022, Innovent Biologics, Inc. received China National Medical Products Administration (NMPA) approval for Cyramza (ramucirumab) to be used in the treatment of patients with hepatocellular carcinoma (HCC). This approval allows the medication to be utilized for managing this form of liver cancer in China. The approval is based on clinical trial data demonstrating the drug's efficacy and safety in treating HCC.

Strategies employed by companies to diversify their offerings within the liver cancer drug market. This involves the development of new formulations, indications, or combination therapies that address various aspects of liver cancer treatment. Effective product expansion can enhance a company's market share and provide patients with a broader range of therapeutic options.

Therapy Insights

The targeted therapy segment dominated the market with a revenue share of 53.10% in 2023. Targeted therapy is valued for its ability to precisely target specific molecules or pathways that contribute to the growth and dissemination of cancer cells. This approach aims to limit harm to normal cells, thereby reducing side effects and enhancing patient outcomes. The targeted therapy has shown promising results in suppressing tumor growth and improving survival rates. Targeted therapies, predominantly multikinase inhibitors (MKIs), being regarded as the most promising advancement in treatment with high expectations in China, currently account for approximately 10% of the liver cancer market in the country. In 2021, sorafenib was included in the fourth cohort of China’s National Centralized Drug Procurement (NCDP) approved list, which typically signals a positive outlook and is expected to lead to an increase in sales for the drugs on this list. The market for targeted therapies is growing, driven by the increasing adoption of these treatments and ongoing advancements in drug development.

The immunotherapy segment is expected to grow at the fastest CAGR during the forecast period. Immunotherapy has proven effective by utilizing the immune system to identify and eradicate cancer cells. This method has exhibited considerable efficacy, resulting in greater adoption and investment in immunotherapy for treatment. In China, Bristol-Myers Squibb’s nivolumab is currently undergoing Phase III trials for the treatment of liver cancer. Meanwhile, Merck has submitted a new drug application (NDA) for pembrolizumab, which is being evaluated as a potential second-line therapy for liver cancer. Furthermore, in November 2023, AstraZeneca's Imfinzi, combined with chemotherapy, received approval in China as the first immunotherapy regimen for treating patients with locally advanced or metastatic biliary tract cancer. This approval marks a significant advancement in treatment options for this patient population, offering a new therapeutic approach to manage biliary tract cancer more effectively. Although more immunotherapies are anticipated to enter the market in the near future, their current status reflects ongoing competition and development hurdles.

Type Insights

The hepatocellular carcinoma (HCC) segment dominated the market with a revenue share of 37.41% in 2023. The high prevalence and mortality rates associated with HCC are prompting extensive research and development efforts to discover effective treatments. HCC constitutes 75-90% of primary liver cancer cases in China, making it the most common type of liver cancer. The difficulties in treating HCC and the limited existing treatment options are motivating companies to invest in developing new and effective drugs. Increased awareness and early detection of liver cancer facilitate timely intervention and treatment, thereby boosting the demand for drugs and combination therapy.

In August 2022, an article in ACS Medicinal Chemistry Letters highlighted the approval of BeiGene's Tislelizumab and Innovent Bio's combination therapy (sintilimab with a bevacizumab biosimilar) as promising treatments for hepatocellular carcinoma (HCC), the most prevalent type of primary liver cancer. Both BeiGene and Innovent Bio are Chinese biopharmaceutical companies, although they are legally registered outside mainland China. Innovent Bio’s therapy has been designated as a first-line treatment. Such advancements drive the market growth in China.

The hepatoblastoma segment is anticipated to grow at a rapid pace during the forecast period. Hepatoblastoma, a type of liver cancer primarily affecting young children, requires targeted therapeutic approaches due to its unique biological behavior and treatment requirements. The segment is characterized by a need for specific drugs and therapies tailored to pediatric patients, which drives research and development efforts. The market for hepatoblastoma drugs in China is influenced by factors such as the incidence rate of the disease, advancements in treatment protocols, and ongoing clinical trials aimed at improving patient outcomes.

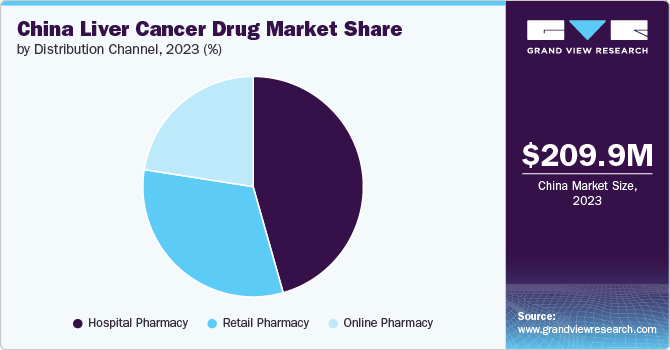

Distribution Channel Insights

Hospital pharmacies dominated the market with a revenue share of 45.60% in 2023. Hospital pharmacies often have access to cutting-edge therapies and clinical trial medications, contributing to their significance in managing complex cases of liver cancer. This segment often deals with specialized, high-cost, and advanced therapies, including targeted treatments and immunotherapies that may not be available through retail channels.

Retail pharmacy is projected to experience significant growth over the forecast period. Retail pharmacies, which include community pharmacies and chain drugstores, provide access to a range of over the counter and prescription medications for liver cancer patients. This segment is focused on delivering medications that are used for ongoing management and supportive care rather than specialized treatments administered in hospitals.

Key China Liver Cancer Drug Company Insights

Leading companies in the China liver cancer drug market are implementing various strategies to enhance their market presence and expand the accessibility of their products and services. Initiatives such as business expansions and strategic partnerships are crucial in driving the market's growth.

Key China Liver Cancer Drug Companies:

- BeiGene

- Chi-Med

- Innovent Biologics

- LianBio

- Hengrui Medicine

- Jiangsu Chia Tai Tianqing Pharmaceutical

- Boehringer Ingelheim

- Bristol-Myers Squibb

- Roche

- Merck & Co.

- Pfizer

- Novartis

- AstraZeneca

Recent Developments

-

In March 2024, Suzhou Ribo Life Science Co., Ltd. and Ribocure Pharmaceuticals AB (Ribo) announced a collaboration with Boehringer Ingelheim to advance the development of new treatments for liver diseases. This partnership aims to leverage both companies' expertise to innovate and enhance therapeutic options for liver conditions. By combining their resources and knowledge, the two organizations seek to address unmet needs in liver disease management and improve patient outcomes through the development of novel treatments.

-

In October 2023,Elevar Therapeutics agreed to pay USD 600 million to acquire rights to a liver cancer therapy from China based Hengrui Medicine to market it in the U.S. The investigational drug is a combination of rivoceranib and camrelizumab, a VEGFR-2 inhibitor, and PD-1 inhibitor, respectively, showing promise in clinical trials.

-

In March 2023, Ablaze Pharmaceuticals collaborated with RayzeBio to develop a first-in-class liver cancer therapy targeting GPC3, a biomarker specific to liver cancer. The drug candidate has shown promise in preclinical studies, demonstrating strong GPC3 binding, rapid internalization, and sustained tumor uptake. Ablaze is likely to handle clinical development and commercialization in China, addressing the high unmet medical need for effective liver cancer treatments in the region.

-

In October 2022, Innovent Biologics, Inc. received China National Medical Products Administration (NMPA) approval for Cyramza (ramucirumab) to be used in the treatment of patients with hepatocellular carcinoma (HCC). This approval allows the medication to be utilized for managing this form of liver cancer in China. The approval is based on clinical trial data demonstrating the drug's efficacy and safety in treating HCC.

China Liver Cancer Drug Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 249.97 million

Revenue forecast in 2030

USD 769.09 million

Growth Rate

CAGR of 20.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapy, type and distribution channel

Key companies profiled

BeiGene, Chi-Med, Innovent Biologics, LianBio, Hengrui Medicine, Jiangsu Chia Tai Tianqing Pharmaceutical, Boehringer Ingelheim, Bristol-Myers Squibb, Roche, Merck & Co., Pfizer, Novartis, AstraZeneca

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Liver Cancer Drug Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the China liver cancer drug market report based on therapy, type, and distribution channel:

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Targeted Therapy

-

Immunotherapy

-

Chemotherapy

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hepatocellular Carcinoma

-

Cholangiocarcinoma

-

Hepatoblastoma

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

Frequently Asked Questions About This Report

b. The China liver cancer drug market size was estimated at USD 209.91 million in 2023 and is expected to reach USD 249.97 million in 2024.

b. The China liver cancer drug market is expected to grow at a compound annual growth rate of 20.6% from 2024 to 2030 to reach USD 769.09 million by 2030.

b. Based on therapy, targeted therapy segment dominated the market in terms of revenue share of 53.10% in 2023. Targeted therapy is valued for its ability to precisely target specific molecules or pathways that contribute to the growth and dissemination of cancer cells. This approach aims to limit harm to normal cells, thereby reducing side effects and enhancing patient outcomes.

b. Some of the key players in the China liver cancer drug market are BeiGene, Chi-Med, Innovent Biologics, LianBio, Hengrui Medicine, Jiangsu Chia Tai Tianqing Pharmaceutical, Boehringer Ingelheim, Bristol-Myers Squibb, Roche, Merck & Co., Pfizer, Novartis, AstraZeneca.

b. Key factors that are driving the China liver cancer drug market growth include increasing incidence of the disease, advancements in treatment modalities, growing awareness and early diagnostic practices in the country.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."