- Home

- »

- Agrochemicals & Fertilizers

- »

-

China And India Cotton Market Size & Share, Report, 2030GVR Report cover

![China And India Cotton Market Size, Share & Trends Report]()

China And India Cotton Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Upland Cotton, Tree Cotton), By Staple Length (Long Staple Cotton, Medium Staple Cotton), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-299-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

China And India Cotton Market Size & Trends

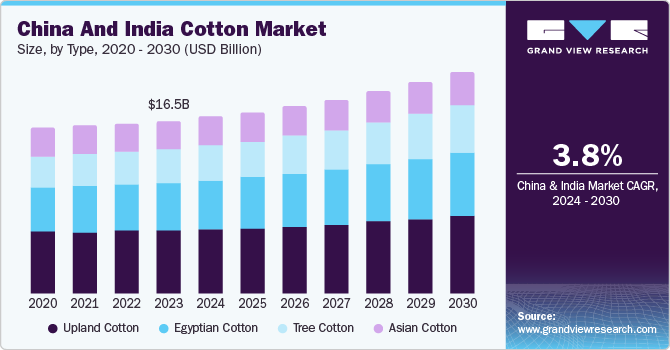

The China and India cotton market size was estimated at USD 16.54 billion in 2023 and is projected to grow at a CAGR of 3.8% from 2024 to 2030. China and India are among the world's largest producers and consumers of textiles, with their cotton sectors playing a pivotal role in supplying raw materials for this industry. The expansion of middle-class populations and rising disposable incomes in both countries drive demand for textiles, including cotton-based products, such as apparel, home textiles, and industrial textiles.

Government policies and regulations also significantly influence the cotton markets in China and India. Both countries implement various policies to support their cotton sectors, including subsidies for farmers, import tariffs, export restrictions, and quality standards. In China, government interventions aim to ensure food security, stabilize prices, and maintain self-sufficiency in cotton production. On the other hand, India implements policies to support cotton farmers, promote exports, and regulate imports to safeguard domestic producers. Changes in government policies, such as adjustments to subsidies or trade regulations, can have significant implications for cotton production, consumption, and prices in both countries.

In April 2024, The Union Textiles Ministry of India plans to launch a Cotton Technology Mission to enhance the quality and yield of India's cotton through the adoption of best practices. The goal is to establish India as a key hub for textile sourcing and foreign investment. This initiative aims to reduce reliance on imports for this cotton and elevate the incomes of over 6 million cotton farmers in the country. India presently falls short by 500,000 bales in meeting its required 900,000 high-quality imports. However, through this initiative, the government aims to substantially reduce these imports by 2030.

Moreover, global market dynamics and international trade patterns are crucial in shaping the cotton markets in China and India. Both countries are major players in the global cotton trade, with China being the world's largest importer and India being one of the largest producers and exporters. Fluctuations in global cotton prices, currency exchange rates, trade agreements, and geopolitical developments can impact import and export patterns, influencing domestic prices and market conditions in China and India. Additionally, changes in demand from key importing countries, such as the U.S., Bangladesh, and Vietnam, can have ripple effects on cotton trade flows and market dynamics in both countries.

Market Concentration & Characteristics

The China and India cotton industry is fragmented, the growth stage is low, and the pace is accelerating owing to increasing investment initiatives to promote cotton cultivation, certification programs, and supply chain transparency. Adopting modern agricultural practices, mechanization, biotechnology, and research and development initiatives to improve yields, quality, and sustainability drive productivity gains in cotton farming. In the textile industry, advancements in spinning, weaving, dyeing, and finishing technologies enhance efficiency, reduce costs, and expand the range of cotton-based products.

Regulations significantly impact the markets in China and India, shaping production, trade, and market dynamics in various ways. These regulations, implemented by the respective governments, aim to stabilize domestic markets, protect farmers' interests, and ensure sustainable agricultural practices. The Indian government supports cotton farmers through the minimum support price (MSP) system, which guarantees a baseline price for cotton, ensuring that farmers are protected from price fluctuations in the market. The Cotton Corporation of India (CCI) plays a pivotal role in procuring cotton at MSP, stabilizing prices, and maintaining buffer stocks. Export policies in India are also tightly regulated to balance domestic needs with international market opportunities. Periodic bans or restrictions on cotton exports are implemented to ensure sufficient domestic supply and control inflation in the textile industry.

The impact of product substitutes on the cotton market is multifaceted, affecting demand and market dynamics in significant ways. The rise of synthetic fibers, such as polyester, nylon, and acrylic, has impacted the cotton market. In addition to synthetic fibers, other natural fibers such as wool, silk, and linen, as well as regenerated cellulose fibers such as viscose, modal, and lyocell, also serve as substitutes for cotton. These fibers cater to niche markets and specific consumer preferences, often emphasizing luxury, performance, or sustainability.

Type Insights

The upland cotton led the market with the largest revenue share of 36.3% in 2023 and is expected to continue its dominance with significant CAGR from 2024 to 2030. This segment plays a critical role in the cotton markets of China and India, driven by various factors that influence production, demand, and market dynamics. Upland cotton is the most widely grown type of cotton globally. In China, upland cotton is a crucial component of the country's textile and apparel sector, one of the world's largest.

Additionally, China has invested in modernizing its agricultural practices, promoting genetically modified (GM) upland cotton varieties that are pest-resistant and have higher yields. These advancements help enhance productivity and reduce the reliance on chemical pesticides, aligning with sustainability goals and improving overall profitability for farmers. China relies heavily on upland cotton, a major portion of its cotton production. According to the USDA Economic Research Service, Xinjiang produces 90% of China's cotton. This region primarily cultivates upland cotton due to its high-quality color and fiber length.

The tree cotton is anticipated to witness the fastest CAGR from 2024 to 2030. Tree cotton has a more established presence in India, particularly in the Deccan Plateau and other semi-arid regions. Tree cotton is valued for its drought tolerance and ability to thrive on marginal lands with minimal water and fertilizer. It makes it an essential crop for smallholder farmers who rely on rain-fed agriculture. Additionally, tree cotton is culturally significant and integrated into local textile traditions, such as handloom weaving, further supporting its cultivation and market demand.

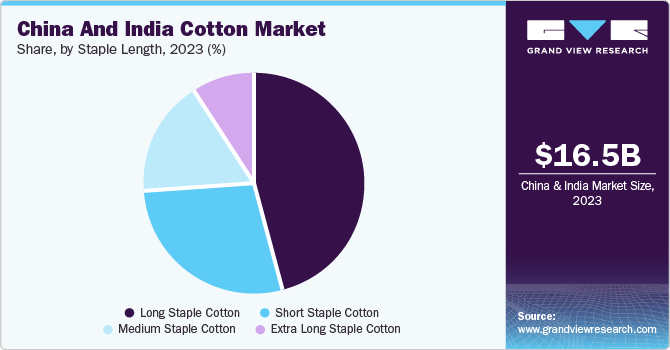

Staple Length Insights

The long-staple cotton segment led the market with the largest revenue share in 2023. In India, long-staple cotton, particularly the Suvin variety, is recognized for its quality and is integral to the country's textile heritage. The Indian government promotes long-staple cotton cultivation through initiatives like the Technology Mission on Cotton, which aims to increase productivity and improve fiber quality. Long-staple cotton in India is primarily grown in Tamil Nadu and parts of Maharashtra, where climatic conditions are conducive to its cultivation. The demand for long-staple cotton in India is driven by the country's thriving textile and garment industry, which seeks high-quality fibers for premium fabrics and export-oriented products.

The medium staple cotton segment is expected to witness the fastest CAGR from 2024 to 2030. China and India have well-established textile industries that rely heavily on medium-stretch cotton to produce a wide range of products, from basic garments to higher-end fashion items. The export markets for these textiles further bolster demand, with both countries being major exporters of cotton goods. The steady demand from these industries ensures a continuous market for medium-stretch cotton, driving its production and trade.

Country Insights

China Cotton Market Trends

China dominated the cotton market with a revenue share of 59.1% in 2023. Domestic demand from the textile industry is driving the market in China. As the world's largest producer and exporter of textiles and apparel, China's textile industry is a significant consumer of raw cotton. The continuous growth of this industry, fueled by both domestic consumption and export demand, ensures a steady market for cotton. The demand for high-quality cotton fibers to produce textiles that meet international standards further drives the need for consistent and reliable cotton production. Additionally, with increasing disposable income, the rising middle class in China boosts demand for cotton-based products, ranging from clothing to home textiles, reinforcing the importance of the domestic cotton market.

India Cotton Market Trends

India's cotton market is expected to witness the fastest CAGR from 2024 to 2030. International trade relationships and global market dynamics also influence India's cotton market. India is a major player in the global cotton trade, both as an exporter and importer. The country exports significant quantities of raw cotton to markets such as China, Bangladesh, and Vietnam, major textile manufacturing hubs. Trade policies, tariffs, and international agreements play a crucial role in shaping these export dynamics.

Key China And India Cotton Company Insights

Some key players operating in the market include Cargill, Incorporated, Louis Dreyfus Company, Nitin Spinners, and Trikuta Exim International.

-

Cargill, Incorporated is an American multinational corporation that operates in numerous sectors, including agriculture, food production, and industrial products. The company sources cotton from major cotton-producing regions worldwide, including the U.S., Brazil, India, and Australia. It trades cotton globally, supplying it to textile mills and other end users in key markets such as China, Bangladesh, and Turkey.

-

Nitin Spinners Ltd. is an Indian textile manufacturer that produces cotton yarn and fabrics. The company has established a strong presence across the entire value chain of the textile industry, from cotton sourcing to yarn spinning and fabric weaving. The company's product portfolio includes a variety of cotton yarns and raw cotton, catering to diverse applications in the textile industry. Nitin Spinners also produces a range of cotton fabrics, including denim, sheeting, shirting, and bottom-weight fabrics, which are supplied to domestic and international markets.

Key China And India Cotton Companies:

- Cargill, Incorporated

- Louis Dreyfus Company

- Nitin Spinners

- Trikuta Exim International

- Jaydeep Cotton Fibres Pvt. Ltd.

- Om Organic Cotton Pvt. Ltd.

- GP Group India

- SUNIL COTTON COMPANY

- Changzhou Keteng Textile Co., Ltd

- Allmonde International

- Satya Cotton Mills

- KAUSHIK COTTON CORPORATION

- Bhura Group

China And India Cotton Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.93 billion

Revenue forecast in 2030

USD 21.23 billion

Growth rate

CAGR of 3.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, staple length

Country scope

China; India

Key companies profiled

Cargill, Incorporated; Louis Dreyfus Company; Nitin Spinners; Trikuta Exim International; Jaydeep Cotton Fibres Pvt. Ltd;, Om Organic Cotton Pvt. Ltd.; GP Group India; SUNIL COTTON COMPANY; Changzhou Keteng Textile Co., Ltd; Allmonde International; Satya Cotton Mills; KAUSHIK COTTON CORPORATION; Bhura Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China And India Cotton Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the China and India cottonmarket research report based on the type and staple length:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Upland Cotton

-

Egyptian Cotton

-

Tree Cotton

-

Asian Cotton

-

-

Staple Length Outlook (Revenue, USD Billion, 2018 - 2030)

-

Long Staple Cotton

-

Short Staple Cotton

-

Medium Staple Cotton

-

Extra Long Staple Cotton

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

China

-

India

-

Frequently Asked Questions About This Report

b. The China and India cotton market size was estimated at USD 16.54 billion in 2023 and is expected to reach USD 16.93 billion in 2024

b. The China and India cotton market is expected to grow at a compound annual growth rate of 3.8% from 2024 to 2030 to reach USD 21.23 billion by 2030

b. China dominated the cotton market with a share of 59.1% in 2023. Domestic demand from the textile industry is driving the cotton market in China. As the world's largest producer and exporter of textiles and apparel, China's textile industry is a significant consumer of raw cotton. The continuous growth of this industry, fueled by both domestic consumption and export demand, ensures a steady market for cotton.

b. Some key players operating in the China and India cotton market include Cargill, Incorporated, Louis Dreyfus Company, Nitin Spinners, Trikuta Exim International, Jaydeep Cotton Fibres Pvt. Ltd., Om Organic Cotton Pvt. Ltd. , GP Group India, SUNIL COTTON COMPANY, Changzhou Keteng Textile Co., Ltd, Allmonde International, Satya Cotton Mills, KAUSHIK COTTON CORPORATION, Bhura Group

b. Factors such domestic demand from the textile industry and government investments in infrastructure, such as irrigation projects and transportation networks are driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.