China In Vitro Diagnostics Market Size, Share & Trends Analysis Report By Test Location (Point of Care, Home Care), By Product (Instruments, Services), By Technology, By Application, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-208-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

China IVD Market Size & Trends

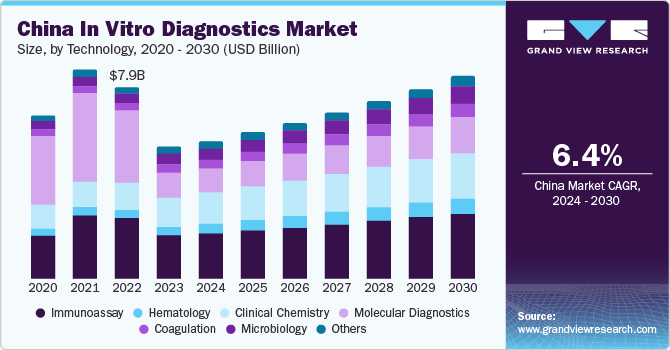

The China in vitro diagnostics (IVD) market size was valued at USD 5.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.4% from 2024 to 2030. The growth is attributed to the increasing prevalence of chronic infectious diseases such as diabetes, and cancer which is at upsurge among the geriatric population mainly. These diseases can be diagnosed and monitored using in vitro diagnostics (IVD) owing to the increasing demand for IVD kits. In addition, the COVID-19 pandemic highlighted the demand for in vitro diagnostics.

With the growing population in China, the need for healthcare expenditure is also accelerating. This surge is expected to fuel the market growth given the significant importance of early diagnosis is in reducing treatment costs and mortality rates. Furthermore, China actively focuses on developing novel technologies and enhancing R&D activities to improve its healthcare facilities. Major IVD tests currently available in the market include FISH-based breast cancer treatment and Human Papillomavirus (HPV) testing. Commercialization and co-marketing deals are becoming increasingly common to facilitate the penetration of products in the market.Several global companies are opting to commercialize their products in China, leveraging opportunities for significant market presence. For instance, companies such as BGI provide significant opportunities for the commercialization and marketing of novel products, particularly in the Chinese market.

The Ministry of Health in China is shifting its focus from healthcare to preventive care and diagnostic testing products, a strategic move expected to contribute to the China’s growth in the IVD market. Moreover, the increasing burden of infectious diseases like tuberculosis (TB), scarlet fever, and syphilis is expected to create growth opportunities in the market. For instance, China is among the 30 countries highly burdened with TB cases, with an incidence rate of nearly 58/100,000 people suffering from the disease. This has given rise to the possibility early diagnosis, thereby fueling the IVD market.

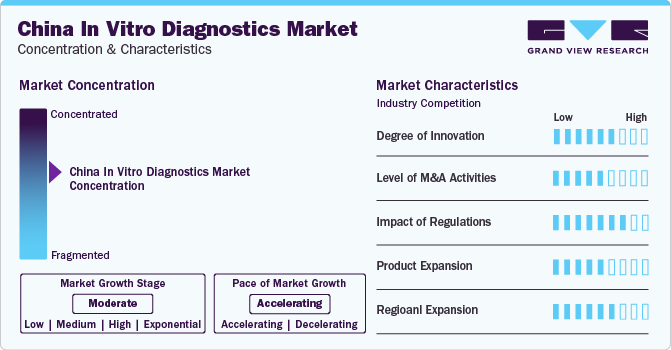

Market Concentration & Characteristics

The market is characterized by a high degree of innovation with the occurrence of several technological advancements in recent years. Several companies are taking the initiative of fostering innovation and enhancing medical capabilities in China. For instance, in September 2023, Roche Diagnostics China Technical Innovation Center (TIC) was inaugurated in Shanghai's Pudong New Area in Jinqiao. The center, covering 7,080 square meters, comprises laboratories and classrooms and is dedicated to advancing smart diagnostics, service innovation, talent training, and customer experience in the field of diagnostics.

China’s in vitro diagnostics market has witnessed several M&A activities majorly from 2018 to 2021 owing to the COVID-19 pandemic. Merger and acquisition (M&A) is one of the major strategies used by the company to expand its presence. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve competency. For instance, in January 2024, Mindrey announced the acquisition of APT Medical which is a medical device company. This focuses on areas like cardiac electrophysiology, coronary artery access, and other segmented fields.

The State Council issued a guideline to implement the country's Healthy China initiative to diminish the incidence of disability among elderly people aged between 65 and 74 years by offering medical and health services. Such initiatives by the government are expected to boost market growth during the forecast period. However, a lack of proper reimbursement and a stringent regulatory framework restricts the market's growth.

Several initiatives are being taken by various companies to expand their prevalence and dominance in IVD’s China market. China is witnessing an accelerating demand for the continuous development of IVD enterprises. Due to several factors like the increasing geriatric population, the emergence of chronic diseases, and economic growth, various startups see China as a platform that requires rapid diagnosis and detection of a wide range of diseases. This makes China an attractive platform for companies to further expand their products and initiatives.

The COVID-19 pandemic has undoubtedly accelerated the market growth significantly. Several Rapid Antigen Tests (RAT) were performed to maintain its zero COVID policy. Furthermore, its variants such as Alpha, Beta, Deta Plus, and Omicron demanded continuous RAT tests in huge numbers making it a trend in the China in vitro diagnostics market. Moreover, Healthy China 2030 (vision to action) has further enhanced the market growth. This policy with over 20 departments drafting 2030 aims at strengthening China’s health science and technology which would help improve the quality of health services, considerably, across the country.

Product Insights

The reagents segment dominated the market with a revenue share of 66% in 2023 and is expected to be the fastest-growing segment. The samples collected for IVD are subjected to several tests using reagents and kits. The local firms focus mainly on the reagents for the tests. The segment continuously witnesses several R&D activities. The launch of kits that enable faster detection of cancer is allowing companies to focus on niche profitable areas in the IVD business. Furthermore, the increasing availability of CE-IVD-certified kits globally for diagnosis and screening of patients during epidemic situations is expected to boost market growth.

The instruments segment is anticipated to be the fastest-growing segment. Increasing technological advancements, such as introduction of portable instruments is expected to fuel the market growth over the forecast period. Commercial kits and robots are used in Polymerase Chain Reaction (PCR) laboratories to help detect and quantify infectious microorganisms, blood antigens, and viral load. Players are aligning their product launches in line with the increasing genetic test requirement globally. For instance, in March 2022, Thermo Fisher Scientific introduced Ion Torrent Genexus Dx Integrated Sequencer for research and diagnostic purposes. The company has further announced the development of a line of assays for hemato-oncology and genomic profiling using the system, which is anticipated to enhance the adoption of the system.

Technology Insights

The immunoassay segment dominated the market with a revenue share of 32% in 2023. It majorly includes an assessment of the mechanism of action of antibodies, antigens, and their interactions. The various applications of immunoassay, including infectious microbe detection like fungus, bacteria, and viruses by confirming the presence of their toxins are the leading cause driving the growth of this segment in China. In addition, market players are focusing on R&D for the development of new immunological diagnostic instruments for the assessment of individuals suspected of immune deficiency.

The coagulation segment is the fastest-growing segment. Coagulation testing is done to assess hemostasis. Increasing prevalence of cardiovascular diseases, blood-related disorders, and autoimmune diseases is expected to boost the demand for coagulation testing, using IVD instruments. The instruments are getting updated and handheld coagulation analyzers, such as Xprecia stride coagulation analyzer, such instruments are anticipated to enhance the overall workflow of detection.

Application Insights

The infectious diseases segment dominated the market with a revenue of 36% in 2023 owing to the introduction of new IVD products facilitating the detection of microorganisms causing infectious diseases. The spread of COVID-19 caused a sudden spike in the uptake of in vitro diagnostics (IVD), leading to a higher market share in the past few years. The increasing introduction of novel testing products for infectious diseases is expected to drive the segment over the forecast period. Key market players are also entering into collaboration to improve access to high-quality, innovative laboratory services for patients & healthcare providers. Furthermore, an increase in product development and subsequent launches is anticipated to drive market growth.

The drug testing segment is the fastest-growing segment with extensive applications in testing for drug abuse. Continuous demand for drug testing in sports and medical test for toxicology and drug abuse in trauma patients are expected to drive the market growth. It is an important part of IVD in clinical medicine as various drugs can affect diagnosis and medical treatment decisions. Several key market players are developing point-of-care devices for use in primary clinics and physician offices.

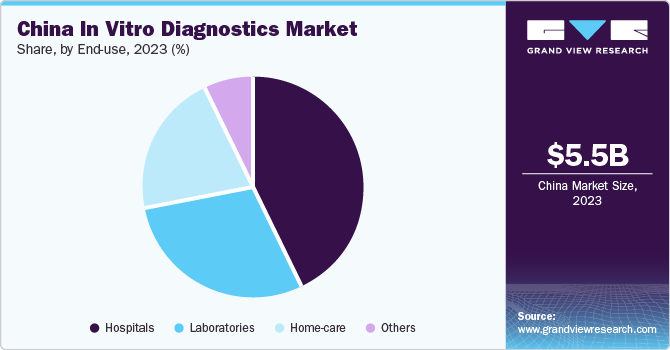

End-use Insights

The hospitals segment dominated the market with a revenue share of 43% in 2023, owing to an increase in hospitalization, as doctors often require diagnostic interpretation for further treatment. Most often, diagnostic centers frequently operate in collaboration with hospitals; resulting in many hospitals having their own diagnostic setup. Furthermore, ongoing development of healthcare infrastructure is anticipated to enhance the existing hospital facilities. Thus, the demand for hospital-based IVD tests is increasing. Most of the IVD devices are purchased by hospitals and are used in significant volumes.

The home-care segment is the fastest-growing segment, due to the rising geriatric population and increasing demand for home-care IVD devices. The escalating demand for molecular diagnosis has led to a growing need for molecular diagnostic platforms that enable patients to conduct self-tests. Self-care devices account for the highest usage as they are more convenient and reduces hospital visits. Owing to these factors, the segment is expected to witness rapid growth over the forecast period.

Test Location Insights

The Point-of-care segment dominated the market with a revenue share of 21.76% in 2023. The use and demand of point-of-care tests and devices are rising owing to increased demand for rapid disease identification near patients to facilitate faster decision-making. This trend is inspiring manufacturers to launch small, transportable, fast, and easy-to-use instruments, making them more accessible in non-laboratory settings. Moreover, pharmacists and pharmacies are largely adopting PoC services, including testing for infections that can be diagnosed with rapid testing.

Home-care is the fastest-growing segment. This trend has witnessed a surge in recent years, majorly due to the pandemic, and growth in the geriatric population, emphasizing the need for rapid diagnosis. These tests have played a crucial role in mitigating the spread of SARS-CoV-2. Significant actions have been taken by the Chinese government to ensure access to affordable and efficient homecare tests.

Key China In Vitro Diagnostics Company Insights

Some of the key established players operating in the IVD market include Abbott, Bio-Rad Laboratories, Inc., Sysmex Corporation, and Shanghai Kehua Bio-Engineering Co. Ltd. These companies employ various market expansion strategies such as collaborations, merger & acquisition activities, and partnerships, along with several product launches to expand their services geographically. In addition, the competitive landscape remains intensely dynamic, with companies encountering challenges in launching diagnostic assays and test kits. Various companies are also expanding their facilities in China owing to their growing population and rising demand for early detection of infectious and communicable diseases. For instance, in January 2022, the company announced plans to invest USD 20 million in expanding its Shanghai manufacturing center to meet the growing demand for liquid chromatography and mass spectrometry in China.

Key China IVD Companies:

- Abbott

- bioMérieux SA

- Mindray Medical International Limited

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- Shanghai Kehua Bio-Engineering Co. Ltd.

- Thermo Fisher Scientific Inc.

- Sysmex Corporation

- Maccura Biotechnology

- Siemens Healthcare GmbH

Recent Developments

-

In April 2023, bioMerieux and Oxford announced their strategic partnership agreement aimed at improving human health outcomes globally by exploring nanopore sequencing for the diagnosis of infectious diseases

-

In January 2022, Agilent Technologies announced plans to invest USD 20 million in expanding its Shanghai manufacturing center to meet the growing demand for liquid chromatography and mass spectrometry in China

-

In December 2022, QuidelOrtho entered into a joint venture with Shanghai Medconn Biotechnology Co., Ltd. to develop and manufacture assays in China for QuidelOrtho’s VITROS platform

China In Vitro Diagnostics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.7 billion |

|

Revenue forecast in 2030 |

USD 8.4 billion |

|

Growth rate |

CAGR of 6.4% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, application, test location, end-use |

|

Country scope |

China |

|

Key companies profiled |

Abbott; bioMérieux SA; Mindray Medical International Limited; Danaher Corporation; Bio-Rad Laboratories, Inc.; Shanghai Kehua Bio-Engineering Co. Ltd.; Thermo Fisher Scientific Inc.; Sysmex Corporation; Maccura Biotechnology; Siemens Healthcare GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

China In Vitro Diagnostics Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the China in vitro diagnostics market report based on technology, product, application, end-use, and test location:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassay

-

Hematology

-

Clinical Chemistry

-

Molecular Diagnostics

-

Coagulation

-

Microbiology

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents

-

Software

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious Diseases

-

Diabetes

-

Oncology

-

Cardiology

-

Nephrology

-

Autoimmune Diseases

-

Drug Testing

-

Other applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Laboratories

-

Home-care

-

Others

-

-

Test Location Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Point of care

-

Home-care

-

Others

-

Frequently Asked Questions About This Report

b. The global China in vitro diagnostics market size was estimated at USD 5.5 billion in 2023 and is expected to reach USD 5.70 billion in 2024.

b. The global China in vitro diagnostics market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030 to reach USD 8.4 billion by 2030.

b. Immunoassay segment dominated the China in vitro diagnostics market with a share of 31.97% in 2023. This is attributable to increasing incidence of chronic & communicable diseases and rising need for early diagnosis

b. Some key players operating in the China in vitro diagnostics market include Abbott; bioMérieux SA; QuidelOrtho Corp.; Siemens Healthineers AG; Bio-Rad Laboratories, Inc.; Qiagen; Sysmex Corp.; Charles River Laboratories; Quest Diagnostics Inc.; Agilent Technologies, Inc.; Danaher Corp.; BD; F. Hoffmann-La Roche Ltd.

b. Key factors that are driving the market growth include increasing adoption of IVD owing to a rise in the incidence of infectious and chronic diseases. The development of automated IVD systems for laboratories and hospitals to provide efficient, accurate, and error-free diagnoses is expected to fuel market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."