China Electric Vehicle Testing, Inspection, And Certification Market Size, Share & Trends Analysis Report By Service Type (Testing, Inspection), By Sourcing Type, By Application, By Vehicle Type, By Industry, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-274-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

China Electric Vehicle TIC Market Trends

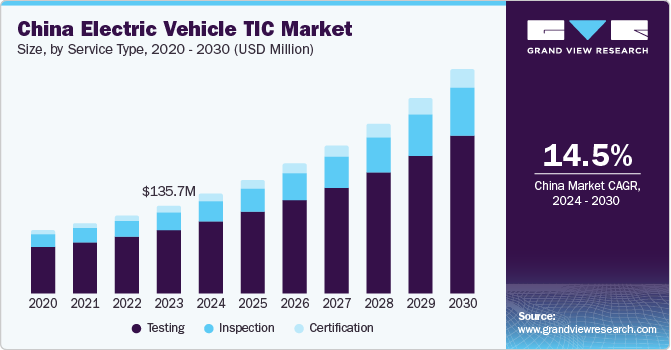

The China electric vehicle testing, inspection, and certification market size was valued at USD 135.7 million in 2023 and is projected to grow at a CAGR of 14.5% from 2024 to 2030. Technological advancements in electric vehicle (EV) systems and the penetration of hybrid vehicles have provided a fillip to the regional market growth. The global push to reduce or slow global warming has prompted the mainland to invest in testing, inspection, and certification (TIC) services for EVs. Moreover, the soaring consumer base for EVs and favorable government policies have augured well for stakeholders vying to bolster their portfolios.

End-users have exhibited increased traction for TIC services for enhanced customer feedback and robust product marketing. Stakeholders are emphasizing testing and certification to minimize charging time on the back of the growth of high-power DC fast-charging stations. Chinese EV companies are counting on research and development activities to augment customer safety. Besides, the Chinese government has adopted bullish policies for the manufacturing, R&D and marketing of EVs.

Some industry dynamics, including the trend for outsourcing testing, inspection and certification services, have encouraged stakeholders to infuse funds into the portfolio. Predominantly, the demand for third-party inspection services has gained ground. For instance, the TIC service providers are using drones to inspect by remotely accessing physical infrastructure. The need for a circular economy will leverage the certification of environmentally-safe building materials.

Market Concentration & Characteristics

The repercussions of the COVID-19 pandemic accentuated Industry 4.0 and prompted industry leaders to expedite digitaltransformation. Innovation could be replete with EV companies slated to inject funds into the landscape. For instance, EV makers are striving to replace more metal components with plastic to minimize weight, thereby reducing transport emissions. Stakeholders are expected to count on quality infrastructure solutions to add competitiveness to the products and services.

Mergers and acquisitions strategies are poised to be pronounced as industry leaders strive to gain a competitive edge. In essence, horizontal and vertical mergers and acquisition strategies will gain traction to bolster global electric vehicle testing, inspection, and certification market penetration, diversify products and services and minimize OPEX. M&A activities could suggest an emphasis on safe and sustainable infrastructure in the automotive sector.

Regulations are likely to have a notable influence on the business outlook as China witnesses an increased penetration of third-party TIC to help meet various goals, including ensuring consumer safety and objectives concerning the environmental sustainability of production and consumption. Businesses are expected to witness increased levels of regulatory compliance and increasing trade volume.

The level of substitutes is likely to be moderate as the demand for specialized testing and certification services gains traction. Stakeholders have witnessed advanced and innovative approaches substituting traditional automotive testing methods. Some dynamics, such as heightened demand for adherence to rigorous environmental regulations and the need for high-voltage component safety could redefine the regional landscape.

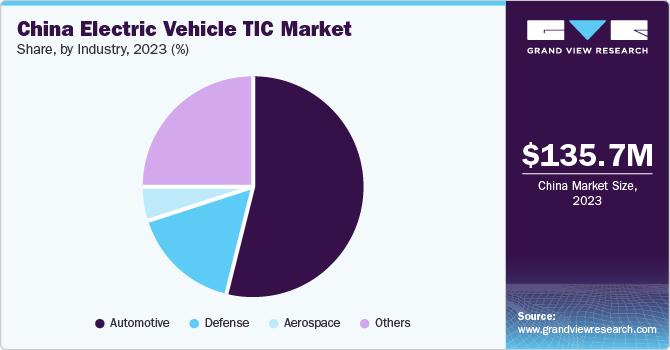

End-users, including automotive, defense and aerospace, are poised to depict robust demand for EV testing, inspection and certification services. For instance, the aerospace industry has exhibited notable traction for electric vehicles to bolster their sustainability quotient. Stakeholders are expected to inject funds to minimize the manufacturing and development costs of EVs vis-à-vis conventional vehicles.

Service Type Insights

The testing segment spearheaded the China electric vehicle TIC market, accounting for the largest revenue share of 72.8% in 2023. Bullish penetration of electric and hybrid vehicles has expedited the need for testing services and solutions. Lately, the adoption of machine learning and artificial intelligence technologies has redefined the TIC sector with more precise and efficient testing methods. Moreover, investments in advanced test equipment to keep up with the demand for next-generation batteries will bode well for industry growth.

The certification segment will grow at a notable rate on the back of the need for cybersecurity and safety certification. Certification bodies have emphasized the formulation of new standards amidst EVs becoming more intricate. Stakeholders have also shown traction for over-the-air (OTA) software updates to enhance the security, safety, and performance of EVs. With China becoming the launch pad to bolster EV penetration, certification services could gain ground in the ensuing period.

Sourcing Type Insights

The in-house segment is likely to grow at a considerable pace on the heels of surging popularity among automotive manufacturers. China has depicted traction for managing TIC procedures internally to ensure EVs meet the most rigorous standards. Automotive manufacturers could seek in-house sourcing to save costs, boost customization and propel flexibility. Besides, companies can tailor their processes in line with their specifications and needs.

The outsourced segment will hold prominence in China as the strategy has become sought-after among small automakers and companies that require more resources to infuse funds into in-house services. Moreover, third-party inspection regulations, along with modifications and updates of testing standards, have prompted stakeholders to invest in outsourcing. Government policies and the rise of third-party inspection will augur growth for outsourced service providers.

Application Insights

The safety and security segment is expected to rise as TIC has become instrumental in leveraging the production of EVs that are safe. EVs undergo stringent safety checks and testing to ensure the safety of the equipment and infrastructure underpinning the environmentally friendly vehicles. Furthermore, regulatory bodies are pitching for TIC services to ensure products meet the expected level of safety, reliability, and quality.

The EV charging segment will gain ground during the forecast period, largely due to soaring demand to install charging points. Predominantly, testing during the development of the product will receive an impetus. The trend is attributed to the reduction of the cost of re-working the final product (if it fails when tested), helping companies ramp up the time taken to roll out the product and boost product efficiency.

Vehicle Type Insights

The battery electric vehicle (BEV) segment is likely to depict a notable revenue share due to bullish demand for sustainable transportation. The demand for testing and certification has gained ground on the back of the rising complexity of electric propulsion systems and technological advancements in battery technologies. With governments implementing rigorous standards and regulations for BEVs, the market footprint of TIC could be pronounced.

The fuel cell electric vehicle (FCEV) segment will witness an uptick against the backdrop of robust investments in zero-emission and sustainable transportation solutions. Investors and end-users, for instance, have sought stringent testing and certification to address concerns about transportation, storage and utilization. Technological advancements in hydrogen fuel cells will encourage automakers to invest in TIC services.

Industry Insights

The automotive segment could account for a lion’s revenue share during the assessment period. The growth is partly attributed to the rising footprint of BEVs and plug-in hybrid electric vehicles (PHEVs). For instance, BEVs have become sought-after in the wake of enhanced performance, extended range, growing charging infrastructure and cost reduction. An uptick in EV production across China will solidify the position of leading companies striving to bolster their portfolios.

The defense segment will rise against the backdrop of increasing penetration of EVs into military operations. China has witnessed traction for EVs in a host of military vehicles, including logistics and armored carriers, to minimize fuel consumption, environmental impact and maintenance costs. Regulatory standards and certifications have gained prominence to reinforce the compliance and safety of electric defense vehicles.

Key China Electric Vehicle Testing, Inspection, And Certification Company Insights

Some of the leading players operating in the market include DEKRA SE, Bureau Veritas, Intertek Group plc and SGS Société Générale de Surveillance SA. They are likely to focus on organic and inorganic strategies to underpin their strategies in the regional landscape.

-

In May 2023, DEKRA announced the opening of DEKRA Greater Bay Area AIoT (Artificial Intelligence of Things) Testing Centre in Guangzhou. The company claims it will provide guarantees for data transmission security and connectivity of high-tech products and provide comprehensive testing and certification services.

-

In October 2023, Nemko China announced its relocation in Shenzhen and suggested it would help for further business expansion and enhanced working environment.

-

In January 2022, SGS reportedly opened a state-of-the-art testing facility for electric and/or connected vehicles and their components in Suzhou, Jiangsu Province. The facility apparently contains a multi-probe vehicular over-the-air (OTA) chamber.

Some emerging companies are slated to expand their portfolios to bolster their value propositions. Some of the prevailing dynamics are delineated below:

-

In November 2022, Cotecna announced the acquisition of Shenzhen Toby Technology, wherein the latter will help the former in providing end-to-end product conformity assessment and supply chain assurance solutions.

-

In July 2022, Intertek announced the acquisition of Clean Energy Associates to bolster its sustainability offering. It will expand the former’s service offering with the World of Energy to offer total quality assurance solutions for energy storage products and installations and solar photovoltaics.

Key China Electric Vehicle Testing, Inspection, And Certification Companies:

- Bureau Veritas

- DEKRA SE

- Element Materials Technology

- Intertek Group plc

- iASYS Technology Solutions

- SGS Société Générale de Surveillance SA

- TÜV SÜD

- TÜV Rheinland

- China Inspection Service Co., Ltd.

- China Inspection and Certification (Group) Co., Ltd.

Recent Developments

-

In January 2023, TÜV Rheinland announced the opening of a new laboratory center in Taicang, China. The testing facility also includes a 4,000-square-meter laboratory for EMC testing, mainly of automotive electronics and automotive parts.

-

In September 2022, DEKRA launched a new testing center for renewable energy in Shanghai and the company asserts its laboratory provides testing and certification along the solar value chain, including low-carbon certification and power plant operation.

China Electric Vehicle Testing, Inspection, And Certification Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 153.7 million |

|

Revenue forecast in 2030 |

USD 345.5 million |

|

Growth rate |

CAGR of 14.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service type, sourcing type, application, vehicle type, industry |

|

Key companies profiled

|

Bureau Veritas; DEKRA SE; Element Materials Technology; Intertek Group plc; iASYS Technology Solutions; SGS Société Générale de Surveillance SA; TÜV SÜD; TÜV Rheinland; China Inspection Service Co., Ltd.; China Inspection and Certification (Group) Co., Ltd. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

China Electric Vehicle Testing, Inspection, And Certification Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the China electric vehicle testing, inspection, and certificationmarket based on service type, sourcing type, application, vehicle type, and industry.

-

Service Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Testing

-

Battery Testing

-

Electric E-motor Testing

-

Electromagnetic Compatibility (EMC) Testing

-

Component Testing

-

-

Inspection

-

Certification

-

-

Sourcing Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

In-house

-

Outsourced

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Safety & Security

-

Connectors

-

Communication

-

EV Charging

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

BEV

-

PHEV

-

FCEV

-

Others

-

-

Industry Outlook (Revenue, USD Billion, 2017 - 2030)

-

Automotive

-

Aerospace

-

Defense

-

Others

-

Frequently Asked Questions About This Report

b. The global China electric vehicle testing, inspection, and certification market size was estimated at USD 135.7 million in 2023 and is expected to reach USD 153.7 million in 2024.

b. The global China electric vehicle testing, inspection, and certification market is expected to grow at a compound annual growth rate of 14.5% from 2024 to 2030 to reach USD 345.5 million by 2030.

b. The testing segment dominated the China electric vehicle testing, inspection, and certification market with a share of 72.8% in 2023. The adoption of machine learning and artificial intelligence technologies has redefined the TIC sector with more precise and efficient testing methods.

b. Some key players operating in the China Electric Vehicle TIC market include Bureau Veritas, DEKRA SE, Element Materials Technology, Intertek Group plc, iASYS Technology Solutions, SGS Société Générale de Surveillance SA, TÜV SÜD, TÜV Rheinland, China Inspection Service Co., Ltd., China Inspection and Certification (Group) Co., Ltd.

b. Key factors that are driving the China electric vehicle testing, inspection, and certification market growth include technological advancements in electric vehicle (EV) systems and the penetration of hybrid vehicles. The global push to reduce or slow global warming has prompted the mainland to invest in testing, inspection, and certification services for EVs.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."